Arm holy hell

Stock Markets

26,479,738 Views |

237227 Replies |

Last: 5 hrs ago by Heineken-Ashi

BT1395 said:BT1395 said:

The NVDA stuff is garbage. Short it if you believe them though! I'm long on it and think it's VERY well positioned for the AI wave over the next few years.

Just revisiting this as NVDA crosses $600 this morning. A tasty 32% rip since this garbage short attack was attempted. There's not enough time or energy in the world to hold folks like this accountable, so I hope their wildly red short positions are punishment enough!

Just crossed $700 today. Obviously due for a pullback of some sort, but still cheap on a relative basis using forward P/E.

https://seekingalpha.com/article/4668173-powell-industries-remains-strong-sa-quant-pick-after-surge?mailingid=34271587&messageid=must_reads&serial=34271587.1506362&utm_campaign=Must%2BReads%2Brecurring%2B2024-02-07&utm_content=seeking_alpha&utm_medium=email&utm_source=seeking_alpha&utm_term=must_reads

I don't like it at these levels but this is a good read regarding POWL and should give everyone confidence to buy it back without fear when the market rolls over.

I don't like it at these levels but this is a good read regarding POWL and should give everyone confidence to buy it back without fear when the market rolls over.

market watch is currently pimping this stock as a buy, which has a large following

Apple pay is going to end them, especially when they pissed off most of their customers last year or just over a year ago. I'd short it before I went long PYPL. JMOtailgatetimer10 said:

market watch is currently pimping this stock as a buy, which has a large following

BT1395 said:BT1395 said:BT1395 said:

The NVDA stuff is garbage. Short it if you believe them though! I'm long on it and think it's VERY well positioned for the AI wave over the next few years.

Just revisiting this as NVDA crosses $600 this morning. A tasty 32% rip since this garbage short attack was attempted. There's not enough time or energy in the world to hold folks like this accountable, so I hope their wildly red short positions are punishment enough!

Just crossed $700 today. Obviously due for a pullback of some sort, but still cheap on a relative basis using forward P/E.

Not advocating shorting, or any of the round trip stuff, but there has been some euphoric hype lately tied to AI (end of clip below). I'd def harvest into Feb 21 earnings. The longer there is no healthy pullback or basing, the harder a correction will be.

PayPal earnings has been so baffling over the past several quarters. ER comes out and it pops 5-10%…then over the next hour continues to plummet to down 5-10%. It has happened several quarters in the past 2 years. What on earth is uncovered over the course of an hour to cause that dramatic swing?!?

I bought some before close - looked at ah hours price and it was up 10%. Not much longer it was down 5%. Crazy!

MARA is going to fry short sellers tomorrow if this bitcoin rip holds.

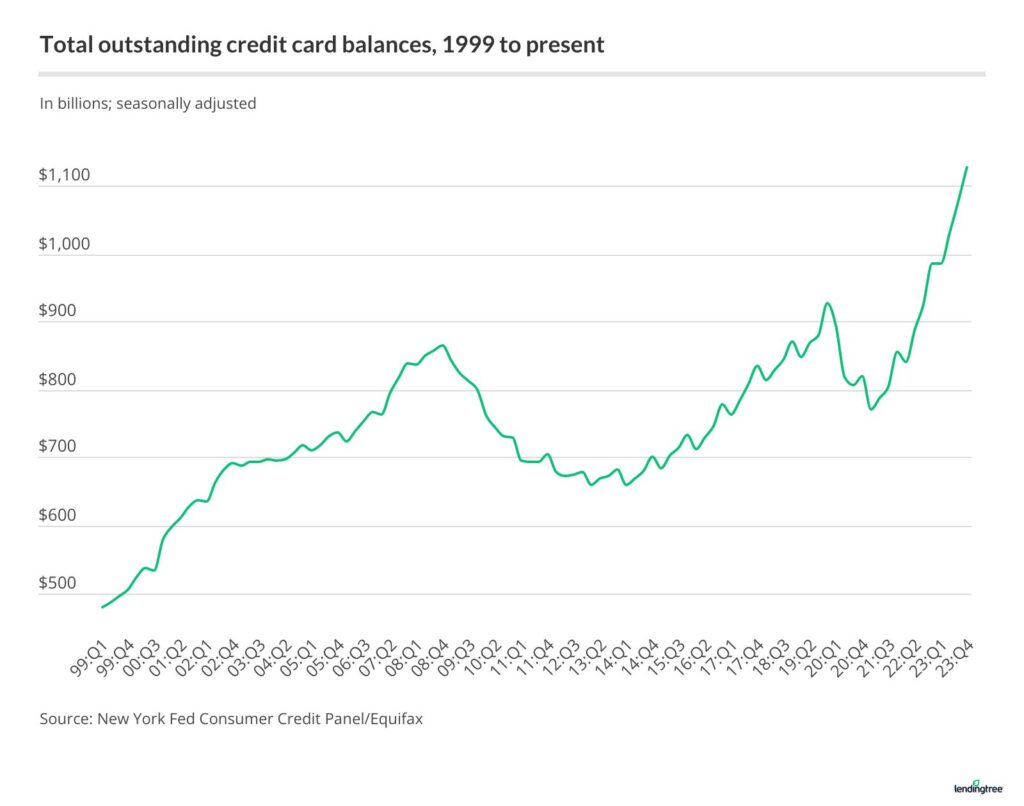

Interesting chart on credit card debt. When does a consumer economy turnover? Is it $1.5Tor $2T?

Just think how much of this credit card debt was inspired by a glimpse at their bloated 401Ks. I'm more of a TA guy, but hard not to see a notable crash in near term (prob post election). Maybe S&P hits $6K first, but once it turns over its gonna be nasty, and not sure the Fed is gonna QE anywhere near as hard as COVID.

Powell just got celebrated on 60min as the soft landing savior, retail is getting complacent, rug pull might be on the horizon.

I've been in AXON now for about three years. Motley Fool recommended it years ago and I bought in. I've done well in it and plan to hold.

I'm assuming FUBO is a dead stock walking with that Dis Fox ESipn deal?

https://www.cnbc.com/2024/02/06/credit-card-delinquencies-surged-in-2023-indicating-financial-stress-new-york-fed-says.html?qsearchterm=credit%20cardBlueTaze said:

Interesting chart on credit card debt. When does a consumer economy turnover? Is it $1.5Tor $2T?

Just think how much of this credit card debt was inspired by a glimpse at their bloated 401Ks. I'm more of a TA guy, but hard not to see a notable crash in near term (prob post election). Maybe S&P hits $6K first, but once it turns over its gonna be nasty, and not sure the Fed is gonna QE anywhere near as hard as COVID.

Powell just got celebrated on 60min as the soft landing savior, retail is getting complacent, rug pull might be on the horizon.

Quote:

Credit card delinquencies surged more than 50% in 2023 as total consumer debt swelled to $17.5 trillion, the New York Federal Reserve reported Tuesday.

Debt that has transitioned into "serious delinquency," or 90 days or more past due, increased across multiple categories during the year, but none more so than credit cards.

With a total of $1.13 trillion in debt, credit card debt that moved into serious delinquency amounted to 6.4% in the fourth quarter, a 59% jump from just over 4% at the end of 2022, the New York Fed reported. The quarterly increase at an annualized pace was around 8.5%, New York Fed researchers said.

Delinquencies also rose in mortgages, auto loans and the "other" category. Student loan delinquencies moved lower as did home equity lines of credit. Overall, 1.42% of debt was 90 days or more past due, up from just over 1% at the end of 2022.

"Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels," said Wilbert van der Klaauw, economic research advisor at the New York Fed. "This signals increased financial stress, especially among younger and lower-income households."

I sold out of my POWL at 120 when I bought in at around $80. I had a nice tidy gain, but now I'm questioning what I was thinking by selling. I'm getting the feeling that this particular thread is for traders and not for buy and holders. Company comes out with great earnings and guidance, the stock pops and I sell? Feeling stupid right now.

Yes, I have it, but at restaurants and travel, you get 3.5 percent.

CheladaAg said:

I'm assuming FUBO is a dead stock walking with that Dis Fox ESipn deal?

That was my thought, unless there's some quick breakthrough in the betting part of their business model

I'm the person that brought POWL to the clubhouse and have followed it for a long time. I'm a swing trader, not a day trader, nor am I a buy and hold forever. I've experienced riding stocks when they go parabolic, only to ride them down and watch that massive profit evaporate. You made a 50% return in a few days, now when it falls with the market, then you'll have more buying power and able to buy a larger position.RightWingConspirator said:

I sold out of my POWL at 120 when I bought in at around $80. I had a nice tidy gain, but now I'm questioning what I was thinking by selling. I'm getting the feeling that this particular thread is for traders and not for buy and holders. Company comes out with great earnings and guidance, the stock pops and I sell? Feeling stupid right now.

POWL is a microcap with a float of only 11.5M shares. I don't think it will see $80 again but I'll be buying it back starting at $100 and add more if it goes lower than that. You'll never pick the bottom or the top so celebrate your profits and don't dwell on 'what ifs'. JMO.

That's my biggest hurdle as a newcomer. Ignore the what ifs and trade what's in front of me.

Is U on the radar even at $32 with earnings in about 3 weeks? Revenue has increased the last four quarters

Edit: Found H-A's comments about it. Looks like it's in his buy zone above $29 to stay bullish, so a possible earnings catalyst back up to $40 range

Is U on the radar even at $32 with earnings in about 3 weeks? Revenue has increased the last four quarters

Edit: Found H-A's comments about it. Looks like it's in his buy zone above $29 to stay bullish, so a possible earnings catalyst back up to $40 range

You've brought a collection of great opportunities to the board for a long time . . . which begs me to wonder when will it be TTD's turn for glory. It seems that the large chops may be smoothing out but still in a downward pattern.ProgN said:I'm the person that brought POWL to the clubhouse and have followed it for a long time. I'm a swing trader, not a day trader, nor am I a buy and hold forever. I've experienced riding stocks when they go parabolic, only to ride them down and watch that massive profit evaporate. You made a 50% return in a few days, now when it falls with the market, then you'll have more buying power and able to buy a larger position.RightWingConspirator said:

I sold out of my POWL at 120 when I bought in at around $80. I had a nice tidy gain, but now I'm questioning what I was thinking by selling. I'm getting the feeling that this particular thread is for traders and not for buy and holders. Company comes out with great earnings and guidance, the stock pops and I sell? Feeling stupid right now.

POWL is a microcap with a float of only 11.5M shares. I don't think it will see $80 again but I'll be buying it back starting at $100 and add more if it goes lower than that. You'll never pick the bottom or the top so celebrate your profits and don't dwell on 'what ifs'. JMO.

It is in the mid to upper 20's. I'm not seeing it as an earnings play at the moment. Their revenue has indeed increased but they've still missed estimates the last 2 quarters. $U is a good company but since they're not profitable, then they'll get crushed if they miss with the market this overextended. If they miss, then I'll happily buy it in the low 20's but it's not worth the gamble for me right now.El_duderino said:

That's my biggest hurdle as a newcomer. Ignore the what ifs and trade what's in front of me.

Is U on the radar even at $32 with earnings in about 3 weeks? Revenue has increased the last four quarters

I am looking at one that reports next Wednesday after the close, but it's in no man's land chartwise. I will post it if I play it before I buy and then post what I buy it at. Actually, I have a small position but will add more if I feel comfortable playing their ER.

TTD is a very good company and the leader in their industry. That said, when AAPL changed it so users had to basically opt into sharing their information it affected their business model. Now GOOG is eliminating cookies so I'm concerned this might adversely affect TTD. I want to see their earnings next Thursday and forward guidance. If they pop, then I'm considering taking some off the table and decrease my exposure.South Platte said:You've brought a collection of great opportunities to the board for a long time . . . which begs me to wonder when will it be TTD's turn for glory. It seems that the large chops may be smoothing out but still in a downward pattern.ProgN said:I'm the person that brought POWL to the clubhouse and have followed it for a long time. I'm a swing trader, not a day trader, nor am I a buy and hold forever. I've experienced riding stocks when they go parabolic, only to ride them down and watch that massive profit evaporate. You made a 50% return in a few days, now when it falls with the market, then you'll have more buying power and able to buy a larger position.RightWingConspirator said:

I sold out of my POWL at 120 when I bought in at around $80. I had a nice tidy gain, but now I'm questioning what I was thinking by selling. I'm getting the feeling that this particular thread is for traders and not for buy and holders. Company comes out with great earnings and guidance, the stock pops and I sell? Feeling stupid right now.

POWL is a microcap with a float of only 11.5M shares. I don't think it will see $80 again but I'll be buying it back starting at $100 and add more if it goes lower than that. You'll never pick the bottom or the top so celebrate your profits and don't dwell on 'what ifs'. JMO.

I've been following since the Taser days. I love the moves, but it's hard to accumulate at these prices. I'm wishing for a split  …..

…..

AXON has become the Industry standard for body cameras. The sky is the limit with the exponential demand for data storage.

…..

…..AXON has become the Industry standard for body cameras. The sky is the limit with the exponential demand for data storage.

Fair enough, I realize that everyone has their own objectives. Lord knows I've been up on some stocks that doubled and I watched while they fell into losses or considerably smaller gains. Right now I'm up very big on CDNS, MELI, AXON, MA, MSFT, SPOT, CRWD, GCT and several others. Not sure when to sell them, but the fear is they pull an Amazon and go up for years.

I can't opine about any on the list other than MSFT and CRWD because I don't follow the others. I'd hold those 2 and not trade them. They're well positioned for the AI boom. I follow PANW and will buy it when the market rolls over. Cyber security is going to be huge going forward.

not necessarily. at least in short term, Heineken is looking for 2.40. also long term, sometimes stocks ignore what people "think" they should do.CheladaAg said:

I'm assuming FUBO is a dead stock walking with that Dis Fox ESipn deal?

RightWingConspirator said:

Fair enough, I realize that everyone has their own objectives. Lord knows I've been up on some stocks that doubled and I watched while they fell into losses or considerably smaller gains. Right now I'm up very big on CDNS, MELI, AXON, MA, MSFT, SPOT, CRWD, GCT and several others. Not sure when to sell them, but the fear is they pull an Amazon and go up for years.

There's a time to long term invest and there's a time to trade. When you see a short term setup, you trade. If you think the company has long term potential, you leave some exposure on the table. You lower your basis continually through profitable trades until you feel completely comfortable letting it ride.

For example. NGL. I bought this one in the mid $3's last year. Sold it in the mid 5's but kept a 20% stake. Then sold a little more just under $6. I now have a completely free ride on remaining shares. No risk. The rest is stashed away as a long term hold. If the market shows signs of a major reversal, I might sell if it hasn't been beaten down already to raise cash. Otherwise, it doesn't get touched.

Without a serious amount of liquidity, buying expensive stocks and trading them to lower basis and build a long term position is very difficult, and it can be nerve wrecking. So just trade them. Use your profits to get yourself to the place you need to be in the future where you can be more aggressive and opportunistic. Take the emotion out.

There will always be new opportunities. Even if we have a major drawdown.

Those asking about PLTR - the $29 - $30 range is huge resistance should it get there. Not only is it a huge chop zone from early in its history, but it's the highest available gap.

Citadel Among Hedge Funds That Got Morgan Stanley's Block-Trading Leaks https://www.bloomberg.com/news/articles/2024-02-07/citadel-caas-and-other-hedge-funds-got-morgan-stanley-s-block-trading-tips

"The block-trading probe exposed a type of leak that has long been suspected on Wall Street. It was widely known that banks engaged in delicate conversations with hedge funds to gauge their potential interest in slugs of stocks that could become available. The question was whether those conversations effectively tipped off hedge funds."

"The block-trading probe exposed a type of leak that has long been suspected on Wall Street. It was widely known that banks engaged in delicate conversations with hedge funds to gauge their potential interest in slugs of stocks that could become available. The question was whether those conversations effectively tipped off hedge funds."

RBLX is a bullish chart. Any retrace should hold $40. If so, it should at least get to upper $50's with most bullish target $80.

Any thoughts on RIG? I've stayed in at a $3 average, but really have regretted riding it back down. I understand the state of O&G right now tho.

On TTD, it's my single largest holding with 3000 shares so I'm thinking about cutting some due to the chop but it is a little painful thinking about why I didn't take some profits when it was over $100.

On TTD, it's my single largest holding with 3000 shares so I'm thinking about cutting some due to the chop but it is a little painful thinking about why I didn't take some profits when it was over $100.

RightWingConspirator said:

Fair enough, I realize that everyone has their own objectives. Lord knows I've been up on some stocks that doubled and I watched while they fell into losses or considerably smaller gains. Right now I'm up very big on CDNS, MELI, AXON, MA, MSFT, SPOT, CRWD, GCT and several others. Not sure when to sell them, but the fear is they pull an Amazon and go up for years.

Have you ever considered writing covered calls on them?

RIG reports earnings on 2/19 and missed 1, 2, and 3Q23 earnings. Looking at the charts, there was no run up prior to earnings in the past year. Are there any factors that are different this time? If not, then wouldn't your capital get a better return in somewhere else? I retired from AT&T at the end of 2022 and started trading with a small part of my retirement last summer. I still had a block of T stock which fell from about $20 to the lows of $13 and some change. My mindset was that I would sell it when it got back to $20 again. Well, it got back to $18 a few days ago and is now dropping again. I finally realized that there have been so many trade opportunities where I have made great returns but had to take small positions because of the size of my trading account. I could have more than recouped my $7 T loss by liquidating T or at least a part of it in order to amplify more profitable trade opportunities. Maybe removing the emotion will help you evaluate not only RIG but TTD as well. BTW, NVDA reports 2/21. We might have an adjustment before then, but in the current environment, would you rather ride earnings with RIG or NVDA? I sure regret not using some of my T dollars to amplify my POWL and PLTR trades. I'm easing out of T to be ready for the next opportunity.

Yeah RIG was another one I toyed with and didn't really make anything on a few years ago. Good company, just floats with oil prices ultimately.

So what is the consensus on short play o' day today?

So what is the consensus on short play o' day today?

The RIG Bagholders meet every other Thursday at 7PM under the same bridge that the WWR bagholders meet at.joekm3 said:

RIG reports earnings on 2/19 and missed 1, 2, and 3Q23 earnings. Looking at the charts, there was no run up prior to earnings in the past year. Are there any factors that are different this time? If not, then wouldn't your capital get a better return in somewhere else? I retired from AT&T at the end of 2022 and started trading with a small part of my retirement last summer. I still had a block of T stock which fell from about $20 to the lows of $13 and some change. My mindset was that I would sell it when it got back to $20 again. Well, it got back to $18 a few days ago and is now dropping again. I finally realized that there have been so many trade opportunities where I have made great returns but had to take small positions because of the size of my trading account. I could have more than recouped my $7 T loss by liquidating T or at least a part of it in order to amplify more profitable trade opportunities. Maybe removing the emotion will help you evaluate not only RIG but TTD as well. BTW, NVDA reports 2/21. We might have an adjustment before then, but in the current environment, would you rather ride earnings with RIG or NVDA? I sure regret not using some of my T dollars to amplify my POWL and PLTR trades. I'm easing out of T to be ready for the next opportunity.

Sorry - the RIG guys are going to have to find a new bridge. I heard the CLOV and GOCO bagholders have taken up a lot of space under that bridge over time. I believe they brought a table with them, and someone is probably still banging on it. Maybe RIG can have the day shift?Red Pear Luke (BCS) said:The RIG Bagholders meet every other Thursday at 7PM under the same bridge that the WWR bagholders meet at.joekm3 said:

RIG reports earnings on 2/19 and missed 1, 2, and 3Q23 earnings. Looking at the charts, there was no run up prior to earnings in the past year. Are there any factors that are different this time? If not, then wouldn't your capital get a better return in somewhere else? I retired from AT&T at the end of 2022 and started trading with a small part of my retirement last summer. I still had a block of T stock which fell from about $20 to the lows of $13 and some change. My mindset was that I would sell it when it got back to $20 again. Well, it got back to $18 a few days ago and is now dropping again. I finally realized that there have been so many trade opportunities where I have made great returns but had to take small positions because of the size of my trading account. I could have more than recouped my $7 T loss by liquidating T or at least a part of it in order to amplify more profitable trade opportunities. Maybe removing the emotion will help you evaluate not only RIG but TTD as well. BTW, NVDA reports 2/21. We might have an adjustment before then, but in the current environment, would you rather ride earnings with RIG or NVDA? I sure regret not using some of my T dollars to amplify my POWL and PLTR trades. I'm easing out of T to be ready for the next opportunity.

Featured Stories

See All

27:26

2h ago

722

19:50

16h ago

7.5k

4:28

2h ago

280

Game Highlights: No. 8 Texas A&M 69, Georgia 53

by Matthew Dawson

Photo Gallery: No. 8 Texas A&M 69, Georgia 53

by Zoe Kelton

3 Days 'til: Outlining what Texas A&M's 'best version' looks like in 2025

by Ryan Brauninger

LukeEvangelist

Postgame Discussion: No. 8 Texas A&M 69, Georgia 53

in Billy Liucci's TexAgs Premium

5