agreedBrian Earl Spilner said:Nobody here is talking about beating the market though.Ragoo said:you are missing the point entirely. Even at $7000 per year or $6500 or less in years past you can invest in stocks that can give you a return much greater than the 401k. If you had put your Roth in apple alone 13 years ago that account would rival the 401k today.txaggie_08 said:Ragoo said:your backdoor roth isn't your 401k. You can direct invest it and have the possibility of a greater return. Which is why I was specific to say only a 401k.txaggie_08 said:Ragoo said:I don't think he is too far off actually.Brian Earl Spilner said:Red Pear Realty said:

My whole point from the beginning was that you cannot rely on a 401k to make you wealthy. You have to invest via other means. With the stats above, even assuming every American has 4-5 accounts with that average balance, the average person will be living below the poverty line.

Already been shown multiple times on this thread that this is untrue.

If a 401k is your only means of saving/investing you aren't getting outsized returns. You may get to $1MM may even get to $2Mm but you aren't getting to $4, 5, or 10MM.

Yes, you can. Between my wife and I, our 401ks, company match, and backdoor Roths, we can have several million in retirement accounts by retirement age (assuming the market continues its same average returns over next 20+ years).

Edit to add: your typical corporate sponsored 401k at best is tracking the S&P and could be doing worse. It is a consistent slow build to a number that should be considered a portion of your retirement picture.

My Roth Contribution is maxed at $7k this year, obviously less every year prior. You're not going to get rich off the Roth IRA.

My 401k has over half a million in it, by itself, and I've been investing in it for about 13 years now. I have 20+ years until retirement. Most of that half million in 401k were under smaller salaries when I wasn't maxing out contributions. But now I'm at a point where I can max out my 401k, plus the compounding interest on the current balance plus future contributions will make this account grow MUCH faster. I will have several million in that 401k by the time I reach retirement, not even counting my wife's 401k and our IRAs. We also have an HSA we're maxing out now with add'l company match. Several different retirement account options to build wealth, but my main point is my 401k alone should build more than enough wealth on its own.

The point is that your wealth and retirement should consist of a blend of avenues. 401k, Roth, hsa, brokerage, even real estate or others if your path allows.

I am not saying what people should or shouldn't do. Simply pointing out that the comment was made that a 401k is a path to wealth but at best it is a path to pacing with the market.

Once more, for the cheap seats -- maxing all retirement accounts (401k, Roth, HSA, Mega-backdoor Roth if available), and starting at the earliest possible time, is almost a guarantee that you will retire a millionaire, barring any disasters. In most cases, multimillionaire.

All you need to do is throw it into S&P or total market index funds and you're good to go. Maybe move to a target date once you get closer to retirement if you want to lower your risk at that point.

millionaires

552,618 Views |

2342 Replies |

Last: 5 days ago by AgOutsideAustin

I have a very simple view on wealth. It's net worth over and above providing for your daily living expenses (which varies widely by individual). Some people hoard their wealth, some spend it all, and some earmark it for a specific purpose. Some people never attain any wealth at all.Kansas Kid said:

There is a fundamental issue that this board will never agree on and that is the definition of wealth. For some, it is putting food on the table and having a ton of close friends. For some it is 1 million. Others $1 billion and possibly some $100 billion so you can be like Musk and Buffett. What is wealthy is highly subjective.

Once people accept that, a lot of the recent debate should end.

That's why being a millionaire can be anything ranging from not even covering your basic future spending "needs" to an ultimate goal to a step toward what you define as true wealth. It's simply a number.

Fighting like high school girls...

Most are saying the same thing - diversification is important unless you are a Kiyosaki follower and have everything in silver.

Can you become rich by using a 401k? Absolutely

Can you eventually get 2,3,4 mill in a 401k? Without question - I have several friends that do

Is a 401k a good tax deferred vehicle for building wealth and future income stream? Emphatic yes

Do the majority of Americans have more than one 401k/rollover? Yes

Should you have other investments besides a 401k? I would say yes

Is RE a good investment? Yes, however you can lose your butt in it as well as the markets. Another thing to keep in mind is that RE is getting a continuous ~2% ad valorem tax per year(non ag). If you are into rental homes, this difference has been magnified lately from the change in the Texas homestead exemption.

Is a business a good investment? Very much so, but only if you can manage it well... a business in my opinion is one of the fastest options in creating wealth... also one of the fastest ways to lose saved up wealth if things don't go well.

I have a friend who recently sold his business. He never invested along the way, so his entire retirement is the proceeds from the sale of his company. He didn't sell it for what he wanted, so there is a decent size gap there between what his income was and what it will be in the future.

The question is... how many legs do you want on your stool at retirement? The more legs, the safer your retirement IMO.

Most are saying the same thing - diversification is important unless you are a Kiyosaki follower and have everything in silver.

Can you become rich by using a 401k? Absolutely

Can you eventually get 2,3,4 mill in a 401k? Without question - I have several friends that do

Is a 401k a good tax deferred vehicle for building wealth and future income stream? Emphatic yes

Do the majority of Americans have more than one 401k/rollover? Yes

Should you have other investments besides a 401k? I would say yes

Is RE a good investment? Yes, however you can lose your butt in it as well as the markets. Another thing to keep in mind is that RE is getting a continuous ~2% ad valorem tax per year(non ag). If you are into rental homes, this difference has been magnified lately from the change in the Texas homestead exemption.

Is a business a good investment? Very much so, but only if you can manage it well... a business in my opinion is one of the fastest options in creating wealth... also one of the fastest ways to lose saved up wealth if things don't go well.

I have a friend who recently sold his business. He never invested along the way, so his entire retirement is the proceeds from the sale of his company. He didn't sell it for what he wanted, so there is a decent size gap there between what his income was and what it will be in the future.

The question is... how many legs do you want on your stool at retirement? The more legs, the safer your retirement IMO.

I think that's the rub for a lot of people. Business can also be a good way to lose decades worth of savings, and RE is not worth the headache of being a landlord to many folks. (Certainly not for me, based on the stories I've heard from friends of mine who went down that path.)

Yes - this is another factor we have only touched on, and is often overlooked. True Market Value at time of Liquidation.Brian Earl Spilner said:

I think that's the rub for a lot of people. Business can also be a good way to lose decades worth of savings, and RE is not worth the headache of being a landlord to many folks. (Certainly not for me, based on the stories I've heard from friends of mine who went down that path.)

A major advantage of publicly traded equities and bonds is a ready market, with minimal transaction costs and massive liquidity.

A business, investment real estate, private equity, alternative investments and the like have significant disadvantages due to their nature. Transaction costs can be huge. Liquidity is a major issue. Risk-adjusted returns are full of potential pitfalls.

When you're ready to use the proceeds of these investments, you'd better hope there is a willing buyer available, that market conditions happen to not be in a down cycle, that tax policy is consistent with the time of original purchase, and that you can find a broker/intermediary who won't overcharge you on transaction fees and commissions, for starters.

This almost always reduces the terminal value of these assets, and is often overlooked in comparing risk-adjusted returns on various investments.

I was gonna say, a couple year maxed 401k gets really fun when you job hop and convert it to a traditional rollover ira with options approval

Ragoo said:I don't think he is too far off actually.Brian Earl Spilner said:Red Pear Realty said:

My whole point from the beginning was that you cannot rely on a 401k to make you wealthy. You have to invest via other means. With the stats above, even assuming every American has 4-5 accounts with that average balance, the average person will be living below the poverty line.

Already been shown multiple times on this thread that this is untrue.

If a 401k is your only means of saving/investing you aren't getting outsized returns. You may get to $1MM may even get to $2Mm but you aren't getting to $4, 5, or 10MM.

this has gotten a lot of response, but to simply put it out there:

assume maxing 401K plus company match gets to $25K/year contributions, over 35 years at a conservative 8% return comes out to $4.3M

using the S&P's last 35 years ~10.2% comes out to $7M

at 40 years those come out to $6.5M and $11.7M

and that's just on a solo income/401K

Ok, but those people are just programmed to believe that they're becoming wealthy, when obviously they're just being kept down by the man.

K, pretty sure this particular convo has run its course and has gone in circles at least twice now.

Moving on.

Moving on.

Harumph!

Maybe we can pivot to debating the definition of how much money does it take to have FU money. In my head I tell myself I want FU money, but I don't really even know what that would mean. Would love to hear perspectives.

Maybe we can pivot to debating the definition of how much money does it take to have FU money. In my head I tell myself I want FU money, but I don't really even know what that would mean. Would love to hear perspectives.

37 million.

That's my goal . I can see absolutely 0 arguments stemming from this question at all.

That's my goal . I can see absolutely 0 arguments stemming from this question at all.

Bingo.Quote:

I was gonna say, a couple year maxed 401k gets really fun when you job hop and convert it to a traditional rollover IRA

It wasn't by desire to job hop (have been laid off three times in my career), but I've made quite a bit of lemonade with the lemons I was dealt.

I would use the 4% rule as the floor.

Can I put this investment into my 401K? Looks like an easy way to make millions.

aggiesundevil4 said:

Harumph!

Maybe we can pivot to debating the definition of how much money does it take to have FU money. In my head I tell myself I want FU money, but I don't really even know what that would mean. Would love to hear perspectives.

I think 50 in todays money is the low side of f u

No material on this site is intended to be a substitute for professional medical advice, diagnosis or treatment. See full Medical Disclaimer.

aggiesundevil4 said:

Harumph!

Maybe we can pivot to debating the definition of how much money does it take to have FU money. In my head I tell myself I want FU money, but I don't really even know what that would mean. Would love to hear perspectives.

To me, FU money and Wealthy definitions are the exact same. It's the point of accumulated and invested funds where my desired spending is equal to our below a conservative expectation of investment returns, after reinvestment for inflation and after expected capital gains taxes.

This basically says I can live my desired lifestyle, indefinitely, without any alternative source of funds or employment.

I think that's an alternative investment offering letter. Or maybe a private equity proposal.Kansas Kid said:

Can I put this investment into my 401K? Looks like an easy way to make millions.

We'll have to consult our local officially "accredited investor" for advice. LMCane, we've hardly missed you!

I do feel blessed that we can get direct business advice from legit "could have been " billionaires!

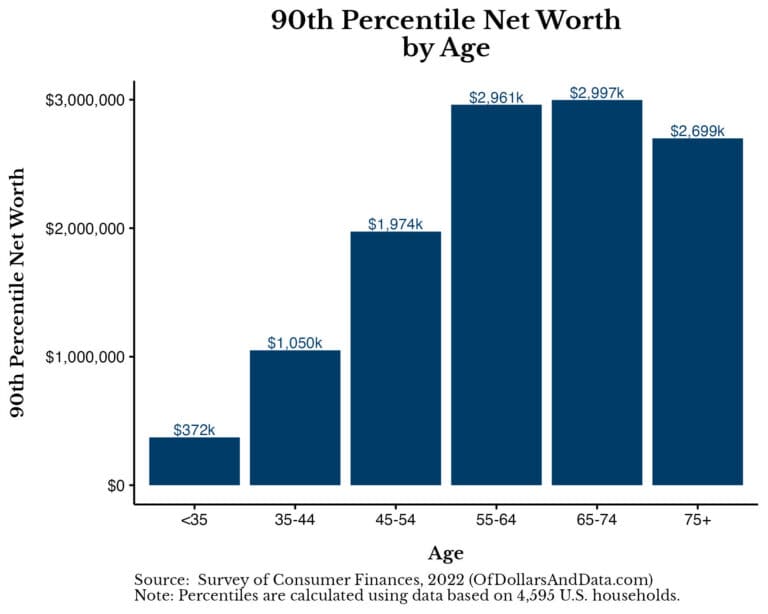

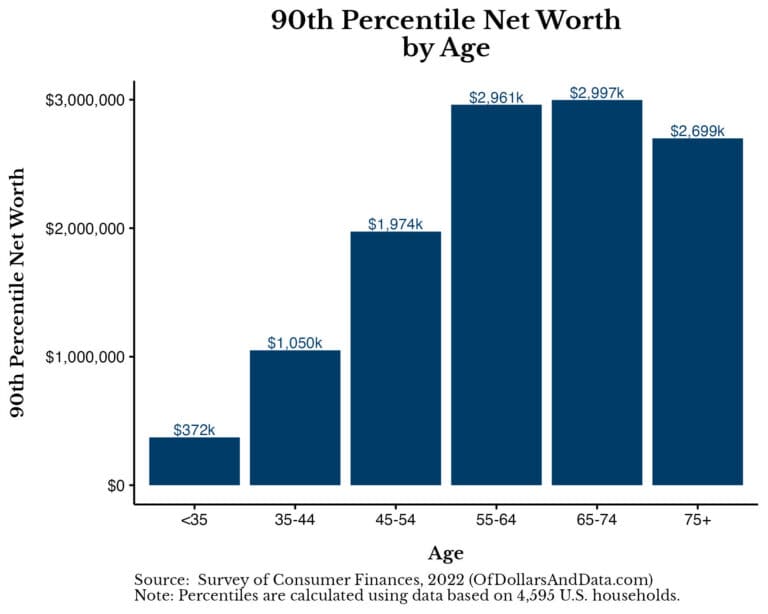

As a reference point for the rest of us:

Being in the top 10% is a pretty good rating point for where you are on a journey to wealthy*. This might help rebaseline, if we can quell the people who tell us about how the rich don't talk about being rich while telling us how rich they are.

As a reference point for the rest of us:

Being in the top 10% is a pretty good rating point for where you are on a journey to wealthy*. This might help rebaseline, if we can quell the people who tell us about how the rich don't talk about being rich while telling us how rich they are.

Man that jump at 35 is killer.

Being 35, I'm quite a ways off.

Being 35, I'm quite a ways off.

Most of them are likely over 40. You have time.

I turn 44 this year.. and am slightly above that bar.

But next year I gotta make 900k somehow lol.

seems like 10 years make a big difference. This should be a point graph

But next year I gotta make 900k somehow lol.

seems like 10 years make a big difference. This should be a point graph

It's probably about the point where doctors have finished residencies and paid off med school and start raking in the big bucks so they can mess up the averages

62strat said:

I turn 44 this year.. and am slightly above that bar.

But next year I gotta make 900k somehow lol.

seems like 10 years make a big difference. This should be a point graph

If you think about it, that means doubling over the next 10 years which is a little over 7% annual increase. Assuming you are still saving, it should be a layup for you. Congrats you top 10%. Now pay your fair share

I think you're well on your way. You appear to have good financial habits, despite an unnatural fixation on triple-leveraged ETFs and questionable taste in movies.Brian Earl Spilner said:

Man that jump at 35 is killer.

Being 35, I'm quite a ways off.

You got this!

so we are assuming the figure shown at each bar is the last age of the range?Kansas Kid said:62strat said:

I turn 44 this year.. and am slightly above that bar.

But next year I gotta make 900k somehow lol.

seems like 10 years make a big difference. This should be a point graph

If you think about it, that means doubling over the next 10 years which is a little over 7% annual increase. Assuming you are still saving, it should be a layup for you. Congrats you top 10%. Now pay your fair share

That's why imo it's a bad graph.

It should be a line graph. (what I meant to say)

I bleed maroon said:I think you're well on your way. You appear to have good financial habits, despite an unnatural fixation on triple-leveraged ETFs and questionable taste in movies.Brian Earl Spilner said:

Man that jump at 35 is killer.

Being 35, I'm quite a ways off.

You got this!

10 years is average double up based on 7% S&P growth. Which is what you are seeing in that graph.

62strat said:so we are assuming the figure shown at each bar is the last age of the range?Kansas Kid said:62strat said:

I turn 44 this year.. and am slightly above that bar.

But next year I gotta make 900k somehow lol.

seems like 10 years make a big difference. This should be a point graph

If you think about it, that means doubling over the next 10 years which is a little over 7% annual increase. Assuming you are still saving, it should be a layup for you. Congrats you top 10%. Now pay your fair share

That's why imo it's a bad graph.

It should be a line graph. (what I meant to say)

It would cover everyone in the range but I think it is safe to assume most of the people would be in the upper age of the bracket when they are accumulating wealth.

but what if those numbers are for the first age of each group?Ragoo said:

10 years is average double up based on 7% S&P growth. Which is what you are seeing in that graph.

age 35, $1.05m, age 45, $1.97m. etc

as opposed to age 44 and 54.

We don't know.

That's why I'm saying a line graph would be a bit more useful.

62strat said:but what if those numbers are for the first age of each group?Ragoo said:

10 years is average double up based on 7% S&P growth. Which is what you are seeing in that graph.

age 35, $1.05m, age 45, $1.97m. etc

as opposed to age 44 and 54.

We don't know.

That's why I'm saying a line graph would be a bit more useful.

I agree a line graph would be better but when they show the range, if it is like any other similar graph I have seen, it takes all the people in that bracket and takes the top 10% and that is your number. I would shocked if they took the first year and that is what they based it on.

Here is more data with it broken down in 5 year increments. It is a little dated but still shows the trend and more percentages.

https://www.myroadtofire.com/blog/average-net-worth-by-age

The drop for 50-54 in 90th percentile is interesting, whereas 99% shoots up. Wonder why that is.

drying curve stallBrian Earl Spilner said:

The drop for 50-54 in 90th percentile is interesting, whereas 99% shoots up. Wonder why that is.

That was the one that surprised me as well. The fact that 90th% peaks earlier than others made sense because a number of them will retire early. The 99% might retire as well but they can keep growing wealth while retired.

It's not just the drop, it's the fact that it also then doubles for the next period. Seems like some data issues to me.Kansas Kid said:

That was the one that surprised me as well. The fact that 90th% peaks earlier than others made sense because a number of them will retire early. The 99% might retire as well but they can keep growing wealth while retired.

So this feels like $10mm net worth by 50 should be FU money territory…?

Featured Stories

See All

9:07

5h ago

2.9k

16:07

7h ago

2.2k

Disparity from deep dooms No. 7 Texas A&M against No. 6 Vols, 77-69

by Olin Buchanan

4:43

8h ago

623

Game Highlights: No. 6 Tennessee 77, No. 7 Texas A&M 69

by Matthew Dawson

13:35

1d ago

4.8k

GWRafterR

LIVE from Blue Bell Park: No. 1 Texas A&M vs. Cal Poly (Saturday)

in Billy Liucci's TexAgs Premium

78

Aggiehunt

LIVE from Blue Bell Park: No. 1 Texas A&M vs. Cal Poly (Saturday)

in Billy Liucci's TexAgs Premium

59

mslags97

LIVE from Blue Bell Park: No. 1 Texas A&M vs. Cal Poly (Saturday)

in Billy Liucci's TexAgs Premium

40