quote:Now THIS is a prediction!quote:

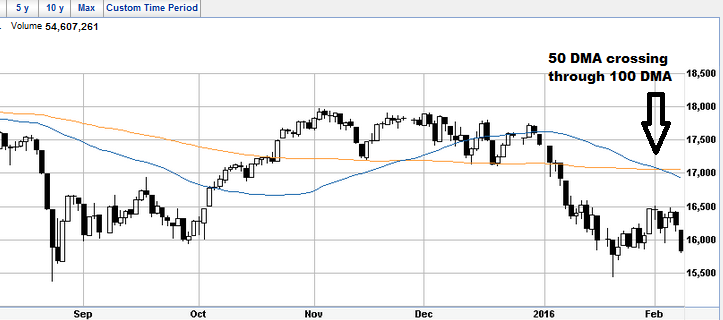

50 day moving average crossing 100 day moving average. We could accelerate down from here.

Two other possibilities from here. Market could move back up, or it could tread water. Based on my technicals I can say with pretty high confidence one of these three will happen.

Stock Markets

26,555,223 Views |

237531 Replies |

Last: 27 min ago by Bocephus

At some point technicals can become a self fulfilling prophecy.

quote:i believe the "support" levels indicate where a lot of the market movers have established positions. This is indicated by heavy BUY volumes at these levels.

Trading on technicals has always baffled me.

Arbitrary support and resistance targets based on the way the market's moved in the past are not crystal ball predictors. If they were, everyone could trade off a chart and make millions.

If a company is growing and continuously adding value for the shareholder the value of that share will likely go up over the long term. In the interim the stock is still traded. Holding from T=0 to T=10 years may result in a nice 8% yoy return, but watching the technicals and trading the share with the swings along the way could dramatically increase that return.

It's painful to not be in this trade.

Here is my best "Technicals for Dummies" explanation. BIG INSTITUTIONAL MONIES CONTROL THE DIRECTION OF THE MARKETS. When they buy the markets respond. Period! All of the day traders, investors, etc. combined buying a stock at the same time will not move higher of there is large institutional selling. If institutions are doing little or no buying or selling then markets move at a different pace.

NOW, with that understanding established, technical bottoms (support) form because institutions are buying all/any volume that is selling. It's just the opposite for tops (resistance) because the institutions are selling as much as people are willing to buy, and they are buying/selling more, in bulk, than the general market. This is why one of the most valuable tools a professional trader has is a market maker tracker that includes a "lot" volume monitor. I can see that GE average trade is 178 shares for today. I have a minute/5 minute volume tracker pulled up and it shows an average of 222 shares trading. Ok, that is slightly higher than the overall daily volume but it certainly isn't institutional action. When I see a minute chart crunching out multiple 10k-100k share lots THEN we have institutional buying in play. When it takes the 5 minute average to 25k+ avg lot then it means something.

Pro traders can see this for individual stocks and for the market as a whole. It's ONE EXAMPLE of the dozens of tools used.

NOW, with that understanding established, technical bottoms (support) form because institutions are buying all/any volume that is selling. It's just the opposite for tops (resistance) because the institutions are selling as much as people are willing to buy, and they are buying/selling more, in bulk, than the general market. This is why one of the most valuable tools a professional trader has is a market maker tracker that includes a "lot" volume monitor. I can see that GE average trade is 178 shares for today. I have a minute/5 minute volume tracker pulled up and it shows an average of 222 shares trading. Ok, that is slightly higher than the overall daily volume but it certainly isn't institutional action. When I see a minute chart crunching out multiple 10k-100k share lots THEN we have institutional buying in play. When it takes the 5 minute average to 25k+ avg lot then it means something.

Pro traders can see this for individual stocks and for the market as a whole. It's ONE EXAMPLE of the dozens of tools used.

quote:

It's painful to not be in this trade.

I've been eyeballing shorting some uvxy calls all morning and afternoon. I should've gone with my gut down 400.

Alright, I found an entry point late. Nice bounce in a down trend.

And following the original OA instructions. (yes, I'm in after hours)

And following the original OA instructions. (yes, I'm in after hours)

quote:When stocks are at support then go for it. You have a disciplined macro market stop sitting right below there. This is when you buy. Fairly pure resistance and support on a macro level. What no one knows is when the channel will break down. Lot of room to the upside if the channel support holds. Frankly people could do a whole lot worse than simply buying when the markets hit down at the low point of the channel (like today) with a disciplined stop at 15700 DOW. Common sense should never be left out of all the tools available.quote:

It's painful to not be in this trade.

I've been eyeballing shorting some uvxy calls all morning and afternoon. I should've gone with my gut down 400.

And don't forget the mid-channel resistance. Pure there as well. Any buys made today near support lows would be closed if we approach that mid-range support (OR at least 50% closed with a protected option used on remaining held).

I'm curious what you think about my entry point.

quote:What was the trade?

I'm curious what you think about my entry point.

Short with a target of Jan lows at least.

What could she say though that would cause a rally?

Hints of QE? Lower interest to zero again?

Hints of QE? Lower interest to zero again?

My other thought too was your retracement from the all time highs. I thought that was the right call too. We got close to 50%, and then sold off again. The target should be lower than the Jan lows if that was a retracement. We should get new lows following that retracement. I don't see that as a channel bounce and breakout when it happens, but a continuation of the Jan selling.

2/19 expire date, so looking to unload in the next couple days

Japan is down 4 1/2% early.

I personally think trying to buy the lower channel bounce is a risky play in the bear market.

quote:With each wave down into a retest it becomes even riskier. You are correct. We haven't officially entered the bear market. People may be feeling like it is but, as you know, we haven't seen anything yet. Based on early action overseas your entry short should give you at least an early exit for a decent gain. DOW futures off 107.

I personally think trying to buy the lower channel bounce is a risky play in the bear market.

I'm late to the party, good to see more trader talk on this board.

Pretty interesting how the last 2 times we got to the October 2014 Ebola lows, we rallied 20+ points on the same day. The bond market will give the all clear in my opinion On the 19th when we crashed and rallied, TLT reversed as well. When we made the Ebola lows, market rallied and TLT reversed. Today, we crashed and reversed but TLT stayed near the highs. There is no bounce coming, we're going down in my opinion.

We're going to 1738 the 2014 low.That level also happens to be near the fibonacci retracement of 38% from March 2009 lows to all-time highs

Pretty interesting how the last 2 times we got to the October 2014 Ebola lows, we rallied 20+ points on the same day. The bond market will give the all clear in my opinion On the 19th when we crashed and rallied, TLT reversed as well. When we made the Ebola lows, market rallied and TLT reversed. Today, we crashed and reversed but TLT stayed near the highs. There is no bounce coming, we're going down in my opinion.

We're going to 1738 the 2014 low.That level also happens to be near the fibonacci retracement of 38% from March 2009 lows to all-time highs

Dan, there goes the easing people into all of the vernacular and analysis.

Seriously though, for everyone's benefit the TLT a 20+ year treasury bond ETF. You can read a quick run-down on it at the below link and then re-read Dan's post.

http://www.etf.com/TLT

Seriously though, for everyone's benefit the TLT a 20+ year treasury bond ETF. You can read a quick run-down on it at the below link and then re-read Dan's post.

http://www.etf.com/TLT

(In Boston accent) Oh, I bet you read a lotta Gordon Wood, huh? You read your Gordon Wood and you regurgitate it from a textbook and you think you're wicked awesome doin' that, And how 'bout 'dem apples? And all that Gordon Wood business.

Japan down over 5%

Tech stocks are getting absolutely murdered. There are some deals to be had in enterprise software if you can find them. PCTY killed the quarter, put out great guidance, and sold off 18%.

quote:speaking of

Well Europe started flat which shot our futures to overnight highs in the middle of the night but now Europe has resumed plunging which drug our futures back down near the lows. DB and European banks imploding. Many are thinking DB might be Europe's Lehman or Bear Stearns. Should be another interesting day.

http://www.cnbc.com/2016/02/08/european-banks-face-major-cash-crunch.html

quote:

The four U.S. banks with the highest dollar amount of exposure to energy loans have a capital position 60 percent greater than European banks Deutsche Bank, UBS, Credit Suisse and HSBC, according to CLSA research using a measure called tangible common equity to tangible assets ratio. Or, as Mayo put it, "U.S. banks have more quality capital.

quote:

"[Standard Chartered] and [Deutsche Bank] would be the most sensitive banks to higher default rates in oil and gas," the analysts wrote in their January report.

amazing that our bank balance sheets are better, yet would anyone call our banks healthy?

Today might be the day when we break support. Hold on to your shorts! (That was for Frisco)

Compared to the rest of the world, our futures are holding up really well. We should be down a lot further.

quote:yes, relative to our euro counterparts ours are better. but, i still wouldn't say they are in great shape.quote:quote:speaking of

Well Europe started flat which shot our futures to overnight highs in the middle of the night but now Europe has resumed plunging which drug our futures back down near the lows. DB and European banks imploding. Many are thinking DB might be Europe's Lehman or Bear Stearns. Should be another interesting day.

http://www.cnbc.com/2016/02/08/european-banks-face-major-cash-crunch.htmlquote:

The four U.S. banks with the highest dollar amount of exposure to energy loans have a capital position 60 percent greater than European banks Deutsche Bank, UBS, Credit Suisse and HSBC, according to CLSA research using a measure called tangible common equity to tangible assets ratio. Or, as Mayo put it, "U.S. banks have more quality capital.quote:

"[Standard Chartered] and [Deutsche Bank] would be the most sensitive banks to higher default rates in oil and gas," the analysts wrote in their January report.

amazing that our bank balance sheets are better, yet would anyone call our banks healthy?

Yes I do think our banks are better capitalized. We had TARP and recapitalized our banks and Europe did nothing.

and you are right. the euros messed around and did absolutely nothing. just unreal.

Featured Stories

See All

19:07

8h ago

3.4k

27:41

1d ago

6.2k

No. 8 Aggies push streak to five with 69-61 victory over Arkansas

by Olin Buchanan

5 Thoughts: No. 8 Texas A&M 69, Arkansas 61

by Luke Evangelist

Nanomachines son

Ex- Miami Dolphins OL Jonathan Martin admits Bullygate was a Lie

in Billy Liucci's TexAgs Premium

2

AgEngr12

Ex- Miami Dolphins OL Jonathan Martin admits Bullygate was a Lie

in Billy Liucci's TexAgs Premium

2