to the guy that recommended abml

546,537 Views |

2542 Replies |

Last: 1 mo ago by Medaggie

<<Would the department of energy validate and fast track ABML's lithium technology with a $4.5 million grant this week if it wasn't legit?>>

Oh Crap! Now you've gone and done it--NEVER under estimate the government's ability to screw something up!

Oh Crap! Now you've gone and done it--NEVER under estimate the government's ability to screw something up!

See Solyndra as exhibit A.IslandAg76 said:

<<Would the department of energy validate and fast track ABML's lithium technology with a $4.5 million grant this week if it wasn't legit?>>

Oh Crap! Now you've gone and done it--NEVER under estimate the government's ability to screw something up!

I see a great short term play for Lithium. I see medium to long term risk for Lithium as the next target of the green movement when they decide they need a new whipping boy following O&G. There's just too much meat on the bone for groups like Sierra Club and the far left to ignore when it comes to the current environmental state of mining and recycling.

Apologies if already posted.

Article update as of Dec 2020.

https://www.nasdaq.com/articles/10-lithium-stocks-to-buy-despite-the-markets-irrationality-2020-12-21

Concise and speculative especially about the new technology, reasserting the gamble aspect while weighing the possibilities. Nothing new but nice to read it alongside other Lithium plays.

Article update as of Dec 2020.

https://www.nasdaq.com/articles/10-lithium-stocks-to-buy-despite-the-markets-irrationality-2020-12-21

Concise and speculative especially about the new technology, reasserting the gamble aspect while weighing the possibilities. Nothing new but nice to read it alongside other Lithium plays.

ABML

https://www.accesswire.com/619716/American-Battery-Metals-Corporation-Closes-Preferred-Stock-Private-Placement-for-a-Total-of-27-Million

December 7, 2020

"raised an additional $1.45 million in Preferred Stock at a fixed price per share of $0.125 common share equivalent, bringing its total raised to $2.7 million under the Preferred offering."

https://www.accesswire.com/619716/American-Battery-Metals-Corporation-Closes-Preferred-Stock-Private-Placement-for-a-Total-of-27-Million

December 7, 2020

"raised an additional $1.45 million in Preferred Stock at a fixed price per share of $0.125 common share equivalent, bringing its total raised to $2.7 million under the Preferred offering."

Solar for residential and commercial use has absolutely zero bearing on what's happening here. The government was trying to switch demand from oil and gas to solar as a policy manner. But demand was already met, and solar is more expensive than oil and gas. Hence failure.Thriller said:See Solyndra as exhibit A.IslandAg76 said:

<<Would the department of energy validate and fast track ABML's lithium technology with a $4.5 million grant this week if it wasn't legit?>>

Oh Crap! Now you've gone and done it--NEVER under estimate the government's ability to screw something up!

I see a great short term play for Lithium. I see medium to long term risk for Lithium as the next target of the green movement when they decide they need a new whipping boy following O&G. There's just too much meat on the bone for groups like Sierra Club and the far left to ignore when it comes to the current environmental state of mining and recycling.

ABML received this grant to mine, recycle and distribute lithium with their technology because the demand for lithium is outstripping supply and we don't want China/Africa being our main source. ABML will be serving pent up demand (as I have documented several times) with the best source of fuel for batteries.

The mining regulations were just changed and Biden is prioritizing mining. All documented in this thread as well. It is impossible to think that lithium is not favored by this administration. New technologies will come but not anytime soon.

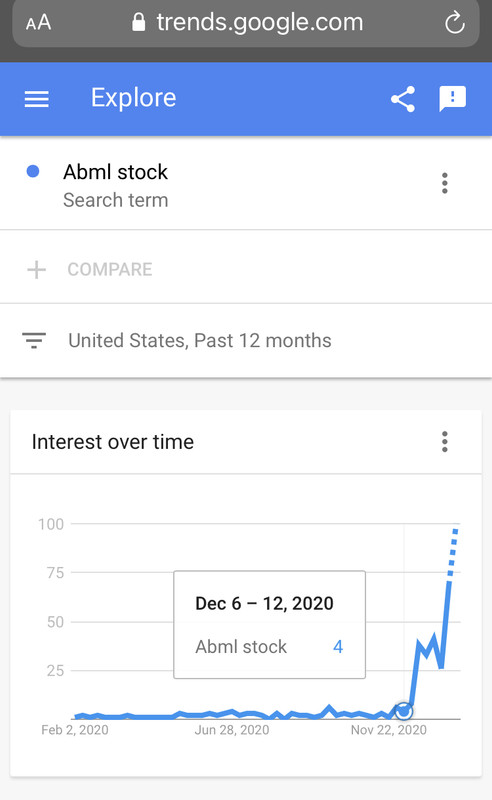

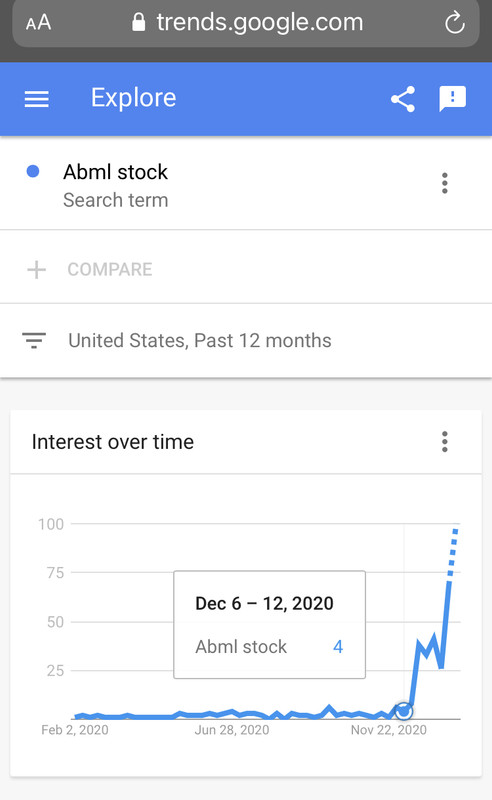

You can see the reaction on Reddit when this was announced below. I invested early and I'm holding long in ABML as a reminder. The first plant in Nevada can produce $200 million of revenue. But their larger plants will produce up to $2 billion of revenue per plant and they are taking this idea global (See video on last page).

https://www.reddit.com/r/pennystocks/comments/l1bb3y/abml_just_awarded_45_million_grant_from/?utm_source=amp&utm_medium=&utm_content=post_body

https://finance.yahoo.com/news/brazil-minerals-inc-adds-two-153000215.html

So were these permit grants baked in earlier this week?

So were these permit grants baked in earlier this week?

I think I first saw them referenced Jan 8th. So yes. First of many catalysts. Dupont, BASF, JV all baked in. I don't know why that matters unless you are trying to day trade it. Everything I find is positive for the long term.rononeill said:

https://finance.yahoo.com/news/brazil-minerals-inc-adds-two-153000215.html

So were these permit grants baked in earlier this week?

Next round is plant construction, board additions, new logistics announcement, and a an international plant.

https://stocktwits.com/Matty_Gambino/message/280000333

Is anyone having issues with Fidelity right now? I am seeing this message: "Fidelity is currently unable to provide brokerage, mutual fund, or stock plan account information. Please try again later."

See GameStop.TxRich said:

Is anyone having issues with Fidelity right now? I am seeing this message: "Fidelity is currently unable to provide brokerage, mutual fund, or stock plan account information. Please try again later."

It's pretty disgusting what the platforms are doing. Volume excuses don't hold. They are going to get exposed.

I brought up Solydra only to provide an example to the previous poster's point. Government involvement doesn't always equal a winning bet.HoustonAggie37713 said:Solar for residential and commercial use has absolutely zero bearing on what's happening here. The government was trying to switch demand from oil and gas to solar as a policy manner. But demand was already met, and solar is more expensive than oil and gas. Hence failure.Thriller said:See Solyndra as exhibit A.IslandAg76 said:

<<Would the department of energy validate and fast track ABML's lithium technology with a $4.5 million grant this week if it wasn't legit?>>

Oh Crap! Now you've gone and done it--NEVER under estimate the government's ability to screw something up!

I see a great short term play for Lithium. I see medium to long term risk for Lithium as the next target of the green movement when they decide they need a new whipping boy following O&G. There's just too much meat on the bone for groups like Sierra Club and the far left to ignore when it comes to the current environmental state of mining and recycling.

ABML received this grant to mine, recycle and distribute lithium with their technology because the demand for lithium is outstripping supply and we don't want China/Africa being our main source. ABML will be serving pent up demand (as I have documented several times) with the best source of fuel for batteries.

The mining regulations were just changed and Biden is prioritizing mining. All documented in this thread as well. It is impossible to think that lithium is not favored by this administration. New technologies will come but not anytime soon.

You can see the reaction on Reddit when this was announced below. I invested early and I'm holding long in ABML as a reminder. The first plant in Nevada can produce $200 million of revenue. But their larger plants will produce up to $2 billion of revenue per plant and they are taking this idea global (See video on last page).

https://www.reddit.com/r/pennystocks/comments/l1bb3y/abml_just_awarded_45_million_grant_from/?utm_source=amp&utm_medium=&utm_content=post_body

You're correct that lithium is the current play, no argument there. But until all the aspects of acquisition, production, and recyling become a lot more environmentally friendly, the risk needs to be acknowledged that this industry could be the next target of the green left.

Watching their heads explode about going after "clearn" energy llike lithium will be entertaining. They've already destroyed coal for future (and increasingly current) generation. Natural gas is squarely in their sights (Berkeley is a an example). Lithium extraction and recycling looks just like what they would attack, but their cognitive dissonance will be enormous.

I wouldn't worry too much about the the grant. Firms don't typically wait a week to issue press releases covering impactful events.

I think it was nothing more than a play to try and continue to capitalize on the recent run up.

I think it was nothing more than a play to try and continue to capitalize on the recent run up.

Joe Biden is prioritizing EV's and everyone knows that means lithium demand is going up. Since when is recycling every attacked as anything but green? I just don't see anything that is relevant that would suggest that lithium will be attacked by the "green left" in the next decade.

ABML with a nice little run up today!

I would like to see it at 4.50+ for a few days...some stability for a bit would be nice...

I think.

I think.

Aww, you ruined it! The first rule about ABML stock run is that you don't talk about ABML stock run.

The same statement could have been (and probably was) made about "cleaner" natural gas a decade ago. Now entire cities, and potentially entire states are outlawing natural gas in new buildings with the eye of electrifying everything,

Lithium, while a cleaner energy source in the form of batteries, isn't at all clean when it comes to sourcing, production, and recycling (yet). If that changes, great. But let's not pretend that lithium is a clean, renewable energy source.

That's not to say it isn't great right now. It's the best solution for EVs today. But just because the Biden administration is pushing EVs doesn't mean those to the left of him with very big megaphones won't start attacking the sourcing.

Lithium enables their agenda, but doesn't fit their agenda. It's a curious conundrum for the left. There are already alternatives being researched for this very reason. Whether that comes in 5, 10, 15 years, who knows.

Lithium, while a cleaner energy source in the form of batteries, isn't at all clean when it comes to sourcing, production, and recycling (yet). If that changes, great. But let's not pretend that lithium is a clean, renewable energy source.

That's not to say it isn't great right now. It's the best solution for EVs today. But just because the Biden administration is pushing EVs doesn't mean those to the left of him with very big megaphones won't start attacking the sourcing.

Lithium enables their agenda, but doesn't fit their agenda. It's a curious conundrum for the left. There are already alternatives being researched for this very reason. Whether that comes in 5, 10, 15 years, who knows.

really-do most people not know where electricity comes from? Do they think they charge their environmentally friendly battery with another battery? Do they actually think that windmills, without the aid of petroleum products, are some day going to provide all our electricity?

Are they looking forward to a wind mill on every corner? Just wondering how stupid we are.

Are they looking forward to a wind mill on every corner? Just wondering how stupid we are.

Refining is a good hedge to lithium!

How else you gonna power all of the mining equipment needed to do all of the extraction from the ground and then from the ore and then refine that to usable lithium.

That's a LOT of diesel and energy my friends. Buy both!

I kid, but probably a little truth in that too. O&G/Refining should come back fairly decent in Q3 this year. We've already seen a step up on most and by Q3 we should have seen another big step up. But, I'm just guessing and I don't want anyone buying anything on my advice. I stink at trading!

How else you gonna power all of the mining equipment needed to do all of the extraction from the ground and then from the ore and then refine that to usable lithium.

That's a LOT of diesel and energy my friends. Buy both!

I kid, but probably a little truth in that too. O&G/Refining should come back fairly decent in Q3 this year. We've already seen a step up on most and by Q3 we should have seen another big step up. But, I'm just guessing and I don't want anyone buying anything on my advice. I stink at trading!

you are a good straight man. I was typing my response and just came in behind yours. Nice....

Unfortunately, I do think people in major metropolitan areas have no clue and don't care where their energy comes from.

Case and point how Californians have put up with rolling blackouts. They are more concerned with the best Botox spot in town than to be bothered with how their Range Rover or Tesla is fueled. LA citizens don't talk about those issues.

Case and point how Californians have put up with rolling blackouts. They are more concerned with the best Botox spot in town than to be bothered with how their Range Rover or Tesla is fueled. LA citizens don't talk about those issues.

It's a fair point (and getting off the topic for this thread a bit), but there is absolutely a large segment of people (politicians especially) that want 100% carbon-free renewable energy. They just don't realize that is impossible (with today's technology).IslandAg76 said:

really-do most people not know where electricity comes from? Do they think they charge their environmentally friendly battery with another battery? Do they actually think that windmills, without the aid of petroleum products, are some day going to provide all our electricity?

Are they looking forward to a wind mill on every corner? Just wondering how stupid we are.

There's absolutely some "robbing Peter to pay Paul" going on in the clean energy businesses. You just don't see a lot of the proponents acknowledge that truth.

Nuclear is the answer. We have any penny stocks related to isotope recycling?

Sign me up for the stock of the company that perfects modular nuclear reactors.

Diggity said:

Nuclear is the answer. We have any penny stocks related to isotope recycling?

Monorail! That's what we need!

It's not possible with today's technology OR today's laws of physics. 'No carbon emissions' defies the laws on entropy, which states entropy is always increasing. Basically, everything humans do will increase carbon emissions, even at a microscopic scale.

We could significantly reduce the pounds of gasoline, natural gas, and coal we burn to power internal combustion engines and to spin turbines and generators. This would reduce the pounds of carbon dioxide we release into the atmosphere. Which would reduce the increasing greenhouse gas effect and reduce global temperature rise. The question is at what cost, and what technology replaces that lost energy production (or rather lost conversion from chemical energy to kinetic and electrical energy).

And this administration is pushing for EVs, which rely on lithium batteries to store energy. Lithium batteries aren't great: the materials are scarce and expensive, they can be unstable, they're far less energy dense than liquid hydrocarbon fuels, and end of life waste handling is a problem. For all those reasons, I think we'll eventually land on a different battery technology. But they're the best battery technology we have for mobile applications, and I'd guess we're a couple decades out from lithium batteries being replaced. There are competitive technologies (carbon/salt water) for stationary applications where energy stored per pound isn't as important, but I haven't seen anything even on a research scale that beats lithium for EVs.

The question on where the electricity for EVs comes from is an interesting one. I agree most folks are ignorant on what happens on the backside of that power plug, maybe willfully so. Natural gas is replacing coal as the biggest primary energy source for electricity production. And it burns cleaner than coal, diesel, and gasoline. But it still produces CO2 as a primary byproduct. I imagine that will be the next thing that gets attacked after the push for ICE to EV.

And this administration is pushing for EVs, which rely on lithium batteries to store energy. Lithium batteries aren't great: the materials are scarce and expensive, they can be unstable, they're far less energy dense than liquid hydrocarbon fuels, and end of life waste handling is a problem. For all those reasons, I think we'll eventually land on a different battery technology. But they're the best battery technology we have for mobile applications, and I'd guess we're a couple decades out from lithium batteries being replaced. There are competitive technologies (carbon/salt water) for stationary applications where energy stored per pound isn't as important, but I haven't seen anything even on a research scale that beats lithium for EVs.

The question on where the electricity for EVs comes from is an interesting one. I agree most folks are ignorant on what happens on the backside of that power plug, maybe willfully so. Natural gas is replacing coal as the biggest primary energy source for electricity production. And it burns cleaner than coal, diesel, and gasoline. But it still produces CO2 as a primary byproduct. I imagine that will be the next thing that gets attacked after the push for ICE to EV.

Bought 1000 shares this morning of ABML. Was tired of sitting on the sidelines with it.

Im in for over 15,000 shares. Going to ride it for 12 months or $20/share. Whichever comes first....

Did you get in? Up 90% today.Madagascar said:

Do you have an opinion on BRLL that just went up (as referenced above)?

Apparently they are a partner with ABML. Saw something about them loaning them space.

No because I'm new to trading and didn't know enough to feel comfortable but wow 90%!

Just for information--bought some ABML and BMIX couple days ago--so, I'm in too.

You just made my point. Natural gas production supply and demand are both up vs 2011. And it was attacked. These things don't happen quickly.

South Platte said:Did you get in? Up 90% today.Madagascar said:

Do you have an opinion on BRLL that just went up (as referenced above)?

Apparently they are a partner with ABML. Saw something about them loaning them space.

ABML is partnering with many different companies. I'm not surprised.

Featured Stories

See All

Texas A&M football's 2026 Signing Class Superlatives

by TexAgs Recruiting

Legacy from Legacy: Mike Brown continues family's Aggie tradition

by Olin Buchanan

Aggies face Campbell in front of 12th Man to open NCAA Tournament

by Olivia Rodriguez

Three Things: A drama-free Signing Day, addition of Baker & more

by Jason Howell

rbduncan25

What non-A&M game result would you change from this season?

in Billy Liucci's TexAgs Premium

81