I don't know what constitutes a long term hold, perhaps 6 months or years but in contrast to the Stock Markets thread that's more for the daily pros and options I thought I'd try and start one for us longer term holders

I'm certainly no expert

My long term holds are the following as a percentage of my self managed portfolio

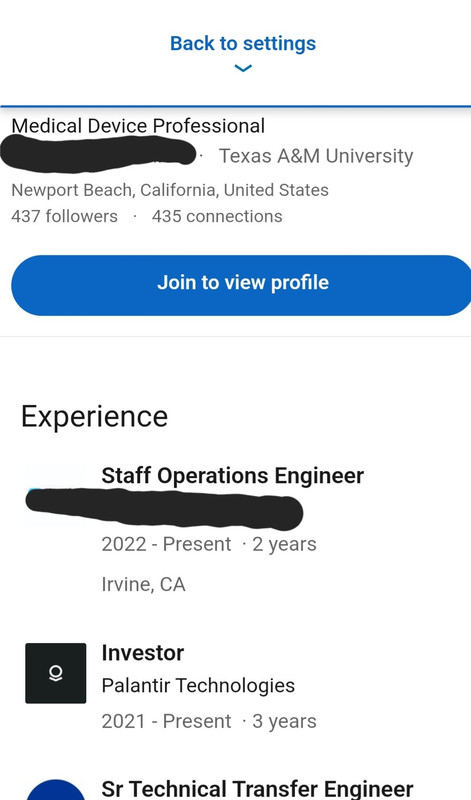

AI 20% mixed bag of AI stocks / ETFs including AIQ, MSFT, PLTR and IONQ. I already sold my NVDA a few times. I have a buy order at $110. If it rolls into my glove I've laid on the ground, great if not, oh well. Same goes for an AAPL order at $196

20% Biotechnology, mostly XBI, and a little ARKG. My XBI is up 30% but holding for much more whenever rates go down

30% Bitcoin in IBIT. I think I'm done buying. Just wait and see, hope to see more adoption

5% in Russell IWM wait for rate cuts. Buy order for more at $197

15% energy in XLE

10% cash

I'm certainly no expert

My long term holds are the following as a percentage of my self managed portfolio

AI 20% mixed bag of AI stocks / ETFs including AIQ, MSFT, PLTR and IONQ. I already sold my NVDA a few times. I have a buy order at $110. If it rolls into my glove I've laid on the ground, great if not, oh well. Same goes for an AAPL order at $196

20% Biotechnology, mostly XBI, and a little ARKG. My XBI is up 30% but holding for much more whenever rates go down

30% Bitcoin in IBIT. I think I'm done buying. Just wait and see, hope to see more adoption

5% in Russell IWM wait for rate cuts. Buy order for more at $197

15% energy in XLE

10% cash