McInnis 03 said:lobwedgephil said:

You obviously know what you are doing

Your premise was wrong.

This is why I'm in micros, single contract, maybe 2. My decision making is terrible and why things like this happen.

McInnis 03 said:lobwedgephil said:

You obviously know what you are doing

Your premise was wrong.

This is why I'm in micros, single contract, maybe 2. My decision making is terrible and why things like this happen.

Sometimes trading is way easier than it seems it should be.jimmo said:

Checked the Sava Yahoo finance forum..

it's about as volatile as the stock.

maybe it's the Phase 3 trial we're waiting for?

(assuming today's isn't associated w/ phase 3)

sorry, I'm not sure

mazag08 said:Sometimes trading is way easier than it seems it should be.jimmo said:

Checked the Sava Yahoo finance forum..

it's about as volatile as the stock.

maybe it's the Phase 3 trial we're waiting for?

(assuming today's isn't associated w/ phase 3)

sorry, I'm not sure

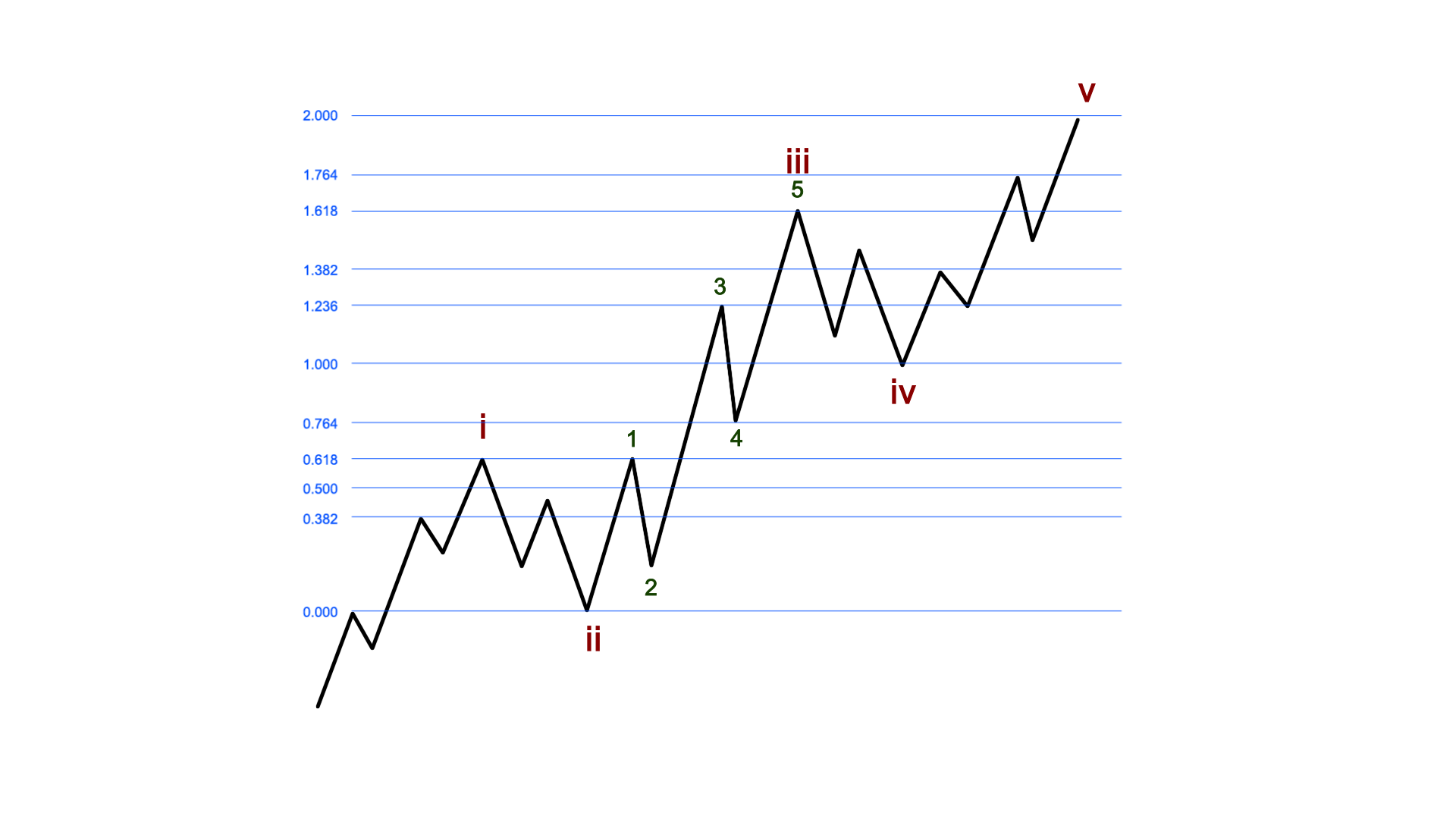

Go to the daily chart for SAVA. Look back to August 26 & 27 and tell me what you see. Once you find it, look at today's close price and notice where it is. Then look at shorter time frame candles and notice where today finished.

Once you realize what happened, do yourself a favor and look back at February 1st and 2nd. Now you realize how important it is to follow the short term trends closely. If this thing makes a lower low before a higher high.. look out below.

But don't get too sad. Because we've got Aug 24 & 25 to look at still. Once we swing these other moves, guess what follows? $$$$$$$$$$

McInnis 03 said:Before that craziness I was down 29 pts on micro ES contracts, not much, $145 or so. After that little jaunt I finished up 6 pts total, so that was a 37pt swing.cptthunder said:That would have been a fun rideMcInnis 03 said:I was sitting in a parking lot eating my Jimmy Johns thinking, "maybe I should put in a limit buy on ES at 4376 just for the hell of it, I mean they love to F with people".......and sure enough that thing went to 4374 and I didn't do it.cptthunder said:

This is just wacky to watch SPY on the 1&5 minute right now

I'm back into a phase of trying to prove futures only trading can be my way forward.....so the micros are my test subject at the moment.

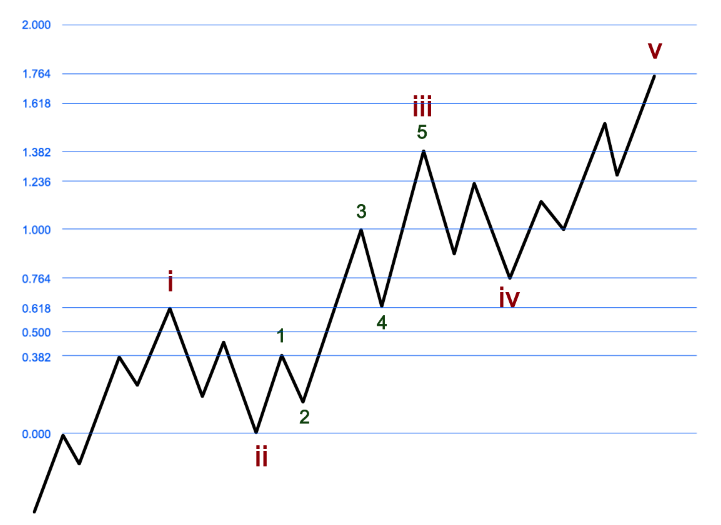

Come on 30K! You know I mean no disrespect and this is in a fun/banter/respectful way, but any super long term chart not in log scale is absolute rubbish chart crime. What timeframe you talking about? You're gonna scare off all the newbs$30,000 Millionaire said:

I mean what could possibly go wrong with this picture? This curve is so steep, we're about to go backwards in time.

oldarmy1 said:

Sell all DOCN

Hello!

*US Jobless Claims +16K To 351K In Sep-18 Wk; Survey 320K

— *Walter Bloomberg (@DeItaone) September 23, 2021

*US Sep-11 Week Continuing Claims +131K to 2,845,000

That was for you bro!ProgN said:

"Rubbish"

Quote:

Roku Raised to Buy From Neutral by Guggenheim

7:46 am ET September 23, 2021 (Dow Jones) Print

Ratings actions from Benzinga: https://www.benzinga.com/stock/ROKU/ratings

2021-09-23 11:46:00 GMT DJ Roku Price Target Announced at $395.00/Share by Guggenheim

$30,000 Millionaire said:

I just think the market is extended. *Whilst* brrr happens, well, you know what will occur.

No doubt extended. I really wish we could get a back test of the 4000 breakout at least. I was hoping it would happen Sept-Oct, and maybe it still will. That's only a 12% correction from the top and would be good. Helps with DCA accounts too instead of propped up sideways consolidation.$30,000 Millionaire said:

I just think the market is extended. *Whilst* brrr happens, well, you know what will occur.

up $1. Trim some.$30,000 Millionaire said:

$CRM October 270C. Needs to hold breakout.

$30,000 Millionaire said:

UPWK 52.5C

NQ joined the party.McInnis 03 said:

ES and RTY running, NQ lagging a bit.

AG 2000' said:

Man ATER got hammered this morning.