You are definitely right. The goal at this point really is to turn it in to a slow burn. I'm not going to go into politics at all but in my city at least the chance to contain it was missed weeks ago when we were requesting testing and isolation for unexplained respiratory illnesses and we missed the window to isolate and stem the initial spread due to public health officials.

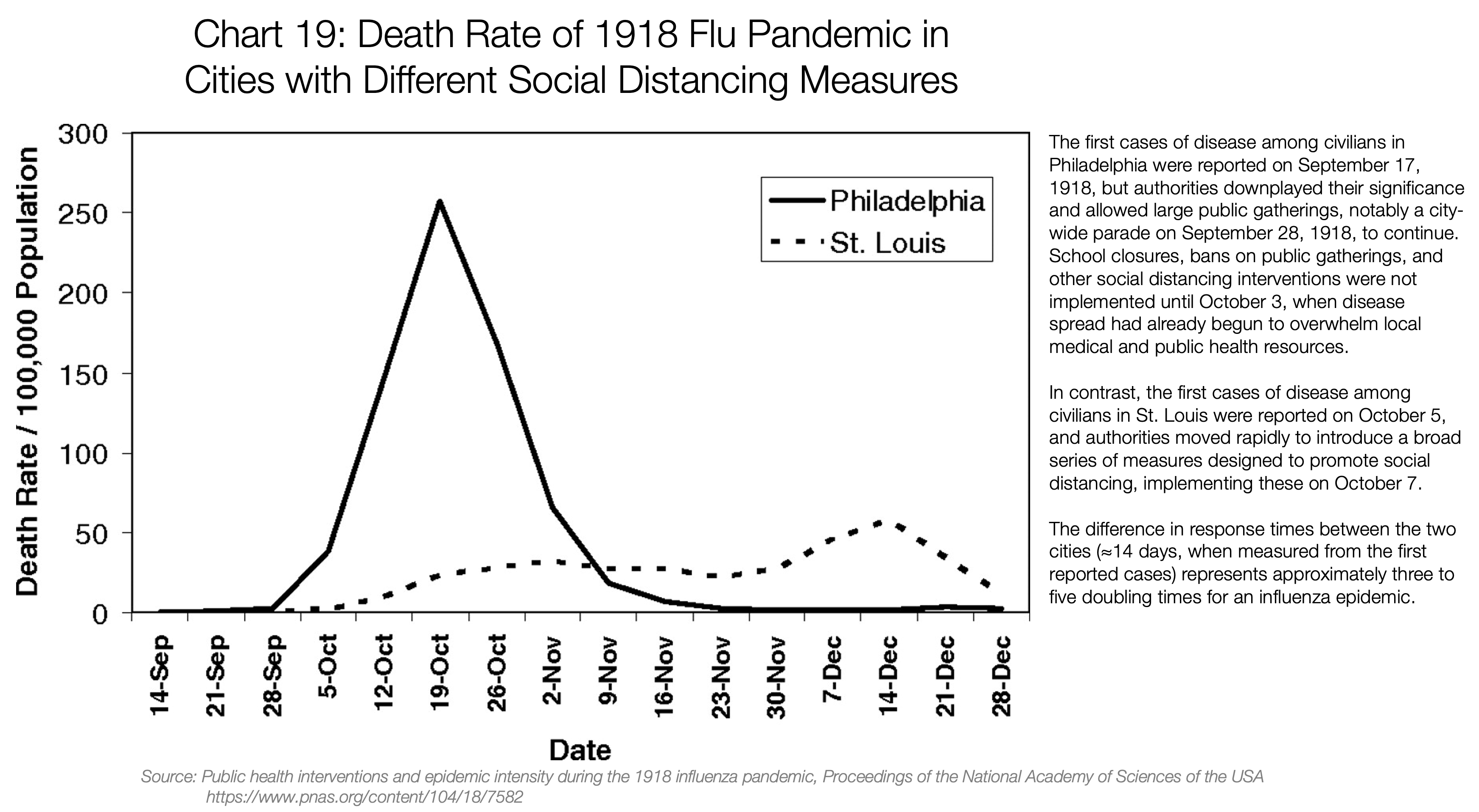

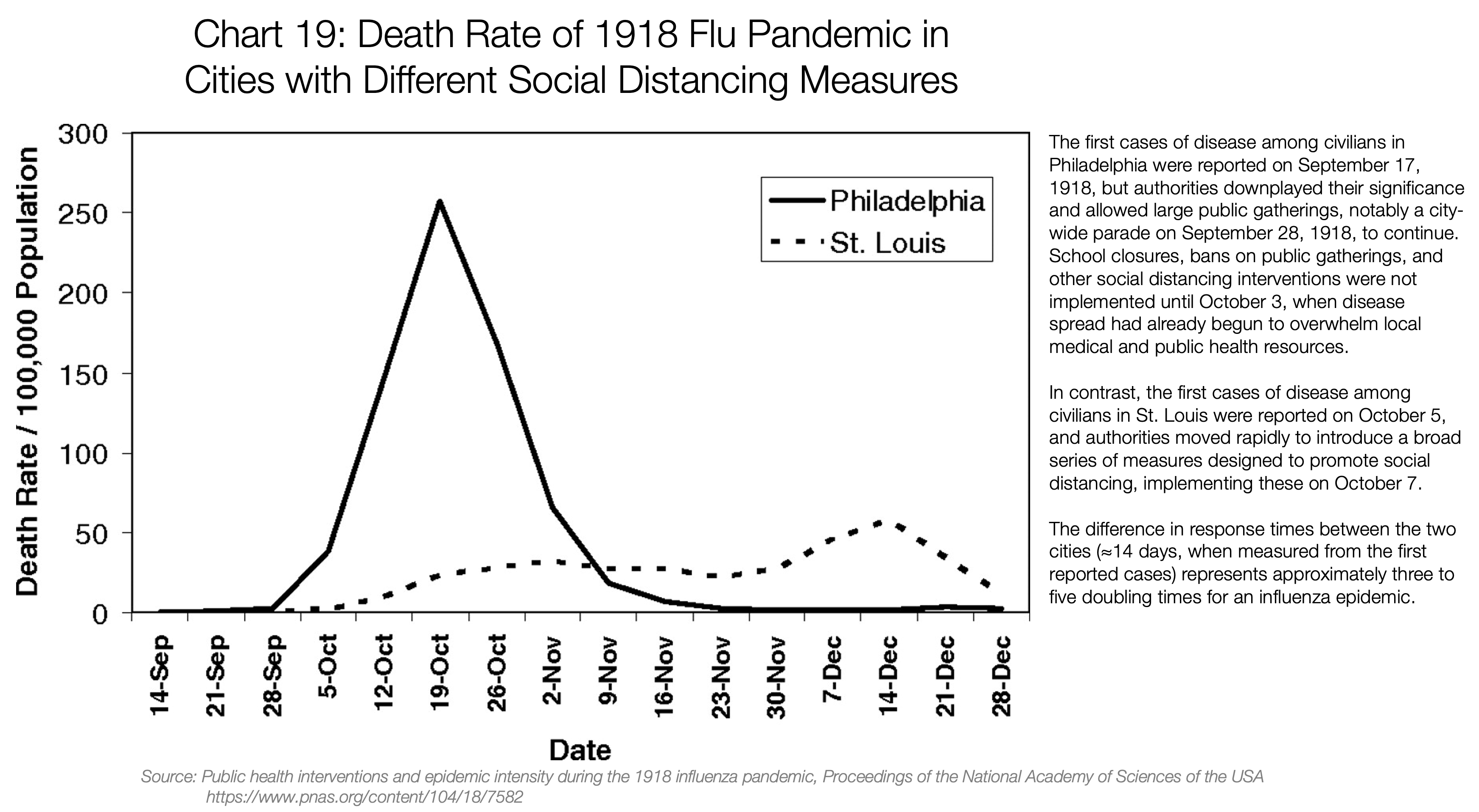

St. Louis vs Philly with the 1918 flu, early social distancing flattens the curve

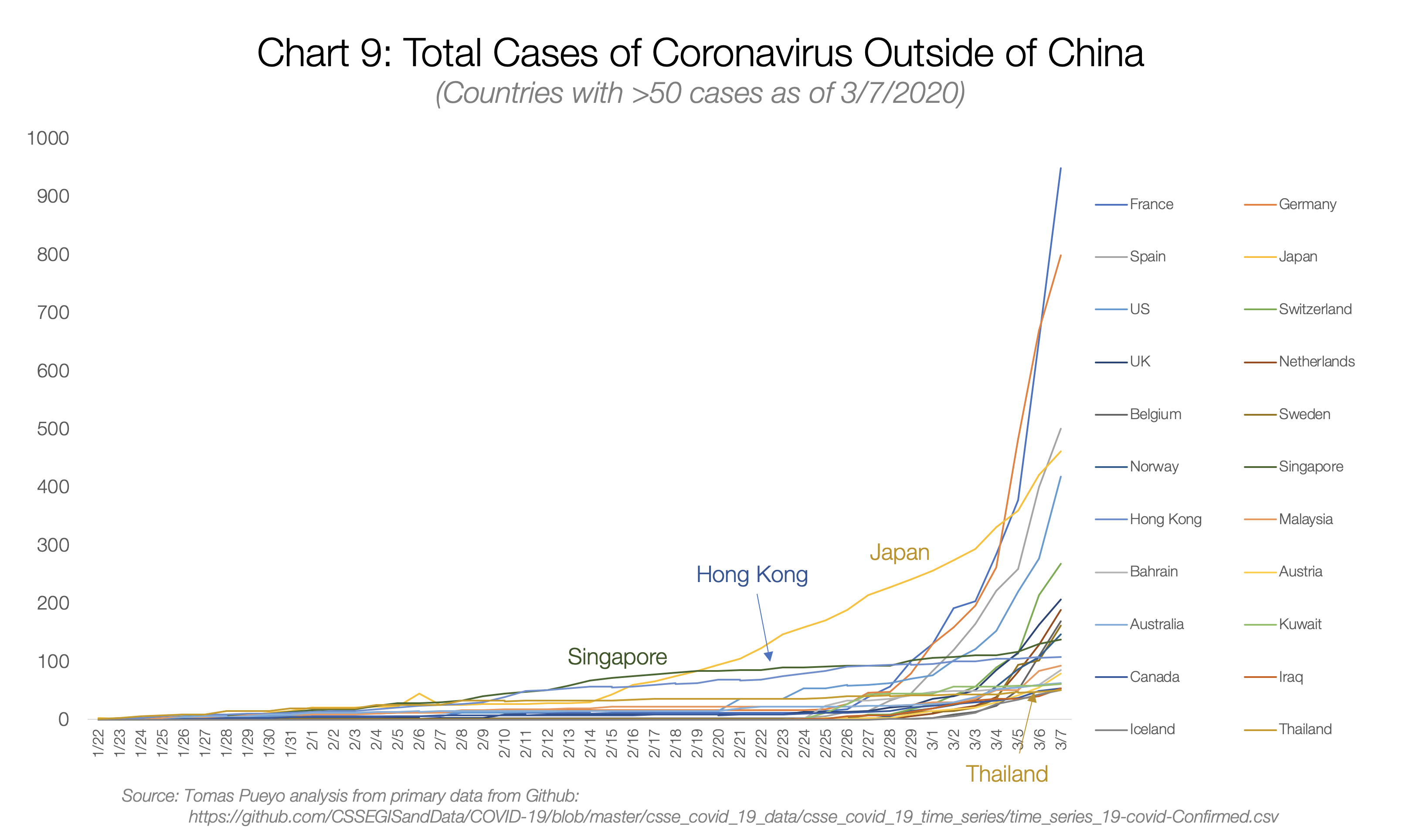

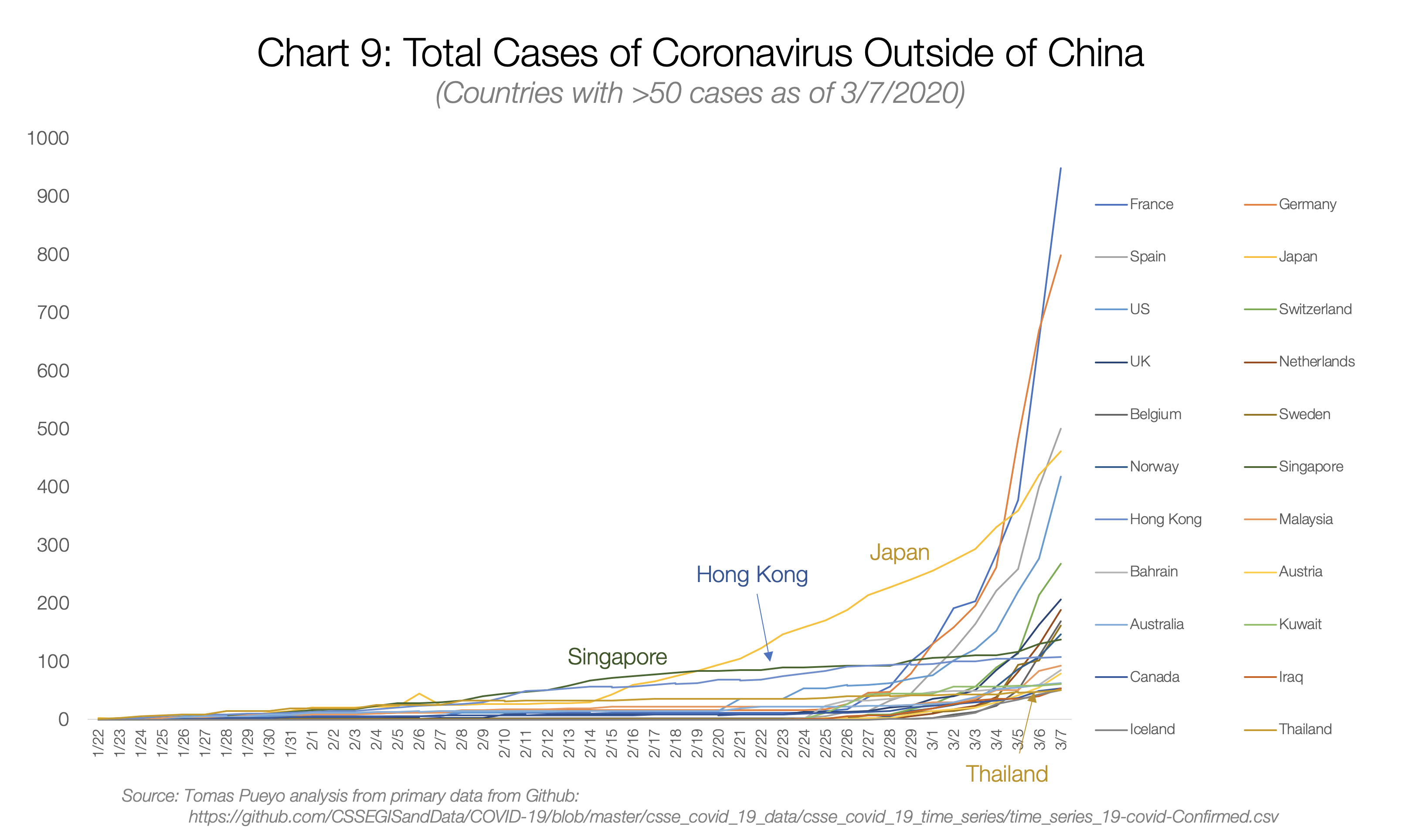

For COVID19, countries that were devastated by SARS and H1N1 enacted swift social restrictions and travel limits and flattened the curve

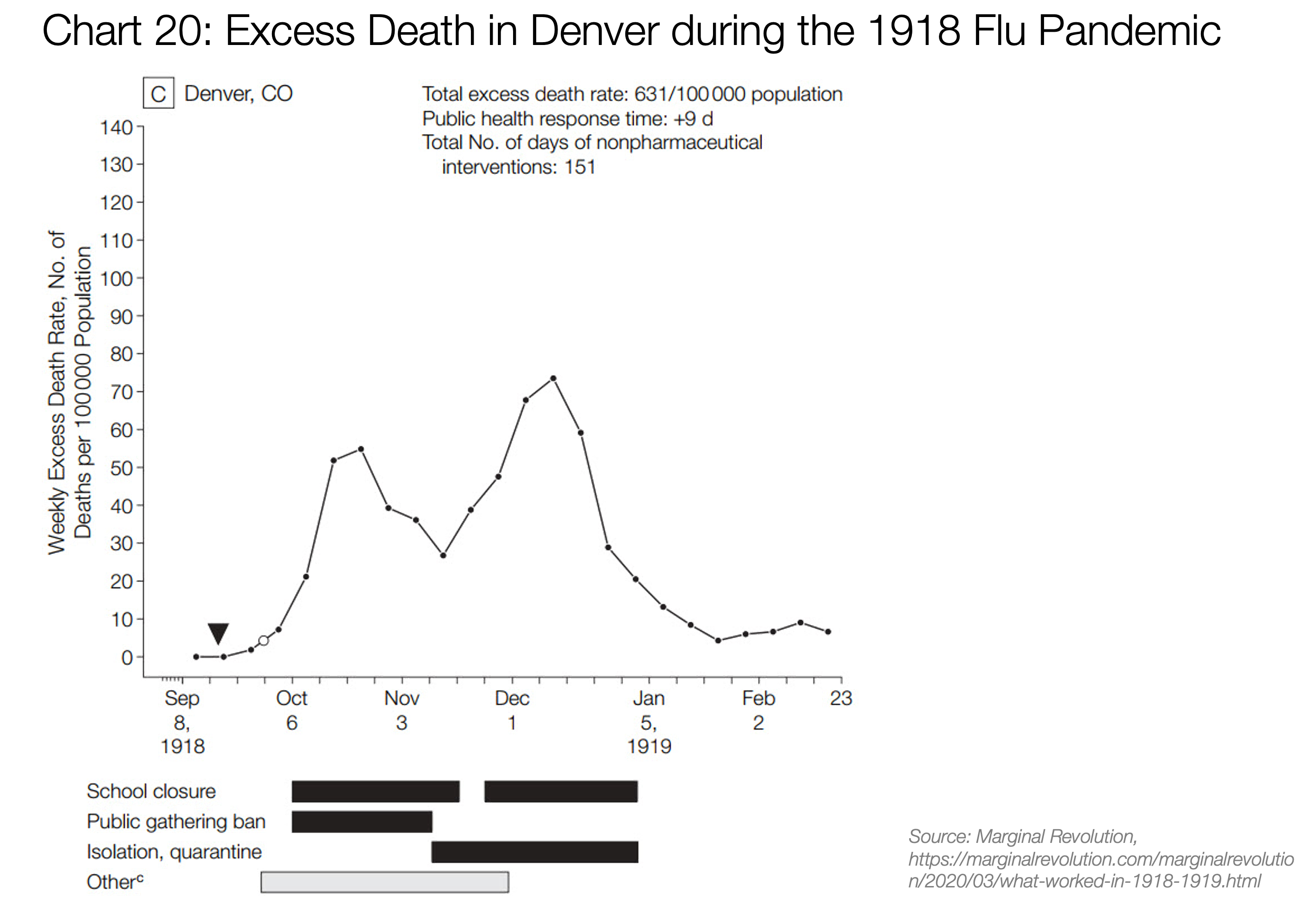

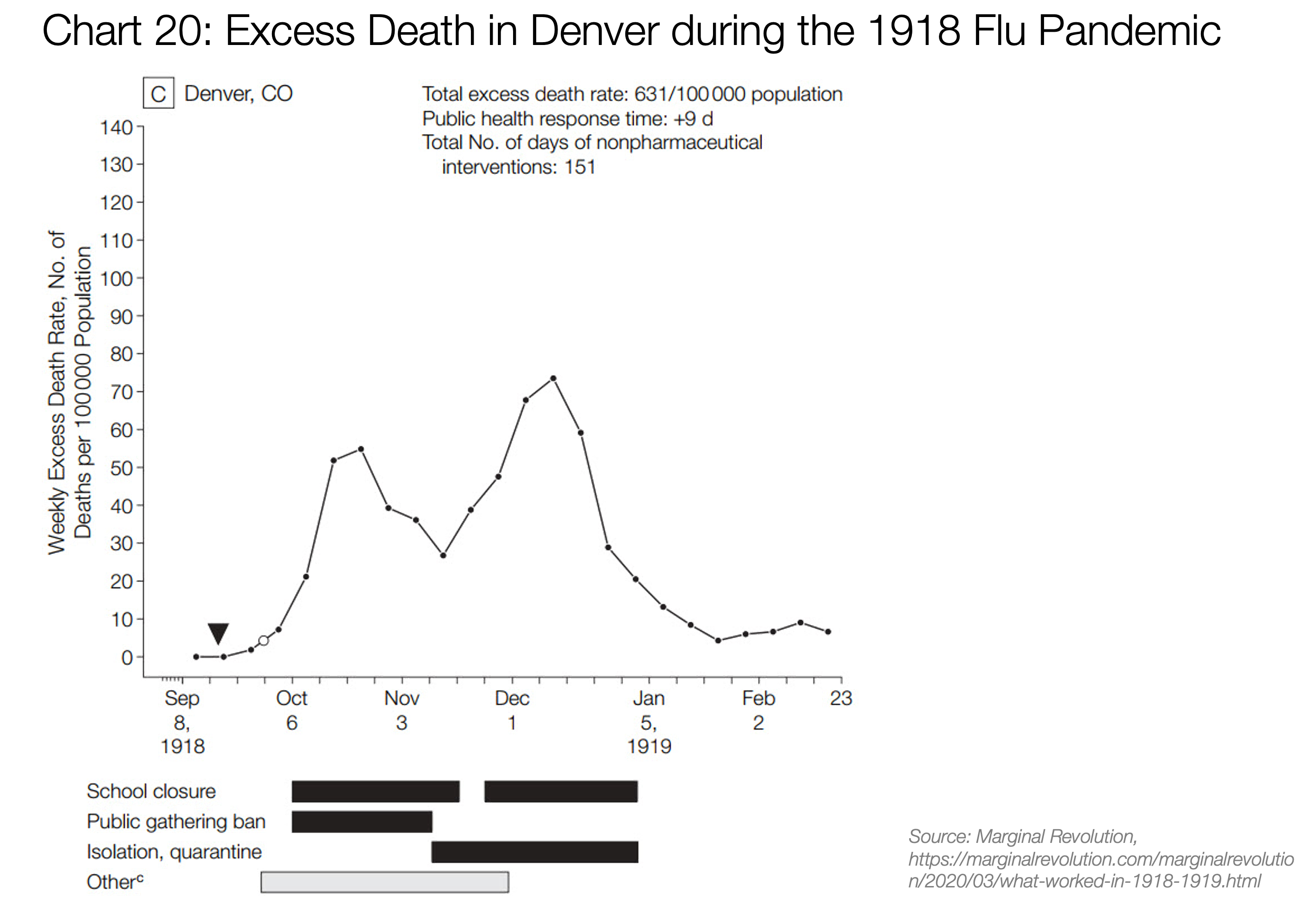

In 1918 Denver had initial measures and relaxed them due to success and had to reinstitute them when cases rose again

I believe due to transmissibility these will spread similarly, we will save many more ill patients than was possible in 1918 and most will not be terribly ill anyway so the death rate hopefully won't be near the same. I believe we hurt for a few weeks and then slowly get back to it, fingers crossed

No material on this site is intended to be a substitute for professional medical advice, diagnosis or treatment. See full

Medical Disclaimer.