$SPY Millions Worth of Puts Just Hit the Tape$SPY $QQQ & $IWM have all seen substantial put orders today, even though the market is green

— Cheddar Flow (@CheddarFlow) July 5, 2024

Are they prepping for something next week? 🤔 pic.twitter.com/eSzM9FvulC

Stock Markets

26,694,210 Views |

238026 Replies |

Last: 22 min ago by Heineken-Ashi

Awesome. Will take me a bit/weekend at least to dig thru all of that. Thx.

Order filled this morning on a dip.

One more for today.

NVDA - this is a common structure. The zones for bullish and bearish are clear based on current structure. What I'm tracking below is a similar structure to what we saw at the end of May but on a larger scale based on the initial decline off the high. Please understand what this chart is showing before the memes of a million scribbly lines show up (always funny IMO and often accurate).

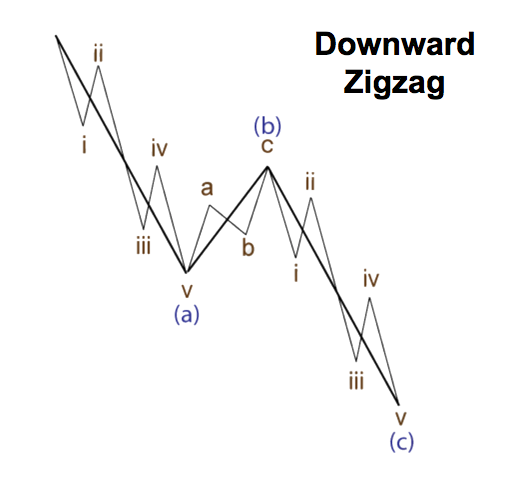

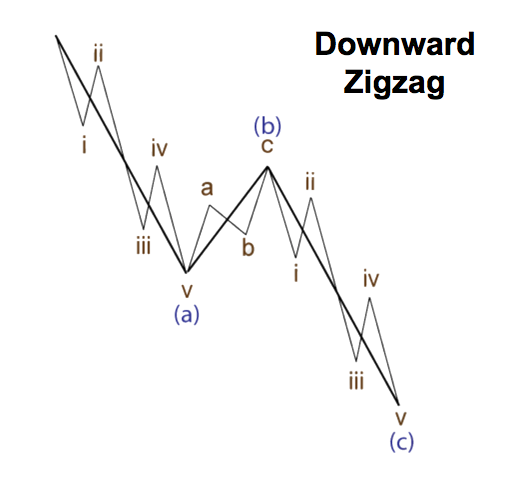

Instruments rarely fall from a high in a single move. Corrections are hard to quanitfy and even harder to time. The saying "like throwing jello for distance" is my favorite. But once you have the initial move off a high, you can measure out the most standard path and adjust as you go. That path is of a typical "zigzag" correction.

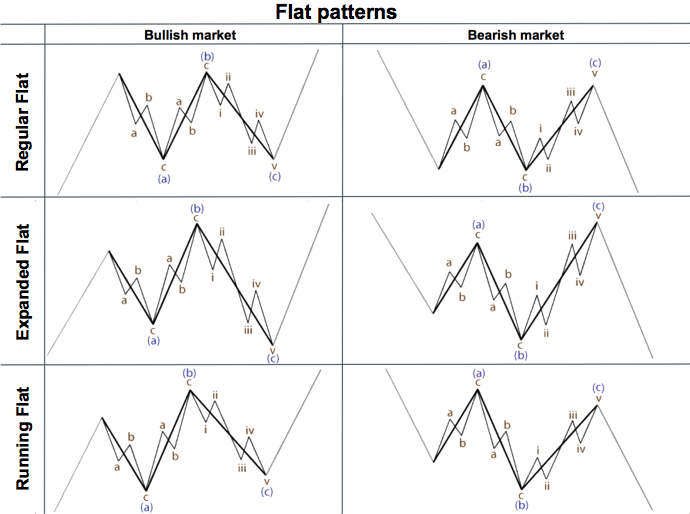

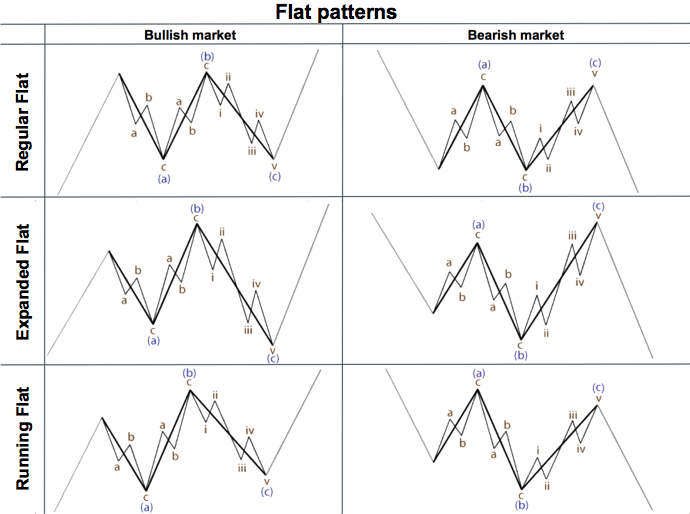

While this doesn't seem to perfectly match that, it is still on the table as long as price doesn't break above $135. If NVDA goes higher than that, then the highest probability is some type of "flat".

But again, corrections are a mix of bullish and bearish sentiment, neither taking hold until the other is exhausted. Which is why they tend to be messy, overalpping, and unpredictable. While there ideal paths you look for similar to the above, there is literally no set rule or guideline. Truly anything can happen. So based on what I'm seeing, the most ideal path for NVDA is as follows.

If you are bullish, you need to see $130 taken out and then you absolutely can't see any breaks back below it. You can use $130 as your new stop level and feel very safe. If you are bearish, your runway to be so is as long as under ATH, and even a little higher in the case of an expanding flat where the "b" wave can go higher than the "a". But in that case, maintaining bearishness at new highs is not wise, as even if a renewed selloff commences, you would need back under $134 with no confirmation of being correct until below $130, at which point the majority of the move back down has already happened. Therefore, if you are bearish and we are above the previous high, your best bet is a lucky guess. If you see NVDA play out cose to what I have charted here, with $135 acting as resistance, please respect that strong probability of another significant move down. It doesn't mean it has to happeb. But the move will be set up perfectly and should be respected until broken. If another selloff does happen, $106 is the current expectation for the next bottom. But a lot to play out before we hone in on lower targets. Next week will be extremely telling. And the worse case scenario is extended sideways action, as all high probability counts get thrown out and whipsaw becomes the expectation.

Lastly, the blue vertical lines on the chart are fib timing. You can see the blue fib numbers in the middle. Not perfect. But I love having them on the chart as timing points to watch for significant action.

Edit to add: I have no position. I bought puts near the recent high and sol them all when it fell under $120. If it plays along with my count, I will look for first move down and reaction off of it to buy puts 1-2 months out. And I will switch to calls very quickly if supports hold and structure seems to want higher. But for now, no position.

NVDA - this is a common structure. The zones for bullish and bearish are clear based on current structure. What I'm tracking below is a similar structure to what we saw at the end of May but on a larger scale based on the initial decline off the high. Please understand what this chart is showing before the memes of a million scribbly lines show up (always funny IMO and often accurate).

Instruments rarely fall from a high in a single move. Corrections are hard to quanitfy and even harder to time. The saying "like throwing jello for distance" is my favorite. But once you have the initial move off a high, you can measure out the most standard path and adjust as you go. That path is of a typical "zigzag" correction.

While this doesn't seem to perfectly match that, it is still on the table as long as price doesn't break above $135. If NVDA goes higher than that, then the highest probability is some type of "flat".

But again, corrections are a mix of bullish and bearish sentiment, neither taking hold until the other is exhausted. Which is why they tend to be messy, overalpping, and unpredictable. While there ideal paths you look for similar to the above, there is literally no set rule or guideline. Truly anything can happen. So based on what I'm seeing, the most ideal path for NVDA is as follows.

If you are bullish, you need to see $130 taken out and then you absolutely can't see any breaks back below it. You can use $130 as your new stop level and feel very safe. If you are bearish, your runway to be so is as long as under ATH, and even a little higher in the case of an expanding flat where the "b" wave can go higher than the "a". But in that case, maintaining bearishness at new highs is not wise, as even if a renewed selloff commences, you would need back under $134 with no confirmation of being correct until below $130, at which point the majority of the move back down has already happened. Therefore, if you are bearish and we are above the previous high, your best bet is a lucky guess. If you see NVDA play out cose to what I have charted here, with $135 acting as resistance, please respect that strong probability of another significant move down. It doesn't mean it has to happeb. But the move will be set up perfectly and should be respected until broken. If another selloff does happen, $106 is the current expectation for the next bottom. But a lot to play out before we hone in on lower targets. Next week will be extremely telling. And the worse case scenario is extended sideways action, as all high probability counts get thrown out and whipsaw becomes the expectation.

Lastly, the blue vertical lines on the chart are fib timing. You can see the blue fib numbers in the middle. Not perfect. But I love having them on the chart as timing points to watch for significant action.

Edit to add: I have no position. I bought puts near the recent high and sol them all when it fell under $120. If it plays along with my count, I will look for first move down and reaction off of it to buy puts 1-2 months out. And I will switch to calls very quickly if supports hold and structure seems to want higher. But for now, no position.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

Was sitting on a loss on WULF for 6 months but just hit 100% return. Guess I was wrong on the thesis, it went up even when bitcoin went downTxAG#2011 said:Philip J Fry said:

Anyone looked at WULF as a BTC miner? Interesting looking chart

Based on my very early look, their operating costs are 11.3K per bitcoin where MARA is around 18k? Currently trading at 3 dollars. I can't say I know enough about miners, but if this is true, is 20-30 dollars a share a reasonable future target?

Bought WULF & SDIG today. Miner metrics don't matter nearly as much as bitcoin go up.

Moves made today and some other general thoughts.

Next week is going to very telling for a lot of stocks and broader markets.

- Sold 50% of July SLV $27 calls to go net free. Rest are ride or die.

- Sold 50% of September $28 SLV calls. Was already net free and had added back. Firmly in the green now and I treat the profit as helping the Sep $30's and Nov $30's toward net free,

- Wednesday I had bought SPY $540 puts for July for $1.05 each. Added today in multiple tranches and 4x'ed the position for avg contract price of $0.80. Will sell half if they 2x in value and ride the rest hoping for $530 range and $10 contract value. Timing might be too tight, but this were purely a hedge against the typical post-July 4th expected bullishness. Historically, market is weak in June and rallies in July. So this is just hoping for opposite day.

- Bought PLTR October $23 puts for just over $1.00 each. Already had August $20 puts and wanted to give more time in case it does make one more push up. Always like to buy puts on low volatility "up" days.

- MARA and CLSK are still wait and sees. Plenty of time to go long. Made a ton of money on miners earlier this year. No hurry to jump in as BTC still can lower.

- Very close to buying XOM. Want to make sure it holds $105 range over next 1-2 weeks. Potential for one more low in an expanding triangle pattern off the Feb 2023 high. So need that to invalidate before I'm 100% comfortable. I have enough energy positions that I don't care if I miss out on a handful I'm watching.

- 2-year yield has already made a new low. Waiting on 10-year to follow. If it does, oh boy..

Next week is going to very telling for a lot of stocks and broader markets.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

Yeah I bought at around $3 probably six months ago, then a few weeks ago saw it finally go green so made ~20% profit on half then set a stop on the rest ~10% profit (and it stopped out that afternoon). Well, I of course regret putting that stop on..

pretty much committed to going down with this ship

AVB - I'm looking at the weekly and liking what I see. Thinking about entering now at 203 with a stop just under recent low of 200. Targeting mini-cup completion at 220; may take all there or trim with eventual target of 260

I'm focused purely on price action and not fundamentals

I'd like to get others thoughts; good or bad

I'm focused purely on price action and not fundamentals

I'd like to get others thoughts; good or bad

AMD on my watch. It popped out of its 100 dma, now let's see if it gets out of the channel. Could form that last leg on a "w" pattern.

A fascinating Friday breakout on above average volume in $AMD ....

— Traderstewie (@traderstewie) July 5, 2024

After a big pullback off March highs and multiple months of frustrating chop, think this one might be ready for a Q3 and Q4 rally phase now going into the next earnings report.

Hints of Accumulation… pic.twitter.com/f87YSLGJYB

ACHR - Stellantis is going in heavy.

Tesla of the skies. Chart looks enticing. Awesome growth story. I'll be forming a position under $5 as once through there, it might not see below that again. Stop will be $2.95 with multi-year price target of $20, and as high as potentially $40 within 3-4 years. Not expecting this to be a quick play, and definitely expecting some significant swings as it moves up, but like I said, form a position here and your basis should be pretty safe once we roll into 2025 and beyond.

Archer Aviation Stock: Flying Towards 2025 Launch (NYSE:ACHR) | Seeking AlphaQuote:

- Archer Aviation (NYSE:ACHR) received an additional $55M funding from Stellantis (STLA) under the companies' strategic funding agreement following the achievement of its transition flight test milestone last month.

- The latest investment builds on Stellantis' (STLA) series of open market purchases of 8.3M shares of Archer's stock in March this year.

- During 2023, Stellantis (STLA) invested $110M through a combination of open market stock purchases and investments under the companies' strategic funding agreement.

- Archer (ACHR) remains on track to complete construction of its high-volume manufacturing facility in Georgia later this year.

Tesla of the skies. Chart looks enticing. Awesome growth story. I'll be forming a position under $5 as once through there, it might not see below that again. Stop will be $2.95 with multi-year price target of $20, and as high as potentially $40 within 3-4 years. Not expecting this to be a quick play, and definitely expecting some significant swings as it moves up, but like I said, form a position here and your basis should be pretty safe once we roll into 2025 and beyond.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

I have the September but didn't know about the November SLV calls. Think we get much pull back to get into November calls (as in hop on now for the ride) or worth waiting for pullback just in case to avoid risk?

The goal is $40 by September. November was purely a tag along play that would benefit equally or more if we get $40 by September, but has the added benefit of extending the timeline if it does indeed take longer.tlh3842 said:

I have the September but didn't know about the November SLV calls. Think we get much pull back to get into November calls (as in hop on now for the ride) or worth waiting for pullback just in case to avoid risk?

Right now the expectation is still $40 by September expiration. Long term, I still think $60 is the target, but that could be 2025-2026. Could it be $60 by election? Sure. I don't time travel. Could it still be $30? Sure.

But we are still tracking nicely with the typical August election year spike.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

Howdy family, I hope everyone had a wonderful and safe holiday weekend. Mine was doing well until the A-coil on my inside unit had a catastrophic leak on a capillary tube. My father had an A/C company for almost 40 years so luckily I found a replacement coil in the old warehouse. It's been many years since I've replaced an evaporator coil, but the old dog did it today and my A/C is functioning perfectly.

Stock related, I'm still 95% in cash and sitting idle.

Stock related, I'm still 95% in cash and sitting idle.

PLTR - new high. I'm still not sold this is fully bullish. Like I said Friday, this is likely an extension of the finality push from the $15 level for the entirety of the move up off ATL. This could also be a slight extension of the corrective move that started in March, which if it undergoes the correction I expect from here, would mean the top is still in and this is new high in what would be called a "running flat". The move is starting to feel "full" similar to what we saw in November with a slight higher high and then a turn back down. RSI and MACD are at similar spots too. Should it push higher, I could see all the way to $31 possible which is a gap fill dating back to Feb 2021. That kind of move would be "blow off top" worthy for this move and would likely have RSI and MACD matching or exceeding the Feb 2024 readings.

If you never exited or took profits, $27.50 should be your stop. The next time it breaks back under that is very likely an initial move down to the $12-$15 level. If you are a newer entrant and dont want to see red, use the same stop. If your basis is under $12 and you dont mind a large drawdown for a long term hold, use the same stop. Overall, I'm still very very bullish long term. This will be over the $45 level, though it might not be until 2025 or 2026.

Any future targets on chart are illustrative. Do not put any weight on "timing" you might think you see.

If you never exited or took profits, $27.50 should be your stop. The next time it breaks back under that is very likely an initial move down to the $12-$15 level. If you are a newer entrant and dont want to see red, use the same stop. If your basis is under $12 and you dont mind a large drawdown for a long term hold, use the same stop. Overall, I'm still very very bullish long term. This will be over the $45 level, though it might not be until 2025 or 2026.

Any future targets on chart are illustrative. Do not put any weight on "timing" you might think you see.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

HTZ - lets go in looking for $4.00 - $5.00. Stop $3.44

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

Thanks Heineken. Thought on RBLX? Seems to have put in a bottom early May and now had a breakout last week from the wedge it had formed.

I'd be surprised if it reclaims above $41. My expectation is down. Haven't followed it for a while as the long term weakness has sustained and all rallies are sold aggressively. Put your money to better use.El_duderino said:

Thanks Heineken. Thought on RBLX? Seems to have put in a bottom early May and now had a breakout last week from the wedge it had formed.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

Thanks. Definitely will, especially when it comes to energy/metals.

Just had a power surge in NW Houston. Don't expect to have power much longer. Good luck to all of you in the path of the storm. Hopefully it passes through with minimal damage and power outages.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

Straight up for eternity? Everyone is going to retire at 32 years old? Can we at least get a small 5% or so pull back?

TSLA up at resistance back to Dec. Cool off here or maintain through earnings to 300? Im not playing options. Too pricey but have shares I picked up in 170s. Setting stop at 230 to capture some profit.

I think I read this morning that the short position in TSLA is the highest since 2021 so $300 would not surprise me with the squeeze

Yeah I would just keep raising stops. I am a believer now in TSLA, the volume the last week or so is insane and the things they have planned are far beyond EV's.

265 is next resistance, then 280, then on to 300's. This volume makes me think it can retest ATH's, over 400. Feel free to call me crazy

oh big buyer today, looking at 1 minute bars, over 200k shares.

265 is next resistance, then 280, then on to 300's. This volume makes me think it can retest ATH's, over 400. Feel free to call me crazy

oh big buyer today, looking at 1 minute bars, over 200k shares.

El Chupacabra said:

Straight up for eternity? Everyone is going to retire at 32 years old? Can we at least get a small 5% or so pull back?

Market says...

Good Lord QQQ is unstoppable.

ProgN said:

Howdy family, I hope everyone had a wonderful and safe holiday weekend. Mine was doing well until the A-coil on my inside unit had a catastrophic leak on a capillary tube. My father had an A/C company for almost 40 years so luckily I found a replacement coil in the old warehouse. It's been many years since I've replaced an evaporator coil, but the old dog did it today and my A/C is functioning perfectly.

Stock related, I'm still 95% in cash and sitting idle.

Feel free to come to my place and help me fix the wine fridge. It's running but not cooling. Totally out over my skis…

I'll DM you later. I have an idea what might be wrong with it. If I'm right then it's an easy fix.

Bought some 180 weeklies this mornings dip. Net free with 2 runners!

Need it to hold until the morning pleaaaase

Need it to hold until the morning pleaaaase

Guessing tomorrow will all be dependent on Powell's testimony at 9:00 I think maybe 10.

Guessing they will release his opening comments in the morning before open but I honestly have no clue what he is going to say. Inflation is still very real.

Thoughts? Sorry long day and I may not be making any sense.

Guessing they will release his opening comments in the morning before open but I honestly have no clue what he is going to say. Inflation is still very real.

Thoughts? Sorry long day and I may not be making any sense.

Keep your powder dry and ignore FOMO, or don't and probably lock yourself up. I'll PM you later brother.backintexas2013 said:

Guessing tomorrow will all be dependent on Powell's testimony at 9:00 I think maybe 10.

Guessing they will release his opening comments in the morning before open but I honestly have no clue what he is going to say. Inflation is still very real.

Thoughts? Sorry long day and I may not be making any sense.

I'm not. I almost bought some puts in my fun, not my true investment, account just thinking at some point a red day would hit and one bad comment could lead to it but got busy

ProgN said:

https://www.marketbeat.com/instant-alerts/nasdaq-smci-sec-filing-2024-07-08/#google_vignette

Is this the important part?

According to data from MarketBeat, the stock currently has an average rating of "Hold" and a consensus price target of $954.38.

No, price targets are like reading a longwinded Ketch soliloquy, that's a never ending run-on sentence, about sip recruiting on the tears thread. Firms adding to their position in SMCI is what you should focus on. The insider sells were only around 500 shrs and still hold thousands of shares so they're not selling either. You have insiders holding and firms adding to their positions. What does that tell you?

Featured Stories

See All

Texas A&M third baseman Gavin Grahovac to miss remainder of 2025

by Richard Zane

38:04

9h ago

2.7k

Baseball Thoughts: Analyzing A&M's 'choppy' start through six games

by Ryan Brauninger

21:49

10h ago

2.2k

NyAggie

Texas A&M third baseman Gavin Grahovac to miss remainder of 2025

in Billy Liucci's TexAgs Premium

217

gkharmon98

Did anyone else just get that breaking news push notification?

in Billy Liucci's TexAgs Premium

71

j_sizzle24

Texas A&M third baseman Gavin Grahovac to miss remainder of 2025

in Billy Liucci's TexAgs Premium

58

AggieCrew44

Texas A&M third baseman Gavin Grahovac to miss remainder of 2025

in Billy Liucci's TexAgs Premium

44