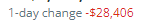

Successful Ichimoku cloud reversal. Next support should it move lower are obvious. Remember a couple weeks ago I mentioned how there was decades low short interest in the markets and to be careful. Today is what happened when there's no shorts covering giving a facade of dip buying.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)