TennAg said:

I see what you're saying but:

1. Nobody's going to buy out tesla with their outstanding debt, warranty, and liability issues.

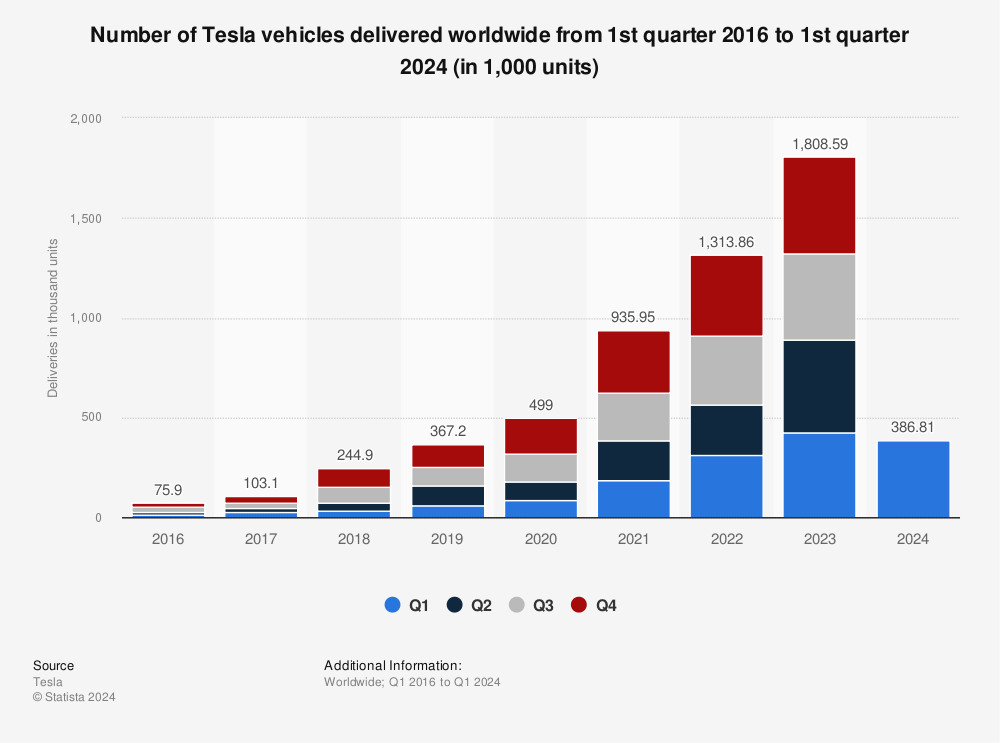

2. We're only a couple months away from seeing actual yoy declines. That hasn't been experienced and will pop the growth story.

3. This stock at this price has tons of room to fall.

4. Regulators and consumer protection groups are finally paying attention to autopilot and its dangers.

5. The robotaxi stuff is bull**** and that's what most of this run up has been about.

6. Tesla forums are almost all complaints about quality and service. A brand that wants to go mainstream can't take much of that and still grow.

I agree in almost all respects, but...

Someone could buy them out simply for the technology and brand. Despite their debt, they do have quite a bit of IP and assets. I could see a buyout.

I could see YoY declines, but the growth potential is still there and excuses could be made (as always). 1 YoY decline probably won't kill them, but repeated declines over the next 3-4 quarters could. They can also inflate their revenues with carbon credits. That's basically free money.

There's definitely tons of room to fall, but less than a year ago. All I'm saying is that last year was a lot more of a sure bet.

Autopilot is definitely as much of a liability as it is a selling point.

Robotaxi is indeed bull****, but I believe more of the run up has been the model 3 in general. I think their downfall is that margins and demand have not been what they projected, likely due to expiring tax credits, late initial deliveries, and quality control issues.

There are plenty of pro-Tesla blogs and forums out there. Their QA/QC is God awful, but people are bought into the brand as much as the car. I agree that that is not enough to take it mainstream, but they'll at least be sustained for awhile.

They're probably still a good long term short, there's just no telling when they tank. Last year, you could tell it wouldn't take long, and they've lost a ton since then.