The reason we should not be concerned about inflation

Señor Chang said:

Any updates on inflation? Is it down yet?

Just wait until they have to drop rates to service the debt. Then the real fireworks kick off.

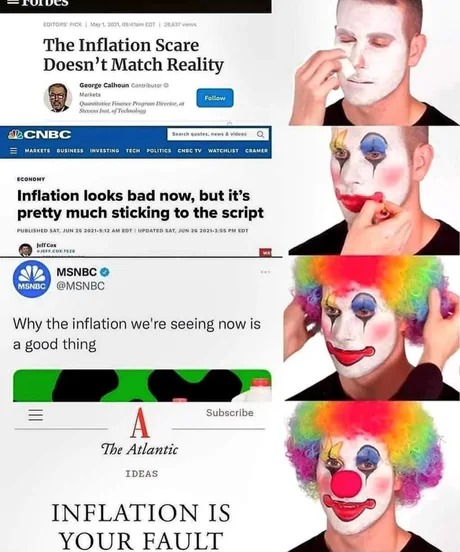

It was actually published as 'real news' .

The interest on the US national debt is already at $1 trillion per year.

— Wall Street Silver (@WallStreetSilv) April 7, 2024

As more older debt matures and needs to be refinanced at the new higher rates, the projected interest payments increase to between $1.2 trillion to $1.6 trillion, depending on if the Fed cuts rates and by… pic.twitter.com/3ZORUuPxGI

Remember that the FED will run a cumulative deficit called "deferred assets" on their balance sheet. They have absolutely no requirement to do anything as they can let that number dip as low as it wants.Red Pear Realty said:

From a thread on the politics board:The interest on the US national debt is already at $1 trillion per year.

— Wall Street Silver (@WallStreetSilv) April 7, 2024

As more older debt matures and needs to be refinanced at the new higher rates, the projected interest payments increase to between $1.2 trillion to $1.6 trillion, depending on if the Fed cuts rates and by… pic.twitter.com/3ZORUuPxGI

Where the issue comes in is with the treasury. In the most bullish case, the FED admitted that there won't be remittances to the treasury until 2029 at the earliest. And we are already breaking from that case. It's probably up to early 2030's already in a best case scenario.

So the treasury is getting nothing from the FED. The only place the treasury can now get money from to cover WHAT THEY HAVE ALREADY SPENT, and what they want to spend new money on, is through tax revenue and issuing new treasuries with the FED buying them, expanding their balance sheet. They can do that at these rates, higher rates, or lower rates. Though as you point out, without lowering rates, they would dig their hole exponentially deeper and kick the remittances down the road decades.

But if the FED were to lower rates, it would be catastrophic for inflation. 2022 will seem like a blip on the radar. Hyperinflation will ensue.

Like I've said for over a year now, the FED can't do anything without getting directly blamed for what breaks. So they will wait for something to break to first, and then they will act based on what bond yields are doing. If they are rocketing, the FED will raise. If they are tanking, the FED will lower.

- I Bleed Maroon (distracted easily by signatures)

And what this will do to housing prices, college tuition...?Red Pear Realty said:Señor Chang said:

Any updates on inflation? Is it down yet?

Just wait until they have to drop rates to service the debt. Then the real fireworks kick off.

More free money will cause another run-up in housing prices, with investors looking for a safe haven.

Would landlords with capital be willing to rent homes cash flow neutral or slightly negative in order to make money in equity?

That, sir, was the greatest post in the history of TexAgs. I salute you. -- Dough

There's no defending the original premise. It was wrong the moment OP's fingers hit the keys on the keyboard.Aglaw97 said:

Anyone heard from OP on this? Not trying to rub his nose in it, but am genuinely curious if anyone can defend the original premise at this point.

This one stands out to me and highlights a fundamental misunderstanding of economics:

- In fact, the fed has struggled the last decade to maintain their inflation level goal of 2%. This even Despite massive spending in 2008 and artificially low interest rates.

Assuming that inflation only manifests in consumer goods and services is a mistake. Asset inflation has been a huge problem and one of the main contributors to Libs despised "wealth gap."

Quote:

Another reason we should not be concerned by the massive spending is that $1 in government spending = greater than $1 in gdp growth.

Gdp growth = 1/ the propensity to save

The propensity to save is currently ~ 20%

Therefore every dollar spent today grows our gdp tomorrow by $5

This $5 of gdp growth then increases tax revenue by $5.

This increase in tax revenue is used to service the debt.

Basically, we can spend as much as we want with little to zero negative consequences. Long term inflation is not on the way.

This whole sections is just, well, infantile.

If ANY of that were true, why doesn't % increase in government spending result in a higher increase in GDP. Total debt to GDP:

Someone tell the chart it's going the wrong way.

The definition of inflation is expansion of the money supply. Period. The end. If you take a pizza and cut it into more slices than the last pizza you made, it takes more pieces of pizza to get you full. You aren't full on the same number of pieces any longer. That's inflation. I don't care what the media says, or what the White House says (no matter who is in office), or what the useful idiot professors are teaching in economics classes.

leoj said:YouBet said:

I don't have a problem with Red Pear's take on inflation. It's reality.

4-5 years of 6% inflation is reality?

Yep.

Oldag2020 said:

Bump

https://www.cnbc.com/amp/2023/12/13/fed-lowers-inflation-forecast-for-2024-seeing-core-pce-falling-to-2point4percent.html

OP will show up in 5 years to brag about how he was right all along. Calling it now.

Never saw this comment from page 1. Man, couldn't have been more wrong..SteveBott said:

To the OP's point

https://www.cnbc.com/2021/07/11/ron-insana-the-bond-market-agrees-with-the-federal-reserve-inflation-is-temporary.html?utm_source=facebook&utm_medium=news_tab&utm_content=algorithm

- I Bleed Maroon (distracted easily by signatures)

I agree and when people try to twist themselves into a pretzel arguing otherwise, it reminds me of Enron and Arthur Andersen since that happened early in my career and I knew people closely involved. I've seen very smart people time and time again think they have outsmarted the system when a 13 year old can take a step back and quickly point out that something isn't right. But the power of rationalization never ceases to amaze me.Red Pear Realty said:

Modern monetary theory (MMT) posits that you can because it's all just pretend play money anyway. And since it's just pretend money, they make us pay taxes to make us remember who is in charge.

The definition of inflation is expansion of the money supply. Period. The end. If you take a pizza and cut it into more slices than the last pizza you made, it takes more pieces of pizza to get you full. You aren't full on the same number of pieces any longer. That's inflation. I don't care what the media says, or what the White House says (no matter who is in office), or what the useful idiot professors are teaching in economics classes.

Again, it's probably more of a psychological fascination for me into the way people operate.

Volcker was needed to pull us out of the 1970's spiral. To date nobody has demonstrated the guts needed to do that.Red Pear Realty said:

I think we are tracking for a repeat of 1970s style inflation. Round 2 will be worse than Round 1, and it's going to last for another few years, at best, if we can pull out of the nosedive we are in now. If we aren't lucky, God help us. And when I said this was going to last several years at best (three years ago on this thread), there were definitely some folks here who incorrectly called me out. Would be nice to see not an apology to me, but rather a change in voting to do something about it for the betterment of the country.

If austerity is tried at some point in the future, it won't be the 70's repeat, it will be the greater depression. And sadly, it's exactly what's needed to get the country back and for our kids and grandkids to build back and have a healthy economy. But it would come with immeasurable pain for every single person in the process. We're talking unwinding of every dollar that's been thrust into the system since 2009.Aglaw97 said:Volcker was needed to pull us out of the 1970's spiral. To date nobody has demonstrated the guts needed to do that.Red Pear Realty said:

I think we are tracking for a repeat of 1970s style inflation. Round 2 will be worse than Round 1, and it's going to last for another few years, at best, if we can pull out of the nosedive we are in now. If we aren't lucky, God help us. And when I said this was going to last several years at best (three years ago on this thread), there were definitely some folks here who incorrectly called me out. Would be nice to see not an apology to me, but rather a change in voting to do something about it for the betterment of the country.

- I Bleed Maroon (distracted easily by signatures)

Red Pear Realty said:

I think we are tracking for a repeat of 1970s style inflation. Round 2 will be worse than Round 1, and it's going to last for another few years, at best, if we can pull out of the nosedive we are in now. If we aren't lucky, God help us. And when I said this was going to last several years at best (three years ago on this thread), there were definitely some folks here who incorrectly called me out. Would be nice to see not an apology to me, but rather a change in voting to do something about it for the betterment of the country.

Wal-Mart beef - good quality control, with once reasonable prices.

What a crazy idea this libertarian economist turned president had. Stop government spending, and inflation would disappear. Can you pick out on the chart when he took office?

With hyperinflation, people/businesses are disincentivized to hold currency. You would rather buy today and hold a good until needed. Very rationale, and necessary. You might even pay today for a future service, if you have confidence it will be honored.

An increased money supply often leads to an increase in velocity (more money chasing more things), which amplifies inflationary impact of increasing M2.

The 2nd order effect is if you are incentivized to spend now (to avoid inflationary erosion), that further increases velocity of money further pushing up prices now, continuing the cycle.

I suspect, velocity of money is slowing rapidly in Argentina, on the simple belief tomorrow won't be as bad. Of course, that is in addition to the very real austerity.

If what you are saying is true (and I do agree, as commodities are in a bottoming pattern and about to turn back up), who do you think is hit harder by the next wave, the country pushing hard austerity, or the country expanding its deficits and exponentially adding to its debts?Casey TableTennis said:

Given the length of time and degree of hyperinflation they have experienced, there is likely a 2nd order effect occurring.

With hyperinflation, people/businesses are disincentivized to hold currency. You would rather buy today and hold a good until needed. Very rationale, and necessary. You might even pay today for a future service, if you have confidence it will be honored.

An increased money supply often leads to an increase in velocity (more money chasing more things), which amplifies inflationary impact of increasing M2.

The 2nd order effect is if you are incentivized to spend now (to avoid inflationary erosion), that further increases velocity of money further pushing up prices now, continuing the cycle.

I suspect, velocity of money is slowing rapidly in Argentina, on the simple belief tomorrow won't be as bad. Of course, that is in addition to the very real austerity.

- I Bleed Maroon (distracted easily by signatures)

Either way heading out for errands, so will be later in the day before I noodle on it and reply.

yeah, its down. I just got off the phone with my friends in AustinSeñor Chang said:

Any updates on inflation? Is it down yet?

Heineken-Ashi said:If what you are saying is true (and I do agree, as commodities are in a bottoming pattern and about to turn back up), who do you think is hit harder by the next wave, the country pushing hard austerity, or the country expanding its deficits and exponentially adding to its debts?Casey TableTennis said:

Given the length of time and degree of hyperinflation they have experienced, there is likely a 2nd order effect occurring.

With hyperinflation, people/businesses are disincentivized to hold currency. You would rather buy today and hold a good until needed. Very rationale, and necessary. You might even pay today for a future service, if you have confidence it will be honored.

An increased money supply often leads to an increase in velocity (more money chasing more things), which amplifies inflationary impact of increasing M2.

The 2nd order effect is if you are incentivized to spend now (to avoid inflationary erosion), that further increases velocity of money further pushing up prices now, continuing the cycle.

I suspect, velocity of money is slowing rapidly in Argentina, on the simple belief tomorrow won't be as bad. Of course, that is in addition to the very real austerity.

Will preface with I don't follow any South American countries closely.

My expectation is the $ strengthening or weakening over next 2-3 years will be a massive influence. Meili is reportedly trying to dollarize, and if $ strengthens, I would expect GDP to benefit and austerity to be softened. Conversely, if we see the end of the ~15 year super cycle and $ weakens, the benefits of dollarization will be minimized.

You loosely stated commodities will trend up, as if fact. I don't discount the possibility, but the World Bank projects a moderating trend on commodity prices. Easy to discount them, but weakening economic conditions, continued elevated debt levels and rate environment would suggest slowing of consumer spend at some point and reduce commodity prices as increasing global M2 is more than offset by reducing velocity, creating less demand for commodities.

Given most industries are back to normal (ish) delivery time and inventory, supply/material chain disruptions are no longer a major influence in inflationary pressure on commodities, relatively speaking. Closer to pure supply/demand dynamics than anytime since pre-covid.

So, in net, I expect austerity to have a bit more impact, given they already have elevated inflation and horrible poverty )over 50% of the country).

But, if dollar strengthens, I think positive impact to debt/GDP could more than make up for consequences of austerity.

Wild opinion, but that is my take after spending 20 min on it.

- I Bleed Maroon (distracted easily by signatures)

AND does anyone believe the official government reporting? I definitely don't regarding unemployment.

https://www.wsj.com/livecoverage/stock-market-cpi-inflation-dow-sp500-nasdaq-live-10-10-2024

Redstone said:

Oh look, still bad

AND does anyone believe the official government reporting? I definitely don't regarding unemployment.

https://www.wsj.com/livecoverage/stock-market-cpi-inflation-dow-sp500-nasdaq-live-10-10-2024

In new NBER paper with @MA_Bolhuis, @juddcramer and Oskar Shulz, we argue that the unprecedented increase in borrowing costs is crucial to explaining the low consumer sentiment of the last two years. 1/N

— Lawrence H. Summers (@LHSummers) February 27, 2024

https://t.co/4CF4xVTlHv

Quote:

With higher rates, mortgage payments, car payments, and other credit payments required to finance everyday purchases have risen as well. It is not surprising that this would affect how consumers feel about the economy.

Quote:

Pre-1983, mortgage costs were in the CPI as were car payments pre-1998. Now, price indexes do not include borrowing costs. Thus, when interest rates jumped last year, official inflation did not fully capture the effects it would have on consumer well-being.

Quote:

In the paper, we show that the variation in the current University of Michigan Index of Consumer Sentiment, which cannot be explained by official inflation and unemployment, has historically shown a strong correlation with proxies for borrowing costs.

Quote:

We also show that the underlying questions in the survey provide direct evidence that concerns of consumers about borrowing costs are at historic highs, surpassed only by the Volcker-era.

Quote:

We then develop alternative CPI measures that explicitly incorporate the cost of money. The CPI does not only exclude mortgage costs, but also personal interest payments, which increased by more than 50 percent in 2023.

Quote:

We show that if we make an effort to reconstruct the CPI of Okun's erawhich would have had inflation peak last year around 18%, we are able to explain 70% of the gap in consumer sentiment we saw last year.

Quote:

We also show the sentiment gap in 2023 was not only a U.S. phenomenon as rates have jumped around the world. Overall, our paper highlights how consumers care about the cost of money, with potential for consumer sentiment to rise significantly if and when interest rates decline.