mcrews - If you think I am lying about the 2009 Form 990, I will be happy to email you a copy.

A look at the Corps of Cadets Association - Where your donor dollars go

17,083 Views |

172 Replies |

Last: 12 yr ago by Dirk Diggler

I have intentionally not posted commentary on this because I don't want to be accused of having some sort of bias for or against the CCA. I see that I am still being accused of posting "intentionally incorrect" information, despite the information being plainly available on public records.

The only piece of commentary I will offer is that as a result of my extensive involvement working with non-profit organizations with budgets ranging from 4-figures to 9-figures, including my currently serving as the CEO of a non-profit in Houston, the CCA Executive Director's salary is significantly inconsistent with the normal salary range for non-profits with similar budgets. That is not an opinion - it is a fact.

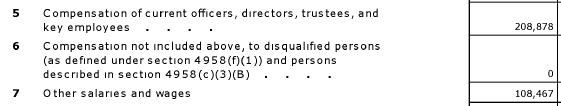

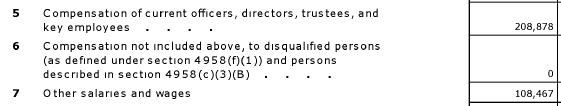

For those who asked about salary information, here you go:

The only piece of commentary I will offer is that as a result of my extensive involvement working with non-profit organizations with budgets ranging from 4-figures to 9-figures, including my currently serving as the CEO of a non-profit in Houston, the CCA Executive Director's salary is significantly inconsistent with the normal salary range for non-profits with similar budgets. That is not an opinion - it is a fact.

For those who asked about salary information, here you go:

Perhaps another approach to this issue would be found in a comparative study of all CCA employee salaries to those "fringe benefited employees salaries" of the FSA, the A&M Foundation and 12th Man Association.

If salaries of the CCA employees are somewhat higher than those of their 990 non-profit counterpart employees (and of those recipients of fringe benefits) then the CCA-BOD, in their infinite wisdom, factored in the possible individual cost to be borne by CCA employee (for any or all retirement, medical/dental, life insurance, paid vacations and Christmas bonus benefit options they elected to select).

If current CCA employee salaries, without fringe benefits, are equal to or lower than their FSA, A&M Foundation, 12 Man Association employee counterparts...the CCA employee NEEDS A RAISE (or a fringe benefit package).

Solution ? Increase CCA base member dues to $75.

[This message has been edited by BeBopAg (edited 12/21/2011 10:29a).]

If salaries of the CCA employees are somewhat higher than those of their 990 non-profit counterpart employees (and of those recipients of fringe benefits) then the CCA-BOD, in their infinite wisdom, factored in the possible individual cost to be borne by CCA employee (for any or all retirement, medical/dental, life insurance, paid vacations and Christmas bonus benefit options they elected to select).

If current CCA employee salaries, without fringe benefits, are equal to or lower than their FSA, A&M Foundation, 12 Man Association employee counterparts...the CCA employee NEEDS A RAISE (or a fringe benefit package).

Solution ? Increase CCA base member dues to $75.

[This message has been edited by BeBopAg (edited 12/21/2011 10:29a).]

For the reportable employee salaries shown above, the ED is the only one that appears out of the norm.

Perhaps the ED carried the entire weight of the CCA (or let's say most of it) on his shoulders for 19 years ? This vital element needs consderation (regarding compensation and benefits).

Also, remember as a 1993 new kid on the 990 non-profit block in College Station there may have been some serious competitive turf battles fought (of which we know nothing and never will).

Let's step back and do some serious cogitation.

Compared to the huge non-profit FSA, the A&M Foundation, and the 12th Man Association...the CAA is still in its infancy.

From the late 1960's 'til now, the demographic shift and imbalance in a former student population (former Corps members vs former non-Reg population) has surely played a factor in the annual contribution flow and varied distributions to C/S non-profit 990's.

Would also be interesting to learn of FSA contributions to the Corps say, from 1970 to 1993.

CCA fringe benefits to its employees should still be an issue worthy of discussion, or a bit of attentiveness by the CCA's-BOD.

However, (on second thought) if all current or future CCA employees sign an affadavit to the effect they need no pay raises or fringe benefits, well, this topic is somewhat dead.

[This message has been edited by BeBopAg (edited 12/21/2011 11:44a).]

Also, remember as a 1993 new kid on the 990 non-profit block in College Station there may have been some serious competitive turf battles fought (of which we know nothing and never will).

Let's step back and do some serious cogitation.

Compared to the huge non-profit FSA, the A&M Foundation, and the 12th Man Association...the CAA is still in its infancy.

From the late 1960's 'til now, the demographic shift and imbalance in a former student population (former Corps members vs former non-Reg population) has surely played a factor in the annual contribution flow and varied distributions to C/S non-profit 990's.

Would also be interesting to learn of FSA contributions to the Corps say, from 1970 to 1993.

CCA fringe benefits to its employees should still be an issue worthy of discussion, or a bit of attentiveness by the CCA's-BOD.

However, (on second thought) if all current or future CCA employees sign an affadavit to the effect they need no pay raises or fringe benefits, well, this topic is somewhat dead.

[This message has been edited by BeBopAg (edited 12/21/2011 11:44a).]

Don Crawford started the CCA on a shoestring budget out of his house in 1993. He underwrote and funded the CCA largely on his own. Before CCA, there was no database of former cadets. The FSA didn't keep those kind of records.

His first order of business was to build a data base of almost 50,000 records to build the CLO volunteer organization to assist the Commandant, Gen. Darling in recruiting for the Corps.

I don't know for certain, but my guess is that Don perfromed the CEO functions for a number of years without compensation. He continued to own a successful insurance agency in the North Dallas Richardson area.

CCA has benefited the Corps as well as all former cadets. As I pointed out, Ryan, CCA is a not for profit; not a charity organization. CCA doesn't charge for pass through donations to the Corps like the Foundation or Former Students. Its revenues are generated largely from membership dues, not charitable donations.

Its a shamee that Don's integrity has been called to question by you and others on this thread.

His first order of business was to build a data base of almost 50,000 records to build the CLO volunteer organization to assist the Commandant, Gen. Darling in recruiting for the Corps.

I don't know for certain, but my guess is that Don perfromed the CEO functions for a number of years without compensation. He continued to own a successful insurance agency in the North Dallas Richardson area.

CCA has benefited the Corps as well as all former cadets. As I pointed out, Ryan, CCA is a not for profit; not a charity organization. CCA doesn't charge for pass through donations to the Corps like the Foundation or Former Students. Its revenues are generated largely from membership dues, not charitable donations.

Its a shamee that Don's integrity has been called to question by you and others on this thread.

quote:This is a false statement. It is organized as a charitable organization under 501(c)(3).

CCA is a not for profit; not a charity organization

I don't think anyone on here has called Don's integrity into question here, and I am not making any judgments as to whether or not his salary is justified. I am merely making an objective observation of where his salary compares to similarly situated non-profits.

I certainly have an appreciation for people who do this work without being compensated, as Don once was. I do not receive compensation for the work I do with my non-profit, and in fact, spend about 13% of my annual take-home pay on the organization through operating expenses and general financial contributions. That is on top of the 40 hours a week I spend doing the work on top of my 55 hours per week at my regular job.

According to Gen. Van Alstyne, during the six years he was Commandant, he never received one dime from the Former Students. They made a contribution to the Aggie Band fund for travel for the "greater good of the NCAA".

This is why our Commandant's office has come to rely on the CCA for its monetary needs in growing and supporting the Corps.

This is why our Commandant's office has come to rely on the CCA for its monetary needs in growing and supporting the Corps.

quote:

As I pointed out, Ryan, CCA is a not for profit; not a charity organization.

According to the IRS, CCA is a charity because it is funded by public donations. I'm assuming that's what Ryan was talking about. You can even see where it meets the IRS test on the 990 - on the 2010 form, it is Part II, with the results in Section C. http://www.irs.gov/charities/charitable/article/0,,id=185584,00.html

Ryan, I did notice that for what it's worth, 2009 (the screenshot you captured) was the only year the box was filled showing any pension plan contributions. The box was blank on the 2008 and 2010 990. I'd agree it is a question to ask since posters here maintain there are no retirement benefits paid to employees of the CCA.

I think most of us care deeply about the Corps of Cadets and recognize that many have given their time (usually uncompensated) to promote and support the Corps. I for one am not trying to question a fellow Aggie's integrity, but believe it is only prudent to be well-informed before giving to a cause. I do hope that someone in the know can give us concrete answers to some of the questions here.

I am hoping we'll see answers here rather than each having to individually call the CCA because as many people have posted here, many more people are lurking with the same questions. If this is addressed and vetted in a public forum, it will reach a lot of people, many, many more than the handful that call. As I am sure the CCA answers each question asked here to its board at least yearly, I am hoping they can make that information more public.

As a reminder, we can all view 990's for free at guidestar.org. You just have to register on the website.

The CCA's information is listed here: http://www2.guidestar.org/organizations/75-2482454/texas-aggie-corps-cadets-association.aspx#

Edit: I wrote this before I saw the responses above.

[This message has been edited by Ark03 (edited 12/21/2011 11:41a).]

To Ryan the Temp.

You have spent quite an amount of time on your vendetta agaisnt CCA. Your premise that the compensation is too high is "fact" is an example of your ignorance and arrogance, I don't care what organization you are CEO of. As for the 401K contributions, if you can prove those were exccessive in relation to the compensation, bring it on.

You have spent quite an amount of time on your vendetta agaisnt CCA. Your premise that the compensation is too high is "fact" is an example of your ignorance and arrogance, I don't care what organization you are CEO of. As for the 401K contributions, if you can prove those were exccessive in relation to the compensation, bring it on.

I don't have a vendetta against the CCA. It is a good organization that I have supported to the fullest extent I could afford.

There was a thread that was deleted wherein several posters asked about the revenues of the CCA. I posted the information for the benefit of those posters. I never made any judgments with regard to retirment benefits, with the exception that it was unusual for a non-profit to offer retirement benefits, and it is unusual, especially for a non-profit with a budget under $1 million.

$18,000 in one year over the course of many years, is a very small number, and probably not at all unreasonable, but feel free to continue your personal attacks on me.

I will also repost this from my OP:

[This message has been edited by Ryan the Temp (edited 12/21/2011 12:58p).]

There was a thread that was deleted wherein several posters asked about the revenues of the CCA. I posted the information for the benefit of those posters. I never made any judgments with regard to retirment benefits, with the exception that it was unusual for a non-profit to offer retirement benefits, and it is unusual, especially for a non-profit with a budget under $1 million.

$18,000 in one year over the course of many years, is a very small number, and probably not at all unreasonable, but feel free to continue your personal attacks on me.

I will also repost this from my OP:

quote:If you have a dispute with those numbers, take it up with ASU.

For perspective on non-profit salaries, the average salary for a non-profit executive director with an annual budget of $500,000 to $1million is $68,175. (Source: Arizona State University)

[This message has been edited by Ryan the Temp (edited 12/21/2011 12:58p).]

NO FSA CONTRIBUTION TO CORPS ?

Little off course topically but...

Could we please have a bit more input concerning a statement found in the above 11:38am post of 12/21/11, regarding Lt. General John Van Alstyne's statement, in that during all of his time as Commandant of the Corps (6-7 years) "he never received one dime" from the Association of Former Students, other than a FSA contribution to the FTAB for "the greater good of the NCAA."

Wow !

If this is factual, something is (was) very, very wrong.

Please verify from a reliable source.

Am sure FSA would give some form of an appropriate response to such a statement.

So the CCA is (or was) all alone in its financial support for the Corps ?

Surely the FSA is (or was) not anti-Corps ?

Was the Van Alstyne statement verbal or in print ?

Perhaps there is serious linkage to be found (in this thread) regarding segments of this info ? Perhaps not ?

eagle.com - Exit Riles A&M Donor - by Vilma Patel - February 15, 2010.

http://www.theeagle.com/am/Exit-riles-A-amp-amp-M-donor

[This message has been edited by BeBopAg (edited 12/21/2011 3:49p).]

Little off course topically but...

Could we please have a bit more input concerning a statement found in the above 11:38am post of 12/21/11, regarding Lt. General John Van Alstyne's statement, in that during all of his time as Commandant of the Corps (6-7 years) "he never received one dime" from the Association of Former Students, other than a FSA contribution to the FTAB for "the greater good of the NCAA."

Wow !

If this is factual, something is (was) very, very wrong.

Please verify from a reliable source.

Am sure FSA would give some form of an appropriate response to such a statement.

So the CCA is (or was) all alone in its financial support for the Corps ?

Surely the FSA is (or was) not anti-Corps ?

Was the Van Alstyne statement verbal or in print ?

Perhaps there is serious linkage to be found (in this thread) regarding segments of this info ? Perhaps not ?

eagle.com - Exit Riles A&M Donor - by Vilma Patel - February 15, 2010.

http://www.theeagle.com/am/Exit-riles-A-amp-amp-M-donor

[This message has been edited by BeBopAg (edited 12/21/2011 3:49p).]

[Try again, without the personal attacks--Staff]

[This message has been edited by TexAgs staff (edited 12/30/2011 7:56a).]

[This message has been edited by TexAgs staff (edited 12/30/2011 7:56a).]

FLASH !!!

After reading this thread...

collective heads of the FSA, the A&M Foundation and 12th Man Association just may call their employees together and announce abolishment of fringe benefits for 2012.

Good enough for the CCA ? Perhaps it's good enough for YOU too.

(Jerk, idiot, cheat, lier, thief and low-life?)

Well, considering all the anticipated verbal abuse they might ask for volunteers to surrender their fringe benefits.

Employees could be allowed to opt out of fringe benefits and, in turn, receive higher wages.

[This message has been edited by BeBopAg (edited 12/21/2011 9:09p).]

After reading this thread...

collective heads of the FSA, the A&M Foundation and 12th Man Association just may call their employees together and announce abolishment of fringe benefits for 2012.

Good enough for the CCA ? Perhaps it's good enough for YOU too.

(Jerk, idiot, cheat, lier, thief and low-life?)

Well, considering all the anticipated verbal abuse they might ask for volunteers to surrender their fringe benefits.

Employees could be allowed to opt out of fringe benefits and, in turn, receive higher wages.

[This message has been edited by BeBopAg (edited 12/21/2011 9:09p).]

Mcrews, are you saying you just went to school at A&M? I would think an Aggie would be above petty name calling. That's pretty low.

Sandy,

Actually, I'm pretty pissed. THe attack on the CCA is disgusting.

But jump right in.

If the best you got is that I 'name call' then by your ommission, everything else I have said is factual.

I can live with that. And I can do to bed tonight knowing that I fought the good fight in defending the honor of the CCA and DON and his staff.

But I will tell you this, I don't hide behind a handle and I write like I talk. I would say the exact same thing if we were all sitting in a room. I don't 'hide' behind a screen.

Actually, I'm pretty pissed. THe attack on the CCA is disgusting.

But jump right in.

If the best you got is that I 'name call' then by your ommission, everything else I have said is factual.

I can live with that. And I can do to bed tonight knowing that I fought the good fight in defending the honor of the CCA and DON and his staff.

But I will tell you this, I don't hide behind a handle and I write like I talk. I would say the exact same thing if we were all sitting in a room. I don't 'hide' behind a screen.

Wow... I wish I got paid that much.

EGA...

Become an entrepreneur.

Work your plan.

Set up a 990 non-profit F.A.C.T. (Former Aggie Cadet Trusteeship).

Funnel donations directly designate to the individual outfit needs.

No frills. No Website. No publications. No recruiting. No volunteers. No product sales.

As donations flow in have a BOD to set your salary.

For starters, say $57,000 a year (with no fringe benefits).

Use direct mailings and be prepared to be called a jerk, idiot, lier, cheat, thief and a low-life.

Is competition not wonderful (and the life blood of democracy) ?

Best to remember, ah lot-of-others, and Bop (come Hell-and-High Water) are still gonna support the CCA !

[This message has been edited by BeBopAg (edited 12/22/2011 7:56p).]

Become an entrepreneur.

Work your plan.

Set up a 990 non-profit F.A.C.T. (Former Aggie Cadet Trusteeship).

Funnel donations directly designate to the individual outfit needs.

No frills. No Website. No publications. No recruiting. No volunteers. No product sales.

As donations flow in have a BOD to set your salary.

For starters, say $57,000 a year (with no fringe benefits).

Use direct mailings and be prepared to be called a jerk, idiot, lier, cheat, thief and a low-life.

Is competition not wonderful (and the life blood of democracy) ?

Best to remember, ah lot-of-others, and Bop (come Hell-and-High Water) are still gonna support the CCA !

[This message has been edited by BeBopAg (edited 12/22/2011 7:56p).]

mrcrews --

Appreciate your willingness to defend a good organization from the d0uchebaggery in our midst.

Rock

Appreciate your willingness to defend a good organization from the d0uchebaggery in our midst.

Rock

Thnks Rock1982.

There are several others here, like Huslinone70 who also stood by and defended CCA

My thanks go uot to them also

There are several others here, like Huslinone70 who also stood by and defended CCA

My thanks go uot to them also

POINT of FACT:

Money can be given to the CCA that is a direct pass thru to the unit or 'thing' that you designate.

example: donations sent to the CCA for the new outfit, Huslin 1, will 'pass thru' 100% AND you will get a tax deduction from the cca.

Money given dirctly to Huslin 1 are not tax deductable.

Money given thru the Foundation or AFS charge 5% to pass the money thru.

CCA recieves $$ designated for reville, uotfits and events that are 100% passed thru.

Finally, these $$$$$$$ ARE NOT reflected on the 990.

Money can be given to the CCA that is a direct pass thru to the unit or 'thing' that you designate.

example: donations sent to the CCA for the new outfit, Huslin 1, will 'pass thru' 100% AND you will get a tax deduction from the cca.

Money given dirctly to Huslin 1 are not tax deductable.

Money given thru the Foundation or AFS charge 5% to pass the money thru.

CCA recieves $$ designated for reville, uotfits and events that are 100% passed thru.

Finally, these $$$$$$$ ARE NOT reflected on the 990.

mcrews, the question that many have asked and that CCA has said they would come back here with the answer to is what amount of the money received is in the form of pass through so it can be deducted from the admin cost and an accurate measure of administrative burden can be determined. This is the least anyone can do when they are asking others to cough up money is to let us know accurately where the money is being spent.

If you had read many of Ryan's post you would realize he does not have an agenda against the CCA. There is no need for name calling of him. I would agree that there are others who have posted on this thread that deserve being referred to negatively for their implication of impropriety on the part of CCA.

If you had read many of Ryan's post you would realize he does not have an agenda against the CCA. There is no need for name calling of him. I would agree that there are others who have posted on this thread that deserve being referred to negatively for their implication of impropriety on the part of CCA.

mcrews:

The burden is not on me to verify the accuracy of the CCA's 990s, regardless of my experience working with non-profits. It is the legal responsibility of the CCA to file accurate 990s with the IRS. If pension/retirement contributions are reported, there is no reason to assume the information is incorrect.

If verifying their 990s is my responsibility, as you indicated, then I ought to be on their payroll. I would be glad to prepare their 990s for them, but since I don't prepare their 990s, don't blame me when their accountant screws it up.

If the pension contribution is an error on the part of the CCA, I will happily go back and edit the OP. That being said, how hard would it have been to post, "Hey Ryan, I called Don and he said the pension contributions was an error and they will file a corrected 990. Do you mind editing your OP?" Instead, you got your panties in a twist and and resorted to personal attacks.

The burden is not on me to verify the accuracy of the CCA's 990s, regardless of my experience working with non-profits. It is the legal responsibility of the CCA to file accurate 990s with the IRS. If pension/retirement contributions are reported, there is no reason to assume the information is incorrect.

If verifying their 990s is my responsibility, as you indicated, then I ought to be on their payroll. I would be glad to prepare their 990s for them, but since I don't prepare their 990s, don't blame me when their accountant screws it up.

If the pension contribution is an error on the part of the CCA, I will happily go back and edit the OP. That being said, how hard would it have been to post, "Hey Ryan, I called Don and he said the pension contributions was an error and they will file a corrected 990. Do you mind editing your OP?" Instead, you got your panties in a twist and and resorted to personal attacks.

Check your email.

mcrews, you are offbase re: Ryan. He has brought up a subject needing to be discussed!

NOT ENOUGH MONEY IS GOING TO THE CORPS!

NOT ENOUGH MONEY IS GOING TO THE CORPS!

Big jim.

Really.......come on.......Take you whining to the commandant.

Can't you read!!!!!!

THe commandant requests the $$$$$$, the CCA gives the full amount. THe commandant could have requested twice as much and gotten all he asked for.

Please aacknowledge you understand this fact.

You really starting to look like a brken record.

Really.......come on.......Take you whining to the commandant.

Can't you read!!!!!!

THe commandant requests the $$$$$$, the CCA gives the full amount. THe commandant could have requested twice as much and gotten all he asked for.

Please aacknowledge you understand this fact.

You really starting to look like a brken record.

From theCCA post earlier

This would lead me to think that the direct pass through money is included in the dollar amount of the budget associated with admin costs.

What you are saying in your post:

Leads me to think that pass through money is handled "Off the Books". I don't think that is the case. I may be wrong. If it is "On the books" than for every dollar that is a "pass through" dollar or "recruiting" dollar currently listed as an administrative cost that is identified, more money (in the mind of the donors) is seen as going towards its intended user. Thus the 12% going towards the Corps would go up significantly. Hypothetically:

Current accounting

Revenues $1,000,000 (100%)

Salaries 330,000 (33%)

Direct Corps Support 120,000 (12%)

Admin Cost (includes pass through $) 330,000 (33%)

Reserves 220,000 (22%)

Moving Recruiting and Pass Through Money to Support Column

(I'll just assume $100,000)

Revenues $1,000,000 (100%)

Salaries 330,000 (33%)

Direct Corps Support 220,000 (22%)

Admin Cost (includes pass through $) 230,000 (23%)

Reserves 220,000 (22%)

See what I did there? While recruiting support may not be viewed as direct support for the Corps, it is helping to grow the Corps which is what we all want.

The basic thing is, if you want me to give you money than you need to come to me with the information that makes me want to give you money. Not the other way around.

ETA: Even if the pass through money is handled "Off the Books" by increasing the revenues to show this money along with reflecting it as a direct support cost it would have the same effect, just not as significant.

[This message has been edited by bqaggie86 (edited 12/22/2011 1:22p).]

quote:

Important or special note –

Any pass through funds are processed as admin costs and there is no admin fee charged for this service. And you still receive a tax benefit for this contribution to the Corps of Cadets.

This would lead me to think that the direct pass through money is included in the dollar amount of the budget associated with admin costs.

What you are saying in your post:

quote:

Next, the pass-thru $$$ would ADD to the total dollars given to the cca, not be subtracted uot of admin costs. so instead of handling $1,000,000 the cca would be handling $1,100,000 (as an example if the pass thru was $100,000.

Pass-thru $$$ would also increase the amount requested and then given to the Corps.

Leads me to think that pass through money is handled "Off the Books". I don't think that is the case. I may be wrong. If it is "On the books" than for every dollar that is a "pass through" dollar or "recruiting" dollar currently listed as an administrative cost that is identified, more money (in the mind of the donors) is seen as going towards its intended user. Thus the 12% going towards the Corps would go up significantly. Hypothetically:

Current accounting

Revenues $1,000,000 (100%)

Salaries 330,000 (33%)

Direct Corps Support 120,000 (12%)

Admin Cost (includes pass through $) 330,000 (33%)

Reserves 220,000 (22%)

Moving Recruiting and Pass Through Money to Support Column

(I'll just assume $100,000)

Revenues $1,000,000 (100%)

Salaries 330,000 (33%)

Direct Corps Support 220,000 (22%)

Admin Cost (includes pass through $) 230,000 (23%)

Reserves 220,000 (22%)

See what I did there? While recruiting support may not be viewed as direct support for the Corps, it is helping to grow the Corps which is what we all want.

The basic thing is, if you want me to give you money than you need to come to me with the information that makes me want to give you money. Not the other way around.

ETA: Even if the pass through money is handled "Off the Books" by increasing the revenues to show this money along with reflecting it as a direct support cost it would have the same effect, just not as significant.

[This message has been edited by bqaggie86 (edited 12/22/2011 1:22p).]

mcrews, ease up on your rhetoric - nobody is whining. It's a discussion with no need for namecalling.

The Better Business Bureau as I previously posted recommends a 60-65% payout for charitable orgs. - or somewhere around $600,000 in this case!

If the Commandant doesn't need this kind of money, It could be used for scholarships.

If $90,000 was used for the Band, but only $30,000 for the Corps, something is wrong!

Why did the Commandant have to ask for direct donations to fund the march in of the Corps at the Cotton Bowl? He collected over $75,000 !

[This message has been edited by BigJim49 AustinNowDallas (edited 12/22/2011 1:41p).]

The Better Business Bureau as I previously posted recommends a 60-65% payout for charitable orgs. - or somewhere around $600,000 in this case!

If the Commandant doesn't need this kind of money, It could be used for scholarships.

If $90,000 was used for the Band, but only $30,000 for the Corps, something is wrong!

Why did the Commandant have to ask for direct donations to fund the march in of the Corps at the Cotton Bowl? He collected over $75,000 !

[This message has been edited by BigJim49 AustinNowDallas (edited 12/22/2011 1:41p).]

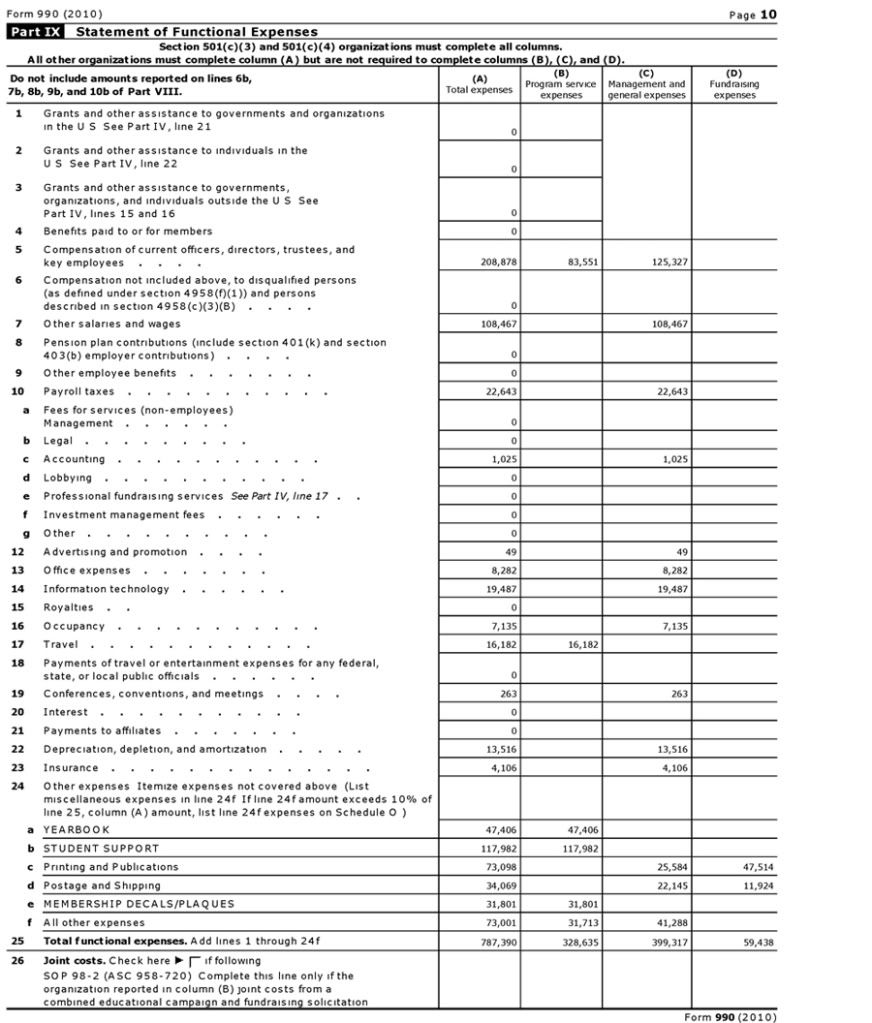

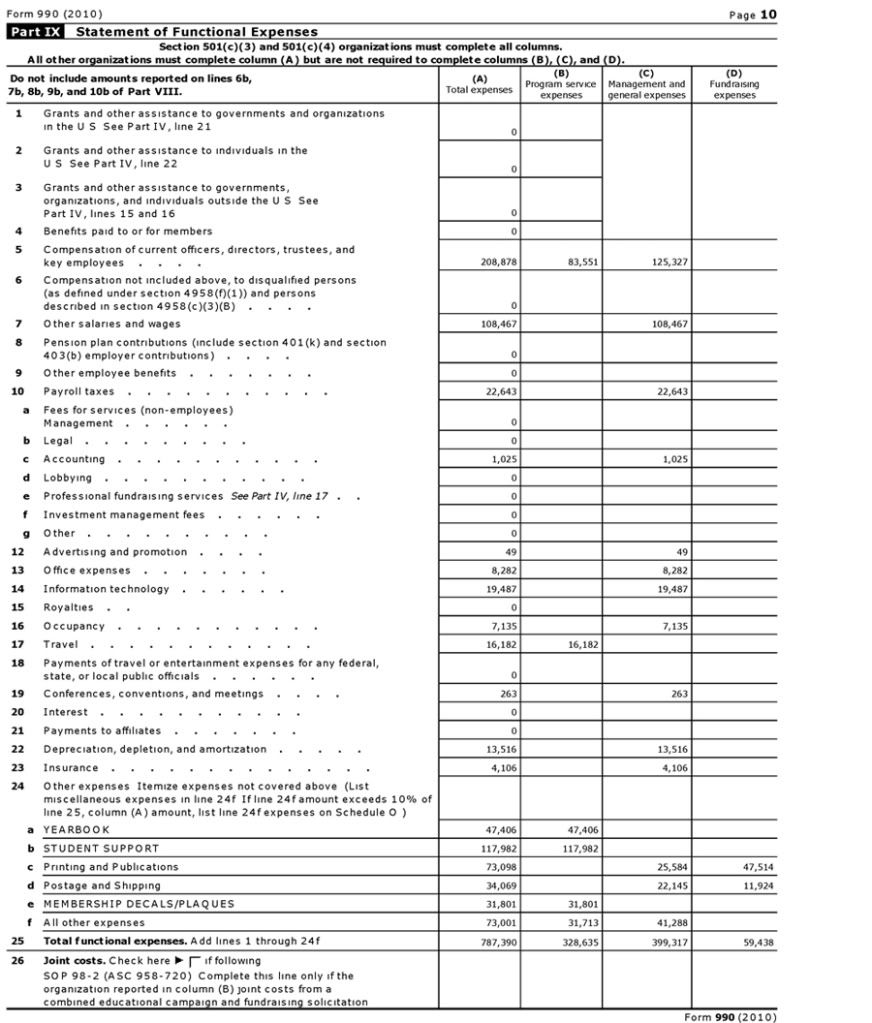

This is the statement of functional expenses for 2010. Direct support to the Corps is on Line 24b.

Column B lists the amounts for activities classifies as being in direct, active execution of its mission.

Column C lists expenses generally associated with simply operating the organization.

Column D lists expenses that were made with the sole purpose of generating additional revenue.

For the totals, go to Line 25.

Column B lists the amounts for activities classifies as being in direct, active execution of its mission.

Column C lists expenses generally associated with simply operating the organization.

Column D lists expenses that were made with the sole purpose of generating additional revenue.

For the totals, go to Line 25.

I would certainly count the Quadrangle yearbook as direct support because it is used for recruiting. I would count printing and publications used for recruiting as direct support as well. Some of the amount for postage would be sending information and decals/plaques to members, so I would not count that. Adding those two amounts adds $120,504 to the total of support for the Corps, as opposed to administrative expenses. New total: $238, 486. New % of revenues devoted to direct support/recruiting: 24%

There is still $73,000 under "other expenses." I'd like to know what that includes.

Now: Does the figure given under Student Support include all the money donated by CCA in support of the list on the CCA website, or is there other money donated? It would be very helpful to see an itemized amount given by CCA to each of these items on the CCA list:

Such an itemized list would help greatly in determining how much of a donated dollar was going to the Corps, including recruiting efforts.

[This message has been edited by OldArmy71 (edited 12/22/2011 6:39p).]

[This message has been edited by OldArmy71 (edited 12/22/2011 6:49p).]

There is still $73,000 under "other expenses." I'd like to know what that includes.

Now: Does the figure given under Student Support include all the money donated by CCA in support of the list on the CCA website, or is there other money donated? It would be very helpful to see an itemized amount given by CCA to each of these items on the CCA list:

quote:

Academic Volunteer Awards

Aggie Eagle Banquets

Aggie Eagle Newsletter

Batan Death March Competition

Boot Dance

Cadet Challenge

Capitol 10K Race Team

CCA/CDC Dining Out

Color Guard

Combat 5K Run/Walk Fund Raiser for Fisher House

Commandant’s Wife Reception for Female Cadets

Corps Baseball Team

Corps Mens Basketball Team

Corps Marathon Team

Corps PT Gear

Corps Recruiting – Brochure, CDs, Presentation Binders

Corps Recruiting "Top Recruiters" Banquet and Awards

Corps Scholarship Golf Tournament

Corps Soccer Team

Corps Softball Team

Corps Triathlon Team

Corps Volleyball Team

Corps Womens Basketball Team

Dorm Flags

Final Review Reception

Fish Drill Team Reunion

Fish Drill Team plaques

Fish Fry Dinner for fish class and parents

Freshman Orientation Week (FOW) Meals

Guidon magazine

Hall of Honor Awards Program and Reception

JCAP (JROTC) Banquets

JROTC Newsletters

Leadership Development Course

March to the Brazos BBQ

Mascot Corporal

Officer of the Day Travel for away football games

Outfit Reunions

Quadrangle Corps Yearbook

Parent Handbook

Rally to the Guidons

ROTCs Dining In (Air Force, Army, Navy/Marine)

Senior Class Dining In

SCONA Cadet Delegates

Simpson Honor Society Banquet and plaques

Sophomore Class BBQ

Texas Aggie Band Show

Such an itemized list would help greatly in determining how much of a donated dollar was going to the Corps, including recruiting efforts.

[This message has been edited by OldArmy71 (edited 12/22/2011 6:39p).]

[This message has been edited by OldArmy71 (edited 12/22/2011 6:49p).]

Speaking of the quadrangle, is it still a hunk of garbage like it was when I got it a few years back? It looked like it was put together by a 7th grader.

Regarding OldArmy 71's last post:

Something is terribly wrong ?

Bop cannot hear through all the void of silence, nor read nonexistent response words from a blank page.

[This message has been edited by BeBopAg (edited 12/22/2011 9:50p).]

Something is terribly wrong ?

Bop cannot hear through all the void of silence, nor read nonexistent response words from a blank page.

[This message has been edited by BeBopAg (edited 12/22/2011 9:50p).]

EGA wrote:

"Speaking of the quadrangle, is it still a hunk of garbage like it was when I got it a few years back? It looked like it was put together by a 7th grader. "

For those who don't know, the Quadrangle is the only year book that prints individual pictures of cadets by class and by outfit. The individual pics are no longer included in the Aggieland except for graduating seniors.

As for the comments about how it is put together, beauty is in the eyes of the beholder. At least somebody is doing something to preserve tradition. Back in our days, the Aggieland was put together by Co. A-2. It may not have been the most professional but I still have all four of mine and it preserves the memories photographically of when I was in school.

"Speaking of the quadrangle, is it still a hunk of garbage like it was when I got it a few years back? It looked like it was put together by a 7th grader. "

For those who don't know, the Quadrangle is the only year book that prints individual pictures of cadets by class and by outfit. The individual pics are no longer included in the Aggieland except for graduating seniors.

As for the comments about how it is put together, beauty is in the eyes of the beholder. At least somebody is doing something to preserve tradition. Back in our days, the Aggieland was put together by Co. A-2. It may not have been the most professional but I still have all four of mine and it preserves the memories photographically of when I was in school.

The Quad yearbook looks great

..."It's just another Corps Trip boys, we'll march-in...behind...the...band."

Featured Stories

See All

Any direct path to Atlanta for Texas A&M goes through South Carolina

by Olin Buchanan

5:17

20h ago

3.5k

1:49

5h ago

1.6k

2025 Texas A&M DT commit DJ Sanders talks district title, Kyle Field

by Ryan Brauninger

113:02

6h ago

1.2k

42:43

1d ago

5.7k

suburban cowboy

Baseball: Jace & Hayden throw epic Halloween party

in Billy Liucci's TexAgs Premium

285

SECond2noneAgs

Baseball: Jace & Hayden throw epic Halloween party

in Billy Liucci's TexAgs Premium

214

suburban cowboy

Baseball: Jace & Hayden throw epic Halloween party

in Billy Liucci's TexAgs Premium

179

Gladiator 96

Baseball: Jace & Hayden throw epic Halloween party

in Billy Liucci's TexAgs Premium

170

Dagny Taggart

Baseball: Jace & Hayden throw epic Halloween party

in Billy Liucci's TexAgs Premium

130