quote:That doesn't look like a squirrel on a clown's shoulders. I'm out!

Simple pattern or not. That was textbook.

Stock Markets

26,942,571 Views |

238953 Replies |

Last: 1 hr ago by Heineken-Ashi

Just when things were looking up, fire sale today.

You are saying the chart is the reason for the big sell off?

You are saying the chart is the reason for the big sell off?

quote:quote:

Eugene Fama wouldn't think that was such a "silly" statement. The winner of the 2013 Nobel laureate in Economics. Known for the efficient-market hypothesis.

"If active managers win, it has to be at the expense of other active managers. And when you add them all up, the returns of active managers have to be literally zero, before costs. Then after costs, it's a big negative sign,"

Happy gambling.

Why do you not understand the difference between "active managers", "stock brokers" and what I do? Fama was speaking to active managers of funds. Of course they can't actively trade their billions in fund deposits. The fees would be enormous even if they tried. Stock brokers? They don't make money unless they are active so they are always looking for the next Joe Sucker to put money in and create transactions in order to deliver broker fee's (revenue).

All of these don't have the least similarity to my approach. I trade only when the formula's I've developed align with technical's generated by multiple software sources, which is then analyzed based on my knowledge, experience and abilities. Everything you listed REQUIRES activity, much of it forced (I'll say coerced some times). A disciplined professional trader/investor doesn't force anything. We wait for alignment and personal confirmation.

There isn't a single thing about it that should remotely be considered gambling. I suppose you could say you "gamble" every time you drive your car because you could get hit and killed. Stop driving! I read your statements and this is the picture I get.

quote:I should listen to sweetie and not even reply to your really ignorant comment, but for the benefit of anyone that is lurking I'll explain.

Just when things were looking up, fire sale today.

You are saying the chart is the reason for the big sell off?

The selling started yesterday on a trend reversal. The switch happened between 10-11 yesterday morning. That was the "head" on my charts that I posted. At which point it turned from an up trend to a down trend. The right shoulder wasn't clear and I was afraid that I was wrong at the close yesterday because the breakout never happened.

Today the neckline was broken and we got the big selloff that was signaled yesterday.

It was a perfect trade for a return of about 50%.

This reads like a Twitter thread.

How so?

Day trading and timing vs buy and hold. Charts vs fundamentals. Grandstanding about successful trades. I told you so's.

Happens daily on Twitter feeds.

Happens daily on Twitter feeds.

Fair enough. I started off just showing charts. The "grandstanding". Was in response to the jack arse coin flip comments.

quote:Don't stop posting. I'm learning from yall

Fair enough. I started off just showing charts. The "grandstanding". Was in response to the jack arse coin flip comments.

I promise you that old army is the one to listen to. Not me.

If this is a trading thread, I'd be curious what people are trading. Futures, etfs (like Spy), options, individual stocks.

I've been day trading SPY options.

Frisco, Why are you day trading SPY options? The E-mini futures are more liquid, have better margin, and have much less spread. Also, you aren't paying for all the greeks like you do in an option. Commissions are better too.

quote:

Frisco, Why are you day trading SPY options? The E-mini futures are more liquid, have better margin, and have much less spread. Also, you aren't paying for all the greeks like you do in an option. Commissions are better too.

100% agree. I opened a futures account this week. OA and jake said the same thing.

I was trained in forex, but I'm very much a novice. Not my day job at all.

If I had to recommend a book to a trader interested in managing their own money, It would have to be two...

How to trade like a stock market wizard by Mark Minervini

How to make money in stocks by William Oneil

If you learn from these two books, you will get rich in bull markets and keep your powder dry in bear markets. If you want to learn to trade on shorter time frames or daytrade, I recommend you get a coach/mentor because I haven't been able to find any decent books out there.

How to trade like a stock market wizard by Mark Minervini

How to make money in stocks by William Oneil

If you learn from these two books, you will get rich in bull markets and keep your powder dry in bear markets. If you want to learn to trade on shorter time frames or daytrade, I recommend you get a coach/mentor because I haven't been able to find any decent books out there.

jake,

if you don't mind me asking, as i have been dipping my hand more into trading ES on the 5 min time frame from Al Brooks books... Do you have a preferred time frame and setup? Recommend any resources?

if you don't mind me asking, as i have been dipping my hand more into trading ES on the 5 min time frame from Al Brooks books... Do you have a preferred time frame and setup? Recommend any resources?

I'm ok with that. I would typically trade 3-5 lots with a target of 10 pips. Don't worry, I'm actually really conservative.

Futures bright red. DOW -230 Retest of support. Overseas markets finished in red.

Someone said trading is a lot of gut feeling...

quote:I would argue that if you want to be consistently successful it's actually a lot of hard work combined with experience and technology. Gambling is a gut feeling and I don't gamble.

Someone said trading is a lot of gut feeling...

I understand why the people posting cartoons on trading do so. Anyone attempting to trade on "gut feel" is going to lose their shirt. You don't wake up one day and say "I think I'll TRY trading" anymore than you do so for any profession. Having established that logic the clowns who post stupid cartoon pictures, or making ignorant blanket statements, also are admitting they don't understand it either.

I actually don't mind that because it keeps my lane free and clear, although my intent was to assist Ags on being wiser investors/traders.

It's breaking pretty hard. I'm going to wait for a bounce. Doubt I will play it to the upside unless we go really deep into the red. I want to go with the trend and look for a good entry to go short.

Insomuch as it is for any profession. Experience, knowledge, tools, timing, etc. all feed into "gut feel". But it isn't some sensation; at least that's not anything I would suggest. You might have simply eaten some bad sushi.

Gold & Silver flying. You're welcome....again.

never mind, i'm an idiot

(i said august lows, but I forgot that they were already breached last month)

(i said august lows, but I forgot that they were already breached last month)

quote:

Gold & Silver flying. You're welcome....again.

For?

You'll find in most markets people dive in without actually taking the time to know exactly what it is they are doing because they see it as a chance to make some extra money on the side because they are "smarter than your average bear". If they have immediate success they chalk it up to being really smart, and if they fail they'll just say the game is rigged and it's impossible to win.

In every market you tend to hear the same bit of initial advice -- trade with play money for an extended period of time to see how you do, and I'd wager that most people jump into real money trading within a small sample size of 3 months or their first successful week, whichever comes first.

Keep the posts coming -- many of us are learning (or trying to) from them.

In every market you tend to hear the same bit of initial advice -- trade with play money for an extended period of time to see how you do, and I'd wager that most people jump into real money trading within a small sample size of 3 months or their first successful week, whichever comes first.

Keep the posts coming -- many of us are learning (or trying to) from them.

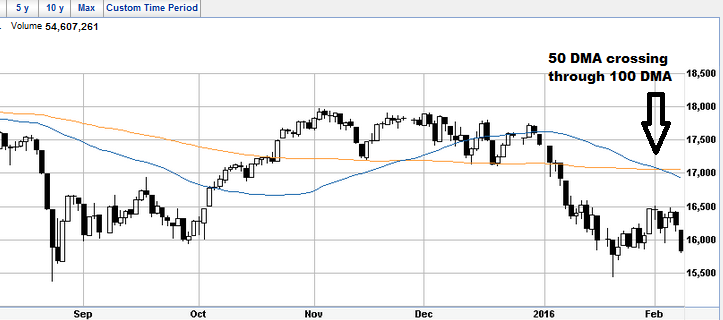

50 day moving average crossing 100 day moving average. We could accelerate down from here.

quote:

50 day moving average crossing 100 day moving average. We could accelerate down from here.

Two other possibilities from here. Market could move back up, or it could tread water. Based on my technicals I can say with pretty high confidence one of these three will happen.

Why comment if you are just going to be an ass?

Featured Stories

See All

8:10

3h ago

2.1k

No. 14 Texas A&M drops series finale to New Mexico State, 4-1

by Richard Zane

6:34

6h ago

1.3k

Kennedy out-dueled in rubber match as Florida downs A&M, 4-2

by Mathias Cubillan

5 Thoughts: No. 22 Texas A&M 66, Louisiana State 52

by Luke Evangelist

Nolanmo13

Weigman "survived" Last Season on Toradol Shots - CBS

in Billy Liucci's TexAgs Premium

177

Aldo the Apache

You've got to know when to hold 'em Know when to fold 'em

in Billy Liucci's TexAgs Premium

102

aggietony2010

Outscored 27-5 and their official account posts this.

in Texas A&M Baseball & Softball

80

FarmerFran

Weigman "survived" Last Season on Toradol Shots - CBS

in Billy Liucci's TexAgs Premium

69