That is just my opinion and I am not a trader and do not have a lot of experience with stocks like this. I have just watched HDY closely for the past 3/4 year and have been baffled by the market's reaction to news at times...even when positive. In other words, even with a signed contract tomorrow, I could see the price remaining unchanged or even drifting down further, although I would expect it to begin a climb back up towards four with an announcement in the morning. The stock seems to be completely out of our (retail investors) control right now and it is very frustrating. I never expected anything like this.

Time to buy HDY

277,435 Views |

1786 Replies |

Last: 4 mo ago by redaszag99

Well, Oil and Gas stocks have been hammered this week with oil dropping from about $112 to $99, so that certainly hasn't helped HDY. I'll wait to see if this announcement is indeed positive, monitor how oil and the O&G sector is trading and pick up some shares if things look good. I just want to hear more positive news from the company before picking up any shares.

Probably a good idea. Honestly, i still believe buying above $4 is a great great opportunity for the long run...i just get nervous in times like these and it may be smart to keep a close eye on things and use sound judgment rather than just trying to get in at the lowest price possible. As for me, i am going to go ahead lube up for tomorrow...could get ugly for those of us with margin as I am not expecting a positive morning presser. Hope I'm wrong though.

quote:

In other words, even with a signed contract tomorrow, I could see the price remaining unchanged or even drifting down further, although I would expect it to begin a climb back up towards four with an announcement in the morning.

So price will remain unchanged, drift down, or begin to climb in the near future.

CB, we all know this is a very volatile stock. We dont need this thread to be cluttered with emotional posts about what you could "see" happening after good or bad days. Lets keep things material. Unless you run a hedge fund thats playing HDY, your short term tomorrow predictions are a crap shoot, just like anyone else here including myself.

If you are going to make predictions at least keep it intermediate to long term and base it on something other than feelings or what price has done in the past.

I agree, the sell off on oil certainly didnt help.

Whats going on today? Up over 10% and I see no news. I just hope this thing flies. I got in early this week at 3.98.

Got in at $3.61. Hoping for a nice pop.

quote:

Whats going on today?

As I have said in the past this is a small cap with large retail ownership.

Unlike institutional holders, retail shareholders like to set stops, over-leverage on margin, and are generally more emotional and more likely to panic sell. This is predictable and makes it an attractive target for hedge funds/ private capital llcs.

We know there is huge short interest that would love to cover lower as well as hedge funds/llcs that would love accumulate a bigger long position cheaper.

They manipulate price down further throwing capital on the short side to trigger stops, margin calls, and panic sells. (This day and age they get help from boutique websites like the fool ect who put out bashing headlines.)

This all creates a flood of sellers driving price down and ultimately transfers shares from weak hands to strong ones. At the end of the day the retail slice of the ownership pie shrinks.

Thats the technical (how) reasons for short term downward price action. It will inevitably correct on days like this and likely create a short squeeze eventually (flood of buyers).

As you mention there has really been no fundamental (why) change. In fact, fundamentals are better than they have ever been. Severely undervalued fundamentally.

Thats how this game works in the short term. Understand there are still a lot of obligated buyers (shorts) on the sideline and HDY has the cash to drill and is on schedule. The only thing missing is more accurate reserve estimates and success probabilities coming in June with the NSAI 3d report. I expect drillship contract PR next week.

Its a gamble to time entry in the short term, understand what is going on and accumulate best you can.

Best to all!

*UPDATE*

Drillship LOI extended to 5-20, should see that PR soon.

http://finance.yahoo.com/news/Hyperdynamics-Announces-prnews-2187122584.html?x=0&.v=1

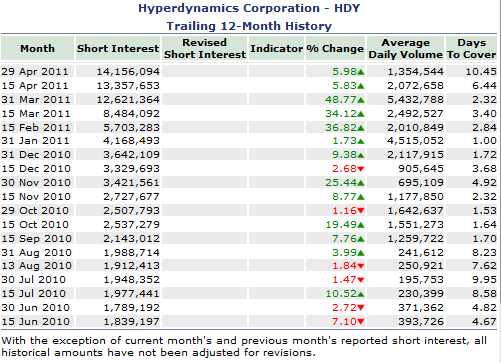

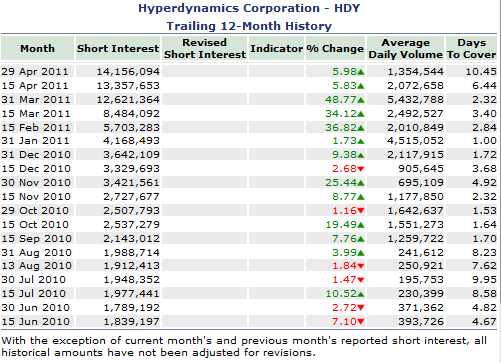

Latest short interest data:

Need a catalyst for a squeeze.

Drillship LOI extended to 5-20, should see that PR soon.

http://finance.yahoo.com/news/Hyperdynamics-Announces-prnews-2187122584.html?x=0&.v=1

Latest short interest data:

Need a catalyst for a squeeze.

This stock is getting reamed

Yep, good opportunity to snag more shares.

Hope we see short covering before June's 3d release, otherwise it will just keep becoming a better "time to buy HDY". Just stay away from margin, no need to lend more shares to shorts or get called.

Hope we see short covering before June's 3d release, otherwise it will just keep becoming a better "time to buy HDY". Just stay away from margin, no need to lend more shares to shorts or get called.

sell in may, go away?

Drillship contract signed:

http://finance.yahoo.com/news/Drilling-Contract-Signed-for-prnews-2924566077.html?x=0&.v=1

Contract Details here:

http://investors.hyperdynamics.com/secfiling.cfm?filingid=1144204-11-30779

[This message has been edited by thirdcoast (edited 5/18/2011 12:14p).]

http://finance.yahoo.com/news/Drilling-Contract-Signed-for-prnews-2924566077.html?x=0&.v=1

Contract Details here:

http://investors.hyperdynamics.com/secfiling.cfm?filingid=1144204-11-30779

[This message has been edited by thirdcoast (edited 5/18/2011 12:14p).]

Up 8% in the premarket.

Up 8% in the premarket.

yarrrrr!

We could see a short squeeze earlier than I anticipated.

The short interest is a giant ball of pocket lent. If the signed contract doesn't ignite it soon, the 3d report from NSAI in June will. IMO

The short interest is a giant ball of pocket lent. If the signed contract doesn't ignite it soon, the 3d report from NSAI in June will. IMO

This thing is exploding today! I'm excited to see what will happen if we get good news from the 3d report from NSAI in June.

Still going up after close. Hit $4.

Very strong close the last half hour...some serious short covering going on!

how do you check pre market and post market changes?

Yahoo finance has a real time ticker. You can also get it from "cnbc rt" mobile app. All over the place these days.

I was so close to buying some more yesterday! Kicking myself now.

Haha always easy to regret in hindsight. I'd this dropped to below 3.15 I would've doubled down

quote:

how do you check pre market and post market changes?

probably your best choice for after mkt quotes is

http://www.nasdaq.com/quotes/after-hours.aspx

FYI

HDY was on Cramer's lightening round yesterday:

"Now we are really going down the food chain...it is a very speculative situation. Why press the bull button? Because if you want to spec in oil and gas and you have a $3 number, you can do that...but remember...stocks that go to 3 to 2 to 0 are very painful. I'm not saying it will do that, but these can be painful."

This is the second time he has commented on HDY....both times it appeared comments were based on 10 min analysis from his secretary...last time he basically said to stay away.

No pain no gain!

Hope Cramer sticks around and makes comments later this year and next.

Ive never been a fan of Cramer regardless.

HDY was on Cramer's lightening round yesterday:

"Now we are really going down the food chain...it is a very speculative situation. Why press the bull button? Because if you want to spec in oil and gas and you have a $3 number, you can do that...but remember...stocks that go to 3 to 2 to 0 are very painful. I'm not saying it will do that, but these can be painful."

This is the second time he has commented on HDY....both times it appeared comments were based on 10 min analysis from his secretary...last time he basically said to stay away.

No pain no gain!

Hope Cramer sticks around and makes comments later this year and next.

Ive never been a fan of Cramer regardless.

cramer is a known flip-flopper

Lots of bullish items on the horizon, one more:

HDY will be added to Russel 2000 soon...

The 2011 reconstitution of the Russell Indexes will take place after the market close on June 24, 2011.

http://www.russell.com/indexes/data/reconstitution/default.asp

HDY will be added to Russel 2000 soon...

The 2011 reconstitution of the Russell Indexes will take place after the market close on June 24, 2011.

http://www.russell.com/indexes/data/reconstitution/default.asp

I looked at it a few days ago at ~$3.50 ish and thought about adding. Today ~$4.30 ish

RAY LEONARD TO BE ON CRAMER TONIGHT AT 6PM ET. SET YOUR DVR's.

Mad Money

CNBC

5pm and 10pm central

CNBC

5pm and 10pm central

THE FACTS ARE OUT, on a massive scale:

I wonder how shorts feel about new buyers?

quote:

Largest west African concession held by any one company...Everything has been de-risked other than the geology.

-HDY CEO Ray Leonard on Mad Money

I wonder how shorts feel about new buyers?

Mad Money Video:

http://www.cnbc.com/id/43156513?__source=yahoo%7Cheadline%7Cquote%7Ctext%7C&par=yahoo

Proud of Ray for going in there and standing up to Cramer after he has consistently smeared HDY with words like "controversial" "unstable" ect...."Speculative", yes..."Volatile", yes.

http://www.cnbc.com/id/43156513?__source=yahoo%7Cheadline%7Cquote%7Ctext%7C&par=yahoo

Proud of Ray for going in there and standing up to Cramer after he has consistently smeared HDY with words like "controversial" "unstable" ect...."Speculative", yes..."Volatile", yes.

Pre Market up to 4.45

Featured Stories

See All

Legacy from Legacy: Mike Brown continues family's Aggie tradition

by Olin Buchanan

Aggies face Campbell in front of 12th Man to open NCAA Tournament

by Olivia Rodriguez

5:16

15h ago

2.2k

Reed Report: Explaining the most impactful college hoops metrics

by Luke Evangelist

rbduncan25

What non-A&M game result would you change from this season?

in Billy Liucci's TexAgs Premium

28

TheNotoriousP.I.P.

Elko Nearly Made A Hire For New OC, Search Ongoing

in Billy Liucci's TexAgs Premium

18