Land value doubled, but improvements dropped...how does that work?

HCAD Values

115,104 Views |

772 Replies |

Last: 2 yr ago by speck3

Oh that was sarcasm? Obviously someone with a screenname such as mine would never participate in sarcastic behavior.

I wonder how much HCAD Board Members values went up?

Looks like you can get 2014 pdata...

http://pdata.hcad.org/download/2014/Real_acct_owner.zip

http://pdata.hcad.org/download/2014/Real_building_land.zip

edit: it is missing improvement values

[This message has been edited by pnut02 (edited 3/26/2014 11:42a).]

http://pdata.hcad.org/download/2014/Real_acct_owner.zip

http://pdata.hcad.org/download/2014/Real_building_land.zip

edit: it is missing improvement values

[This message has been edited by pnut02 (edited 3/26/2014 11:42a).]

....would be interesting to see the values of Mike Sullivan's house compared to his neighbors. I would also check Paul Bettencourt just for the fun of it (since he was the former Harris County Tax Assessor-Collector that opened a company to fight property tax values.....and is now running for Texas Senate).

quote:

So property taxes are going up making cost of ownership increase.

If interest rates increase or oil price dips i expect prices to drop quickly.

quote:

The increases are a fairly modest amount of overall ownership. Even if your appraised value increased $100k that is about $3k in extra taxes due each year or about $250 each month. If you are talking about a $200k house that saw a 20% increase that is about a $1200 per year increase.

Sure that extra $100 per month will squeeze and truly hurt some, buy for the vast majority it will just be absorbed.

A dip in oil or increase in rates might make values stabilize, but it is going to take something very dramatic to cause prices to start falling.

Lets take this example

In 2012 a couple purchased a 200k home with a 150k 30 year mortgage @ 3.5% interest. At the time their home was assessed properly (in actuality it was probably assessed low). Their mortgage payment would be $674, insurance $167, and taxes $417 for a total payment of ~$1,257.

2014 rolls around and their assessed value increases to 240k. Now they wont have to pay all of the increased taxes immediately, but eventually they will. Their new payment will look like this: Mortgage $674, insurance $200, and taxes $500 with a new total payment of ~$1,374.

That is roughly a 9% increase in total monthly payment. This will be substantial.

Now lets say interest rates increase to ~6% and a new couple buys the house. $240k home with $192k 30 year mortgage @6%. The mortgage payment would be $1151, insurance $200, and taxes $500 for a total payment of $1,851. That is 47% more for the exact same house.

@ 6% interest rates you could only purchase a ~$163,000 house and have the same payment as you did in 2012.

I would say in general this will drive home prices down. If interest rates increase then a lot of it will be attributed to that, but increasing taxes will also make an impact.

^^^ From what Yellen has been saying I don't think rates will increase anytime soon.

quote:

In 2012 a couple purchased a 200k home with a 150k 30 year mortgage @ 3.5% interest. At the time their home was assessed properly (in actuality it was probably assessed low). Their mortgage payment would be $674, insurance $167, and taxes $417 for a total payment of ~$1,257.

2014 rolls around and their assessed value increases to 240k. Now they wont have to pay all of the increased taxes immediately, but eventually they will. Their new payment will look like this: Mortgage $674, insurance $200, and taxes $500 with a new total payment of ~$1,374.

Why did you increase their insurance costs? They have zero to do with your argument.

Also, as you alluded to, it's 10% a year so they is plenty of time to absorb those changes. In your example, their property taxes will go up about $40/month the first year. If they can't handle that, they need to buy less Starbucks.

Interesting data from another website:

quote:

Why did you increase their insurance costs? They have zero to do with your argument.

Also, as you alluded to, it's 10% a year so they is plenty of time to absorb those changes. In your example, their property taxes will go up about $40/month the first year. If they can't handle that, they need to buy less Starbucks.

Diggity, I will admit I do not know how home insurance works. I assumed that most people would want to have insurance covering the value of the house?

Also, I am not familiar with the market. I assume most people try to buy as much house as they can afford. If they could have afforded 10% more they would have purchased a more expensive house in the first place?

quote:

Diggity, I will admit I do not know how home insurance works. I assumed that most people would want to have insurance covering the value of the house?

Also, I am not familiar with the market. I assume most people try to buy as much house as they can afford. If they could have afforded 10% more they would have purchased a more expensive house in the first place?

You wouldn't generally increase your coverage rates based on arbitrary figures such as HCAD. Your replacement cost is based on local construction costs more than anything.

To your second point, there certainly are people that buy more home than they can afford (as evidenced by the subprime fiasco) but that is the exception, not the rule. I would argue that anyone who is going to end up missing payments over a $60-100 increase in their total payment was gong to find a reason to miss their payments eventually anyway.

42% increase

quote:

You wouldn't generally increase your coverage rates based on arbitrary figures such as HCAD. Your replacement cost is based on local construction costs more than anything.

To your second point, there certainly are people that buy more home than they can afford (as evidenced by the subprime fiasco) but that is the exception, not the rule. I would argue that anyone who is going to end up missing payments over a $60-100 increase in their total payment was gong to find a reason to miss their payments eventually anyway.

bingo- at least in houston, a city with much fewer foreclosures than the average large city post-2008.

what really takes the hit is businesses reliant upon discretionary spending and, of course, the consumer that chooses not to buy a good or services they would have otherwise, and instead are sending money to the "state".

sure, its a good thing for realizable value to increase, but most don't sell their homes and realize that value for quite some time, if ever.

unfortunately, sometimes that value isn't even real (see 2008), and the consumer loses both A) the marketable equity, and B) the tax money they already paid on that bubble value.

That being said, I don't believe we are in danger of losing realizable value anytime soon in Houston, but that doesn't make anyone more excited to send $600-$1200 more a year to the state, when they have no offset other than selling their home.

25% market, 10% capped, 77079,thanks a lot Twin Peaks!

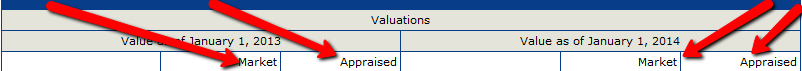

I guess I don't see where my "Market Value" is stated on the HCAD site - can someone help a dummy out.

Forgive the ignorance and I think I know the answer to this based on previous posts but say someone bought in early 2013, how come HCAD can appraise the house in 2014 for greater than 110% of the purchase price? I know the home owner wouldn't have the homestead exception yet, but wow that's highway robbery of our government not even following their own 10% max increase rule...

10% only applies if you had the homestead exemption on Jan. 1, 2013.

There is no 10% max increase rule. They can increase the market value as much as they want. The appraised value that is your tax basis is capped to a 10% increase each year until it catches up to the market value if you have a homestead exemption.

quote:

I guess I don't see where my "Market Value" is stated on the HCAD site - can someone help a dummy out.

1.) type "ctrl+f"

2.) type "market"

3.) press enter

3.) opposite of profit

[This message has been edited by Diggity (edited 3/26/2014 3:38p).]

How can "Improvement" increase 42% if there has not been any improvements to the home in over 10 years?

it's just a way for them to play with the numbers.

In my section, they upped the land values by 20% and added a bit to the improvement value for most homes.

In the section next to me, they doubled the land values and dropped the improvement values for most homes.

The end result was pretty similar but there doesn't seem to be much rhyme or reason to it.

In my section, they upped the land values by 20% and added a bit to the improvement value for most homes.

In the section next to me, they doubled the land values and dropped the improvement values for most homes.

The end result was pretty similar but there doesn't seem to be much rhyme or reason to it.

I can answer that for you Diggity-

The appraisers know the ARB will not reduce the land value 90% of the time. If 2 of the 3 ARB members feel it should be reduce the chair either agrees or it doesn't pass. If the land value is cut, the ARB members must state their value is based on land is X and improvements are Y. If they don't state the value allocation, the appraiser will take all the value out of the improvements and not the land to keep it equitable.

The appraisers know the ARB will not reduce the land value 90% of the time. If 2 of the 3 ARB members feel it should be reduce the chair either agrees or it doesn't pass. If the land value is cut, the ARB members must state their value is based on land is X and improvements are Y. If they don't state the value allocation, the appraiser will take all the value out of the improvements and not the land to keep it equitable.

Basically, its a way to fudge numbers to what they want them to be, and land is nearly impossible to get reduced.

I get that, but why would they vary so much from one section in the neighborhood to another? They have the dirt across from me valued at nearly twice what mine is.

From what you're saying, I guess it's a good thing that most of the value for my place is in improvements since it's easier to argue those down?

Do different appraisers have different methods for approaching value?

From what you're saying, I guess it's a good thing that most of the value for my place is in improvements since it's easier to argue those down?

Do different appraisers have different methods for approaching value?

quote:I could be wrong, but I'm pretty sure the surroundings around a house (bad neighbors moving in, crime activity going up, local attractions shutting down, etc.) could drive the "land" value down as opposed to the "improvement" value.

land is nearly impossible to get reduced.

Edit: if HCAD values two land parcels right next to another at significantly different %/acre, then that is wrong in my opinion. And it happens way to often IMO...

[This message has been edited by AgHunter2011 (edited 3/26/2014 4:38p).]

Look at the neighborhood group numbers on your property as opposed to the one across the street. They call those appraisal boundary lines to value different sections differently. All appraisers are given the same marching orders. DO NOT REDUCE THE LAND. One domino falls....then the rest will follow. They say let the ARB make the descision in which they can manipulate by taking the value out of the imps unless the ARB chair demands so.

[This message has been edited by Mr. McGibblets (edited 3/26/2014 4:38p).]

[This message has been edited by Mr. McGibblets (edited 3/26/2014 4:38p).]

My land value remained unchanged yr to yr but improvements increased big time. Seems odd.

quote:

Look at the neighborhood group numbers on your property as opposed to the one across the street. They call those appraisal boundary lines to value different sections differently. All appraisers are given the same marching orders. DO NOT REDUCE THE LAND. One domino falls....then the rest will follow. They say let the ARB make the descision in which they can manipulate by taking the value out of the imps unless the ARB chair demands so.

I understand that....but that still doesn't explain why dirt on one side of the street is upped by 20% and the other 100%.

[This message has been edited by Diggity (edited 3/26/2014 4:43p).]

quote:quote:

Look at the neighborhood group numbers on your property as opposed to the one across the street. They call those appraisal boundary lines to value different sections differently. All appraisers are given the same marching orders. DO NOT REDUCE THE LAND. One domino falls....then the rest will follow. They say let the ARB make the descision in which they can manipulate by taking the value out of the imps unless the ARB chair demands so.

I understand that....but that still doesn't explain why dirt on one side of the street is upped by 20% and the other 100%.

[This message has been edited by Diggity (edited 3/26/2014 4:43p).]

It's the boundary line. The analyst will realize the issue when the people on the other side if the street point it out and then next year you are equalized. So enjoy it for this year.

quote:

I could be wrong, but I'm pretty sure the surroundings around a house (bad neighbors moving in, crime activity going up, local attractions shutting down, etc.) could drive the "land" value down as opposed to the "improvement" value.

He meant from an administrative standpoint in terms of HCAD changing the numbers. Land value is much easier to appear equitably assessed (the CAD has two directives, essentially, appraise at market value, and appraise equally and uniformly). For any two houses next to each other there might be myriad adjustments, age, size, condition, utility, that you can argue go into differences in the value of improvements, but its much harder argument to convince someone that two lots next to each other need any adjustment, if they are the same size and shape basically they should be equal. Thus HCAD will never ever admit that their initial land appraisal is off, otherwise each subsequent appeal based on the first adjustment would win based on inequality with the lot that got changed.

Where one street has oddly valued lots, its usually because its at a neighborhood boundary where one neighborhood is mingling with another differently valued one and their models aren't able to get it right.

[This message has been edited by JJxvi (edited 3/26/2014 4:47p).]

possibly...but I don't think it was a mistake because the total values ended up being about the same since they reduced the improvement values on the expensive dirt while increasing the improvement values on the cheap dirt.

+10%

Grandma's house value was reduced by 40%, land value increased by 40%, result is a net increase of 30%. Her 2300 s.f. house is now worth less than the 2007 Mazda 3 in the garage.

Since it's obvious HCAD isn't really interested in logic and the value isn't accurate, would it be possible to get her property value reduced to a negative number if we can prove it needs more than $8k in repairs? Or is $0 the lowest we can go?

Since it's obvious HCAD isn't really interested in logic and the value isn't accurate, would it be possible to get her property value reduced to a negative number if we can prove it needs more than $8k in repairs? Or is $0 the lowest we can go?

$0 is as low as they go

As much as I complain about HCAD, I have rarely seen cases where they overvalue land. It's typically the opposite.

[This message has been edited by Diggity (edited 3/26/2014 4:54p).]

As much as I complain about HCAD, I have rarely seen cases where they overvalue land. It's typically the opposite.

[This message has been edited by Diggity (edited 3/26/2014 4:54p).]

Yukon Cornelius

Sham recruiting weekend!! this needs more attention

in Billy Liucci's TexAgs Premium

94

Himbo Fisher

Rapid Reaction: Inside Schlossnagle's shocking departure from A&M

in Billy Liucci's TexAgs Premium

83

The 5200 Acres

Sham recruiting weekend!! this needs more attention

in Billy Liucci's TexAgs Premium

79