My UROY had one beautiful trading day today

Stock Markets

26,505,053 Views |

237321 Replies |

Last: 9 min ago by BucketofBalls99

Reverse head and shoulders maybe. Could be worth a shot with a tight stop. Let's see if it plays out. I would love that as my $225 put has basis in that range and likely wouldn't get assigned. So I could buy shares at that basis and keep the $12 premium reward.Charismatic Megafauna said:

Is there not support in the 212-215 range?

Good to see you my friend$30,000 Millionaire said:

I had a pretty awesome trade on NUGT this week. In 30.70, out 32.50.

https://www.cassavasciences.com/news-releases/news-release-details/cassava-sciences-announces-dividend-distribution-warrantsTexas Tea said:Charismatic Megafauna said:

Sava ran today, and closed above the magical 26.4 price that somehow impacts the warrants (which doubled today). I think I'm going to exercise my warrants to get the bonus shares but it looks like I'll have to call fidelity to do that. Anybody looked into it yet?

I was looking at exercising my warrants today but it appears to me that if I sell the warrants and just buy the stock, I'll come out ahead. Am I missing something?

https://www.cassavasciences.com/news-releases/news-release-details/cassava-sciences-completes-dividend-distribution-warrants

I haven't had time to look thoroughly into the details but at first glance it looks like you get more shares for your buck if exercised within the first 30 days or you can just sell the warrants. If that is the case then I'll exercise and get the bonus shares.Quote:

AUSTIN, Texas, Jan. 05, 2024 (GLOBE NEWSWIRE) -- Cassava Sciences, Inc. (Nasdaq: SAVA) ("Cassava Sciences" or the "Company") today announced the completion of a previously announced distribution of warrants (the "Warrants") to its shareholders. The Warrants now trade on Nasdaq under the ticker SAVAW.

Stockholders received four (4) Warrants for each ten (10) shares of the Company's common stock held as of December 22, 2023 (the "Record Date"), rounded down to the nearest whole number for any fractional warrant. As an example, a shareholder who owned 1,000 shares of Cassava Sciences as of the Record Date received a distribution of 400 Warrants on January 3, 2024. Each Warrant entitles the holder to purchase, at the holder's sole and exclusive election, one share of Cassava Sciences' common stock at an initial exercise price of $33.00 per share plus, as applicable and as described below, the Bonus Share Fraction.

Warrant holders may cash-exercise their Warrants, or they may sell their Warrants on the open market. Cassava Sciences will receive cash proceeds only from Warrant holders who exercise their Warrants under the terms and conditions of a warrant agreement filed with the U.S. Securities and Exchange Commission ("SEC").

All Warrants will expire on Friday, November 15, 2024, at 5:00 p.m. New York City time, unless redeemed by the Company before that date. The Warrants will be redeemable by the Company on or after April 15, 2024, upon 20 calendar days' notice. Warrants will have no financial value after they expire or are redeemed by the Company, whichever comes first.

Details of Bonus Share Program

All Warrant holders may participate in the Bonus Share Program. The Bonus Share Fraction entitles a holder to receive an additional 0.5 of a share of common stock for each Warrant exercised (the "Bonus Share Fraction") without payment of any additional exercise price. The right to receive the Bonus Share Fraction will expire at 5:00 p.m. New York City time (the "Bonus Share Expiration Date") upon the earlier of (i) the first business day following the last day of the first 30 consecutive trading day period, commencing on or after January 3, 2024, in which the daily volume weighted average price ("VWAP") of the shares of common stock has been at least equal to a specified price, initially $26.40 per share, for at least 20 trading days (whether or not consecutive) (the "Bonus Price Condition") and (ii) the date specified by the Company upon not less than 20 business days' public notice. Any Warrant exercised after the Bonus Share Expiration Date will not be entitled to the Bonus Share Fraction. Cassava Sciences will make a public announcement of the Bonus Share Expiration Date (i) prior to market open on the Bonus Share Expiration Date in the case of a Bonus Price Condition and (ii) at least 20 business days prior to such date, in the case of the Company setting a Bonus Share Expiration Date.

I'll post more info once I've read into it more.

Ok, I'll post my watchlist of the stocks that have my primary attention this weekend. I'll answer questions if asked and will post buys/sells when I commit funds to a stock. I'll also post any changes to the list, adds/drops.El_duderino said:

That would be much appreciated as someone who's trying to learn and get into trading.

Warrants are something I still can't wrap my head around. I'm understanding that we have to call to exercise them, correct?

Honestly in all my years in the market I rarely, if ever, traded warrants or been in this type of situation. I will have to look into the exercising vs. selling on the open market in more detail before I'll be comfortable posting a rec. At face value from reading the headlines it seems more in my favor to exercise them. I'll have to report back when I know more. That's the best I can do right now.agdaddy04 said:

Warrants are something I still can't wrap my head around. I'm understanding that we have to call to exercise them, correct?

Weekend reading. If the Fed is lowering rates and inflation is not yet to 2%, it's not because they are claiming victory.

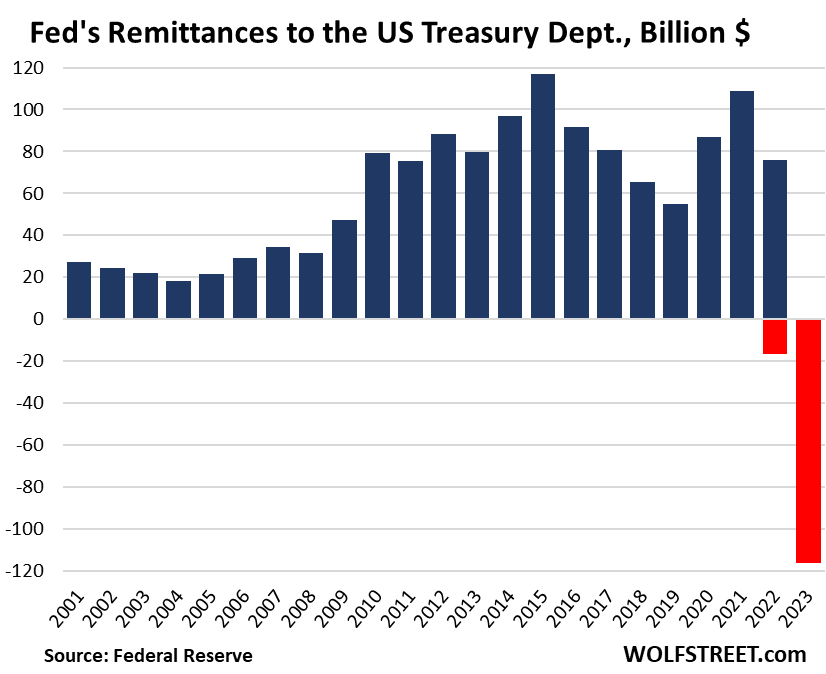

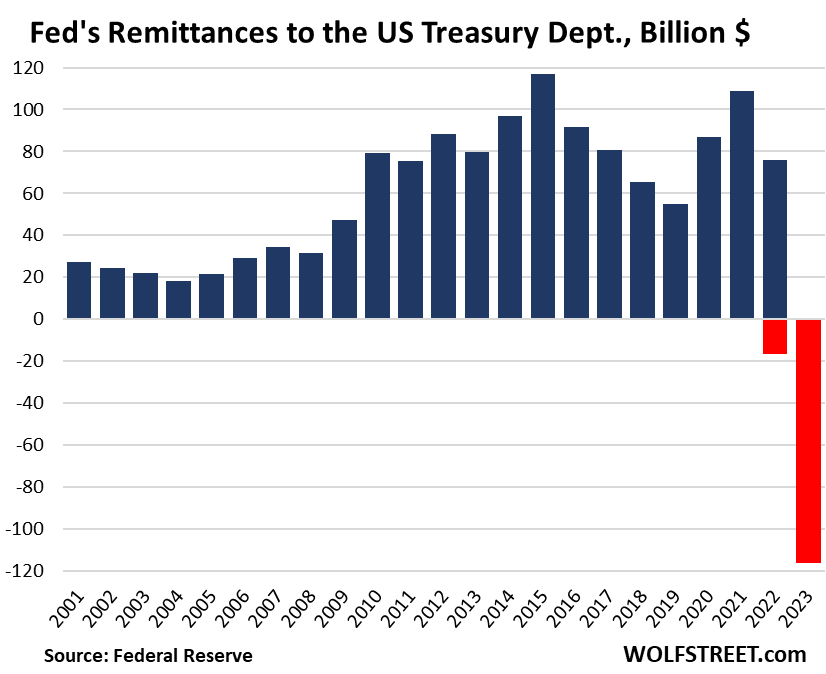

Fed Reports Operating Loss of $114 billion for 2023, as Interest Expense Blows Out | Wolf Street

When the treasury comes calling for the unending spending it so requires thanks to increasingly loose and unsustainable fiscal policy (deficit spending), and the FED isn't injecting it with cash like it was in years of lower rates, something either breaks, or the FED has to move to emergency actions to keep the engine humming.

See, the FED really doesn't have many levers it can pull to attempt to massage away natural economic cycles. The first and most innocent is to move the Federal Funds Rate.

In 2022, the FED started a 1+ year long drastic increase in Fed Funds rate to attempt to fight runaway inflation, taking the rate from near 0 to where it is today above 5%. And despite the massive increase in losses on the balance sheet when rates sustain this high, I've explained before how the losses themselves don't matter to the FED.

Through manipulative accounting, the FED doesn't count losses from period to period. Losses accumulate and are shown as a running total. And the FED can keep digging that hole and stay there until it eventually comes out of the hole. Because that running total is actually listed as a freaking ASSET on its balance sheet. Let me know if you can get away with that at your company. This article explains it in greater detail. Here's an exerpt.

How The Fed Turns A $105 Billion Loss Into An Asset | Seeking Alpha

This process can't sustain any shocks to the system. Banks liquidity will start going down. This in a time where deposits are slowing and bank balance sheets are flush with bad assets like unperforming CRE loans and rate mismatched bond holdings that if sold at PAR would turn into losses.

Still bullish banks in 2024? Can banks wait years while their balance sheets slowly decline? Better have no bank runs.

Where does this all lead?

Well, the hope (and more accurate - prayer) is that this multi-year drop in rates and return to profitability for the FED can happen smoothly. The treasury patientely awaits. Banks hold on. The fed turns proftable, pays off its "deferred assets", and the treasury eventually gets its money.

But what if it doesn't go smoothly? What if there is a shock?

That's where lever #2 comes in. Fire up the printers. In a last ditch effort when lever number 1 gets squeezed, the Fed, like in 2008 and 2020 will pull its last lever, injecting banks with fresh cash. This devalues the currency similar to your $1,000 in company A being devalued when they issue new shares. When you puy $1,000 shares of a stock valued at $1, and it drops to $0.50, and that company issues new shares, you still only have $1,000 invested. But now it will take a significantly larger move in the stock for you to even get your money back due to more equity fighting for the same increase. When the Fed expands the money supply, every $1 you have falls in value. It will then take economic growth, wage increases, and investment returns of a longer term and greater magnitude merely fo ryou to get back to where you were before on an inflation adjsuted basis. Everything in the economy will rise in value. Your $1 will be the same but chasing higher prices. This is how the FED slowly destroys the middle class for the benefit of the wealthy (banks and their beneficiaries) and the government (the treasury gets its money, and the treasury doesn't ever pay back its debt). Even people who think they are "buying up assets on the cheap" and getting those wonderful 25-35% IRR's once the bottom hits and we enter the next period of growth, on an inflation adjusted basis, they are truly making less than they would have before.

And in the event of a true crisis or shock, before the FED through any of its lever pulling can perform a multi year facade of healing, do you understand what will happen to your money in a bank that goes bankrupt? Have you researched bail ins? Because its likely coming. Where in previous shocks and downturns, banks were rescued through direct FED bailout like in 2008, if there is too much pain for the even the FED to emergency rescue, they wil authorize a bailin where your deposits are held ransom and converted to "shares" in the bank. Similar to a devalue of currency, the majority of your cash will be used to anchor the bank's balance sheet. The rest will be your "share". Likely 10% to 25% for every dollar. So the bank will have to recover and grow to point where your share is back to 100% whole, and likely higher, before they let you pull your money out. And by then, your money has been devalued from Lever #2, so its worth far less than it was when you put it in.

Are you familiar with your bank's balance sheet? Do you trust your bank? And don't simply believe because you are with Chase, Wells, or BOA that they are too big to fail. They all just as much pressure on them as other banks. And even the healthy ones will likely be expected to merge or acquire smaller ones, similar to JPM "buying" (thanks to help from the FED) SVB in 2023. Holders of deposits on both side of the transaction are devalued as the bigger bank has to first dig out of the hole the smaller bank incurred and then grow at a larger rate than before for your "share" to get back to where it was before.

And for those who want to rely on the backstop of FDIC. Sure, they can back deposits of up to $250k in the time of crisis. But this only works if its constrained to a small handful of banks, preferably smaller regional banks like SVB.

We can't have any shocks. The Fed is up against a wall and needs everything to play out EXACTLY PERFECTLY or else we face a calamity.

Fed Reports Operating Loss of $114 billion for 2023, as Interest Expense Blows Out | Wolf Street

And for the crowd that thinks we are in QT. Yes, on the surface. This was explained a couple weeks ago in weekend reading I put out. Through the RRP facility, the FED has actually been injecting liquidity into banks which is the main driver IMO that has fueled this rally. All while main street is struggling to pay bills and projecting layoffs and declining forward revenue trends. Banks are being propped up by this liquidity.Quote:

The Fed's red-ink era began in September 2022, when it started losing money after its rate hikes had increased the interest rate it pays banks for their reserve balances at the Fed (5.4% currently) and the interest rate it pays the counterparties of the overnight Reverse Repos, mostly money market funds (5.3% currently).

And those surging interest expenses have far surpassed the interest income from its now dwindling portfolio of much lower yielding securities that it had bought during QE mostly years ago since QT began in the summer of 2022, the Fed has shed $1.02 trillion in Treasury securities and $308 billion in MBS.

The total loss from operations (estimated income minus total expenses) nearly doubled to $114.3 billion in 2023 (from a loss of $58.8 billion in 2022).

And the US treasury is no longer getting its money from the FED.Quote:

Since the last rate hike in July 2023, the Fed has been paying banks 5.4% on the cash they put on deposit at the Fed ("reserve balances"); and it has been paying ON RRP counterparties, mostly money market funds, 5.3% in interest.

This increase of $178.7 billion in interest expense arose from paying banks $116.3 billion more in interest on their reserve balances in 2023 than a year earlier, and paying money market funds and other ON RRP counterparties $62.4 billion more in interest.

Quote:

The Fed is required to remit all its leftover income after paying its expenses and statutory dividends to the US Treasury Department, a form of a 100% income tax bracket.

Since 2001, the Fed has remitted $1.36 trillion to the US Treasury. Even over the first eight months in 2022, the Fed still remitted $76 billion to the US Treasury. The remittances stopped in September when it started to lose money.

Over the last months in 2022, the Fed books $16.6 billion in losses against future remittances (red for 2022 in the chart below); and in the year 2023, it booked $116.4 billion in losses against future remittances.

When the treasury comes calling for the unending spending it so requires thanks to increasingly loose and unsustainable fiscal policy (deficit spending), and the FED isn't injecting it with cash like it was in years of lower rates, something either breaks, or the FED has to move to emergency actions to keep the engine humming.

See, the FED really doesn't have many levers it can pull to attempt to massage away natural economic cycles. The first and most innocent is to move the Federal Funds Rate.

In 2022, the FED started a 1+ year long drastic increase in Fed Funds rate to attempt to fight runaway inflation, taking the rate from near 0 to where it is today above 5%. And despite the massive increase in losses on the balance sheet when rates sustain this high, I've explained before how the losses themselves don't matter to the FED.

Through manipulative accounting, the FED doesn't count losses from period to period. Losses accumulate and are shown as a running total. And the FED can keep digging that hole and stay there until it eventually comes out of the hole. Because that running total is actually listed as a freaking ASSET on its balance sheet. Let me know if you can get away with that at your company. This article explains it in greater detail. Here's an exerpt.

How The Fed Turns A $105 Billion Loss Into An Asset | Seeking Alpha

While the losses don't matter, the Treasury is what breaks this. Because it needs money. So we come to the point where the treasury comes calling. The FED is in a bind. If it prints money, it devalues the currency and signals to the economy that something is wrong. And historically, that end doesn't end well for the market over a multi-year period. The Fed wants to maintain the illusion that it's managing us into a soft landing. So lever number 1 is pulled. The Fed starts to lower the fed funds rate. It starts with an innocent timeline to not spook markets and the masses. Markets think it's because inflation is coming down and the Fed is happy with that. But in reality, it's because the Fed is praying that the Treasury can wait until it slowly comes to target, gets itself out of its hole, and can start remitting cash back to the treasury.Quote:

With regards to their operating loss, the Fed does not have anything to remit to the Treasury. They also don't want to have the loss flow through to their capital account. The Fed keeps a slim capital position of $42.7 billion, and at 2.5 times their capital, a -$105 billion loss would wipe it out.

To prevent that from happening, FAM created a new account called "Deferred Asset Remittances to the Treasury."

The Deferred Asset account is a plug account on the balance sheet, that prevents the operating loss from impacting the Fed's capital. Using the Fed's lenient accounting procedure, Voila! they turn an operating loss into an asset. In effect, they are hiding the loss.

An asset, by definition, is something of value. The Fed's Deferred Asset, however, doesn't really fit that description. It can't be sold, nor does it contribute to how the Fed runs its operations.

Quote:

At that point, instead of remitting the income to the Treasury Department, it will take this income against the negative balance in "Earnings remittances due to the U.S. Treasury" until the balance turns positive. This will likely take years. And once the balance turns positive, it will start remitting its income to the Treasury.

This process can't sustain any shocks to the system. Banks liquidity will start going down. This in a time where deposits are slowing and bank balance sheets are flush with bad assets like unperforming CRE loans and rate mismatched bond holdings that if sold at PAR would turn into losses.

The Reverse Repo facility is what has been injecting liquidity into banks. Essentially, the Fed has been "borrowing" treasury holdings from banks (the lender in this scenario) in the overnight market and paying a high rate of interest. Banks are now getting less of this liquidity, and with Fed lowering rates, they will be getting decreased interest on decreased "lending" ot the Fed. Falling deposits and falling interest income will offset any gain from bond holdings un-mismatch, at least until that mismatch is closer to zero.Quote:

ON RRP balances are returning to their normal non-QE status of zero or near zero, at which point the interest payments on ON RRPs will be minimal. ON RRPs have already dropped from over $2.2 trillion in 2022 and early 2023 to $603 billion today.

Still bullish banks in 2024? Can banks wait years while their balance sheets slowly decline? Better have no bank runs.

Where does this all lead?

Well, the hope (and more accurate - prayer) is that this multi-year drop in rates and return to profitability for the FED can happen smoothly. The treasury patientely awaits. Banks hold on. The fed turns proftable, pays off its "deferred assets", and the treasury eventually gets its money.

But what if it doesn't go smoothly? What if there is a shock?

That's where lever #2 comes in. Fire up the printers. In a last ditch effort when lever number 1 gets squeezed, the Fed, like in 2008 and 2020 will pull its last lever, injecting banks with fresh cash. This devalues the currency similar to your $1,000 in company A being devalued when they issue new shares. When you puy $1,000 shares of a stock valued at $1, and it drops to $0.50, and that company issues new shares, you still only have $1,000 invested. But now it will take a significantly larger move in the stock for you to even get your money back due to more equity fighting for the same increase. When the Fed expands the money supply, every $1 you have falls in value. It will then take economic growth, wage increases, and investment returns of a longer term and greater magnitude merely fo ryou to get back to where you were before on an inflation adjsuted basis. Everything in the economy will rise in value. Your $1 will be the same but chasing higher prices. This is how the FED slowly destroys the middle class for the benefit of the wealthy (banks and their beneficiaries) and the government (the treasury gets its money, and the treasury doesn't ever pay back its debt). Even people who think they are "buying up assets on the cheap" and getting those wonderful 25-35% IRR's once the bottom hits and we enter the next period of growth, on an inflation adjusted basis, they are truly making less than they would have before.

And in the event of a true crisis or shock, before the FED through any of its lever pulling can perform a multi year facade of healing, do you understand what will happen to your money in a bank that goes bankrupt? Have you researched bail ins? Because its likely coming. Where in previous shocks and downturns, banks were rescued through direct FED bailout like in 2008, if there is too much pain for the even the FED to emergency rescue, they wil authorize a bailin where your deposits are held ransom and converted to "shares" in the bank. Similar to a devalue of currency, the majority of your cash will be used to anchor the bank's balance sheet. The rest will be your "share". Likely 10% to 25% for every dollar. So the bank will have to recover and grow to point where your share is back to 100% whole, and likely higher, before they let you pull your money out. And by then, your money has been devalued from Lever #2, so its worth far less than it was when you put it in.

Are you familiar with your bank's balance sheet? Do you trust your bank? And don't simply believe because you are with Chase, Wells, or BOA that they are too big to fail. They all just as much pressure on them as other banks. And even the healthy ones will likely be expected to merge or acquire smaller ones, similar to JPM "buying" (thanks to help from the FED) SVB in 2023. Holders of deposits on both side of the transaction are devalued as the bigger bank has to first dig out of the hole the smaller bank incurred and then grow at a larger rate than before for your "share" to get back to where it was before.

And for those who want to rely on the backstop of FDIC. Sure, they can back deposits of up to $250k in the time of crisis. But this only works if its constrained to a small handful of banks, preferably smaller regional banks like SVB.

The FDIC CAN't and WON'T be able to rescue a large number of banks or multiple bigger banks.Quote:

According to the FDIC, $124.5 billion is currently on the agency's balance sheet, with an additional $100 billion line of credit available from the U.S. Treasury, for a total of $224.5 billion.

We can't have any shocks. The Fed is up against a wall and needs everything to play out EXACTLY PERFECTLY or else we face a calamity.

That is a tough read, not because of the financial concepts, but the alarming nature.

Seems owning assets (preferably income producing) is better than money sitting in the bank, but don't have enough experience in that area yet myself.

Seems owning assets (preferably income producing) is better than money sitting in the bank, but don't have enough experience in that area yet myself.

Yes, better, but again, there's really no way to perform better (in a scenario where they devalue our currency) than you would have had they not and we experienced un-"managed" real economic cycles. This has been going on since the creation of The Federal Reserve. This marriage of the FED and government was how the government could conttinue to grow and spend without repercussion and the uber wealthy class (think JP Morgan himself, Rockafellers, etc) and banks could roll their losses onto the backs of the middle class and maintain their position and holding.ravingfans said:

That is a tough read, not because of the financial concepts, but the alarming nature.

Seems owning assets (preferably income producing) is better than money sitting in the bank, but don't have enough experience in that area yet myself.

Fistful of Dollars: How the Federal Reserve destroyed America | IBTimes

But the real kicker here and the question we should ask.. what happens if the FED doesn't follow historical norms and pull the levers like they always have? We are in FAR worse economic position and the FED is in far worse position than any other time in our lives that they have done this. What if the FED defaults?

I'm not predicting it, but I think it's prudent to give it a thought exercise, if nothing else, than to be prepared. Because the result would be massive DEFLATION which is FAR FAR more hurtful than hyperinflation.

We cannot ever go back to the way things were unless the FED were to break historical norms and FAIL to act. And the process of going back would be very painful.

I've sensed some of this as a finance layman, particularly the rock and a hard place the banks are in between unrealized losses and CRE situation, this drill down is very helpful. Question is what to do. Doesn't seem like there's anything completely safe especially if a good portion of wealth is in a 401k. I've distributed cash holdings between several banks. Cash generating RE can mean different things and different probability of success. STRs are already struggling. In a recession they are going to get clobbered. Rents depend on people having jobs. Servicing debt on RE often depends on the owner having a job as well. Owning RE free and clear is maybe the best starting position.

Interesting discussion recently with my 91yo FIL. He made a comment that stuck with me about the Great Depression. "Farmers ate". He grew up on a small farm in MN. Meals were sporadic for non-farmers. He also talked about a relative that had a large farm that had a mortgage. They lost that farm to the bank.

Interesting discussion recently with my 91yo FIL. He made a comment that stuck with me about the Great Depression. "Farmers ate". He grew up on a small farm in MN. Meals were sporadic for non-farmers. He also talked about a relative that had a large farm that had a mortgage. They lost that farm to the bank.

ProgN said:https://www.cassavasciences.com/news-releases/news-release-details/cassava-sciences-announces-dividend-distribution-warrantsTexas Tea said:Charismatic Megafauna said:

Sava ran today, and closed above the magical 26.4 price that somehow impacts the warrants (which doubled today). I think I'm going to exercise my warrants to get the bonus shares but it looks like I'll have to call fidelity to do that. Anybody looked into it yet?

I was looking at exercising my warrants today but it appears to me that if I sell the warrants and just buy the stock, I'll come out ahead. Am I missing something?

https://www.cassavasciences.com/news-releases/news-release-details/cassava-sciences-completes-dividend-distribution-warrantsI haven't had time to look thoroughly into the details but at first glance it looks like you get more shares for your buck if exercised within the first 30 days or you can just sell the warrants. If that is the case then I'll exercise and get the bonus shares.Quote:

AUSTIN, Texas, Jan. 05, 2024 (GLOBE NEWSWIRE) -- Cassava Sciences, Inc. (Nasdaq: SAVA) ("Cassava Sciences" or the "Company") today announced the completion of a previously announced distribution of warrants (the "Warrants") to its shareholders. The Warrants now trade on Nasdaq under the ticker SAVAW.

Stockholders received four (4) Warrants for each ten (10) shares of the Company's common stock held as of December 22, 2023 (the "Record Date"), rounded down to the nearest whole number for any fractional warrant. As an example, a shareholder who owned 1,000 shares of Cassava Sciences as of the Record Date received a distribution of 400 Warrants on January 3, 2024. Each Warrant entitles the holder to purchase, at the holder's sole and exclusive election, one share of Cassava Sciences' common stock at an initial exercise price of $33.00 per share plus, as applicable and as described below, the Bonus Share Fraction.

Warrant holders may cash-exercise their Warrants, or they may sell their Warrants on the open market. Cassava Sciences will receive cash proceeds only from Warrant holders who exercise their Warrants under the terms and conditions of a warrant agreement filed with the U.S. Securities and Exchange Commission ("SEC").

All Warrants will expire on Friday, November 15, 2024, at 5:00 p.m. New York City time, unless redeemed by the Company before that date. The Warrants will be redeemable by the Company on or after April 15, 2024, upon 20 calendar days' notice. Warrants will have no financial value after they expire or are redeemed by the Company, whichever comes first.

Details of Bonus Share Program

All Warrant holders may participate in the Bonus Share Program. The Bonus Share Fraction entitles a holder to receive an additional 0.5 of a share of common stock for each Warrant exercised (the "Bonus Share Fraction") without payment of any additional exercise price. The right to receive the Bonus Share Fraction will expire at 5:00 p.m. New York City time (the "Bonus Share Expiration Date") upon the earlier of (i) the first business day following the last day of the first 30 consecutive trading day period, commencing on or after January 3, 2024, in which the daily volume weighted average price ("VWAP") of the shares of common stock has been at least equal to a specified price, initially $26.40 per share, for at least 20 trading days (whether or not consecutive) (the "Bonus Price Condition") and (ii) the date specified by the Company upon not less than 20 business days' public notice. Any Warrant exercised after the Bonus Share Expiration Date will not be entitled to the Bonus Share Fraction. Cassava Sciences will make a public announcement of the Bonus Share Expiration Date (i) prior to market open on the Bonus Share Expiration Date in the case of a Bonus Price Condition and (ii) at least 20 business days prior to such date, in the case of the Company setting a Bonus Share Expiration Date.

I'll post more info once I've read into it more.

Thank you for your response. You are correct about the bonus, however there is one important caveat. The exercise price on the warrants is $33 before the bonus. With SAVA trading at $26.27 it makes no sense to exercise without the bonus. The warrants closed yesterday at $9 so, if my math is correct, by selling the warrants and buying the shares, you come out around 1.73/share ahead. Of course, the warrants should decrease in value, relative to the stock, as the bonus expiration nears. Long story short, I am just curious as to why this arbitrage opportunity exists at all or if I am missing something.

On a side note, if I had time yesterday, I was going to sell inside the money puts expiring yesterday to pick up shares a little cheaper (and sell the warrants). Prior to discovering this thread a few years ago, I wouldn't have the knowledge (or confidence) to attempt that. So I appreciate everyone that has contributed to this thread over the years, and you're near the top of that list.

Debt free farmland, a decent herd, and some precious metals will be worth a lot more than NVDA or TSLA in that scenario

Thanks for the explanation...makes sense. I'll probably do the same.Charismatic Megafauna said:

Yeah the math right now seems to favor selling the warrants and buying the shares, and you could probably sell the warrants then wait and get an even better entry for the shares, but i think the conscientious investor assumes that the shorts are buying warrants as insurance to be able to cover at $22/shr, so instead you exercise the warrants to demand the shares they represent. Not sure I'm willing to make that donation to the cause, but i probably will

jagvocate said:

Debt free farmland, a decent herd, and some precious metals will be worth a lot more than NVDA or TSLA in that scenario

100% agree but that's practically impossible for most Americans.

Last year, I started following bond markets and ran across a couple of people on youtube that have been talking about the very thing that Heineken-Ashi has posted for weekend reading. It's quite ominous, but good on him for fleshing it out here.

I am with Schwab and have been a novice user with their StreetSmart Edge platform for a few years. They are killing that off and switching to ToS. Once they approve me for ToS, I will lose access to StreetSmart, which I assume will be next week.

I primarily look at a chart with +/- 1, 2, 3 ATR, 8 & 21 EMA, and the upper, mid & lower Bollinger bands. I also have RSI and volume charts below this main chart. I think this should be pretty simple, but I'll need to know ToS terms for the ATR lines. They're setup with Keltner channels in StreetSmart Edge. Are the ATR lines labeled as ATR or Keltner when trying to set it up?

I have some other charts, but they're similar to my main one so I'll be able to set them up once I have the above setup figured out.

At one point there was a third party option chart, but they took that away several years ago. Is there a self explanatory option candle chart showing daily pricing and volume in ToS?

I've never been able to figure out the screener very well. Is it simple enough to use in ToS?

Does anybody have links to other setups they use for ToS, possibly just a direct link to a post in this thread? Is there a dedicated thread where users have posted their setups for ToS? Just looking for some additional tools to use once I figure out my basic charts I have been using.

I primarily look at a chart with +/- 1, 2, 3 ATR, 8 & 21 EMA, and the upper, mid & lower Bollinger bands. I also have RSI and volume charts below this main chart. I think this should be pretty simple, but I'll need to know ToS terms for the ATR lines. They're setup with Keltner channels in StreetSmart Edge. Are the ATR lines labeled as ATR or Keltner when trying to set it up?

I have some other charts, but they're similar to my main one so I'll be able to set them up once I have the above setup figured out.

At one point there was a third party option chart, but they took that away several years ago. Is there a self explanatory option candle chart showing daily pricing and volume in ToS?

I've never been able to figure out the screener very well. Is it simple enough to use in ToS?

Does anybody have links to other setups they use for ToS, possibly just a direct link to a post in this thread? Is there a dedicated thread where users have posted their setups for ToS? Just looking for some additional tools to use once I figure out my basic charts I have been using.

Has anyone done a deep dive into bank balance sheets to see who is in better shape to weather a storm? I've been looking to move away from Wells.

I'm going to drill this down deeper because there is still a tiny bit of time to prepare. But worst case is that your eyes are opened and you know the playbook going forward on the true purpose of the FED, how they work, and who benefits.

Assuming worst case scenario doesn't happen (FED default and massive deflation - which would likely usher in the "new world order and CBDC conspiracy theories), the only way you survive these events is having a large enough cash position to buy up cheap assets at the bottom and hold them for 5-10 years, potentially rolling gains into new investments, until the next crash.

Again, that method looks great on paper and can make you wealthy in real dollars.. it's what every CRE equity company, every institutional investor, every hedge fund manager does every time this happens. They call it the "generational buying opportunity". But again, in inflation adjusted dollars, while you still have real gains, it's a fraction of what you would have had in an unmanipulated real economy that incentivized real growth and real savings.

This is why the wealthy don't care who's elected and why both parties seem to never effect real change. They know the playbook. They know what these fed created cycles do for their bottom line. They ENCOURAGE them. Why do you think so many CRE deals traded between 2020 and 2022? These people had COVID as the shock that the end of a cycle was coming. They always have the warning shot. 2000 dotcom bubble burst was the warning shot for 2008. The main street analysts, seeking alpha word vomit article writers, and backward thinkers take the warning shot as the top and freak out and miss out on the last wave of gains and last chance to exit at the real top. Which is this year for stocks. It was 2021 for most commercial real estate. The smart ones got out and went to cash and are waiting for 2025/2026 when the bottom hits to redeploy and ride the wheel back up.

Many of the wealthy and beneficiaries of these cycles don't truly understand the playbook. They merely know it happens periodically and are smart enough and sometimes lucky enough to recognize trends and profit off of it. Whether you're enlightened or just luck smart, you are the top winner over time. But the real kicker is that it could have been better without this FED managed roller coaster. Real investment, natural cycles, real savings that provide real returns for ALL of the economy. Instead, we get thee manipulated cycles that ONLY benefit the wealthy and continuously grow the gap between haves and have nots. Because in the downturns, the middle class and lower class get crushed. The wealthy are the only ones with the capital to benefit from buying assets the bottom.

Once you realize all of this, you realize that people in the upper middle can at best marginally benefit. They swing from middle in downturns to upper middle in upswings. The truly dedicated and opportunistic, hard working and determined, might move up to the lower end of the wealthy class. But most won't because they merely don't have the capital. And they weren't prepared by the time the event happens.

Many in the middle class will swing down badly. They don't know how this works and how to prepare and they get CRUSHED and have to start over.

In the event of the worst case scenario, only the very top elite will survive. Very very top. The general wealthy class will finally lose to the benefit of the mega wealthy. Because if the FED defaults and can't manage another upswing, everyone outside of the black rocks and JPM types will buy assets thinking it's like every other time. But those assets will continue to decline and deflate until those people are forced to liquidate or default at which point the biggest banks and mega wealthy will be the only one left to scoop them up.

Do you get it now? Once you get it, it's absolutely mind numbingly eye opening and you can never be ignorant and just live day to day ever again. You will still trade stocks and still make money. But you will always know this and always be preparing and trying to get to the next level, knowing you ultimately have no chance of not being eventually crushed, and it scares the ever living **** out of you.

Is the approaching downturn going to be a normal swing providing a buying opportunity for the wealthy, one which upper middle can marginally participate through LP's and stock buying and get scraps off of? Or will it finally be the end of the line and the big one that crushes everyone? We don't know. And we don't know when it will start. The warning signs were evident for years. COVID was the last warning. It was the secret transcribed telegram to the haves to get themselves prepared. But even in the worst case scenario, the warning is meant to suck them in so the mega players can crush them and scoop up their assets. Again, we don't know which this will be. But an event is coming. It's almost inevitable. Are you preparing? Not to become wealthy? But to not get wiped out?

Lastly, let's clear up gold. Gold does NOT perform like the assets I'm talking about. It will merely run up in the events leading to and during this process, and then will get crushed back down like everything else. Don't believe me? Go look up the gold chart and look at every economic downturn. You buy gold now with plan to SELL before the bottom happens, and maybe even before the top.

Edit: One more thing. The bond market will also crash. It is not a safe haven in these events. I think many of us are hoping BTC will be the safe haven. I truly believe in it long term. But not sure it wont too swing. We've now given institutions the ability to leverage it and attempt to manipulate it the same way we gave them that ability with physical metals years ago. While it's great for further adoption of the technology and platform, it's potentially crushing for the long term bullish outlook.

Assuming worst case scenario doesn't happen (FED default and massive deflation - which would likely usher in the "new world order and CBDC conspiracy theories), the only way you survive these events is having a large enough cash position to buy up cheap assets at the bottom and hold them for 5-10 years, potentially rolling gains into new investments, until the next crash.

Again, that method looks great on paper and can make you wealthy in real dollars.. it's what every CRE equity company, every institutional investor, every hedge fund manager does every time this happens. They call it the "generational buying opportunity". But again, in inflation adjusted dollars, while you still have real gains, it's a fraction of what you would have had in an unmanipulated real economy that incentivized real growth and real savings.

This is why the wealthy don't care who's elected and why both parties seem to never effect real change. They know the playbook. They know what these fed created cycles do for their bottom line. They ENCOURAGE them. Why do you think so many CRE deals traded between 2020 and 2022? These people had COVID as the shock that the end of a cycle was coming. They always have the warning shot. 2000 dotcom bubble burst was the warning shot for 2008. The main street analysts, seeking alpha word vomit article writers, and backward thinkers take the warning shot as the top and freak out and miss out on the last wave of gains and last chance to exit at the real top. Which is this year for stocks. It was 2021 for most commercial real estate. The smart ones got out and went to cash and are waiting for 2025/2026 when the bottom hits to redeploy and ride the wheel back up.

Many of the wealthy and beneficiaries of these cycles don't truly understand the playbook. They merely know it happens periodically and are smart enough and sometimes lucky enough to recognize trends and profit off of it. Whether you're enlightened or just luck smart, you are the top winner over time. But the real kicker is that it could have been better without this FED managed roller coaster. Real investment, natural cycles, real savings that provide real returns for ALL of the economy. Instead, we get thee manipulated cycles that ONLY benefit the wealthy and continuously grow the gap between haves and have nots. Because in the downturns, the middle class and lower class get crushed. The wealthy are the only ones with the capital to benefit from buying assets the bottom.

Once you realize all of this, you realize that people in the upper middle can at best marginally benefit. They swing from middle in downturns to upper middle in upswings. The truly dedicated and opportunistic, hard working and determined, might move up to the lower end of the wealthy class. But most won't because they merely don't have the capital. And they weren't prepared by the time the event happens.

Many in the middle class will swing down badly. They don't know how this works and how to prepare and they get CRUSHED and have to start over.

In the event of the worst case scenario, only the very top elite will survive. Very very top. The general wealthy class will finally lose to the benefit of the mega wealthy. Because if the FED defaults and can't manage another upswing, everyone outside of the black rocks and JPM types will buy assets thinking it's like every other time. But those assets will continue to decline and deflate until those people are forced to liquidate or default at which point the biggest banks and mega wealthy will be the only one left to scoop them up.

Do you get it now? Once you get it, it's absolutely mind numbingly eye opening and you can never be ignorant and just live day to day ever again. You will still trade stocks and still make money. But you will always know this and always be preparing and trying to get to the next level, knowing you ultimately have no chance of not being eventually crushed, and it scares the ever living **** out of you.

Is the approaching downturn going to be a normal swing providing a buying opportunity for the wealthy, one which upper middle can marginally participate through LP's and stock buying and get scraps off of? Or will it finally be the end of the line and the big one that crushes everyone? We don't know. And we don't know when it will start. The warning signs were evident for years. COVID was the last warning. It was the secret transcribed telegram to the haves to get themselves prepared. But even in the worst case scenario, the warning is meant to suck them in so the mega players can crush them and scoop up their assets. Again, we don't know which this will be. But an event is coming. It's almost inevitable. Are you preparing? Not to become wealthy? But to not get wiped out?

Lastly, let's clear up gold. Gold does NOT perform like the assets I'm talking about. It will merely run up in the events leading to and during this process, and then will get crushed back down like everything else. Don't believe me? Go look up the gold chart and look at every economic downturn. You buy gold now with plan to SELL before the bottom happens, and maybe even before the top.

Edit: One more thing. The bond market will also crash. It is not a safe haven in these events. I think many of us are hoping BTC will be the safe haven. I truly believe in it long term. But not sure it wont too swing. We've now given institutions the ability to leverage it and attempt to manipulate it the same way we gave them that ability with physical metals years ago. While it's great for further adoption of the technology and platform, it's potentially crushing for the long term bullish outlook.

You have to pay, but yes. SaferBankingResearch - Identifying some of the strongest banksEast Dallas Ag said:

Has anyone done a deep dive into bank balance sheets to see who is in better shape to weather a storm? I've been looking to move away from Wells.

They have a bunch of free articles on seekingalpha over the last couple of years warning of whats coming.

Two of the very best a doing this was Bonfire96 and AustinAg90 but they no longer post here. AustinAg was burned by someone here and that betrayal and risk it caused to him made it not worth it. Bonfire96 was perma'd because moderation took issue with his stance/punishment against child predators.East Dallas Ag said:

Has anyone done a deep dive into bank balance sheets to see who is in better shape to weather a storm? I've been looking to move away from Wells.

That said, I stay in contact with them offsite regularly and can pass on your questions. Should they choose, then I'll get you in touch with them. You have stars, so PM me the questions. I'll pass them along and ask if they'd mind talking to you.

They're my go sources when it comes banks and analyzing their strengths and weaknesses. I'm grateful they are now my friends.

I don't have the knowledge many on here have but is what I am doing.

I am 67 now and for most of my adult life have been fully invested in the stock market. But now I am sitting on more cash than ever and also have about $1M in the stock market, which is probably too much. We live in San Antonio but also have a house in College Station so we have a fair amount of wealth in RE. And when my 95 yo FIL no longer has us tethered to SA we will sell our house and move somewhere. Probably Aggieland.

I feel the markets are artificially high now because of many things mentioned in this thread. Cash and ONE house is where I want most of our wealth sitting but FOMO keeps me in the market.

Wish I owned a ranch with cattle and deer and a big lock on a big gate. But if things do become chaos we do have a ranch or 2 we can run to.

I am 67 now and for most of my adult life have been fully invested in the stock market. But now I am sitting on more cash than ever and also have about $1M in the stock market, which is probably too much. We live in San Antonio but also have a house in College Station so we have a fair amount of wealth in RE. And when my 95 yo FIL no longer has us tethered to SA we will sell our house and move somewhere. Probably Aggieland.

I feel the markets are artificially high now because of many things mentioned in this thread. Cash and ONE house is where I want most of our wealth sitting but FOMO keeps me in the market.

Wish I owned a ranch with cattle and deer and a big lock on a big gate. But if things do become chaos we do have a ranch or 2 we can run to.

This is out of "left field", but wondering what folks on here think of Cracker Barrel stock (CBRL). Each location I've visited in last 6 months seem to be packed. Their stock has been in a downward trend over the last 2.5 yrs, but yield a compelling 7%+ div. Worth a consideration given their div payout?

Heineken-Ashi said:

I'm going to drill this down deeper because there is still a tiny bit of time to prepare. But worst case is that your eyes are opened and you know the playbook going forward on the true purpose of the FED, how they work, and who benefits.

Assuming worst case scenario doesn't happen (FED default and massive deflation - which would likely usher in the "new world order and CBDC conspiracy theories), the only way you survive these events is having a large enough cash position to buy up cheap assets at the bottom and hold them for 5-10 years, potentially rolling gains into new investments, until the next crash.

Again, that method looks great on paper and can make you wealthy in real dollars.. it's what every CRE equity company, every institutional investor, every hedge fund manager does every time this happens. They call it the "generational buying opportunity". But again, in inflation adjusted dollars, while you still have real gains, it's a fraction of what you would have had in an unmanipulated real economy that incentivized real growth and real savings.

This is why the wealthy don't care who's elected and why both parties seem to never effect real change. They know the playbook. They know what these fed created cycles do for their bottom line. They ENCOURAGE them. Why do you think so many CRE deals traded between 2020 and 2022? These people had COVID as the shock that the end of a cycle was coming. They always have the warning shot. 2000 dotcom bubble burst was the warning shot for 2008. The main street analysts, seeking alpha word vomit article writers, and backward thinkers take the warning shot as the top and freak out and miss out on the last wave of gains and last chance to exit at the real top. Which is this year for stocks. It was 2021 for most commercial real estate. The smart ones got out and went to cash and are waiting for 2025/2026 when the bottom hits to redeploy and ride the wheel back up.

Many of the wealthy and beneficiaries of these cycles don't truly understand the playbook. They merely know it happens periodically and are smart enough and sometimes lucky enough to recognize trends and profit off of it. Whether you're enlightened or just luck smart, you are the top winner over time. But the real kicker is that it could have been better without this FED managed roller coaster. Real investment, natural cycles, real savings that provide real returns for ALL of the economy. Instead, we get thee manipulated cycles that ONLY benefit the wealthy and continuously grow the gap between haves and have nots. Because in the downturns, the middle class and lower class get crushed. The wealthy are the only ones with the capital to benefit from buying assets the bottom.

Once you realize all of this, you realize that people in the upper middle can at best marginally benefit. They swing from middle in downturns to upper middle in upswings. The truly dedicated and opportunistic, hard working and determined, might move up to the lower end of the wealthy class. But most won't because they merely don't have the capital. And they weren't prepared by the time the event happens.

Many in the middle class will swing down badly. They don't know how this works and how to prepare and they get CRUSHED and have to start over.

In the event of the worst case scenario, only the very top elite will survive. Very very top. The general wealthy class will finally lose to the benefit of the mega wealthy. Because if the FED defaults and can't manage another upswing, everyone outside of the black rocks and JPM types will buy assets thinking it's like every other time. But those assets will continue to decline and deflate until those people are forced to liquidate or default at which point the biggest banks and mega wealthy will be the only one left to scoop them up.

Do you get it now? Once you get it, it's absolutely mind numbingly eye opening and you can never be ignorant and just live day to day ever again. You will still trade stocks and still make money. But you will always know this and always be preparing and trying to get to the next level, knowing you ultimately have no chance of not being eventually crushed, and it scares the ever living **** out of you.

Is the approaching downturn going to be a normal swing providing a buying opportunity for the wealthy, one which upper middle can marginally participate through LP's and stock buying and get scraps off of? Or will it finally be the end of the line and the big one that crushes everyone? We don't know. And we don't know when it will start. The warning signs were evident for years. COVID was the last warning. It was the secret transcribed telegram to the haves to get themselves prepared. But even in the worst case scenario, the warning is meant to suck them in so the mega players can crush them and scoop up their assets. Again, we don't know which this will be. But an event is coming. It's almost inevitable. Are you preparing? Not to become wealthy? But to not get wiped out?

Lastly, let's clear up gold. Gold does NOT perform like the assets I'm talking about. It will merely run up in the events leading to and during this process, and then will get crushed back down like everything else. Don't believe me? Go look up the gold chart and look at every economic downturn. You buy gold now with plan to SELL before the bottom happens, and maybe even before the top.

Edit: One more thing. The bond market will also crash. It is not a safe haven in these events. I think many of us are hoping BTC will be the safe haven. I truly believe in it long term. But not sure it wont too swing. We've now given institutions the ability to leverage it and attempt to manipulate it the same way we gave them that ability with physical metals years ago. While it's great for further adoption of the technology and platform, it's potentially crushing for the long term bullish outlook.

So what are you doing to prepare for this economic implosion old wise wizard? What do you do for a living?

This is the second thread you have posted on with a condescending tone in your posts. I don't think you actually care what I say and am bordering on not giving you the time of day. But I don't post this stuff to fluff my own feathers. So I will respond respectfully.WestHoustonAg79 said:Heineken-Ashi said:

I'm going to drill this down deeper because there is still a tiny bit of time to prepare. But worst case is that your eyes are opened and you know the playbook going forward on the true purpose of the FED, how they work, and who benefits.

Assuming worst case scenario doesn't happen (FED default and massive deflation - which would likely usher in the "new world order and CBDC conspiracy theories), the only way you survive these events is having a large enough cash position to buy up cheap assets at the bottom and hold them for 5-10 years, potentially rolling gains into new investments, until the next crash.

Again, that method looks great on paper and can make you wealthy in real dollars.. it's what every CRE equity company, every institutional investor, every hedge fund manager does every time this happens. They call it the "generational buying opportunity". But again, in inflation adjusted dollars, while you still have real gains, it's a fraction of what you would have had in an unmanipulated real economy that incentivized real growth and real savings.

This is why the wealthy don't care who's elected and why both parties seem to never effect real change. They know the playbook. They know what these fed created cycles do for their bottom line. They ENCOURAGE them. Why do you think so many CRE deals traded between 2020 and 2022? These people had COVID as the shock that the end of a cycle was coming. They always have the warning shot. 2000 dotcom bubble burst was the warning shot for 2008. The main street analysts, seeking alpha word vomit article writers, and backward thinkers take the warning shot as the top and freak out and miss out on the last wave of gains and last chance to exit at the real top. Which is this year for stocks. It was 2021 for most commercial real estate. The smart ones got out and went to cash and are waiting for 2025/2026 when the bottom hits to redeploy and ride the wheel back up.

Many of the wealthy and beneficiaries of these cycles don't truly understand the playbook. They merely know it happens periodically and are smart enough and sometimes lucky enough to recognize trends and profit off of it. Whether you're enlightened or just luck smart, you are the top winner over time. But the real kicker is that it could have been better without this FED managed roller coaster. Real investment, natural cycles, real savings that provide real returns for ALL of the economy. Instead, we get thee manipulated cycles that ONLY benefit the wealthy and continuously grow the gap between haves and have nots. Because in the downturns, the middle class and lower class get crushed. The wealthy are the only ones with the capital to benefit from buying assets the bottom.

Once you realize all of this, you realize that people in the upper middle can at best marginally benefit. They swing from middle in downturns to upper middle in upswings. The truly dedicated and opportunistic, hard working and determined, might move up to the lower end of the wealthy class. But most won't because they merely don't have the capital. And they weren't prepared by the time the event happens.

Many in the middle class will swing down badly. They don't know how this works and how to prepare and they get CRUSHED and have to start over.

In the event of the worst case scenario, only the very top elite will survive. Very very top. The general wealthy class will finally lose to the benefit of the mega wealthy. Because if the FED defaults and can't manage another upswing, everyone outside of the black rocks and JPM types will buy assets thinking it's like every other time. But those assets will continue to decline and deflate until those people are forced to liquidate or default at which point the biggest banks and mega wealthy will be the only one left to scoop them up.

Do you get it now? Once you get it, it's absolutely mind numbingly eye opening and you can never be ignorant and just live day to day ever again. You will still trade stocks and still make money. But you will always know this and always be preparing and trying to get to the next level, knowing you ultimately have no chance of not being eventually crushed, and it scares the ever living **** out of you.

Is the approaching downturn going to be a normal swing providing a buying opportunity for the wealthy, one which upper middle can marginally participate through LP's and stock buying and get scraps off of? Or will it finally be the end of the line and the big one that crushes everyone? We don't know. And we don't know when it will start. The warning signs were evident for years. COVID was the last warning. It was the secret transcribed telegram to the haves to get themselves prepared. But even in the worst case scenario, the warning is meant to suck them in so the mega players can crush them and scoop up their assets. Again, we don't know which this will be. But an event is coming. It's almost inevitable. Are you preparing? Not to become wealthy? But to not get wiped out?

Lastly, let's clear up gold. Gold does NOT perform like the assets I'm talking about. It will merely run up in the events leading to and during this process, and then will get crushed back down like everything else. Don't believe me? Go look up the gold chart and look at every economic downturn. You buy gold now with plan to SELL before the bottom happens, and maybe even before the top.

Edit: One more thing. The bond market will also crash. It is not a safe haven in these events. I think many of us are hoping BTC will be the safe haven. I truly believe in it long term. But not sure it wont too swing. We've now given institutions the ability to leverage it and attempt to manipulate it the same way we gave them that ability with physical metals years ago. While it's great for further adoption of the technology and platform, it's potentially crushing for the long term bullish outlook.

So what are you doing to prepare for this economic implosion old wise wizard? What do you do for a living?

I am long with sizeable positions in metals and miners for the run up. Will sell most of my position when signs of major top is forming. Could be this year. Could be a couple years from now. I do hold some physical metals as a pure hedge. The value of them doesn't matter. It's a long-term hedge purchased with money that was set aside for that specific purpose.

I have a modest position in BTC and BTC miners. Wish I would have gotten in years ago, but glad I have something. A portion is HODL and rest will be sold when it hits $100k, If we show signs of major top having already happened or happening closer to current levels, I will start exiting some small tranches of the tradeable portion.

I am currently about 65-70% cash. I don't expect that to change unless SPX dips to 4600 level or whatever a 50% retrace to November from the top would be, holds support, and reverses. I will likely deploy some cash for the runup to 5k. When approaching it, I will be exiting back to my 65-70% cash position. And if we get a BIG drop, I will wait for the retrace up to go to 90-95% cash.

I am currently long on TLT with a small position formed in November. I'm expecting/hoping for $120 minimum target to exit 75%-80% of that position. The next major move down could be the first in a series of legs that takes it to new lows. So I don't want much if any risk there. If you are holding bonds and can afford to hold through maturity and bond prices start collapsing, just hold them. You can't lose if you don't have to lose. Long term bonds might be scarier as a complete collapse would be unprecedented. I frankly don't know what would happen and have stayed away from direct holdings of long term treasuries.

I play options on volatility and correlations to major indexes in a trading group. So I will likely be deploying some cash when downside setups present and hopefully profiting off any major moves should the market drop significantly.

Real estate myself and my family owns is no higher than 70% leveraged. Most is paid off. So I can stomach a 30% drop in RE prices. And a further drop is not something that can be planned for, nor could you truly plan for the economic calamity that would be going on around you with job status and the such. I like to think I'm in a relatively safe space and could wait out any event. Like I said in the posts above, if you aren't positioned to get wealthy from these events, are you at least positioned to not get wiped out? If you have a job that could go away with a major market downturn, and you own a 90% leveraged house, and RE prices drop 30%, you are at major risk of foreclosure if you don't have a sizeable cash position that could be liquidated to meet your families needs and debt requirements.

Like I've stated multiple times, the warning signs have been flashing and growing more steady for years. COVID was a major shock and 2022 was even a minor shock. If you aren't preapring for a scenario like the ones I've gone into detail about, for the purpose of maintaining you and your families status and preserving as much capital as possible, then you are at major risk. At least have a plan.

Could I be wrong about all of this and the FED. Sure. Though history isn't in favor it. Could the FED perform a stick save and soft landing and this economy and market stay range bound or even go significantly higher? SURE! But are you betting on it? Is it your base case with history showing inflation comes in segments of 3 - a sharp rise followed by a cool off culminating in a sharper rise, and us being in the cool off? Is banking on things chugging forward and recovering quickly the smart thing to do with record debt, deficits, credit exposure, potentially sticky interest rates, and the FED underwater on its obligations with the treasury STILL spending?

All I'm saying is to evaluate your investments and your financial position. Figure out what it would look like in a minor downturn. Figure out what it would look like in a major downturn. Identify changes you could make quickly to stabilize your position. Identify where the liquidity could from should you need it. These are things you should ALWAYS know. But if you don't, in this environment, why wouldn't you now with an election of the same two candidates that produced absolutely turbulent times just 4 years ago?

Heineken-Ashi said:This is the second thread you have posted on with a condescending tone in your posts. I don't think you actually care what I say and am bordering on not giving you the time of day. But I don't post this stuff to fluff my own feathers. So I will respond respectfully.WestHoustonAg79 said:Heineken-Ashi said:

I'm going to drill this down deeper because there is still a tiny bit of time to prepare. But worst case is that your eyes are opened and you know the playbook going forward on the true purpose of the FED, how they work, and who benefits.

Assuming worst case scenario doesn't happen (FED default and massive deflation - which would likely usher in the "new world order and CBDC conspiracy theories), the only way you survive these events is having a large enough cash position to buy up cheap assets at the bottom and hold them for 5-10 years, potentially rolling gains into new investments, until the next crash.

Again, that method looks great on paper and can make you wealthy in real dollars.. it's what every CRE equity company, every institutional investor, every hedge fund manager does every time this happens. They call it the "generational buying opportunity". But again, in inflation adjusted dollars, while you still have real gains, it's a fraction of what you would have had in an unmanipulated real economy that incentivized real growth and real savings.

This is why the wealthy don't care who's elected and why both parties seem to never effect real change. They know the playbook. They know what these fed created cycles do for their bottom line. They ENCOURAGE them. Why do you think so many CRE deals traded between 2020 and 2022? These people had COVID as the shock that the end of a cycle was coming. They always have the warning shot. 2000 dotcom bubble burst was the warning shot for 2008. The main street analysts, seeking alpha word vomit article writers, and backward thinkers take the warning shot as the top and freak out and miss out on the last wave of gains and last chance to exit at the real top. Which is this year for stocks. It was 2021 for most commercial real estate. The smart ones got out and went to cash and are waiting for 2025/2026 when the bottom hits to redeploy and ride the wheel back up.

Many of the wealthy and beneficiaries of these cycles don't truly understand the playbook. They merely know it happens periodically and are smart enough and sometimes lucky enough to recognize trends and profit off of it. Whether you're enlightened or just luck smart, you are the top winner over time. But the real kicker is that it could have been better without this FED managed roller coaster. Real investment, natural cycles, real savings that provide real returns for ALL of the economy. Instead, we get thee manipulated cycles that ONLY benefit the wealthy and continuously grow the gap between haves and have nots. Because in the downturns, the middle class and lower class get crushed. The wealthy are the only ones with the capital to benefit from buying assets the bottom.

Once you realize all of this, you realize that people in the upper middle can at best marginally benefit. They swing from middle in downturns to upper middle in upswings. The truly dedicated and opportunistic, hard working and determined, might move up to the lower end of the wealthy class. But most won't because they merely don't have the capital. And they weren't prepared by the time the event happens.

Many in the middle class will swing down badly. They don't know how this works and how to prepare and they get CRUSHED and have to start over.

In the event of the worst case scenario, only the very top elite will survive. Very very top. The general wealthy class will finally lose to the benefit of the mega wealthy. Because if the FED defaults and can't manage another upswing, everyone outside of the black rocks and JPM types will buy assets thinking it's like every other time. But those assets will continue to decline and deflate until those people are forced to liquidate or default at which point the biggest banks and mega wealthy will be the only one left to scoop them up.

Do you get it now? Once you get it, it's absolutely mind numbingly eye opening and you can never be ignorant and just live day to day ever again. You will still trade stocks and still make money. But you will always know this and always be preparing and trying to get to the next level, knowing you ultimately have no chance of not being eventually crushed, and it scares the ever living **** out of you.

Is the approaching downturn going to be a normal swing providing a buying opportunity for the wealthy, one which upper middle can marginally participate through LP's and stock buying and get scraps off of? Or will it finally be the end of the line and the big one that crushes everyone? We don't know. And we don't know when it will start. The warning signs were evident for years. COVID was the last warning. It was the secret transcribed telegram to the haves to get themselves prepared. But even in the worst case scenario, the warning is meant to suck them in so the mega players can crush them and scoop up their assets. Again, we don't know which this will be. But an event is coming. It's almost inevitable. Are you preparing? Not to become wealthy? But to not get wiped out?

Lastly, let's clear up gold. Gold does NOT perform like the assets I'm talking about. It will merely run up in the events leading to and during this process, and then will get crushed back down like everything else. Don't believe me? Go look up the gold chart and look at every economic downturn. You buy gold now with plan to SELL before the bottom happens, and maybe even before the top.

Edit: One more thing. The bond market will also crash. It is not a safe haven in these events. I think many of us are hoping BTC will be the safe haven. I truly believe in it long term. But not sure it wont too swing. We've now given institutions the ability to leverage it and attempt to manipulate it the same way we gave them that ability with physical metals years ago. While it's great for further adoption of the technology and platform, it's potentially crushing for the long term bullish outlook.

So what are you doing to prepare for this economic implosion old wise wizard? What do you do for a living?

I am long with sizeable positions in metals and miners for the run up. Will sell most of my position when signs of major top is forming. Could be this year. Could be a couple years from now. I do hold some physical metals as a pure hedge. The value of them doesn't matter. It's a long-term hedge purchased with money that was set aside for that specific purpose.

I have a modest position in BTC and BTC miners. Wish I would have gotten in years ago, but glad I have something. A portion is HODL and rest will be sold when it hits $100k, If we show signs of major top having already happened or happening closer to current levels, I will start exiting some small tranches of the tradeable portion.

I am currently about 65-70% cash. I don't expect that to change unless SPX dips to 4600 level or whatever a 50% retrace to November from the top would be, holds support, and reverses. I will likely deploy some cash for the runup to 5k. When approaching it, I will be exiting back to my 65-70% cash position. And if we get a BIG drop, I will wait for the retrace up to go to 90-95% cash.

I am currently long on TLT with a small position formed in November. I'm expecting/hoping for $120 minimum target to exit 75%-80% of that position. The next major move down could be the first in a series of legs that takes it to new lows. So I don't want much if any risk there. If you are holding bonds and can afford to hold through maturity and bond prices start collapsing, just hold them. You can't lose if you don't have to lose. Long term bonds might be scarier as a complete collapse would be unprecedented. I frankly don't know what would happen and have stayed away from direct holdings of long term treasuries.

I play options on volatility and correlations to major indexes in a trading group. So I will likely be deploying some cash when downside setups present and hopefully profiting off any major moves should the market drop significantly.

Real estate myself and my family owns is no higher than 70% leveraged. Most is paid off. So I can stomach a 30% drop in RE prices. And a further drop is not something that can be planned for, nor could you truly plan for the economic calamity that would be going on around you with job status and the such. I like to think I'm in a relatively safe space and could wait out any event. Like I said in the posts above, if you aren't positioned to get wealthy from these events, are you at least positioned to not get wiped out? If you have a job that could go away with a major market downturn, and you own a 90% leveraged house, and RE prices drop 30%, you are at major risk of foreclosure if you don't have a sizeable cash position that could be liquidated to meet your families needs and debt requirements.

Like I've stated multiple times, the warning signs have been flashing and growing more steady for years. COVID was a major shock and 2022 was even a minor shock. If you aren't preapring for a scenario like the ones I've gone into detail about, for the purpose of maintaining you and your families status and preserving as much capital as possible, then you are at major risk. At least have a plan.

Could I be wrong about all of this and the FED. Sure. Though history isn't in favor it. Could the FED perform a stick save and soft landing and this economy and market stay range bound or even go significantly higher? SURE! But are you betting on it? Is it your base case with history showing inflation comes in segments of 3 - a sharp rise followed by a cool off culminating in a sharper rise, and us being in the cool off? Is banking on things chugging forward and recovering quickly the smart thing to do with record debt, deficits, credit exposure, potentially sticky interest rates, and the FED underwater on its obligations with the treasury STILL spending?

All I'm saying is to evaluate your investments and your financial position. Figure out what it would look like in a minor downturn. Figure out what it would look like in a major downturn. Identify changes you could make quickly to stabilize your position. Identify where the liquidity could from should you need it. These are things you should ALWAYS know. But if you don't, in this environment, why wouldn't you now with an election of the same two candidates that produced absolutely turbulent times just 4 years ago?

Thank you for the in depth reply.

You are welcome sir. As I said on the other thread we discussed together, I wish you nothing but the best and pray daily that ANY of the potential scenarios I've outlined don't come to pass.

The best advice is to approach everything with risk management in focus. And that doesn't matter if you are old or young. 2020 showed that unpredictable events that change the world can and will happen. And the stability of the political and economic underpinnings, both in our country and across the world, is worse off today than in late 2019.

I am invested and looking up. I have plans to invest more given certain conditions. And I have plans to deploy fully if even more certain conditions come to fruition. I always advise to approach investments and the market from a stance of neutrality with a removal of directional bias. Because you can ALWAYS find profitable setups in any market. What you can't do is reverse course from a position of directional bias if not prepared for the possibility of the opposite happening.

And that thinking is not an inherent trait for most people, and it wasn't for me until fairly recently. You can say that 2020-2022 exposed a lot of my previous investment bias and forced me to figure out a way to not let it happen again.

The best advice is to approach everything with risk management in focus. And that doesn't matter if you are old or young. 2020 showed that unpredictable events that change the world can and will happen. And the stability of the political and economic underpinnings, both in our country and across the world, is worse off today than in late 2019.

I am invested and looking up. I have plans to invest more given certain conditions. And I have plans to deploy fully if even more certain conditions come to fruition. I always advise to approach investments and the market from a stance of neutrality with a removal of directional bias. Because you can ALWAYS find profitable setups in any market. What you can't do is reverse course from a position of directional bias if not prepared for the possibility of the opposite happening.