ravingfans said:

Heineken-Ashi said:

I have another busy weekend with traveling. Two things I've promised but haven't had time to compile a post I'm confident can be understood easily yet.

1. How to identify and profit from downside setups. IWM will have strong potential, and I can use what happened today as an example. How to know when to GO. How to know when to bail. How to identify targets.

2. A look into each sector to find some actionable options setups.

Will try to get to #1 this weekend. Regarding #2, I'm not confident in any of them right now. Energy and utilities are the only ones not looking some sort of overbought, but neither is looking like they are ready for big pops. In fact, a couple hit minimum targets I identified earlier this week when doing my initial look. There's always potential upside, but what I'm mostly doing is looking for first level supports that if broken could point to a significant reversal. If we can identify those on each sector, it can give a lot of insight into what might drive markets down. Still need to do a deeper dive.

On #2, my brother a few years ago was trying to educate me on a concept that "It's all one market". Believe this was during our Elliott Wave theory period which is fascinating, but not too useful to me (yet).

The concept is mainly that investors have cash and need to invest or keep investing it to get it off the sidelines. they will try every concept there is including Stocks, Bonds, Real Estate, Metals and all other schemes looking to gain. A lot of FOMO at work, but in the end there is a giant bubble forming and takes all the markets down at a single point. All the analysts say they never saw it coming, it is an incredible event, once in a lifetime, and yet here we are on the precipice of something possibly historic.

Anyway, that was 2007 and he advised me to move out of the market which I did, but at that point I never got the signal to get back in so lost a few years of nice returns.

thanks for #1 when you have time!

I want to do this right now..

But I won't. It's time to out myself. And someone nailed it within my first 5 posts as Heineken.

Sorry that this is super long, but it needs to be so I can explain myself. If you don't read it, I can't say I blame you. I get long winded. But I do so to be clear and complete about my intentions and my methods. And I think the market is at a point where I need to be completely transparent.

I've been hesitant to reveal myself. Mainly because it's not about me. And I'm truly nothing special. Just an Aggie who has a passion for finance, has found ways to get better and become successful, and loves sharing with others to help them. I've enjoyed being a rando that nobody knows. But this place was always special to me, and when I was permabanned, I really missed it. I missed sharing ideas here. And I missed learning here. I learned a lot and still do from many people here. And there are many more who lurk. Many beginners who just want to learn. This isn't about being right or patting myself on the back. Prog and I talk about this all the time on discord. This is about us coming together and getting better together. Iron sharpens iron. Also, I've been scared of texags giving me another perma. I hope they don't. I've proven for a couple years now I only wade into politics to discuss financial matters and I don't attack other users. And I absolutely do not question moderation.

I fell into the trap under the old username as I consumed more and more politics of subscribing to red team vs blue team. I let it consume me. While I'm strong in my generally conservative beliefs, I have learned through reading history that my enemy is not my neighbor who thinks differently. My perma required me to step back and re-evaluate civil and productive discussion. And to understand that everyone sees the world through their own eyes from their own life experiences. Just because you think someone is wrong doesn't mean you have the right to judge them or to publicly ridicule them. As Prog says, we are all on team green here. But if I'm disappeared after this, I guess I will regret this post.

But also, many here had great distaste for my analysis and methods before my ban. And some of you for me in general as I was often unkind over on F16. And I have to say, it wasn't 100% unwarranted. I was much less accurate, less financially savvy, and less careful. Definitely less mature. When I first started posting on this thread, while I had been trading a couple years, I was just a beginner using Elliott Wave. The past two years have really been great. Not because of the money I've made, but because I took the time to learn so much and see where I was so wrong on so many things. At my day job, in the markets, and in my personal life. I'm a market junkie, an avid reader of financial articles and books (highly recommend The Creature from Jekyll Island, Layered Money, The Great Taking, Elliott Wave Principle, and Fibonacci Applications and Strategies for Traders), and a very humbled trader. I don't discount anyone anymore. I've honed in my knowledge and skills. I've practiced my craft extensively. I've taken MANY steps to try and master my art. And as y'all have witnessed with my current screen name, I've learned new arts, and I use EVERYTHING to make my strategies better.

Yes, I'm the Elliott Wave guy.. voodoo magic and crazy terminology and all. And yes, I do plan to support some of my posts with EW in the future, though I promise I will concisely explain why. That's the main reason I'm coming clean here. I don't want to hide that sometimes what I'm seeing is through that lens. But please know, the mazag08 who came on here pumping wave counts was NOT an expert at EW. He was irrational and frankly, underqualified. I was just getting into it in 2020/2021. I made some good calls and I made some awful ones, because I didn't actually take the time to learn the deep nuances.

And that's where people get soured over EW, get burned and decide its trash, and eyes gloss over. They don't understand it. AND I DIDN'T UNDERSTAND IT FULLY. So let me be very clear on what is actually is and how it's the best system I've found. And I'll link to

www.elliottwavetrader.net, as the method Avi Gilburt came up with, "Fibonacci Pinball", of which I fully subscribe to and use daily, is the best in the business and is the only fully quantifiable method of using EW, versus just slapping some numbers and letter on charts. He offers the absolute best free education section I have found.

It is not a prediction tool, though it often does predict quite well. It is not magic fairy dust that tells you exactly what will happen. I used to think it was. I would make predictions and end up looking like an ass over half the time. If you to ask me to post a wave chart on a stock, I will. But merely as a blueprint based on what is currently observable. Ultimately, the market decides if a rally is a rally or if it breaks down into something else. Just because a setup looks great, doesn't mean it will confirm.

What EW does do is provide an outline for the highest probability of what could happen using market sentiment as the indicator. And it gives you phenomenal support and resistance outlook. And when you know how to apply it, you know what to look for next as well as where the play might invalidate so you can quickly pivot. It's not simply slapping 1-2-3-4-5 or a-b-c on a chart. It's a highly sophisticated system. The biggest complaint against EW analysts is that "when they are wrong, they just claim its something else to always look right!" On the surface, it does seem that way. That's because when you ARE wrong (and you will be, sometimes quite often), something else DID happen. You aren't pivoting to save face. You are pivoting because it's necessary to adapt your count to the most likely scenario moving forward so you don't lose money. No system is perfect. The "wave slappers" as we call them, they don't know where their count could be wrong. I was one of these people.

Markets are their own creature made up of millions of individuals and institutions each following some combo of inherent bullishness, inherent bearishness, fundamentals, technicals, stupidity, and pure emotion.

Elliott Wave, properly applied, merely provides a framework based on the observed price action to date.

Markets do not follow a pre-determined set path, are not omniscient, and market sentiment can remain irrational far longer than you can remain solvent. That is why you MUST consider the alternatives as part of your primary analysis and manage risk appropriately. Know the pivot zones that could lead to the primary path failing. This is why I always have stops. It's why you might see me abandon plays I previously liked like UNFI (though I might get back in if it can start to prove itself).

I was loose and inaccurate back in the mazag08 days. I've come a long way and am learning more every day. While I use Elliott Wave as my primary tool, I have a much larger toolbelt now, including beer candles to determine trends and strength of trends. It all comes together to help me paint the clearest picture possible. And I absolutely will not enter a trade if there isn't clarity on some timeframe from an EW perspective. Experience in the market is more crucial than anything. And even though I had spent some time, I hadn't experienced a true bear market. I hadn't experienced falling knives. 2022 was so important for learning. If you didn't take the time to truly look back at that year and hone in your skills, you're doing yourself a disservice. 2022 was the best preparation for what is likely coming. Because it wasn't straight down. It was a slow and methodical unwinding that was very painful as every bounce completely failed until the bottom was hit.

I will not try and convince any of you to do EW. Nor will I try and convince you that I'm right or that what you do is inferior. I will merely use it to support some of my analysis. And I hope it benefits you like it benefits me. I don't get paid to share anything. I share because I want to help others. Especially fellow Aggies and many good friends I've met here over the years.

Those on discord followed me on plays like MARA, PLTR, NGL, AMD, and many others. Had some misses too, but that's where stops came in handy. Speaking of PLTR, I had a public tradingview post on it that you can see here.

PLTR - Earnings pop incoming? for NYSE:PLTR by mazag08 TradingViewAs to this comment..

Quote:

The concept is mainly that investors have cash and need to invest or keep investing it to get it off the sidelines. they will try every concept there is including Stocks, Bonds, Real Estate, Metals and all other schemes looking to gain. A lot of FOMO at work, but in the end there is a giant bubble forming and takes all the markets down at a single point. All the analysts say they never saw it coming, it is an incredible event, once in a lifetime, and yet here we are on the precipice of something possibly historic.

What you're talking about is the end of a long term cycle. The end of a 5th wave. I'm going to go into it now, so if you are already rolling your eyes, feel free to skip ahead and call me a kook. I promise I won't mind.

--------------------------

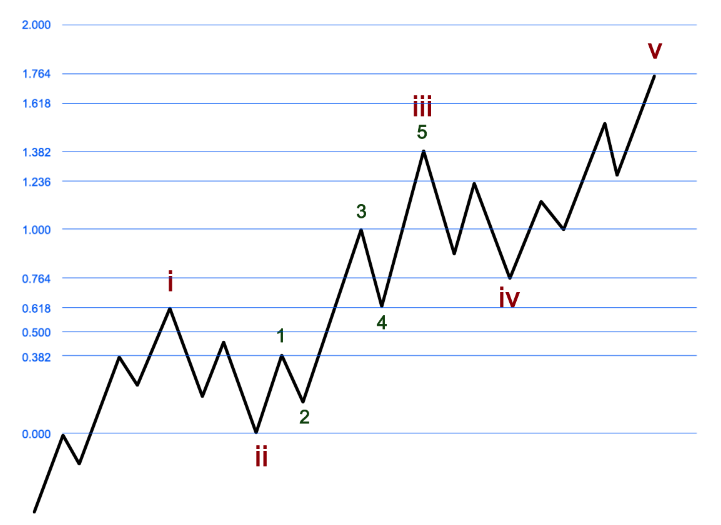

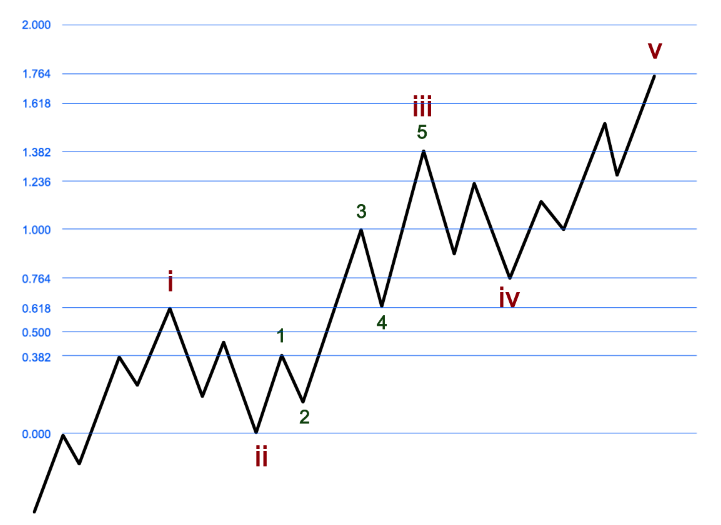

When a market bottoms in a huge downturn event, it will reverse quite spectacularly. The initial move up off that bottom is what we call "disbelief". How can people be buying? Don't they know the sky is falling?? Sentiment is through the floor. Everyone is looking lower. But the market still moves up.

That move up is a Wave i.

Once it tops, the market will usually sell off to 50%-61.8% of that initial move up. Often times even deeper. Those who were looking down take this as the sign that they were right, and they resume their bearishness. They are absolutely sure new lows are incoming. But then something happens. The market doesn't make a new low. It holds support at or above where the first wave started.

That's a Wave ii.Then it starts to move back up again. Perplexed and frustrated, most traders still aren't convinced. The market usually makes one more mini top under the high of the initial Wave i. This is what we call wave 1 of iii. The market is fractal in nature. Bullish waves will breakdown into smaller bullish structures. But then it sells off again, this time shorter and not as deep, holding an even higher support. We now have wave 1 and wave 2 inside of the larger 3rd wave. The market starts to look like a wedge. As more and more participants start to realize that new lows might not be incoming, they start to buy in. What happens next is truly a thing of beauty. Wave 3 of iii begins, usually gapping above the Wave i high. By that point, it's hard to catch it. Sentiment pours in and it's off to the races, usually aiming for 100%-123.6% of the Wave i from the bottom of Wave ii (remember my analysis this week on looking for the 100% extension of a move? That's what I'm looking for. You're either going to get a 3rd wave boom, or it will stop there around 100% in the top of a correction). This zone is very important. Because it will give back a bit. And if it fails, new lows ARE a possibility, and the potential 5-wave rally is broken. But if the market comes down in Wave 4 of iii and can hold the 61.8% - 76.4% extension zone, it's very bullish for continuation. It's usually only after that hold of support that the general market STARTS to get bullish on the market. They pour in sending it again to new highs. Now you are in Wave 5 of iii targeting 138.2%-161.8%.

And when it tops, you have a completed Wave iii. And these extension levels can "extend". 3rd waves are almost always the most impulsive. It's not uncommon to see one get to 200% or higher.

This is where the market gives back again, sometimes even deeper. It should target 76.4% - 100% extension level of Wave 1 from the bottom of Wave 2, or a 23.6%-50% retracement level of the 3rd wave for

Wave iv. Some people might turn bearish. But "buy the dip" creeps in. A standard wave 4 (wave 2 as well) will have 3 legs, the first being the a-wave, usually breaking down itself into 3 segments. The second is the b-wave, a rally attempt to go to new highs that fails under the previous high, and finally, a c-wave which is an impulsive downward structure that usually happens itself in a 5-wave move into the support zone above the top of Wave i. The most standard is called a zig-zag where c = 100% the size of the a wave (again, that's why I look for the 100% play. Even if something is acting corrective upward, it will usually target 100% of an initial move from a support zone). These can get tricky though. 4th waves tend to be extremely complex. If you ever see the market moving sideways for long periods, or being in a Darvas box, that's usually a 4th wave of some degree. Look at Crude futures, USO, XLE, XOP, or practically every energy stock right now and you will see what I mean. It's not a clear 3-wave move down from a high. 4th waves can be triangles, they can be a series of triangles, they can be sets of triple a-b-c moves. These are usually what breakdown the wave slappers and make them throw in the towel on EW. They never learn corrective patterns and they blow up their accounts. Why is it that these are often complex though? It's because the market has stalled after a significant 3rd wave high, but the bears simply can't gain control. There is just too much inherent bullishness preventing a breakdown. It might take longer and look sloppier, but it will eventually give up and the bulls will win.

Wave iv is when most of the FOMO kicks in. This is where retail traders jump in after missing most of the move. Smart money might have even exited at this point. Analysts and seeking alpha authors are moving their targets up. The market eventually moves again to a new high. It can be short, or it can be huge, but

Wave v will come to an end most commonly targeting the 176.4-200% extension levels. And the reversal from the top of a 5th wave is usually sharp and dramatic.

What you are talking about in that post, is what happens when a 5th wave ends. And in 2000, the market put in a 5th wave top from a 5-wave move that began during World War 2. It was a cycle 3rd wave top. Meaning it was a 5th wave inside of an even larger 3rd wave that began with the Great Depression bottom. 2007 was the "c" wave of that subsequent 4th wave correction. And ever since that bottom of the Great Recession, which was a 4th wave bottom, we've been working on the cycle 5th wave top. It was initially expected to get to about 6000, but that was before 2022.

When 2022 broke well below support from the COVID bottom, retracing all of the post-COVID gains by 50%, the expectation had to shift to the potential that we had already topped in the nearly 100 year 5-wave supercycle. That was my primary count. And I even got bearish in last year's August-October selloff as it was trying really hard to form a potential Wave 1 pointing down in a deeper 5-wave selloff. But like markets often do, it stick saved and reversed upward HARD. The bulls stepped in (or fed liquidity, same thing really). But once the market broke to new highs in January, there was only one potential left, that of an ending diagonal.

Quote:

An ending diagonal typically happens when a move goes "too far, too fast". A diagonal is motive wave (a move in the direction of the larger trend) however it lacks the 5 wave non overlapping pattern of an impulse wave. Diagonals are only 5 waves in the larger degree, however all subwaves of an ending diagonal will break into zigzags (ABC patterns). Ending Diagonals will only appear as a 5th wave, or a C-wave. Also, when diagonals complete they often end with a spike over the trend line, and a strong reversal, and often target where they started from quite quickly.

Basic Rules for an Ending Diagonals

- Wave 3 is never the shortest

- Wave 3 always goes beyond the end of wave 1

- Wave 2 never goes beyond the start of wave 1

- Wave 4 never moves beyond the end of wave 2

- All sub waves are Zigzags (ABC)

Basic Guidelines for an Ending Diagonal

- Wave 2 will retrace .500-.764 of Wave 1

- Wave 4 will retrace .500-.764 of Wave 3

- Price action usually will fall within a channel (throw under on wave 4 will lead to throw over on wave 5)

Personality of Diagonals -

Diagonals have a unique personality, after a very strong 3rd wave you have a combination of people chasing and buying every dip, and the smart money that bought when fear was high (before the 3rd wave) are selling/taking profits on the rallies, This causes sub waves 1,3, and 5 within a diagonal to be low volume very choppy 3 wave moves, while the waves 2 and 4 of a diagonal seem to be higher volume declines that "feel" impulsive but never develop a full 5 waves down until the diagonal is complete (this is not a requirement, but something I have noticed on many occasions). They often form the shape of a wedge, and once this wedge breaks down it often triggers a flood of selling (assuming an ending diagonal up).

Determining where the 4th wave ends, and where a 5th wave ending diagonal begins is often VERY difficult, and it isn't until the later stages of the ending diagonal that you actually have confirmation that you are indeed in an ending diagonal. Because the sub waves are all 3 wave moves, the early stages of an ending diagonal will look like a continuation to the 4th wave and often mis-categorized as a b-wave. There is not always a scientific way to determine when a 4th wave ends and an ending diagonal begins, but often if the "look" of the 4th wave is too large, you might be forming an ending diagonal.

I mentioned earlier and many times today how an instrument that gets too far too fast will often break down deeper than expected (check.. 2022) and then follow through with only marginal, choppy, overlapping new highs. That's an ED. We're in one off the COVID bottom. Where a normal impulsive wave doesn't retrace below the Wave 1 top, this one off the COVID bottom did, and its the classic markings of an ED. And ED's terminate lower than a standard 5-wave move would. We actually have enough in place for the long-term top to finally be considered complete, though there can be some upside targets left. But ending diagonals have one major caveat. When they sell off, they almost always retrace quickly back to their beginning. In this case, it would be the October 2022 bottom. It likely won't happen in a straight line, but don't be surprised if we are back there late this year or early next. But I have to consider where I might be wrong. And in this case, it's the fact that we're in the final move of a final move in a major, lifetime, supercycle. And these cycle or supercycle tops can tend to happen in blowoff top fashion, even when they are ED's. That's what happened in 2000 topping off the previous cycle. And on the same timeframe in an election year. That's why I've been referring to the 2000 fractal so much. It has so many similarities. Problem is, this topping is one of a greater degree. And the selloff should be expected to be of a greater degree but likely take many more years than the Great Depression, as many as 20. I certainly hope not though. The blowoff top also happened leading up to the great depression. And that selloff, which was the 2nd wave of the all-time grand supercycle, included more than 50% of banks failing and one of the worst periods of economic calamity in this history of modern society. Too many things are starting to line up to repeat that, and it's scary. you can see my targets of where this could keep going on the chart attached. Maybe AI takes us all the way to 5600. Maybe I'm still not good at this and have miscalculated. It's certainly possible, though I'm not alone, and Avi Gilburt, who has over 8,000 subscribers (1k of which are money managers), would tell you the same thing I am.

The charts are in LOG mode. Almost everything I do is in LOG. The market is non-linear. You shouldn't be viewing it as if it is. In small timeframes and short price moves, linear and log will look similar. But you only need to look at NVDA, SMCI, and other parabolic moves to understand that you being on a linear scale IS NOT painting the proper picture. Switch to LOG, calculate your fibs in log, and you will see the true trends.

----------------------------

All of this to say, you know who I am, what I do, and I hope I've been transparent on why I'm becoming so cautious. Not only is civil unrest, political landscapes, world turmoil, the nature of money, and general sentiment starting to breakdown at levels we've never seen, but it's constantly getting worse by the day. At the same time, the market is on the precipice of what can be counted as the top of a nearly 100-year supercycle, where all of the gains are coming from only a handful of parabolic stocks in a hyped up industry propping it up. I don't want to be right, trust me. Being right likely means people losing their life savings. Being right likely means the third leg of the upcoming correction will lead to world war as we fight to preserve an economic system that we have controlled for nearly 100 years. I don't want my friends and family to go through this. I don't want any of you to go through it.

And trust me, you think I like being the guy crying wolf while the market continues to push higher? I know how damaging to my credibility it is to be warning about a major market top and reversal. We've been programmed to think the FED will always step in and save the day. That markets always go up. Because we've been lucky enough to have been alive for the greatest period of economic success in the history of the world. But the warning signs are there. And I'd rather be wrong and look like a fool than be quiet and have not tried to help as many people as possible prepare. At this point, it's about risk management. I'm not aggressively shorting until supports start to break. And even then, I will wait for a high probability downward setup before I consider it.

And when you ask what to do, where to put your money, or how to avoid something that will clearly affect everyone. I don't have those answers. I will say that if we do top, cash will be king for at least the first half of the unwinding. When assets are falling in value, the dollar is usually gaining. It's called deleveraging. Will there be a CBDC? Will Bitcoin save us all? Will hoarding gold, silver, and bullets be the right play? I truly don't know. I can't see the future. I can only look to history. It doesn't always match, but it does rhyme. Protect your wealth as best you can. Make sure your bank or banks are safe. Have exposure to Bitcoin. Have exposure to gold. Those can be a hedge against the financial system and a hedge against each other. Don't go into new debt positions you can't quickly get out of. You can make money in a bear market. But you will likely have to shift your thinking from buying dips and hoping for new highs to buying dips and exiting at first resistance, smartly spotting put setups, playing volatility spikes, and looking for where the bull markets are. It might be in metals one day, crypto the next, and energy the next. You might have to short the Euro. You might have to buy TNX.

Thank you for reading. I love you guys (and gals? Do we have those here?) and wish you all the best. I'm here to learn and here to help if you need me.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

I fell into the trap under the old username as I consumed more and more politics of subscribing to red team vs blue team. I let it consume me. While I'm strong in my generally conservative beliefs, I have learned through reading history that my enemy is not my neighbor who thinks differently. My perma required me to step back and re-evaluate civil and productive discussion. And to understand that everyone sees the world through their own eyes from their own life experiences. Just because you think someone is wrong doesn't mean you have the right to judge them or to publicly ridicule them. As Prog says, we are all on team green here. But if I'm disappeared after this, I guess I will regret this post.

I fell into the trap under the old username as I consumed more and more politics of subscribing to red team vs blue team. I let it consume me. While I'm strong in my generally conservative beliefs, I have learned through reading history that my enemy is not my neighbor who thinks differently. My perma required me to step back and re-evaluate civil and productive discussion. And to understand that everyone sees the world through their own eyes from their own life experiences. Just because you think someone is wrong doesn't mean you have the right to judge them or to publicly ridicule them. As Prog says, we are all on team green here. But if I'm disappeared after this, I guess I will regret this post.