Step right into my office

Stock Markets

26,661,134 Views |

237923 Replies |

Last: 9 hrs ago by EliteZags

I work as the director of inpatient medicine at a hospital on a gulf coast city. We are on divert as we're out of vents, nurses, quarantinable units. I've never seen us on divert, I've taken care of stroke patients in the hallway when we're super busy.

I'm going to keep repeating this on this thread. If your city's public health services become overwhelmed (lots of you) you will realize what a privileged place you've lived in, the greatest damn country that has ever been, and you're not ready for this. The rest of the world understands what a public health crisis looks like, we've never had one in our lifetimes. Please be calm and safe and seriously just stay away from people and let this thing slow itself down until its a slow burn rate on our medical services.

Guys, take your meds, don't eat a lot of salt, don't smoke as much, don't have any reason to show up to the hospital; we're going to be handing out errors and slow response times like its candy, and everyone who comes in (like 80% of our patients who are here for non-covid related diseases) will be affected.

I'll continue to be harassed in my inbox and accused of being an alarmist or socialist by people on this thread with a third grade understanding of medicine and public health and think that spitting off a death rate means they know anything about this. I'm not, I just want this to chill for a minute and then we go back to life like normal like korea did (until patient 31 got away). You should probably trust the opinion of literally every single doctor that's shown up on any thread on this site in days, we can never agree with each other, except about this.

Now that I've ruined the thread...puts on Zillow, have you guys been to the oil thread yet and seen the layoff numbers already? Glad I didn't buy up thousands of distressed properties before all this went down.

I'm going to keep repeating this on this thread. If your city's public health services become overwhelmed (lots of you) you will realize what a privileged place you've lived in, the greatest damn country that has ever been, and you're not ready for this. The rest of the world understands what a public health crisis looks like, we've never had one in our lifetimes. Please be calm and safe and seriously just stay away from people and let this thing slow itself down until its a slow burn rate on our medical services.

Guys, take your meds, don't eat a lot of salt, don't smoke as much, don't have any reason to show up to the hospital; we're going to be handing out errors and slow response times like its candy, and everyone who comes in (like 80% of our patients who are here for non-covid related diseases) will be affected.

I'll continue to be harassed in my inbox and accused of being an alarmist or socialist by people on this thread with a third grade understanding of medicine and public health and think that spitting off a death rate means they know anything about this. I'm not, I just want this to chill for a minute and then we go back to life like normal like korea did (until patient 31 got away). You should probably trust the opinion of literally every single doctor that's shown up on any thread on this site in days, we can never agree with each other, except about this.

Now that I've ruined the thread...puts on Zillow, have you guys been to the oil thread yet and seen the layoff numbers already? Glad I didn't buy up thousands of distressed properties before all this went down.

No material on this site is intended to be a substitute for professional medical advice, diagnosis or treatment. See full Medical Disclaimer.

gougler08 said:

New strategy is to by a +10/-10 SPY put and call right before close, we haven't had a flat open in weeks

Yep. Or just go long after a big down day and short after a big up day.

Aggie1391 said:gougler08 said:

New strategy is to by a +10/-10 SPY put and call right before close, we haven't had a flat open in weeks

What's your selling strategy?

Seems like best option is just sell the big gain at the open and then see if I can make a bit back on the loser before closing it out. Then do it all again

Fun anecdote. My buddy helped open Zillow's Houston office spring 2019. Got laid off in December when they closed the whole office. Never could quite figure out what they did and raised a few eyebrows when they were using their own open sales comps to justify home prices inside the same neighborhood.

Thoughts on EXIV? Almost grabbed it at $8 this afternoon.

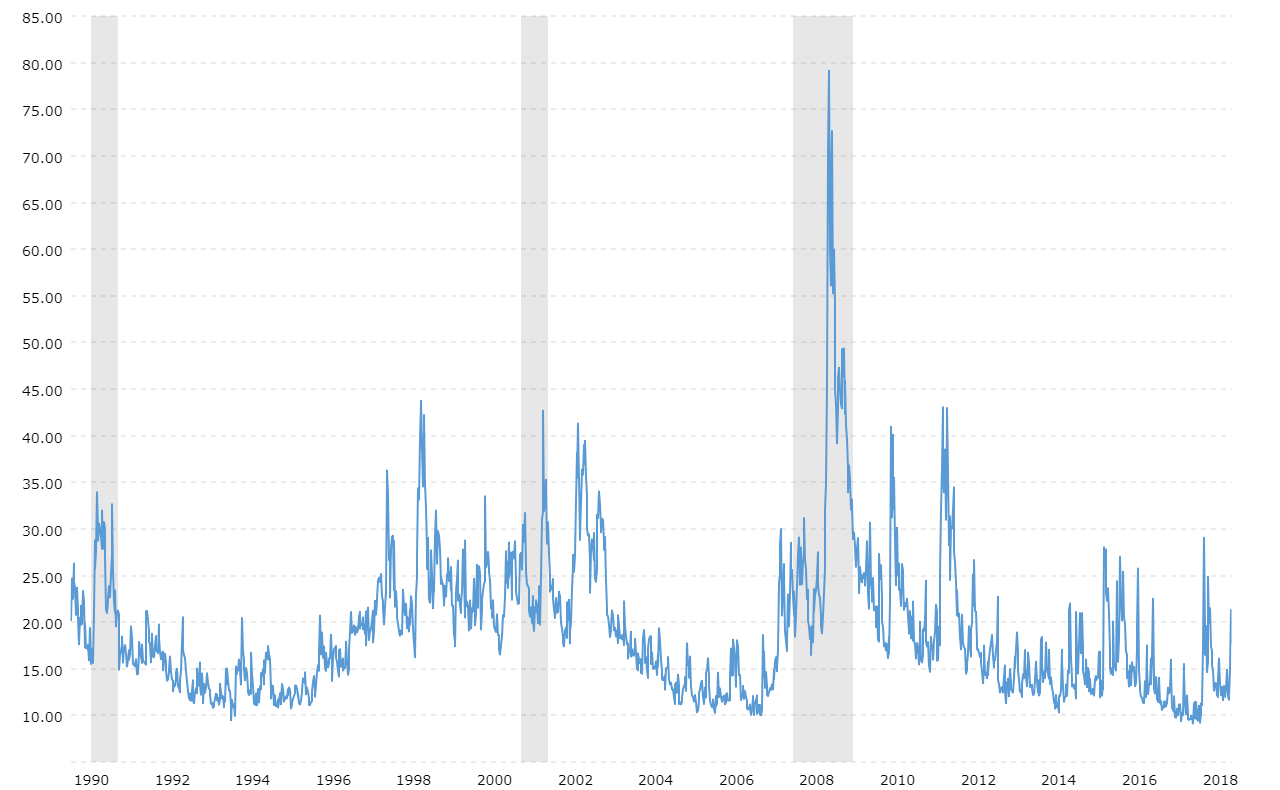

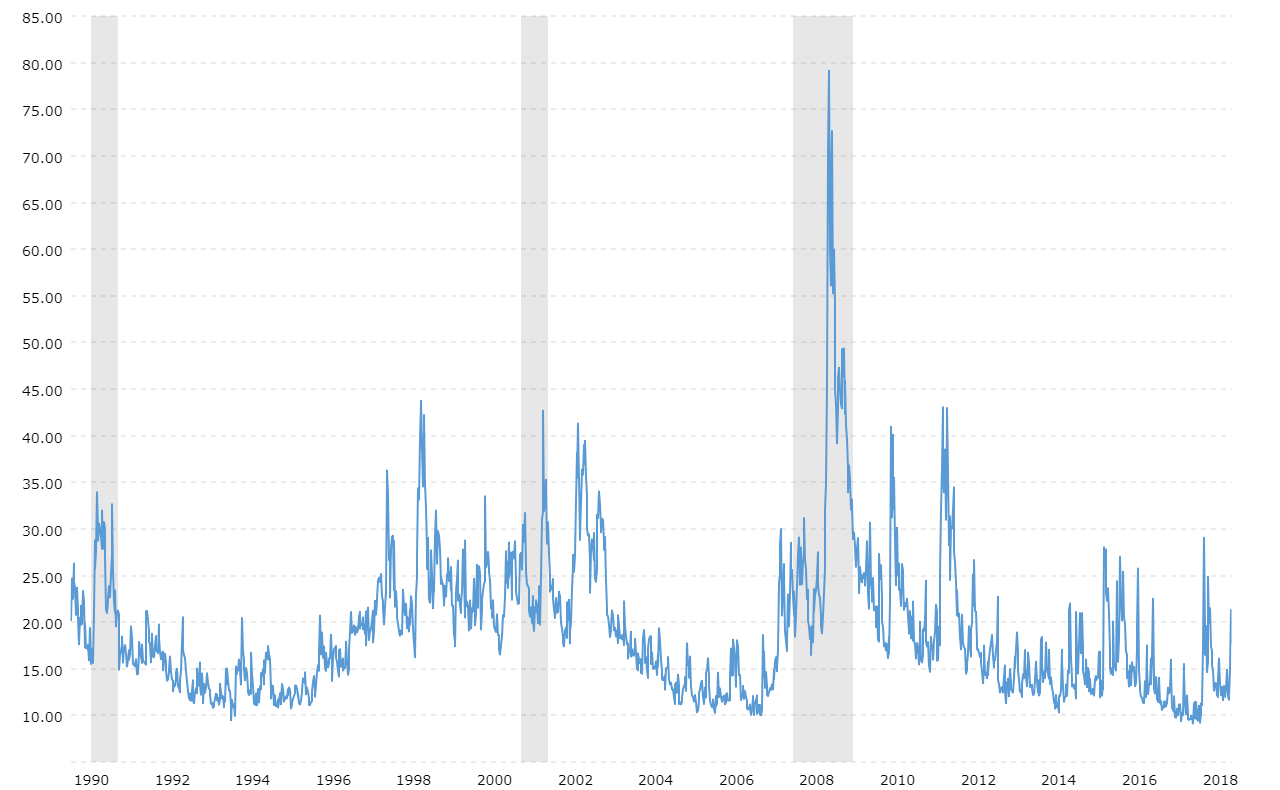

I don't see how the VIX can go much higher, and history shows it retreats quickly once the worst of it is over (which I expect by summer). My only concern is decay on this ETN, even though it is 1x.

I don't see how the VIX can go much higher, and history shows it retreats quickly once the worst of it is over (which I expect by summer). My only concern is decay on this ETN, even though it is 1x.

I've been burned on precious metals a few times before, but silver looks incredibly cheap right now! Maybe some physical or long term options?

VIX to 85, but that's a pretty risky bet I'm making

https://vixmon.com/ for all your VIX goodness

https://vixmon.com/ for all your VIX goodness

No material on this site is intended to be a substitute for professional medical advice, diagnosis or treatment. See full Medical Disclaimer.

Confucius said:

Thoughts on EXIV? Almost grabbed it at $8 this afternoon.

I don't see how the VIX can go much higher, and history shows it retreats quickly once the worst of it is over (which I expect by summer). My only concern is decay on this ETN, even though it is 1x.

It does seem like it's getting close to grab this

Had never looked at that fund. It tracks Europe. Might be a decent lower-priced alternative.Confucius said:

Thoughts on EXIV? Almost grabbed it at $8 this afternoon.

I don't see how the VIX can go much higher, and history shows it retreats quickly once the worst of it is over (which I expect by summer). My only concern is decay on this ETN, even though it is 1x.

https://sixfigureinvesting.com/2017/08/how-do-velocityshares-evix-and-exiv-work/

them and the airlines are going to be great buys down here!

I'm not in WYNN or the airlines but some of our friends here bought it so I'm just passing along the info I run across.

Love your posts! just followed you on twitter.

So in that scenario, if we follow 1998's script. We'd rip on a squeeze to 300ish (Friday for options?), then drop hard next week or soon after and retest 237, before resuming our regularly scheduled program.

So in that scenario, if we follow 1998's script. We'd rip on a squeeze to 300ish (Friday for options?), then drop hard next week or soon after and retest 237, before resuming our regularly scheduled program.

Most admirable thing about Riley's trades is the execution. It's one thing to identify an edge, and an entirely other thing to execute.

hey man, can I tell you that's what has been the craziest part of this. There were days that I was down $340k but confident in my trade and knew before expiry came around I was going to be sitting on a reasonably profitable trade. I just had to have diamond hands and be confident that we were headed this way. I've made plenty of very poor trades along the way and at one point lost $60k learning what stupid options trades are. I am very lucky to be single and to have a good job that is recession proof so I am willing to risk a lot to exit the real world.

No material on this site is intended to be a substitute for professional medical advice, diagnosis or treatment. See full Medical Disclaimer.

yall remember when GM stock price literally went to $1 after the bailout was announced?

No material on this site is intended to be a substitute for professional medical advice, diagnosis or treatment. See full Medical Disclaimer.

Anyone else picturing Christian Bale when reading Riley's posts?

Yes I do, that's why it's hard to get excited about a bailout if one does come, although the circumstances are different than in 08-09. I've never really liked the airlines and have never invested or traded them for that matter and I refrain from giving my opinion on them for that reason.riley290 said:

yall remember when GM stock price literally went to $1 after the bailout was announced?

what literature did you read or people did you follow to learn better trades? I myself am still making bad trades. A lot of people here are making bad trades.riley290 said:

hey man, can I tell you that's what has been the craziest part of this. There were days that I was down $340k but confident in my trade and knew before expiry came around I was going to be sitting on a reasonably profitable trade. I just had to have diamond hands and be confident that we were headed this way. I've made plenty of very poor trades along the way and at one point lost $60k learning what stupid options trades are. I am very lucky to be single and to have a good job that is recession proof so I am willing to risk a lot to exit the real world.

BidAskClub issues a strong sell on ROKU. I scooped up everything under $59 early and already sold for &2+ to average offset losses on holdings.

These geniuses will set the bottom. Remember selling ROKU at $142? Now that is a call worth a darn. A service issuing a strong sell after weeks of sell off should make most people question their mental state.

These geniuses will set the bottom. Remember selling ROKU at $142? Now that is a call worth a darn. A service issuing a strong sell after weeks of sell off should make most people question their mental state.

I am curious about this as well. I am currently in grad school for medicine and I would love to learn how to wipe out my student debt in an afternoon. When/where did you start because I know you didn't have time while in your program? I sure as hell don't.Ragoo said:what literature did you read or people did you follow to learn better trades? I myself am still making bad trades. A lot of people here are making bad trades.riley290 said:

hey man, can I tell you that's what has been the craziest part of this. There were days that I was down $340k but confident in my trade and knew before expiry came around I was going to be sitting on a reasonably profitable trade. I just had to have diamond hands and be confident that we were headed this way. I've made plenty of very poor trades along the way and at one point lost $60k learning what stupid options trades are. I am very lucky to be single and to have a good job that is recession proof so I am willing to risk a lot to exit the real world.

SFIX crushed and with the majority of their textile fulfillment bring in Honduras there is no relief in sight.

The government there issued a closure of all non-essential business for 1 week Sunday night. I received an exemption certificate after petitioning the government, because I have healthcare related clients. But with additional cases one city where I operate issued a 24 hour curfew.

Only a matter of time before they all do, so I received all clients approval to shift to a home-based model and we're getting ahead of the inevitable. But StichFix doesn't have that option. Thinking of a $10 Put if it gets any bounce.

The government there issued a closure of all non-essential business for 1 week Sunday night. I received an exemption certificate after petitioning the government, because I have healthcare related clients. But with additional cases one city where I operate issued a 24 hour curfew.

Only a matter of time before they all do, so I received all clients approval to shift to a home-based model and we're getting ahead of the inevitable. But StichFix doesn't have that option. Thinking of a $10 Put if it gets any bounce.

Aggie09Derek said:

on TDAmeritrade if you hold an option into the close on expiration does it auto convert it for you?

In my Roth at TDA I have to take action myself to close the position. They will not auto convert or close prior to EOB.

jj9000 said:oldarmy1 said:

BidAskClub issues a strong sell on ROKU. I scooped up everything under $59 early and already sold for &2+ to average offset losses on holdings.

These geniuses will set the bottom. Remember selling ROKU at $142? Now that is a call worth a darn. A service issuing a strong sell after weeks of sell off should make most people question their mental state.Quote:

As reported by Bloomberg, after Monday's market close, Morgan Stanley (NYSE:MS) said that it was offering a large six million-share block of Roku stock between $57.50 and $59 to interested shareholders, below the closing price of $63.84. The sellers are apparently the giant private investment firms FMR LLC, or Fidelity Investments, and The Vanguard Group.

6 million shares will be mostly, if not all, gone by the time its reported. But it will help the bottom changeover happening.

You run a clothing company??oldarmy1 said:

SFIX crushed and with the majority of their textile fulfillment bring in Honduras there is no relief in sight.

The government there issued a closure of all non-essential business for 1 week Sunday night. I received an exemption certificate after petitioning the government, because I have healthcare related clients. But with additional cases one city where I operate issued a 24 hour curfew.

Only a matter of time before they all do, so I received all clients approval to shift to a home-based model and we're getting ahead of the inevitable. But StichFix doesn't have that option. Thinking of a $10 Put if it gets any bounce.

***If this post is on Business and Investing, take it with a grain of salt. I am wrong way more than I am right (but I am less wrong than I used to be) and if you follow me you will be too.***

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

I wonder if it's just a relatively calm day until word of the senate passing the package?

So your saying American Airlines wasn't a smart buy?!

Featured Stories

See All

9:07

7h ago

3.2k

16:07

10h ago

2.4k

Disparity from deep dooms No. 7 Texas A&M against No. 6 Vols, 77-69

by Olin Buchanan

4:43

11h ago

654

Game Highlights: No. 6 Tennessee 77, No. 7 Texas A&M 69

by Matthew Dawson

13:35

1d ago

4.9k

tboag

Postgame Discussion: No. 6 Tennessee 77, No. 7 Texas A&M 69

in Billy Liucci's TexAgs Premium

2

J Peterman

Postgame Discussion: No. 6 Tennessee 77, No. 7 Texas A&M 69

in Billy Liucci's TexAgs Premium

2