Futures bright green right now

Stock Markets

26,758,735 Views |

238329 Replies |

Last: 57 min ago by El Chupacabra

Futures his 3074. 3097 next leg up

ES MINI PARTY TIME

***If this post is on Business and Investing, take it with a grain of salt. I am wrong way more than I am right (but I am less wrong than I used to be) and if you follow me you will be too.***

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

Reading through this last page gave me a headache. Irish gave great advice. Don't look at futures unless you trade them. When down over 15 buy the ES Mini call because we closed right up against the breakout and as stated "no way big money expend all this energy to get us here and not breakout".

If you can trade at 3am central then you have something you can do. I didn't plan on waking up last night because either we breakout and then I wouldn't be selling anything or we consolidate and I already have positions wanted and initial SPY long Puts to cover.

Now we watch for any bear attempt to lose $306 SPY or SPX counterpart or it's a fairly smooth opening to move towards that $313 mark.

Late buys on V look good. CRM, ROKU, AMBA and other positions look good. Everyone should be in good shape this morning.

If you can trade at 3am central then you have something you can do. I didn't plan on waking up last night because either we breakout and then I wouldn't be selling anything or we consolidate and I already have positions wanted and initial SPY long Puts to cover.

Now we watch for any bear attempt to lose $306 SPY or SPX counterpart or it's a fairly smooth opening to move towards that $313 mark.

Late buys on V look good. CRM, ROKU, AMBA and other positions look good. Everyone should be in good shape this morning.

WORK up $1.58. Going to exit 75% of those calls at the open after it moved nicely from posting the calls yesterday and a good move early. Calls should be up 200% if current price holds.

more of an ascending channel I think...but could argue a wedge as well.TChaney said:

MPW

Not very good at reading charts like you guys but does this meet the definition of a Darvas Box?

Looking at the 1 mo chart from 5/15 to today

oldarmy1 said:

Reading through this last page gave me a headache. Irish gave great advice. Don't look at futures unless you trade them. When down over 15 buy the ES Mini call because we closed right up against the breakout and as stated "no way big money expend all this energy to get us here and not breakout".

If you can trade at 3am central then you have something you can do. I didn't plan on waking up last night because either we breakout and then I wouldn't be selling anything or we consolidate and I already have positions wanted and initial SPY long Puts to cover.

Now we watch for any bear attempt to lose $306 SPY or SPX counterpart or it's a fairly smooth opening to move towards that $313 mark.

Late buys on V look good. CRM, ROKU, AMBA and other positions look good. Everyone should be in good shape this morning.

The NET breakout happened yesterday, correct? What kind of run do you expect from this thing?

You mentioned ZM $200p yesterday, which date?

What's up with AZN?

TXAG14 said:

What's up with AZN?

I was going to follow on the trade and fortunately only received 1 fill. Still will go ahead and use the selling to nab a few, if for no reason than to average down.

Prognightmare said:

You mentioned ZM $200p yesterday, which date?

Next Friday

It's going bankrupt. We've all been sucked into a bull trap.TXAG14 said:

What's up with AZN?

It's back testing on low volume. It may not finish green today, but there is nothing wrong with it. 54.04 was the low of the last hour on Friday. It bounced off at 54.10

There are also almost 25K OI on the 6/5 $56C for the adventurous types.

I'm net free on my remaining MU June19 47c. Anyone else still in on these? They've taken a beating over the last few days.

Continue to hold?

Continue to hold?

V up $2. I'm selling 50% at the open just in case V does what it usually does on a good open and sell down before support comes back in.

Last week, on our exit day, it barely was up and proceeded to push higher most of the day.

This was a lotto trade and with a $2 move $0.52 should get you $0.80 and a nice cushion for remaining 50%.

Last week, on our exit day, it barely was up and proceeded to push higher most of the day.

This was a lotto trade and with a $2 move $0.52 should get you $0.80 and a nice cushion for remaining 50%.

By now everyone has probably seen this, right?

Well they must be reading our forum because V gains cut in half. Actually, per my post, this might be a good thing for more trend movement upward. Give less opening sell power.

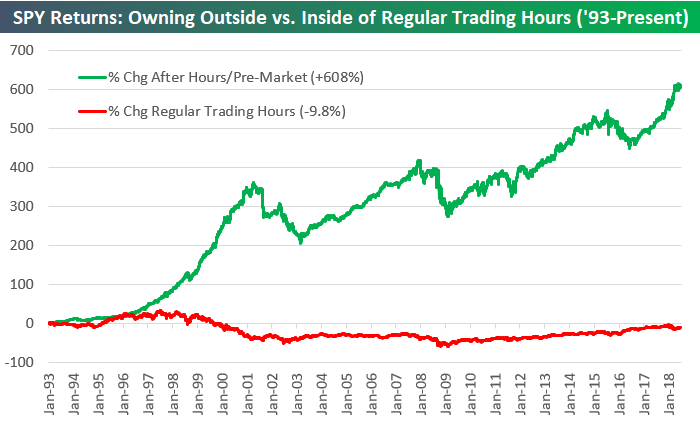

Sell the open. Buy the close.

Suntrust, Sipudon and Oppenheimer all 3 with V outperform calls this morning and average $220 target.

Just as these services get it wrong downgrading near bottoms they also tell me we're closing in on our top. But they are useful idiots to our cause today!

Just as these services get it wrong downgrading near bottoms they also tell me we're closing in on our top. But they are useful idiots to our cause today!

LADR and INMD both at the top of their box/channel in premarket trading...could see a run if they break through early

oldarmy1 said:

Suntrust, Sipudon and Oppenheimer all 3 with V outperform calls this morning and average $220 target.

Just as these services get it wrong downgrading near bottoms they also tell me we're closing in on our top. But they are useful idiots to our cause today!

I hope one day I get upgraded to useful idiot. I'm halfway there!

Every knee shall bow and every tongue shall confess

gougler08 said:

LADR and INMD both at the top of their box/channel in premarket trading...could see a run if they break through early

I have the top of LADR box at 8.51. Is that what you see?

Pre market the stock is up to $8.20-8.4 or so. If it doesn't see a sell at open it could break that easily.Aggies1322 said:gougler08 said:

LADR and INMD both at the top of their box/channel in premarket trading...could see a run if they break through early

I have the top of LADR box at 8.51. Is that what you see?

I just got this email from Fidelity. Not sure what I did, maybe not enough cash in the account to day trade?

A violation occurred on 06/02/2020 due to day trading activity. As a result of this violation, your account has been restricted from day trading for 90 calendar days.

A violation occurred on 06/02/2020 due to day trading activity. As a result of this violation, your account has been restricted from day trading for 90 calendar days.

CrazyRichAggie said:

I just got this email from Fidelity. Not sure what I did, maybe not enough cash in the account to day trade?

A violation occurred on 06/02/2020 due to day trading activity. As a result of this violation, your account has been restricted from day trading for 90 calendar days.

Likely didnt let the funds settle before you used them to buy and sell again.

You got PDT'd. You can remove the restriction by getting rid of margin access on your account or upping your capital to $25K.CrazyRichAggie said:

I just got this email from Fidelity. Not sure what I did, maybe not enough cash in the account to day trade?

A violation occurred on 06/02/2020 due to day trading activity. As a result of this violation, your account has been restricted from day trading for 90 calendar days.

***If this post is on Business and Investing, take it with a grain of salt. I am wrong way more than I am right (but I am less wrong than I used to be) and if you follow me you will be too.***

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

Does the total account value need to be $25K or does the cash on hand?

thoughts of buying moneygram at open?

Total in the account between cash and equities.

This. I only trade a small token part of my account, but because I have equities in the form of stocks, ETF's and mutual funds that exceed $25K I do not get PDT limited.jtmoney03 said:

Total in the account between cash and equities.

***If this post is on Business and Investing, take it with a grain of salt. I am wrong way more than I am right (but I am less wrong than I used to be) and if you follow me you will be too.***

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

Yep...when I looked earlier it was trading near 8.50 but seems to have come back down a bit, will need to break and hold through that to get goingAggies1322 said:gougler08 said:

LADR and INMD both at the top of their box/channel in premarket trading...could see a run if they break through early

I have the top of LADR box at 8.51. Is that what you see?

With the siginifcant swings overnight & mediocre volume, opening gap fill plays could pay off if you can find'em worth playing.

***If this post is on Business and Investing, take it with a grain of salt. I am wrong way more than I am right (but I am less wrong than I used to be) and if you follow me you will be too.***

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

Got it. I will just move some from my bank to mutual fund

(SDC) Smile Direct Club Expands SmileShops through Newly Announced Partnership with Watsons in AsiaTelehealth leader increases access to care with new retail partnership

Featured Stories

See All

27:36

13h ago

13k

10:42

1h ago

439

16:23

3h ago

1.9k

5 Thoughts: Vanderbilt 86, No. 12 Texas A&M 84

by Luke Evangelist

LIVE from Fasken: 2025 SEC Indoor Championships, Day 1

by Will Huffman

aggiez03

No rationalization exists for No. 12 Texas A&M's 86-84 loss to Vandy

in Billy Liucci's TexAgs Premium

32

AgGrad99

How much do seeds matter in the NCAA MENS TOURNAMENT?? (According to GROK 3)

in Billy Liucci's TexAgs Premium

21