Not having enough ARM

Stock Markets

26,479,616 Views |

237227 Replies |

Last: 5 hrs ago by Heineken-Ashi

agdaddy04 said:

Any thoughts on RIG? I've stayed in at a $3 average, but really have regretted riding it back down. I understand the state of O&G right now tho.

I like RIG calls if it holds strong historical support in the $5-4.50 range. Maybe ladder into some $5 calls out to next year, or load shares. Or watch for basing here, support to hold, and wait for higher lows to add later on a trend reversal.l

Spirit earnings call is at 9 central today, but they have released the report. Adjusted EPS: $(1.36). Here's a link to the report: https://ir.spirit.com/files/doc_financials/2023/q4/Earnings-Release-4Q23.pdfHeineken-Ashi said:

SAVE at significant resistance. Breakdown from here and bottom might not be in. Needs to get through $7.75 for real confirmation of bottom.

Here's a link to the webcast if anyone's interested. https://events.q4inc.com/attendee/789063928

SAVE is up about 4.5% in pre-market trading right now, but still below the $7.75 level Heineken suggests.

Edit: now up over 5%

bought shares yesterday, but also 18C's next week on the dip. Net free now on themBrewmaster said:

MARA is going to fry short sellers tomorrow if this bitcoin rip holds.

riding the rest to Valhalla

riding the rest to Valhalla

Can't wait for DIS to hit $110 so I can sell this dog of a stock. What an epic crash and burn in one of the biggest overall market bull runs in history.

Your theme song for this ride Viking Rise - Peyton Parrish (VIKING RISE Mobile Game Theme Song) Music Video (youtube.com)Brewmaster said:bought shares yesterday, but also 18C's next week on the dip. Net free now on themBrewmaster said:

MARA is going to fry short sellers tomorrow if this bitcoin rip holds.

riding the rest to Valhalla

You still holding these big dawg? You were caught driving by a Ring doorbell camera.confucius_ag said:

I have 20 contracts PLTR 2/9 18 calls @ . $59 avg. I sweated all day, trying to decide to sell them or keep through ER.

PATH trying to make a little move up

Posted this play before.. but back in.. Last time I got out during a runup following a buyout offer... Stock has slid back since...

Chek cap... (CHEK) Was a colon cancer research company. Research failed. Announced company for sale. First offer that was accepted was in exchange for stock of Keystone dental (private company) Eventually failed in December when activist investor research concluded wasn't a good valuation for shareholders... Several members of previous board thrown out in exchange for activist members..

With research shut down to nill last spring/summer - they have been conservatively burning 1 million dollars in cash per month (hopefully less monthly cash burn at this point-- last reported cash was as of September at 28 million). That would put them at 24 million in cash on hand for Feb-1 (no debt). Company currently valued at about 12 million.

There is also possible some IP and value associated with stock listing that could be harvested. Been trading at 2.07 to 2.25 range for a couple weeks. Feels to me manipulation by the activist investor to get more shares before sale. I've been buying at the low end of the range and holding for the runup I expect if/when the sale is announced.

Chek cap... (CHEK) Was a colon cancer research company. Research failed. Announced company for sale. First offer that was accepted was in exchange for stock of Keystone dental (private company) Eventually failed in December when activist investor research concluded wasn't a good valuation for shareholders... Several members of previous board thrown out in exchange for activist members..

With research shut down to nill last spring/summer - they have been conservatively burning 1 million dollars in cash per month (hopefully less monthly cash burn at this point-- last reported cash was as of September at 28 million). That would put them at 24 million in cash on hand for Feb-1 (no debt). Company currently valued at about 12 million.

There is also possible some IP and value associated with stock listing that could be harvested. Been trading at 2.07 to 2.25 range for a couple weeks. Feels to me manipulation by the activist investor to get more shares before sale. I've been buying at the low end of the range and holding for the runup I expect if/when the sale is announced.

ARM up over 40% today. Just my opinion, but if you like NVDA, ARM should be a no brainer, long term hold

MARA - $21.25 first target for new shares (excluding long time hold) once over $19.75. Can either take some profits there or move stop to $20 range. Next target would be $23-$23.30 range.

Red Pear Jack said:

Citadel Among Hedge Funds That Got Morgan Stanley's Block-Trading Leaks https://www.bloomberg.com/news/articles/2024-02-07/citadel-caas-and-other-hedge-funds-got-morgan-stanley-s-block-trading-tips

"The block-trading probe exposed a type of leak that has long been suspected on Wall Street. It was widely known that banks engaged in delicate conversations with hedge funds to gauge their potential interest in slugs of stocks that could become available. The question was whether those conversations effectively tipped off hedge funds."

I was reading about this this morning. So messed up. MS got fined 249M and one trader got a year in the penalty box. None of the hedge funds that shorted the stocks (with the guarantee that they would be able to cover by buying the blocks) were penalized, and most were able to stay anonymous

"Sellers offloading blocks of stock have long vented frustrations about prices that slip just before a trade is executed, reducing their proceeds. Morgan Stanley, a force in block trading, was a target of scorn among envious rivals, who dubbed price declines before its sales 'the Morgan Stanley fade.''

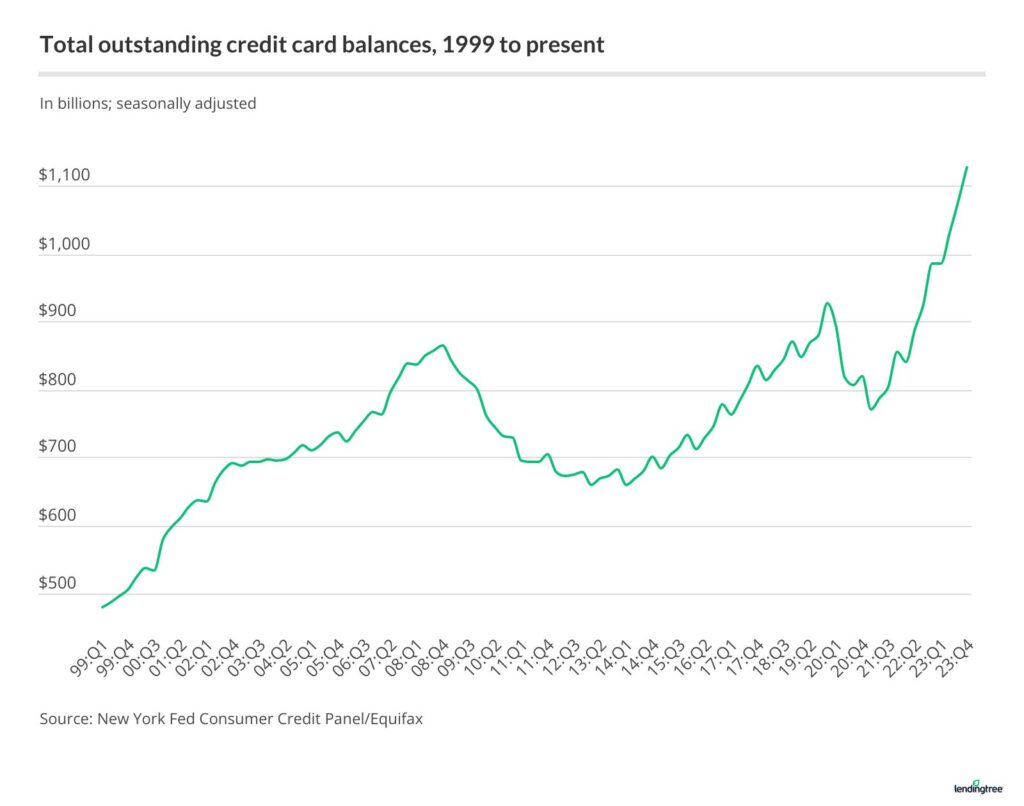

Yeah I expect to see a chart like this, what a sad reality. However, nominal vs real dollars makes it not look near as bad. I'm waiting for a day of reckoning but the government refuses to let anyone fail, especially those who take too much risk. It's like the more irresponsible you are the more you get rewarded.BlueTaze said:

Interesting chart on credit card debt. When does a consumer economy turnover? Is it $1.5Tor $2T?

Just think how much of this credit card debt was inspired by a glimpse at their bloated 401Ks. I'm more of a TA guy, but hard not to see a notable crash in near term (prob post election). Maybe S&P hits $6K first, but once it turns over its gonna be nasty, and not sure the Fed is gonna QE anywhere near as hard as COVID.

Powell just got celebrated on 60min as the soft landing savior, retail is getting complacent, rug pull might be on the horizon.

I have an opinion the government could not let Baby Boomers lose massive amounts of their portfolios close to retirement so we had bailouts. Now that most have retired, left the workforce and are more likely to have a higher share of fixed income in their portfolios, the QE/bailouts aren't going to be near covid levels. I have no evidence of it but it makes too much sense to me haha.

I sold those and my 5/17 20C I had as well..ProgN said:You still holding these big dawg? You were caught driving by a Ring doorbell camera.confucius_ag said:

I have 20 contracts PLTR 2/9 18 calls @ . $59 avg. I sweated all day, trying to decide to sell them or keep through ER.

Been a nice week. Only options on PLTR I have left are $20 leaps that are doing nice as well. But I only have 4 of those.

PATH has to break the previous high. If so, target is gap fill $29 with highest being $35 probably. If it can't, a break below $22.16 will mean it is threatening to try for lower gap fill $20 with $18's as a possibility.

Find me a time in history where there were bailouts with the FED remittances to the treasury in such a hole.Chef Elko said:Yeah I expect to see a chart like this, what a sad reality. However, nominal vs real dollars makes it not look near as bad. I'm waiting for a day of reckoning but the government refuses to let anyone fail, especially those who take too much risk. It's like the more irresponsible you are the more you get rewarded.BlueTaze said:

Interesting chart on credit card debt. When does a consumer economy turnover? Is it $1.5Tor $2T?

Just think how much of this credit card debt was inspired by a glimpse at their bloated 401Ks. I'm more of a TA guy, but hard not to see a notable crash in near term (prob post election). Maybe S&P hits $6K first, but once it turns over its gonna be nasty, and not sure the Fed is gonna QE anywhere near as hard as COVID.

Powell just got celebrated on 60min as the soft landing savior, retail is getting complacent, rug pull might be on the horizon.

I have an opinion the government could not let Baby Boomers lose massive amounts of their portfolios close to retirement so we had bailouts. Now that most have retired, left the workforce and are more likely to have a higher share of fixed income in their portfolios, the QE/bailouts aren't going to be near covid levels. I have no evidence of it but it makes too much sense to me haha.

Heineken-Ashi said:Find me a time in history where there were bailouts with the FED remittances to the treasury in such a hole.Chef Elko said:Yeah I expect to see a chart like this, what a sad reality. However, nominal vs real dollars makes it not look near as bad. I'm waiting for a day of reckoning but the government refuses to let anyone fail, especially those who take too much risk. It's like the more irresponsible you are the more you get rewarded.BlueTaze said:

Interesting chart on credit card debt. When does a consumer economy turnover? Is it $1.5Tor $2T?

Just think how much of this credit card debt was inspired by a glimpse at their bloated 401Ks. I'm more of a TA guy, but hard not to see a notable crash in near term (prob post election). Maybe S&P hits $6K first, but once it turns over its gonna be nasty, and not sure the Fed is gonna QE anywhere near as hard as COVID.

Powell just got celebrated on 60min as the soft landing savior, retail is getting complacent, rug pull might be on the horizon.

I have an opinion the government could not let Baby Boomers lose massive amounts of their portfolios close to retirement so we had bailouts. Now that most have retired, left the workforce and are more likely to have a higher share of fixed income in their portfolios, the QE/bailouts aren't going to be near covid levels. I have no evidence of it but it makes too much sense to me haha.

Everyone wants the Instagram life on a MySpace budget.

Big 30 yr treasury auction today at noon. Thinking it could get pretty volatile. Could definitely give SPX the final oomph it needs to hit 5,000 if it goes like yesterdays 10 year.

Not sure what you're asking, but you sound smart!

Wish I had listened yesterday!ToddyHill said:

ARM up over 40% today. Just my opinion, but if you like NVDA, ARM should be a no brainer, long term hold

What's the next entry point?

This popped up when I went to YouTube to look for something and damn, I forgot how funny these were when they came out. These will brighten your morning.

Heineken-Ashi said:

MARA - $21.25 first target for new shares (excluding long time hold) once over $19.75. Can either take some profits there or move stop to $20 range. Next target would be $23-$23.30 range.

nice, I'm doing something right. I had 21.25 marked too.

Is anyone still tracking BIG? Did it break free of a down trend this morning?

Wish I could help you. I'm a buy and hold investor. My personal opinion...I think ARM is a buy even at these levels if the intent is to hold it for the long term.

big cup n handle since August, thank you sir for postingHeineken-Ashi said:

RBLX is a bullish chart. Any retrace should hold $40. If so, it should at least get to upper $50's with most bullish target $80.

ETX_Ag_22_24 said:

Long time lurker, but this thread has been phenomenal lately! Prog and Heineken have been spot on and extremely helpful. Curious if anyone else is still Holding FSLY after today's action? Also, would love to hear thoughts on BLZE. I have been trading this stock since mid December and it looks like it may finally have some real life!

You still riding shotgun on FSLY with me? It might breakout if we breakthrough 5000 on SPX.

at least you had some, I'm all legs, lol.Ranger222 said:

Not having enough ARM

Ranger has the armsBrewmaster said:at least you had some, I'm all legs, lol.Ranger222 said:

Not having enough ARM

Brew has the legs

BES has the TNA

If we were talking about something else, I'd have to put BES in 1st.

Wish I could say I had the patience to hold onto it! Instead, I've had a few rather material learning lessons this week sadly!

Cramer touting ARM as a buy at these levels... Run or?

Out on short term MARA

Time to short itlck90 said:

Cramer touting ARM as a buy at these levels... Run or?

Question for the board about trailing stops.

I bought a pretty good amount of MARA yesterday, and before the market opened this morning I put in a trailing stop of 2% to trigger in case it went south. The stop triggered this morning, and I sold my shares. I still made a good profit, but I left quite a bit on the table.

That leads me to believe that I set my trailing stop too tight.

Where do y'all set trailing stops? Do you use percentage, or a dollar amount? Does it vary for each occasion, or do you typically stay with the same setup?

Also, why did the stop trigger? The stock never dropped by 2%. There were a few fluctuations this morning, but never a 2% drop.

I bought a pretty good amount of MARA yesterday, and before the market opened this morning I put in a trailing stop of 2% to trigger in case it went south. The stop triggered this morning, and I sold my shares. I still made a good profit, but I left quite a bit on the table.

That leads me to believe that I set my trailing stop too tight.

Where do y'all set trailing stops? Do you use percentage, or a dollar amount? Does it vary for each occasion, or do you typically stay with the same setup?

Also, why did the stop trigger? The stock never dropped by 2%. There were a few fluctuations this morning, but never a 2% drop.

NVDA reports earnings 2/21. What are the prospects of an SMCI type earnings move? I'm considering buying dips leading up to 2/21 with the intention of swinging the new buys and then retaining my existing core position. What's the board's thoughts?

The FED nor the treasury has any ability to bailout anyone without creating massive amounts of inflation.Chef Elko said:

Not sure what you're asking, but you sound smart!

Since 2008 the FED has been borrowing from the treasury, not printing money. They then pay remittances or interest back to the treasury, and its a tiny fraction of what they owe. By 2020, all the money borrowed was long spent and being paid back at a rate that would take decades at best. Then they went into hyperdrive and borrowed more in 1 year than ALL of the borrowing between 2008 and 2020. They then did it again with the banking failures last year.

FED remittances to the treasury are shown as monthly figures. But once they stop, and they start dipping into a hole, the remittances owed are shifted to be a CUMULATIVE number to the downside. And it's categorized as an ASSET (lol) on the Fed balance sheet. The FED can only remit to the treasury again once it first climbs out of its hole. And they can't do that with high rates. So the hole keeps growing.

myf.red/g/1aTK6

There is no money. The only way they get money is to borrow even more, and the treasury is not in a spot to loan much more. Printing might be the only option, but that would so inflationary it would cripple the economy.

Bailouts aren't coming.

Featured Stories

See All

27:26

2h ago

642

19:50

16h ago

7.4k

4:28

1h ago

250

Game Highlights: No. 8 Texas A&M 69, Georgia 53

by Matthew Dawson

Photo Gallery: No. 8 Texas A&M 69, Georgia 53

by Zoe Kelton

3 Days 'til: Outlining what Texas A&M's 'best version' looks like in 2025

by Ryan Brauninger

LukeEvangelist

Postgame Discussion: No. 8 Texas A&M 69, Georgia 53

in Billy Liucci's TexAgs Premium

5