https://www.bloomberg.com/news/articles/2022-10-03/inflation-in-europe-now-looks-even-less-transitory-than-in-usWhen pandemic inflation took off last year, it was seen as more likely to stick around in the US -- where stimulus was much bigger and consumer demand stronger -- than in Europe. But the energy crisis has upended that picture.

Euro-area price increases have now outpaced the US for two straight months. The gap likely widened in September, when Europe-wide inflation hit 10% while in Germany it accelerated to 10.9%. US numbers aren't due out for another 10 days....

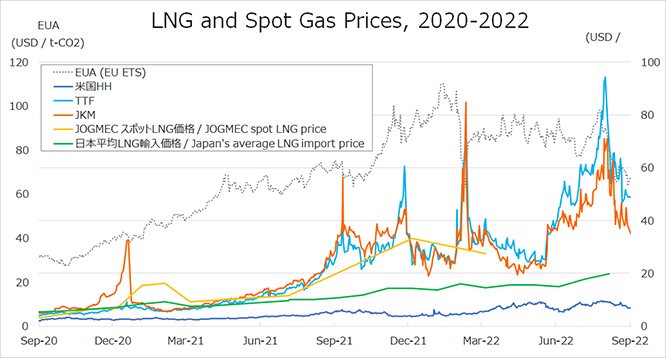

The reason is Europe's natural-gas crunch, the result of shortfalls in Russian imports that got worse after the invasion of Ukraine. That sent electricity prices soaring too, helping drive up costs in pretty much every corner of the economy -- with the result that inflation is now broader in Europe, as well as higher....

It means Europe's central bankers who are applying the same inflation medicine as their US peers, by rapidly raising interest rates have less ability to address the root problem, and run more risk of hurting their economy in the attempt. ...

"Core inflation is likely to take longer to fall in Europe than in the US, partly because Europe will continue to suffer from a bigger energy supply shock," analysts at Capital Economics wrote last month. "While we expect the Fed to cut rates in the second half of 2023, we doubt that the BoE and ECB will be able to do so before 2024."