Not sure if that question was directed at me, but it would be more accurate to say that the stock price shot up from $1 bc the odds of hitting oil have increased dramatically along the way. For years people were unsure whether this co. was going anywhere at all. Just over a yr ago when the price was around $1.50-$2.00 it was hard to imagine drilling ever becoming a reality. From Blackrock and other big investors coming on board, 3D seismic showing what we're sitting on, all the way up to contracting a rig and spudding the first well. Even a potential JVP deal that fell through. All of these events have had tremendous impact on SP. Ultimately what matters is that we hit oil of course, I just think that saying "the chance of hitting oil is why the SP shot up from $1" is over simplifying things a bit. Just under a yr ago we were at $7.75. This was mostly based on the potential for a JV deal. Dropped to the upper $3's when a deal was not reached.

Time to buy HDY

247,175 Views |

1784 Replies |

Last: 2 yr ago by Decay

2.92 and sinking.

thirdcoast = levinsmarket?

Has anyone bothered to look at what is happening to similar oil spec stocks?

Hdy shot up above $7 before there was any financing to drill for oil.

It's a speculative stock with no revenue....as I have said from the beginning.

Great time to accumulate IMO, horrible time to unload for a loss...

[This message has been edited by thirdcoast (edited 11/23/2011 10:58a).]

It's a speculative stock with no revenue....as I have said from the beginning.

Great time to accumulate IMO, horrible time to unload for a loss...

[This message has been edited by thirdcoast (edited 11/23/2011 10:58a).]

Surely they have to be extremely close to hitting their target depth. Don't you think so? Anticipation...

Wish I knew more about deep sea drilling. But here's to hoping Ray know.

They are probably getting very close to potential pay zones but are probably a little ways to go from target depth.

I would love to see the wellbore schematic and drilling probability schedule..

I would love to see the wellbore schematic and drilling probability schedule..

quote:

thirdcoast = levinsmarket?

What is this?

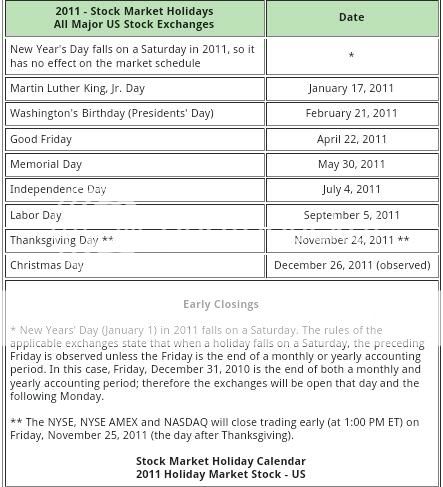

Noon close

Dp

[This message has been edited by thirdcoast (edited 11/25/2011 10:21a).]

[This message has been edited by thirdcoast (edited 11/25/2011 10:21a).]

2.93 -0.11 -3.62%

Actually it closed at 2.85

quote:

posted 10:46a

Ah, for some reason I thought that was posted later..

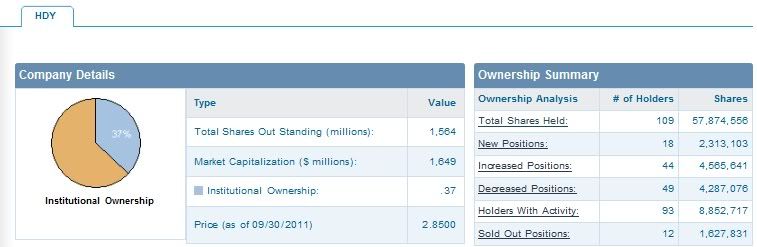

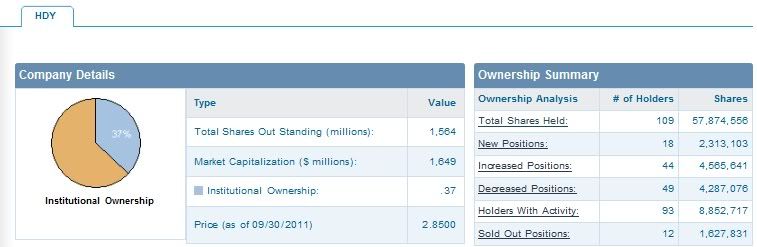

Any have updated 'tute ownership figures? Curious to see how the numbers have panned out during this drop.

Seems that there's speculation they are logging at the moment?

Yeah, dates are about right for what was projected after delays. There's some noise about ship positioning, too, and how that MAY indicate they're preparing for hole #2. Which of course would most likely happen with at least some success at hole #1.

Will you post that link?

Im swamped...I will try to provide links to tute ownership data and short interest later....unless someone wants to do so.

As for the ship movements, a lot to speculate on....keep in mind this is not as reliable as the google maps on our smartphones.

As for the ship movements, a lot to speculate on....keep in mind this is not as reliable as the google maps on our smartphones.

As I have stated from the beginning, port infrastructure and virginity of the region are the biggest risk concerns (aside from complete drilling failure with multiple dry holes).

I have reaffirmed this concern after the latest cc considering Ray's remarks. Also, major operators in the GOM often dont meet drilling timelines, but dates have to be established to push vendors and all other aspects of the operation to minimize rig expenses.

I personally believe the facts above are part of the safety net for shorts/hedges into late Nov. With such high expectations from heavily owned retail it becomes even safer IMO.

Time is on the side of longs as each passing day brings us closer to logging results despite delays/difficulties. Broad market rallies like today and confidence in general, also make covering/un-hedging at this level attractive.

I have reaffirmed this concern after the latest cc considering Ray's remarks. Also, major operators in the GOM often dont meet drilling timelines, but dates have to be established to push vendors and all other aspects of the operation to minimize rig expenses.

I personally believe the facts above are part of the safety net for shorts/hedges into late Nov. With such high expectations from heavily owned retail it becomes even safer IMO.

Time is on the side of longs as each passing day brings us closer to logging results despite delays/difficulties. Broad market rallies like today and confidence in general, also make covering/un-hedging at this level attractive.

3.25 +0.40 (+14.04%)

3.65 right now in after hours

Over 4 in afterhours it looks like

Last: 3.90

Bid: 3.45 x100

Ask: 3.89 x1,000

Bid: 3.45 x100

Ask: 3.89 x1,000

The icon is mostly from the bid/ask spread. I wonder what's pushing it up, though.

Um...I'm guessing a leak

We shouldn't get ahead of ourselves here...News should be coming any day though. Could be a big week!

bought more at $3.04 today.

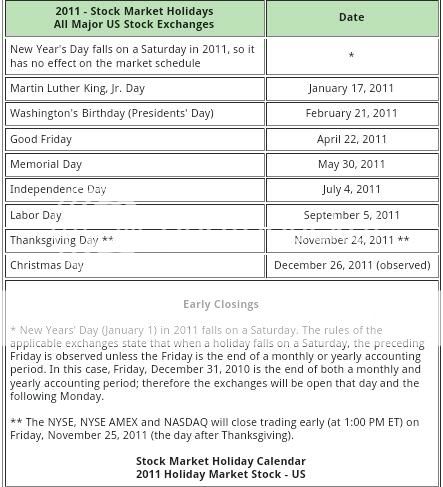

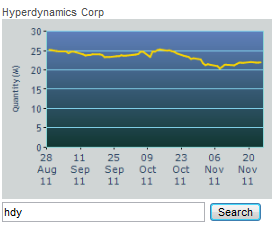

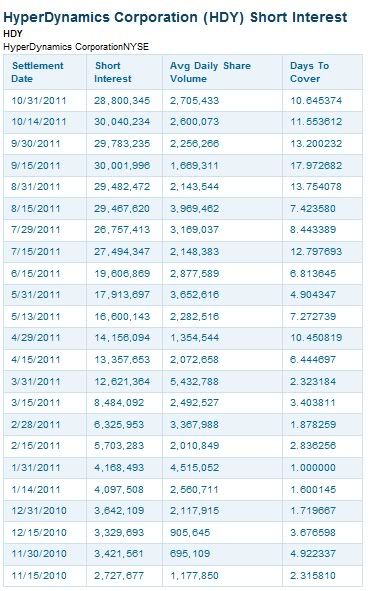

NASDAQ short interest is available by issue for a rolling 12 months and updated twice a month. Short Interest data is based on a mid-month and end of month settlement dates and released after 4:00 p.m, ET

FINRA member firms are required to report their short positions as of settlement on (1) the 15th of each month, or the preceding business day if the 15th is not a business day, and (2) as of settlement on the last business day of the month.* The reports must be filed by the second business day after the reporting settlement date. FINRA compiles the short interest data and provides it for publication on the 8th business day after the reporting settlement date.

http://www.nasdaqtrader.com/Trader.aspx?id=ShortIntPubSch

http://www.nasdaq.com/symbol/hdy/short-interest

"The longer the days to cover, the more pronounced this effect (short squeeze) can be."

http://www.investopedia.com/terms/d/daystocover.asp#axzz1f4RLwLhS

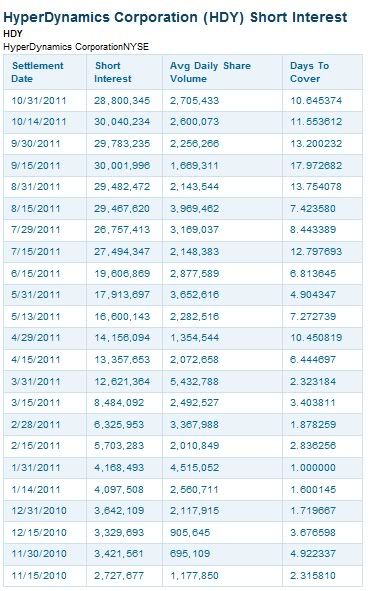

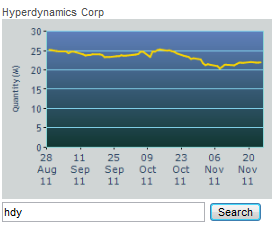

Shares out on loan can be accessed here with much less lag:

http://www.dataexplorers.com/

To my knowledge tute ownership numbers are only released on quarterly reports filed with the SEC on form 13-F.

All we have is 9/30 data on HDY....my guess is we are easily north of a 50% tute slice now.

http://www.nasdaq.com/symbol/hdy/institutional-holdings

If anyone wants surf around to dig up the past quarterly tute % numbers over the last 2 yrs and chart them, that would be cool to see.

I believe some short data and possibly tute data can be accessed quicker per some subscriptions that are out there. If anyone has access or better links to this type of info, please share.

AH link:

http://www.nasdaq.com/symbol/hdy/after-hours

[This message has been edited by thirdcoast (edited 11/28/2011 11:51p).]

FINRA member firms are required to report their short positions as of settlement on (1) the 15th of each month, or the preceding business day if the 15th is not a business day, and (2) as of settlement on the last business day of the month.* The reports must be filed by the second business day after the reporting settlement date. FINRA compiles the short interest data and provides it for publication on the 8th business day after the reporting settlement date.

http://www.nasdaqtrader.com/Trader.aspx?id=ShortIntPubSch

http://www.nasdaq.com/symbol/hdy/short-interest

"The longer the days to cover, the more pronounced this effect (short squeeze) can be."

http://www.investopedia.com/terms/d/daystocover.asp#axzz1f4RLwLhS

Shares out on loan can be accessed here with much less lag:

http://www.dataexplorers.com/

To my knowledge tute ownership numbers are only released on quarterly reports filed with the SEC on form 13-F.

All we have is 9/30 data on HDY....my guess is we are easily north of a 50% tute slice now.

http://www.nasdaq.com/symbol/hdy/institutional-holdings

If anyone wants surf around to dig up the past quarterly tute % numbers over the last 2 yrs and chart them, that would be cool to see.

I believe some short data and possibly tute data can be accessed quicker per some subscriptions that are out there. If anyone has access or better links to this type of info, please share.

AH link:

http://www.nasdaq.com/symbol/hdy/after-hours

[This message has been edited by thirdcoast (edited 11/28/2011 11:51p).]

good start

another pop would be a nice sign. For a leak, it would be a lot better to see very large volume, which wasn't the case yesterday.

I personally am thinking it is more short covering than a leak. If it were a positive leak we would probably see a lot more volume.

Featured Stories

See All

75:27

18h ago

7.5k

No. 13 A&M a 'go-for-launch' as 2024-25 opens on the road in Orlando

by Luke Evangelist

Keys to the Game: No. 13 Texas A&M at UCF

by Luke Evangelist

Scouting Report: Texas A&M at Central Florida

by Tom Schuberth