TSLA

171,802 Views |

1168 Replies |

Last: 3 mo ago by TxAG#2011

Always fun to read the OP on this one.

$TSLA beats again on top and bottom line.

$TSLA beats again on top and bottom line.

Insane Construction Speed

Another Giga (Tera) Texas Construction Update.

Future home of the TESLA SEMI, CYBERTRUCK, and Model Y for the East Coast!!!

Another Giga (Tera) Texas Construction Update.

Future home of the TESLA SEMI, CYBERTRUCK, and Model Y for the East Coast!!!

I have been following this thread and wanted to get a Model S 7 years ago. Actually put a deposit down but never pulled the trigger. I also thought the stock was way overpriced and never could pull the trigger at $200 Pre split. last year when I found this thread.

Fast forward to this April and the MY came out. It was the perfect car for us. I always like a cross over/mid sized SUV b/c of the utility. Took Ownership in June, drove it around for probably 10 miles back home.

Got out of the car, went straight to my Ameritrade account and pulled the trigger at a $700/share. I thought the price was insane but amazed at the whole car driving experience. Just an opinion, but my X5 and 3 series is pedestrian compared to the MY.

Stock appreciation alone would get me a Cyber Truck, Model S, and Model but if I pulled the trigger on the S 7 years ago, I would be retired.

Fast forward to this April and the MY came out. It was the perfect car for us. I always like a cross over/mid sized SUV b/c of the utility. Took Ownership in June, drove it around for probably 10 miles back home.

Got out of the car, went straight to my Ameritrade account and pulled the trigger at a $700/share. I thought the price was insane but amazed at the whole car driving experience. Just an opinion, but my X5 and 3 series is pedestrian compared to the MY.

Stock appreciation alone would get me a Cyber Truck, Model S, and Model but if I pulled the trigger on the S 7 years ago, I would be retired.

I don't have a horse either way but finally had some time to read through this thread. I see alot of reasons to doubt Musk/Tesla but there is a lot of irrational hatred.Bobaloo said:

An analyst on Squawk Box yesterday put a target price of $4000 in 5 years. That would put TSLA at a market cap in the $600B range. Hmmm....

Looks like even the optimists sold Musk Short. He only hit 600B in 18 months.

I have been a a skeptic and critic of TSLA over the years, but making the S&P 500 probably counts for something after poopooing the stock.

I'm way, way late to the game because I kept thinking that I missed out on the run up. Finally couldn't sit on the sidelines any longer and bought one whole share. I figure if it crashes I won't really miss $600, but if it keeps climbing I'll have something to show for it. Up 10% so far!

I just did the math (my account show "N/A" for total return)....14,905%

You've owned since single digits? (4.25 to 639 is 14,935%) NiceDuncan Idaho said:

I just did the math (my account show "N/A" for total return)....14,905%

I bought some about 10 years after doing a case study on EVs in grad school.

So no matter what I do on life, I've made one good decision.

Sadly my position is as big as you would expect a grad student's position to be.

So no matter what I do on life, I've made one good decision.

Sadly my position is as big as you would expect a grad student's position to be.

You could get rich just betting the opposite of every popular prediction ever made on Texags. From stocks to sports betting to politics. Only guy that got anything right was the Bitcoin guy. Hopefully he's retired on a beach somewhere off of his Bitcoin earnings.

What is funny around the same time I did the math to figure out what it would take for bitcoin to be profitable based off my electric bill and other expenses and it was going to require bitcoin triple in price. So I blew that idea off

This is pretty nuts, but only time will tell if its justifiable.

RockOn said:

This is pretty nuts, but only time will tell if its justifiable.

Well, also add in some other major battery makers, like Panasonic.

Tesla is priced to be larger than the worlds biggest battery maker and car maker combined.

It's overpriced for my taste, but a lot of the price is psychology, so the market cap relative to other companies might stay inflated indefinitely.

I don't like TSLA being added to the index, I don't want to be exposed to it.

I hope everyone put their MOC orders in. Mine closed at 695. I wonder what it opens on Monday -- guessing lower.

Looked like 675 after hours.

Was watching the after hours action.

Pretty cool. Doesn't happen like that......well ever

Was watching the after hours action.

Pretty cool. Doesn't happen like that......well ever

It's 1% of the index.

TSLA becomes my first 4 bagger.....

FunkyKO said:

It's 1% of the index.

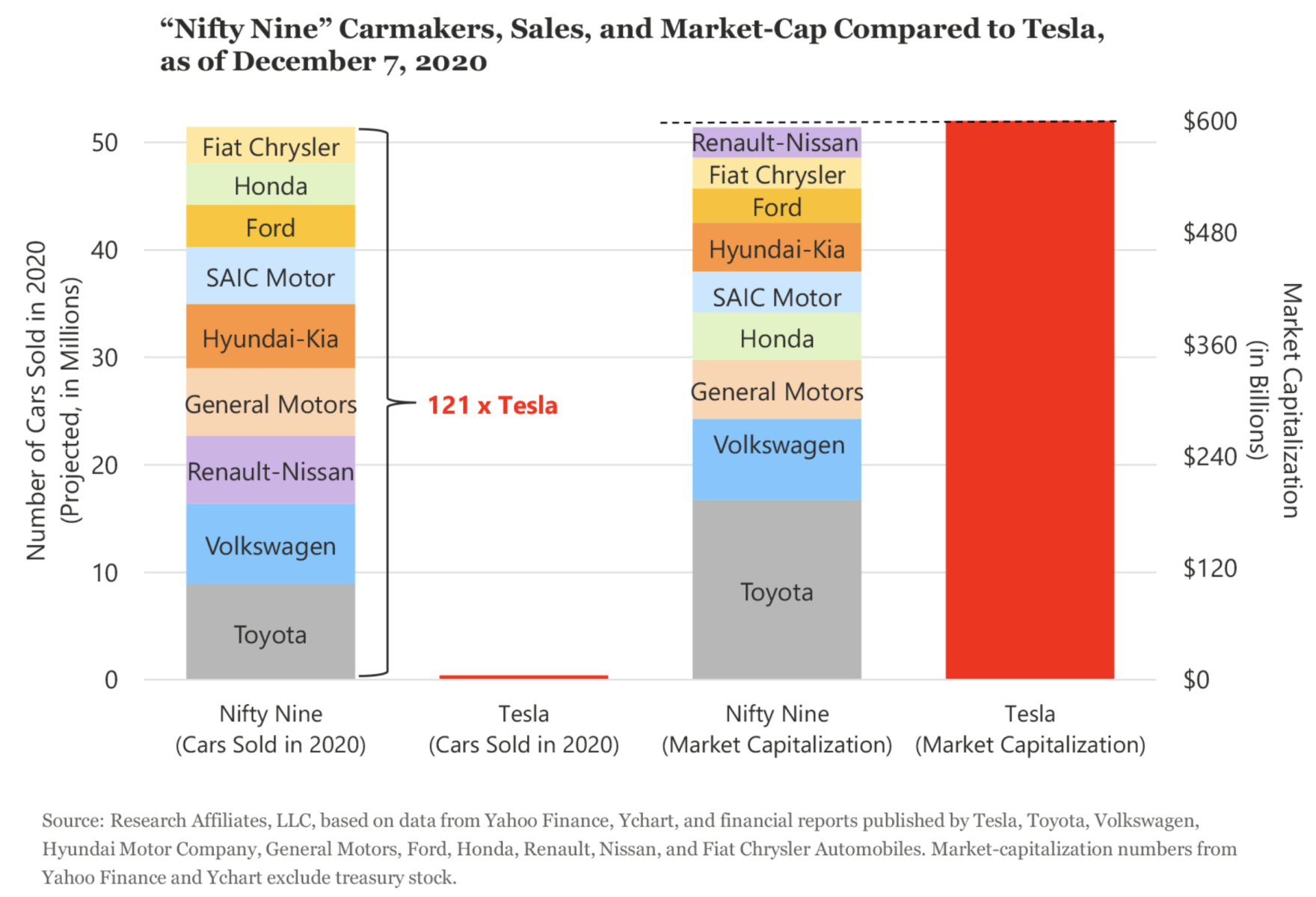

The apparent change in portfolio management strategy is my concern, not the magnitude of the holding at this time. I buy an S&P 500 fund because I don't want to answer question "why is this firm valued equally to the rest of an industry combine when those other firms output 100x more product?"

Just my $0.02, I personally think TSLA was added to the S&P 500 to establish more ESG credibility for the index and signal that Wall Street backs clean tech as a mainstream investment. I don't think it was TSLA was added to generate superior investor returns.

Esg already has its own index. Approx 340 names. MSCI USA. Which coincidentally also happen to mirror the Nasdaq top 6. ( I find that suspicious). It's like yeah we are Esg. But we aren't about to have a crappy performing esg so let's mirror the Nasdaq top 5.

75% of the Nasdaq 100 is on the esg index.

Tsla is on Nasdaq. Etc.

It should have been added earlier this year

The MOC order priced at 695, but I sold a couple more in extended hours at 675. I'm not an expert MOC so just followed @dampedspring advice. It worked out. I had some 640 12/28 call but the volatility stopped/scare me out. I bought at 10 and again at 26, it closed at 55 but went up and down between 10 and 40 wildly.

IMO Tesla stays flat or goes down moving forward. All the institutional buying is done and so is the front running. Now it's just weekly passive flows keeping it alive and active investors who want to own it. There are a lot of those types of actives, but not enough to keep the price up. I think MIke Green @profplum99 does a great job explaining this on all his podcast appearances.

IMO Tesla stays flat or goes down moving forward. All the institutional buying is done and so is the front running. Now it's just weekly passive flows keeping it alive and active investors who want to own it. There are a lot of those types of actives, but not enough to keep the price up. I think MIke Green @profplum99 does a great job explaining this on all his podcast appearances.

One thing I'm not hearing from media or YouTubers.

A big amount of the float just got pulled to the side.

Indexers aren't traders. Thus there are less shares to go around for traders. What happens next. I don't know.

So what it does in the short term is anyone's guess. No one has a playbook of what happens when a company goes from zero to number 6 on the S&P that just happens to pull x% of its float to the side.

In A company that is at the crossroads of 7 converging themes.

The analysts and people have completely missed the story.

A big amount of the float just got pulled to the side.

Indexers aren't traders. Thus there are less shares to go around for traders. What happens next. I don't know.

So what it does in the short term is anyone's guess. No one has a playbook of what happens when a company goes from zero to number 6 on the S&P that just happens to pull x% of its float to the side.

In A company that is at the crossroads of 7 converging themes.

The analysts and people have completely missed the story.

Looking at Tesla revenues I can see somewhat why the stock price exploded, but I still can't get over the absurdity of being priced higher than the worlds highest volume auto makers and battery makers combined.

The PE ratio is still high and profitability uncertain in my opinion. A high PE might be justified but how high is the question. I still think this stock is priced on unicorn farts and fairy dust. It's priced on the "vision" of the stock holders which is something I think has a low probability (Tesla becoming worlds biggest auto and battery maker combined).

A lot of stock performance is purely psychology of the masses of investors with very few objective metrics. That's my conclusion after looking at some stock pricing and revenue histories.

I don't think Tesla is as bad an invest as I once did. It's made it through a major phase of uncertainty, especially impressive given the climate of 2020. I won't be holding it anytime soon since it still doesn't check all of the boxes for me. Too many unknowns for me, and too much competition in the space for my taste, but Tesla as a company I think is here to stay now.

The PE ratio is still high and profitability uncertain in my opinion. A high PE might be justified but how high is the question. I still think this stock is priced on unicorn farts and fairy dust. It's priced on the "vision" of the stock holders which is something I think has a low probability (Tesla becoming worlds biggest auto and battery maker combined).

A lot of stock performance is purely psychology of the masses of investors with very few objective metrics. That's my conclusion after looking at some stock pricing and revenue histories.

I don't think Tesla is as bad an invest as I once did. It's made it through a major phase of uncertainty, especially impressive given the climate of 2020. I won't be holding it anytime soon since it still doesn't check all of the boxes for me. Too many unknowns for me, and too much competition in the space for my taste, but Tesla as a company I think is here to stay now.

This is why I'm not sold on Tesla

https://www.thedrive.com/news/38579/these-repair-bulletins-for-teslas-quality-problems-are-downright-embarrassing-and-serious

Too many quality control issues, some of which are pretty serious, with seemingly no desire to improve their QC process. Other manufacturers, particularly Toyota and Honda, figured out QC a LONG time ago and build it into everything they do. It blows my mind that they could deliver vehicles missing nuts on key suspension parts or still have spontaneous glass shattering issues.

People may love the cars, but I feel like they won't put up with this kind of stuff forever. It's like buying a $50k vehicle com Harbor Freight with how hit or miss they can be.

https://www.thedrive.com/news/38579/these-repair-bulletins-for-teslas-quality-problems-are-downright-embarrassing-and-serious

Too many quality control issues, some of which are pretty serious, with seemingly no desire to improve their QC process. Other manufacturers, particularly Toyota and Honda, figured out QC a LONG time ago and build it into everything they do. It blows my mind that they could deliver vehicles missing nuts on key suspension parts or still have spontaneous glass shattering issues.

People may love the cars, but I feel like they won't put up with this kind of stuff forever. It's like buying a $50k vehicle com Harbor Freight with how hit or miss they can be.

Lol if you think the stock price is going to care about any of that

TxAG#2011 said:

Lol if you think the stock price is going to care about any of that

The stock price might not.

But you will lose repeat customers enough so that it might prevent you from taking market share of 10 biggest automakers combined.

Tesla's PE ratio is 1,400.

The idea of Tesla makes people feel good.

Do you care about making money or do you care about Tesla's PE ratio?

Not of what you are saying matters in the current environment.

Not of what you are saying matters in the current environment.

ABATTBQ11 said:

This is why I'm not sold on Tesla

https://www.thedrive.com/news/38579/these-repair-bulletins-for-teslas-quality-problems-are-downright-embarrassing-and-serious

Too many quality control issues, some of which are pretty serious, with seemingly no desire to improve their QC process. Other manufacturers, particularly Toyota and Honda, figured out QC a LONG time ago and build it into everything they do. It blows my mind that they could deliver vehicles missing nuts on key suspension parts or still have spontaneous glass shattering issues.

People may love the cars, but I feel like they won't put up with this kind of stuff forever. It's like buying a $50k vehicle com Harbor Freight with how hit or miss they can be.

A lot of the organization is run by young and inexperienced engineers. That's why they are creative and fast and take risks, but sometimes miss what others figured out a long time ago. They are trying to reinvent the wheel in every conceivable form... sometimes it goes well, sometimes not-so-well.

TxAG#2011 said:

Do you care about making money or do you care about Tesla's PE ratio?

Not of what you are saying matters in the current environment.

I look at PE ratio combined with other fundamentals. Consumer psychology, market share, competitive advantages, all go into my investment outlook. Are they doing something well that their competition isn't. Compared to

other investment opportunities, how certain do I feel about the company's position 5 and 10 years from now.

If a company checks all of the boxes, then I really don't care about PE ratio, but for me Tesla doesn't check the boxes.

My assessment of consumer psychology is that Tesla is at risk of being a fad, and lower priced models might ultimately dilute their brand image in the long term. Their original luxury consumers probably rotate cars every 3-5 years and may jump ship to other luxury makers when their electric offerings are ready (Porsche and Audi for example). PE ratio just says it might be a fad for investors too.

The winning play would have been to keep the Tesla name for the high end model S and Roadster cars, and put the model 3 and Y, the lower priced vehicles under a different name. There is a reason you have Honda/Acura, Toyota/Lexus, etc.

To Teslas credit what they do have going for them is being the first brand name that consumers associate with "electric car". Owning a word or phrase is good.

And I said above, Tesla is looking better as an investment than it did two years ago. The revenues are still growing like crazy.

No offense, but the fact that robinhood traders were going all in back in April is more valuable information than all of that.

It's a different climate these days. You can get better information reading the front page of wallstreetbets than looking at a companies balance sheet.

It's a different climate these days. You can get better information reading the front page of wallstreetbets than looking at a companies balance sheet.

No offense taken, getting into the head of investors is a good strategy.

Featured Stories

See All

9:07

15h ago

4.5k

5 Thoughts: No. 6 Tennessee 77, No. 7 Texas A&M 69

by Luke Evangelist

16:07

17h ago

2.8k

Disparity from deep dooms No. 7 Texas A&M against No. 6 Vols, 77-69

by Olin Buchanan

4:43

18h ago

735

Game Highlights: No. 6 Tennessee 77, No. 7 Texas A&M 69

by Matthew Dawson