before or after the 1:100 split?Heineken-Ashi said:Can't imagine what you will do when WWR hits $50.E said:

I will quit my job tomorrow if this hits $50 then

Stock Markets

26,661,605 Views |

237923 Replies |

Last: 10 hrs ago by EliteZags

Yes, I tend to agree. The FED keeps a 2% promise with lots of jabbering when its above there about how they are working to get it back. The market and public will take a little variance above if they feel confidence that the FED will get it back, even if they don't. Like I said, it's the sustained breaks upward that cause action from the public. This is why the FED had to move from "transitory" to the quickest rate hike cycle in our lifetimes in 2022. The data was strongly moving against them and the public started throwing a fit. Now things have quieted down despite not being back to target. This is because the public perceives that the FED is doing a good job and is "on track".I bleed maroon said:Good thoughts. I'd argue a couple points - unemployment is typically inverse of inflation rates. Also, if you look back 50 years, 90%+ of the time, we have experienced more than 2% inflation.Heineken-Ashi said:Their 2% target is merely set at the level that 100+ years of history has shown people are willing to be taxed at (inflation) without creating a fuss. Once it goes over that level, inflation starts to erode away enough from people that they actual feel like they aren't keeping up. And significantly higher for a long period causes revolts and the people along with the general economy force widespread governmental changes. Above 2% usually also comes with rising unemployment, one of the two things the FED is supposed to prevent. So when people start losing jobs, they immediately blame the institution tasked with preventing that from happening.I bleed maroon said:Yes - it will be interesting to see.Heineken-Ashi said:

CPI tomorrow. Can't imagine it being a non-factor, but it has been a non-factor many times before.

Keep your eye on treasury yields. The 2-year is moving down and has broken support. 10-year is moving down but hasn't yet matched the 2-year depth of drop. When those start really moving you will see the market, and the FED, react.

Sidebar: I think Powell has worked himself into a win-win scenario. He can't really be blamed if he keeps rates constant, as we have not reached the inflation target, and unemployment is low enough that it doesn't justify easing on those grounds. However, if he cuts rates before year-end, he can be thought of as forward-looking in terms of his protecting a potentially fragile economy.

As an objective observer, I'm amazed that the Fed has set such a stringent inflation target. I truly believe a range would have been much more appropriate, whether it was 1.5-2.5%, 2-3%, or 1-4%. An absolute target is by definition going to be too high or too low 99%+ of the time, and it's no way to set an overriding strategy, in my opinion.

Put simply, they can erode away the dollar as much as they want as long as it maintains at a 2% average clip. Beyond that, and the people start to fuss.

I would like to have a constant 2% inflation rate, but I'd be lying to myself if I said it is "the norm". And interestingly, the discussion actually gets very provocative when inflation is below the target - just think if this was truly half the time, on average!

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

WWR/GOLD.E said:before or after the 1:100 split?Heineken-Ashi said:Can't imagine what you will do when WWR hits $50.E said:

I will quit my job tomorrow if this hits $50 then

When valued in gold, WWR dropped to a ratio of .0002. The good news is, it really can't go significantly lower

Until you realize it can still lose 100% of its value lolz

But break that upper channel trendline its toying around with and..

WWR to outperform gold moving forward? Whoa.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

I'd go further than that - if you or i were in charge, we'd use some sort of backward moving average paired with a consensus forward-looking composite to more mechanically set interest rates. I'd say a 1.5-3.0% range would be adequate in most cases.Heineken-Ashi said:Yes, I tend to agree. The FED keeps a 2% promise with lots of jabbering when its above there about how they are working to get it back. The market and public will take a little variance above if they feel confidence that the FED will get it back, even if they don't. Like I said, it's the sustained breaks upward that cause action from the public. This is why the FED had to move from "transitory" to the quickest rate hike cycle in our lifetimes in 2022. The data was strongly moving against them and the public started throwing a fit. Now things have quieted down despite not being back to target. This is because the public perceives that the FED is doing a good job and is "on track".I bleed maroon said:Good thoughts. I'd argue a couple points - unemployment is typically inverse of inflation rates. Also, if you look back 50 years, 90%+ of the time, we have experienced more than 2% inflation.Heineken-Ashi said:Their 2% target is merely set at the level that 100+ years of history has shown people are willing to be taxed at (inflation) without creating a fuss. Once it goes over that level, inflation starts to erode away enough from people that they actual feel like they aren't keeping up. And significantly higher for a long period causes revolts and the people along with the general economy force widespread governmental changes. Above 2% usually also comes with rising unemployment, one of the two things the FED is supposed to prevent. So when people start losing jobs, they immediately blame the institution tasked with preventing that from happening.I bleed maroon said:Yes - it will be interesting to see.Heineken-Ashi said:

CPI tomorrow. Can't imagine it being a non-factor, but it has been a non-factor many times before.

Keep your eye on treasury yields. The 2-year is moving down and has broken support. 10-year is moving down but hasn't yet matched the 2-year depth of drop. When those start really moving you will see the market, and the FED, react.

Sidebar: I think Powell has worked himself into a win-win scenario. He can't really be blamed if he keeps rates constant, as we have not reached the inflation target, and unemployment is low enough that it doesn't justify easing on those grounds. However, if he cuts rates before year-end, he can be thought of as forward-looking in terms of his protecting a potentially fragile economy.

As an objective observer, I'm amazed that the Fed has set such a stringent inflation target. I truly believe a range would have been much more appropriate, whether it was 1.5-2.5%, 2-3%, or 1-4%. An absolute target is by definition going to be too high or too low 99%+ of the time, and it's no way to set an overriding strategy, in my opinion.

Put simply, they can erode away the dollar as much as they want as long as it maintains at a 2% average clip. Beyond that, and the people start to fuss.

I would like to have a constant 2% inflation rate, but I'd be lying to myself if I said it is "the norm". And interestingly, the discussion actually gets very provocative when inflation is below the target - just think if this was truly half the time, on average!

You must admit, Powell has amazingly recovered from being a laughingstock for his "transitory inflation" claim several years ago to today, where he's respected or tolerated by most. I wish (as you do too, I imagine) that he'd put more emphasis on our government's current fiscal irresponsibility as a root cause of economic risk, as monetary policy can only go so far.

I can admit that, on its face. But deeper analysis shows he hasn't done anything. They never do. The moves he's made since finally realizing he was wrong and starting to raise rates have been minimal, with the most action coming in the formation of the BTFP, something that would have never been a possibility even in 2020. It was a creative, out of left field, last resort (because there were literally no other options) move to funnel liquidity to a banking sector in crisis. Without it, the meltdown would have started in March of 2023. What the FED has done since 2008 has been nothing more than applying putty on leaks in a submarine. Every time a new leak springs up, they just plug it and keep diving deeper. Nothing is being done to steer the ship to safety. Repairs aren't even in consideration. And we are at a point where they will no longer have the benefit of year over year oil and commodity changes being negative. Those YOY numbers are going to be flat to positive moving forward. Inflation will be deemed "sticky" and "stubborn" with a significant risk of spikes causing inflation to ramp up again. At which point, it will be evident that he did absolutely nothing and certainly not as much as he should have done when he had the chance.I bleed maroon said:I'd go further than that - if you or i were in charge, we'd use some sort of backward moving average paired with a consensus forward-looking composite to more mechanically set interest rates. I'd say a 1.5-3.0% range would be adequate in most cases.Heineken-Ashi said:Yes, I tend to agree. The FED keeps a 2% promise with lots of jabbering when its above there about how they are working to get it back. The market and public will take a little variance above if they feel confidence that the FED will get it back, even if they don't. Like I said, it's the sustained breaks upward that cause action from the public. This is why the FED had to move from "transitory" to the quickest rate hike cycle in our lifetimes in 2022. The data was strongly moving against them and the public started throwing a fit. Now things have quieted down despite not being back to target. This is because the public perceives that the FED is doing a good job and is "on track".I bleed maroon said:Good thoughts. I'd argue a couple points - unemployment is typically inverse of inflation rates. Also, if you look back 50 years, 90%+ of the time, we have experienced more than 2% inflation.Heineken-Ashi said:Their 2% target is merely set at the level that 100+ years of history has shown people are willing to be taxed at (inflation) without creating a fuss. Once it goes over that level, inflation starts to erode away enough from people that they actual feel like they aren't keeping up. And significantly higher for a long period causes revolts and the people along with the general economy force widespread governmental changes. Above 2% usually also comes with rising unemployment, one of the two things the FED is supposed to prevent. So when people start losing jobs, they immediately blame the institution tasked with preventing that from happening.I bleed maroon said:Yes - it will be interesting to see.Heineken-Ashi said:

CPI tomorrow. Can't imagine it being a non-factor, but it has been a non-factor many times before.

Keep your eye on treasury yields. The 2-year is moving down and has broken support. 10-year is moving down but hasn't yet matched the 2-year depth of drop. When those start really moving you will see the market, and the FED, react.

Sidebar: I think Powell has worked himself into a win-win scenario. He can't really be blamed if he keeps rates constant, as we have not reached the inflation target, and unemployment is low enough that it doesn't justify easing on those grounds. However, if he cuts rates before year-end, he can be thought of as forward-looking in terms of his protecting a potentially fragile economy.

As an objective observer, I'm amazed that the Fed has set such a stringent inflation target. I truly believe a range would have been much more appropriate, whether it was 1.5-2.5%, 2-3%, or 1-4%. An absolute target is by definition going to be too high or too low 99%+ of the time, and it's no way to set an overriding strategy, in my opinion.

Put simply, they can erode away the dollar as much as they want as long as it maintains at a 2% average clip. Beyond that, and the people start to fuss.

I would like to have a constant 2% inflation rate, but I'd be lying to myself if I said it is "the norm". And interestingly, the discussion actually gets very provocative when inflation is below the target - just think if this was truly half the time, on average!

You must admit, Powell has amazingly recovered from being a laughingstock for his "transitory inflation" claim several years ago to today, where he's respected or tolerated by most. I wish (as you do too, I imagine) that he'd put more emphasis on our government's current fiscal irresponsibility as a root cause of economic risk, as monetary policy can only go so far.

IBR - I just reread this. If it comes across argumentative that's not the purpose. I've enjoyed this dialogue. Merely trying to expand on my thoughts as we go.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

I guess we just have a difference of perspective. I never really figured you as a monetary policy driven guy, but maybe you are. I see whatever Powell does as much less important to our future than fixing our fiscal irresponsibility (Trump/Biden/Bush/Obama, yep, all of them). Decisive action on fiscal restraint can make monetary policy much less important, but some see the Fed as the be-all/end-all, which it was never intended to be. It happens to be more politically palatable (by all parties) than the much less popular belt-tightening that's needed.

You convinced me! Doubling down

I'm not a monetary policy guy. But we live in a monetary policy world and I have to make decisions in my personal and professional life that monetary policy can affect.I bleed maroon said:

I guess we just have a difference of perspective. I never really figured you as a monetary policy driven guy, but maybe you are. I see whatever Powell does as much less important to our future than fixing our fiscal irresponsibility (Trump/Biden/Bush/Obama, yep, all of them). Decisive action on fiscal restraint can make monetary policy much less important, but some see the Fed as the be-all/end-all, which it was never intended to be. It happens to be more politically palatable (by all parties) than the much less popular belt-tightening that's needed.

Regarding Powell in the FED, there's nothing they can do except take measure to kick the can further. Every time we kick the can, we steal more productivity from the future economy to merely stabilize the current economy. We steal wealth from our own futures and our kids futures to maintain the status quo of the present. Nobody wants a recession or depression. People will lose jobs, homes, wealth, and some will die. But this is the reality of what you get when you start down the path of devaluing the currency to smooth out natural economic cycles. You essentially create a "buy the dip" moment at the present while kick down the road what would have been a natural cycle down, but will now be longer and deeper when it comes. And we've done this continually since 2008. Before that, the FED could take a little action here or there with small movements in rates and adding or subtracting assets on their balance sheer. The economic backdrop was in a long term period of growth and debt was manageable. In 2008, they "saved" the economy by changing the rules of the game. Instead of adding assets to their balance sheet from the treasury sale of new securities to expand the money supply, they borrowed the money from the banks and then loaned it back to the banks 100fold. This was when the economy and middle class went into a hole that it couldn't recover from. Because that money would never be paid back. Then they did it again in 2020 at a 4x factor. The FED from the 1970's and 1980's that used strict interest rate management to defeat inflation and get the country back on track turned into a FED that took money from the people, leveraged it, AND used interest rate management to merely prop up a structure that needed to be reset. There are no tools left. The balance sheet is mostly full. If they buy treasuries and add them to the balance sheet, the interest on the debt will explode, and it's already 1.1T. If they stimulate in any way its going to cause runaway hyperinflation. And if they use strict interest rate management to put a high top over inflation, they will cause the massive recession they are being celebrated as avoiding. There are no tools. They are sitting ducks just waiting, all in the hopes they aren't the ones blamed.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

I change my mind...5,700 TOMORROW!!!!EnronAg said:

be careful shorting this donkey market...5,700 coming in about 5 trading days...

Heineken-Ashi said:Can't imagine what you will do when WWR hits $50.E said:

I will quit my job tomorrow if this hits $50 then

Did you say.....WHEN?

You when it happensTalon2DSO said:Heineken-Ashi said:Can't imagine what you will do when WWR hits $50.E said:

I will quit my job tomorrow if this hits $50 then

Did you say.....WHEN?

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

TheVarian said:

What's the long term goal for them you think? I want to put some cash in some stock like this and hold for the long term.

know how they say if buyers of the original Model S had put that money into TSLA instead they'd be worth 8 figures? well I put that Model S into PLTR and riding the long rocket up

Markets ripped today. Let's see how tomorrows CPI report goes

Heineken-Ashi said:You when it happensTalon2DSO said:Heineken-Ashi said:Can't imagine what you will do when WWR hits $50.E said:

I will quit my job tomorrow if this hits $50 then

Did you say.....WHEN?

Still young enough for two chicks at the same time?

That's not a concern anymore. They got pills for that if needed

El_duderino said:

That's not a concern anymore. They got pills for that if needed

And if WWR hits $50, I'll welcome the 4 hour "side effect"

Heineken-Ashi said:I'm not a monetary policy guy. But we live in a monetary policy world and I have to make decisions in my personal and professional life that monetary policy can affect.I bleed maroon said:

I guess we just have a difference of perspective. I never really figured you as a monetary policy driven guy, but maybe you are. I see whatever Powell does as much less important to our future than fixing our fiscal irresponsibility (Trump/Biden/Bush/Obama, yep, all of them). Decisive action on fiscal restraint can make monetary policy much less important, but some see the Fed as the be-all/end-all, which it was never intended to be. It happens to be more politically palatable (by all parties) than the much less popular belt-tightening that's needed.

Regarding Powell in the FED, there's nothing they can do except take measure to kick the can further. Every time we kick the can, we steal more productivity from the future economy to merely stabilize the current economy. We steal wealth from our own futures and our kids futures to maintain the status quo of the present. Nobody wants a recession or depression. People will lose jobs, homes, wealth, and some will die. But this is the reality of what you get when you start down the path of devaluing the currency to smooth out natural economic cycles. You essentially create a "buy the dip" moment at the present while kick down the road what would have been a natural cycle down, but will now be longer and deeper when it comes. And we've done this continually since 2008. Before that, the FED could take a little action here or there with small movements in rates and adding or subtracting assets on their balance sheer. The economic backdrop was in a long term period of growth and debt was manageable. In 2008, they "saved" the economy by changing the rules of the game. Instead of adding assets to their balance sheet from the treasury sale of new securities to expand the money supply, they borrowed the money from the banks and then loaned it back to the banks 100fold. This was when the economy and middle class went into a hole that it couldn't recover from. Because that money would never be paid back. Then they did it again in 2020 at a 4x factor. The FED from the 1970's and 1980's that used strict interest rate management to defeat inflation and get the country back on track turned into a FED that took money from the people, leveraged it, AND used interest rate management to merely prop up a structure that needed to be reset. There are no tools left. The balance sheet is mostly full. If they buy treasuries and add them to the balance sheet, the interest on the debt will explode, and it's already 1.1T. If they stimulate in any way its going to cause runaway hyperinflation. And if they use strict interest rate management to put a high top over inflation, they will cause the massive recession they are being celebrated as avoiding. There are no tools. They are sitting ducks just waiting, all in the hopes they aren't the ones blamed.

You must be fun at parties… (jokes aside, I really enjoyed y'all's back and forth. Great thoughts and perspectives)

Heineken-Ashi said:I'm not a monetary policy guy. But we live in a monetary policy world and I have to make decisions in my personal and professional life that monetary policy can affect.I bleed maroon said:

I guess we just have a difference of perspective. I never really figured you as a monetary policy driven guy, but maybe you are. I see whatever Powell does as much less important to our future than fixing our fiscal irresponsibility (Trump/Biden/Bush/Obama, yep, all of them). Decisive action on fiscal restraint can make monetary policy much less important, but some see the Fed as the be-all/end-all, which it was never intended to be. It happens to be more politically palatable (by all parties) than the much less popular belt-tightening that's needed.

Regarding Powell in the FED, there's nothing they can do except take measure to kick the can further. Every time we kick the can, we steal more productivity from the future economy to merely stabilize the current economy. We steal wealth from our own futures and our kids futures to maintain the status quo of the present. Nobody wants a recession or depression. People will lose jobs, homes, wealth, and some will die. But this is the reality of what you get when you start down the path of devaluing the currency to smooth out natural economic cycles. You essentially create a "buy the dip" moment at the present while kick down the road what would have been a natural cycle down, but will now be longer and deeper when it comes. And we've done this continually since 2008. Before that, the FED could take a little action here or there with small movements in rates and adding or subtracting assets on their balance sheer. The economic backdrop was in a long term period of growth and debt was manageable. In 2008, they "saved" the economy by changing the rules of the game. Instead of adding assets to their balance sheet from the treasury sale of new securities to expand the money supply, they borrowed the money from the banks and then loaned it back to the banks 100fold. This was when the economy and middle class went into a hole that it couldn't recover from. Because that money would never be paid back. Then they did it again in 2020 at a 4x factor. The FED from the 1970's and 1980's that used strict interest rate management to defeat inflation and get the country back on track turned into a FED that took money from the people, leveraged it, AND used interest rate management to merely prop up a structure that needed to be reset. There are no tools left. The balance sheet is mostly full. If they buy treasuries and add them to the balance sheet, the interest on the debt will explode, and it's already 1.1T. If they stimulate in any way its going to cause runaway hyperinflation. And if they use strict interest rate management to put a high top over inflation, they will cause the massive recession they are being celebrated as avoiding. There are no tools. They are sitting ducks just waiting, all in the hopes they aren't the ones blamed.

I am not economically smart or educated enough to know how this plays out, and your scenario certainly sounds plausible. My big question is how long can they keep the balls in the air? Months, years, decades?

If Trump is elected the next step is obvious, tank the economy and blame him. Gives the fed cover and general population doesn't understand and they get credit for a job well done.

(tinfoil hat off now)

(not politics related either so please don't read my post that way)

(tinfoil hat off now)

(not politics related either so please don't read my post that way)

FishrCoAg said:Heineken-Ashi said:I'm not a monetary policy guy. But we live in a monetary policy world and I have to make decisions in my personal and professional life that monetary policy can affect.I bleed maroon said:

I guess we just have a difference of perspective. I never really figured you as a monetary policy driven guy, but maybe you are. I see whatever Powell does as much less important to our future than fixing our fiscal irresponsibility (Trump/Biden/Bush/Obama, yep, all of them). Decisive action on fiscal restraint can make monetary policy much less important, but some see the Fed as the be-all/end-all, which it was never intended to be. It happens to be more politically palatable (by all parties) than the much less popular belt-tightening that's needed.

Regarding Powell in the FED, there's nothing they can do except take measure to kick the can further. Every time we kick the can, we steal more productivity from the future economy to merely stabilize the current economy. We steal wealth from our own futures and our kids futures to maintain the status quo of the present. Nobody wants a recession or depression. People will lose jobs, homes, wealth, and some will die. But this is the reality of what you get when you start down the path of devaluing the currency to smooth out natural economic cycles. You essentially create a "buy the dip" moment at the present while kick down the road what would have been a natural cycle down, but will now be longer and deeper when it comes. And we've done this continually since 2008. Before that, the FED could take a little action here or there with small movements in rates and adding or subtracting assets on their balance sheer. The economic backdrop was in a long term period of growth and debt was manageable. In 2008, they "saved" the economy by changing the rules of the game. Instead of adding assets to their balance sheet from the treasury sale of new securities to expand the money supply, they borrowed the money from the banks and then loaned it back to the banks 100fold. This was when the economy and middle class went into a hole that it couldn't recover from. Because that money would never be paid back. Then they did it again in 2020 at a 4x factor. The FED from the 1970's and 1980's that used strict interest rate management to defeat inflation and get the country back on track turned into a FED that took money from the people, leveraged it, AND used interest rate management to merely prop up a structure that needed to be reset. There are no tools left. The balance sheet is mostly full. If they buy treasuries and add them to the balance sheet, the interest on the debt will explode, and it's already 1.1T. If they stimulate in any way its going to cause runaway hyperinflation. And if they use strict interest rate management to put a high top over inflation, they will cause the massive recession they are being celebrated as avoiding. There are no tools. They are sitting ducks just waiting, all in the hopes they aren't the ones blamed.

I am not economically smart or educated enough to know how this plays out, and your scenario certainly sounds plausible. My big question is how long can they keep the balls in the air? Months, years, decades?

That's the question. And you have to believe they will exhaust every option possible to do it. All of the liquidity injection methods will be tried. They have never been tried with an economic backdrop and financial situation as weak as it currently is. We will all find out together.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

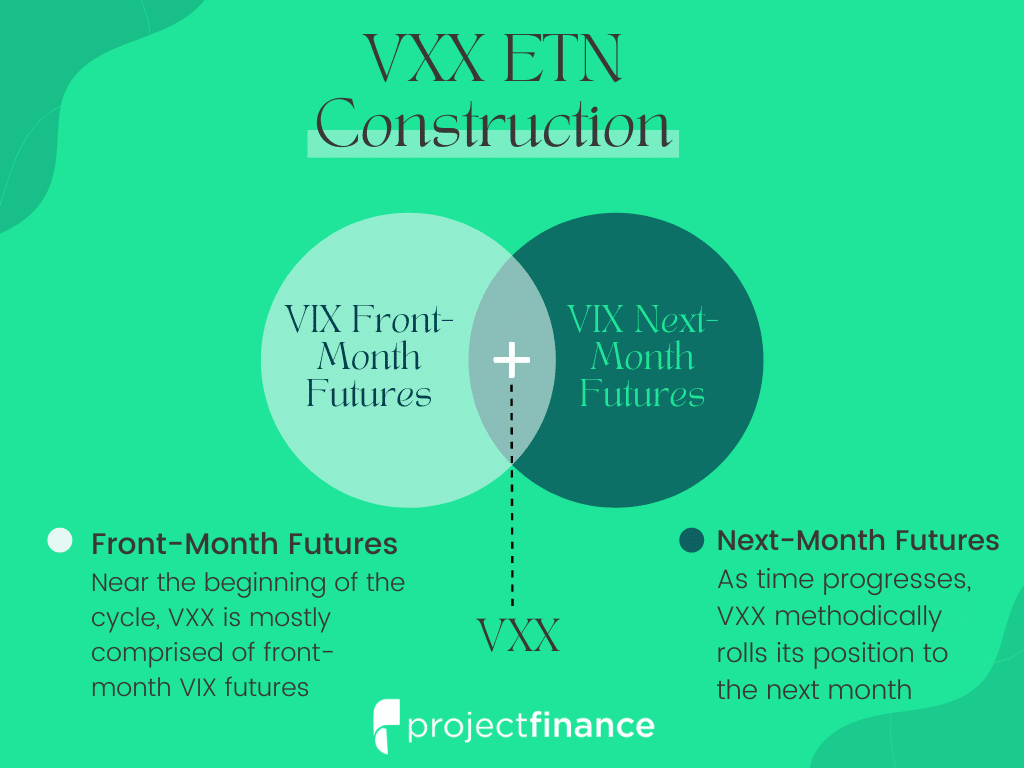

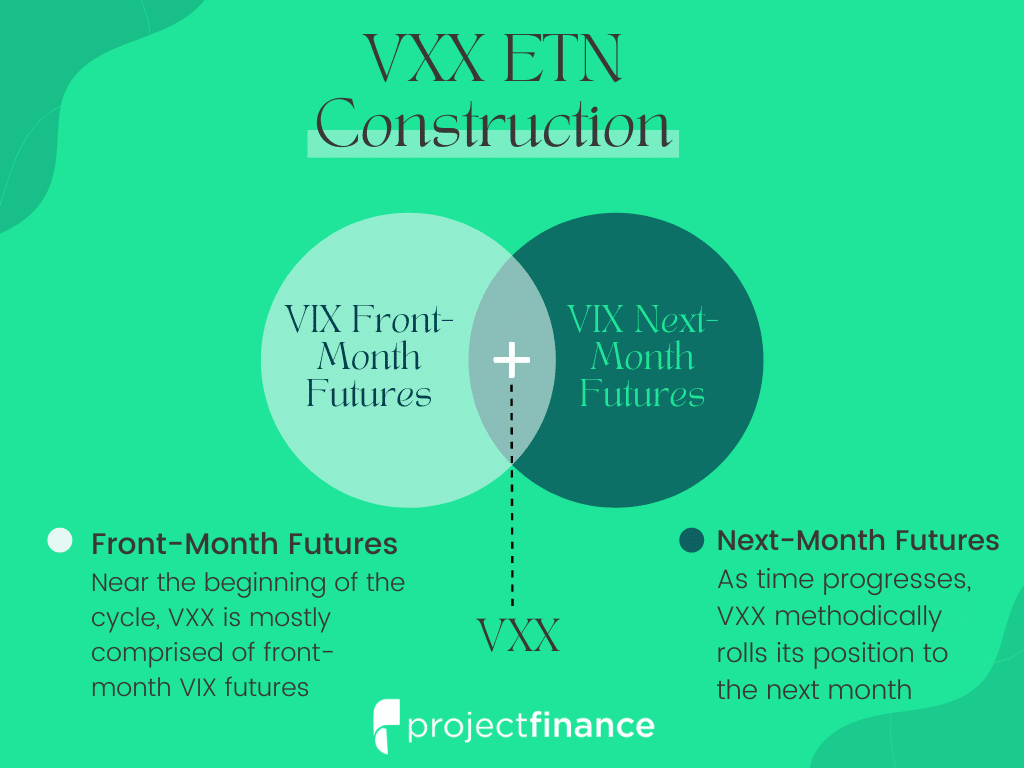

I've mentioned VXX here before. It's an ETN which is different from an ETF in that it's structured as a debt note and doesn't hold any of the underlying that it tracks.

So what does VXX track?

.webp

.webp

To put it simply, VXX is tracking the daily percentage changes of the weighted 30-day VIX future. It is constantly decaying wherein the VIX itself swings up and down within a pretty stable range save for massive volatility spikes.

It's because of the constant decay that you can gain clues. See, when VIX starts to move up, it's hard to decipher if it's a significant move or a short term bounce, again, because its exists within a stable range. VXX on the other hand, when it spikes through a resistance level, you can actually look for it to hold support and start to move back up. When it no longer decays, even for a shorter period of time, you know that volatility is increasing, since VXX is tracking the short end of the VIX futures curve on a weighted basis. If it then moves above the previous high it just made, you are likely trading in a growing volatility event. You continue to watch supports and resistance. If more resistance starts to get taken out, you know volatility is getting more extreme. If it wasn't, VXX would be decaying back down. So the trade is to buy VXX, or VXX options, once you see the first spike and a hold of support.

Looking at the all-time chart in log mode, you really can't tell that the great financial crisis was a massive volatility event. And 2020 appears rather tame. Until you realize that the decay distorts things and 2020 was a nearly 500% gain had you owned shares of VXX prior to January 1st. Of course the actual price at the time was much lower. You are seeing an instrument that was split twice since then 1:4, always in the $9-$13 range when it happens. But you can see on the chart below that when VXX moves off a low and holds support, a 1-3 month bet on volatility buy buying VXX or buying VXX calls can be extremely profitable. If it doesn't happen in that timeframe, it's likely not going to. But of course, it's not a sure thing, which is why I like to see it not only hold support, but take a resistance level too. And it helps if there is negative divergence in SPX to go along with it.

But you have to be very careful. Because of the constant decay, VXX can be reverse split on a moments notice. Today was the announcement for the next 1:4 reverse split set to take hold on July 24th. The value post split from today would be $41. People betting on volatility, if it doesn't come before that date, will be severely devalued. And if they sell out before then with no volatility spikes, they will be selling at a loss. The good news is, post split, it's not likely it will have another one for at least a year. So after July 24th, we watching for bottoming patterns and resistance take outs with the market showing very significant negative divergence and severely overbought could be an extremely proftable setup.

Barclays Announces a Reverse Split of the iPath Series B S&P 500 VIX Short-Term Futures ETNs and the iPath Series B S&P 500 VIX Mid-Term Futures ETNs (yahoo.com)

And don't go thinking the date of a split has any meaning. There's nothing there that can be converted to a tradeable event. Happen chance at best and meaningless at worst.

So what does VXX track?

Quote:

The VIX Index measures a constant 30-day weighting by using multiple SPX options expiration cycles. Since there isn't an exact 30-day expiration cycle on every single trading day, Cboe uses the following methodology to calculate a constant 30-day implied volatility using SPX options:

"Only SPX options with more than 23 days and less than 37 days to the Friday SPX expiration are used to calculate the VIX Index. These SPX options are then weighted to yield a constant, 30-day measure of the expected volatility of the S&P 500 Index." Cboe

As mentioned earlier, VXX tracks the S&P 500 VIX Short-Term Futures Index, which tracks the first and second month VIX futures contracts:

The S&P 500 VIX Short-Term Futures Index utilizes prices of the next two near-term VIX futures contracts to replicate a position that rolls the nearest month VIX futures to the next month on a daily basis in equal fractional amounts. This results in a constant one-month rolling long position in first and second month VIX futures contracts. (source)

VXX's goal is to track the daily percentage change of a 30-day VIX futures contract. Since there isn't a VIX futures contract with 30 days to settlement on each trading day, they use the first-month and second-month VIX futures to calculate a 30-day VIX futures contract from the weightings and prices of the futures that are actually trading.

.webp

.webpTo put it simply, VXX is tracking the daily percentage changes of the weighted 30-day VIX future. It is constantly decaying wherein the VIX itself swings up and down within a pretty stable range save for massive volatility spikes.

It's because of the constant decay that you can gain clues. See, when VIX starts to move up, it's hard to decipher if it's a significant move or a short term bounce, again, because its exists within a stable range. VXX on the other hand, when it spikes through a resistance level, you can actually look for it to hold support and start to move back up. When it no longer decays, even for a shorter period of time, you know that volatility is increasing, since VXX is tracking the short end of the VIX futures curve on a weighted basis. If it then moves above the previous high it just made, you are likely trading in a growing volatility event. You continue to watch supports and resistance. If more resistance starts to get taken out, you know volatility is getting more extreme. If it wasn't, VXX would be decaying back down. So the trade is to buy VXX, or VXX options, once you see the first spike and a hold of support.

Looking at the all-time chart in log mode, you really can't tell that the great financial crisis was a massive volatility event. And 2020 appears rather tame. Until you realize that the decay distorts things and 2020 was a nearly 500% gain had you owned shares of VXX prior to January 1st. Of course the actual price at the time was much lower. You are seeing an instrument that was split twice since then 1:4, always in the $9-$13 range when it happens. But you can see on the chart below that when VXX moves off a low and holds support, a 1-3 month bet on volatility buy buying VXX or buying VXX calls can be extremely profitable. If it doesn't happen in that timeframe, it's likely not going to. But of course, it's not a sure thing, which is why I like to see it not only hold support, but take a resistance level too. And it helps if there is negative divergence in SPX to go along with it.

But you have to be very careful. Because of the constant decay, VXX can be reverse split on a moments notice. Today was the announcement for the next 1:4 reverse split set to take hold on July 24th. The value post split from today would be $41. People betting on volatility, if it doesn't come before that date, will be severely devalued. And if they sell out before then with no volatility spikes, they will be selling at a loss. The good news is, post split, it's not likely it will have another one for at least a year. So after July 24th, we watching for bottoming patterns and resistance take outs with the market showing very significant negative divergence and severely overbought could be an extremely proftable setup.

Barclays Announces a Reverse Split of the iPath Series B S&P 500 VIX Short-Term Futures ETNs and the iPath Series B S&P 500 VIX Mid-Term Futures ETNs (yahoo.com)

And don't go thinking the date of a split has any meaning. There's nothing there that can be converted to a tradeable event. Happen chance at best and meaningless at worst.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

Saw a similar video on apple and if you had put the cost of every iPhone into the stock.

20k to 200m

20k to 200m

Bam! TNA - $38 limit sell executed in premarket.

Got more set at 39 and 40.

Got more set at 39 and 40.

And 39 done.

Sitting on $25k now and unsure where to put it.

Sitting on $25k now and unsure where to put it.

BOIL low is priced to perfection  LOL

LOL

LOL

LOL

Yields dropping this morning.

markets gave back everything from those cool CPI numbers...personally, I think fake, but that's beside the point...how are we not just ripping on that??? early morning shakeout before rocket launch???

To quote Ari Gold -- "Think of it as the Holocaust, Lloyd. Never again."

Lol.

I put in some market orders before the open for BRK/B, QQQM, SOXQ, and ISCG with about $8k of that.

Sitting on the rest for now and seeing what the market does today.

Lol.

I put in some market orders before the open for BRK/B, QQQM, SOXQ, and ISCG with about $8k of that.

Sitting on the rest for now and seeing what the market does today.

I'm sitting on a 7/12 SPY 565C. Let's see what happens.

Market doesn't know what it wants to do

it wants to correct...but the fake economic data and dovish Fed is propping it up...

And there's $40.Brian Earl Spilner said:

Bam! TNA - $38 limit sell executed in premarket.

Got more set at 39 and 40.

Quote:

Inflation tame in June

Government's key measure in line with expectations, despite higher food prices.

NEW YORK (CNNMoney.com) -- Prices paid by consumers rose in June, but when food and energy prices were stripped out the government's key inflation measure was in line with Wall Street expectations

July 18 2007: 10:55 AM EDT

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

Gross...but I'm here for it.

Featured Stories

See All

9:07

8h ago

3.3k

16:07

11h ago

2.4k

Disparity from deep dooms No. 7 Texas A&M against No. 6 Vols, 77-69

by Olin Buchanan

4:43

11h ago

655

Game Highlights: No. 6 Tennessee 77, No. 7 Texas A&M 69

by Matthew Dawson

13:35

1d ago

4.9k

tboag

Postgame Discussion: No. 6 Tennessee 77, No. 7 Texas A&M 69

in Billy Liucci's TexAgs Premium

2