I think the culture of 'fraud' is much more prevalent in certain areas of Texas regarding roofing. Austin and DFW for sure. I do think DFW probably has more hail storms of significance than Colorado. I don't think Austin does, though.

Stock Markets

26,580,116 Views |

237619 Replies |

Last: 21 min ago by Ayto Siks

I would love to hear more about the roofing business. It always seems super shady to me, at minimum. I personally know a few people who own roofing companies but don't want to offend them asking about fraud, margins, etc.PeekingDuck said:

I think the culture of 'fraud' is much more prevalent in certain areas of Texas regarding roofing. Austin and DFW for sure. I do think DFW probably has more hail storms of significance than Colorado. I don't think Austin does, though.

It looks too easy to just tell someone their roof needs replacing and then just charge insurance a bunch and have huge margins without pushback. It's not like I'm going to go up on my roof or notice anything wrong unless it's leaking.

Man, this thread is a bucket of joy

Orlando Ayala Cant Read said:Ags2013 said:

I've been noting a lot of attention on PYPL. Near 52 Wk Low and looks to have a typically decent bounce at this level. I don't read charts quite as well as ya'll but it looks like an opportunity.

Been thinking about moving on this one and just did a Sep 15 $57c. Seems safe, but some of the ones that seem the safest often end up in the red but lets see.

Not sure how many of you went in on this but its +31% right now.

My problem is greed. Discipline says "sell, and move on". Greed says "I can get more". Lets see which one wins out.

What was your goal when you placed the trade?Orlando Ayala Cant Read said:Orlando Ayala Cant Read said:Ags2013 said:

I've been noting a lot of attention on PYPL. Near 52 Wk Low and looks to have a typically decent bounce at this level. I don't read charts quite as well as ya'll but it looks like an opportunity.

Been thinking about moving on this one and just did a Sep 15 $57c. Seems safe, but some of the ones that seem the safest often end up in the red but lets see.

Not sure how many of you went in on this but its +31% right now.

My problem is greed. Discipline says "sell, and move on". Greed says "I can get more". Lets see which one wins out.

Simply identifying a low point is an awesome achievement. But if you jumped in without a goal, what exactly are you doing?

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

What do you think about the 70's as an example?... Gold really took off by the end of '78.

Stagflation in '72

end of gold standard in '73

12.3% inflation in '74

big inflation numbers '77 to '80.

I don't think we've seen any real inflation yet.

but I hope I'm wrong! or at least a little bit wrong.

Where's aggiedaniel to drop the Japan 20 year chart - "the forgotten years"

Stagflation in '72

end of gold standard in '73

12.3% inflation in '74

big inflation numbers '77 to '80.

I don't think we've seen any real inflation yet.

but I hope I'm wrong! or at least a little bit wrong.

Where's aggiedaniel to drop the Japan 20 year chart - "the forgotten years"

Heineken-Ashi said:What was your goal when you placed the trade?Orlando Ayala Cant Read said:Orlando Ayala Cant Read said:Ags2013 said:

I've been noting a lot of attention on PYPL. Near 52 Wk Low and looks to have a typically decent bounce at this level. I don't read charts quite as well as ya'll but it looks like an opportunity.

Been thinking about moving on this one and just did a Sep 15 $57c. Seems safe, but some of the ones that seem the safest often end up in the red but lets see.

Not sure how many of you went in on this but its +31% right now.

My problem is greed. Discipline says "sell, and move on". Greed says "I can get more". Lets see which one wins out.

Simply identifying a low point is an awesome achievement. But if you jumped in without a goal, what exactly are you doing?

Full disclosure, I'm not a full time trader I only do it when I have the time away from an otherwise very full time life that includes a 60 hour work week and a special needs child.

I welcome any feedback or improvement ideas you guys can provide.

I basically take overbought or oversold tickers, look at the charts, check out any recent news that might be affecting action, then if I find something I feel is way oversold or overbought with no major PR that can fast track it either way I'll buy a longer term call on in back the other way (Not always long term, but usually). I then wait for it to hit +12-15% and I hit the sell button. So the stated goal is to walk at 12-15% but there are too many times I don't follow that and let it ride longer and most of those times I'll still walk away in the plus, but in hindsight sticking to the 12-15 strategy woulda been better. Hope that makes sense.

Great strategy. But I'd stop worrying about the ones that got away and make sure you don't have any that get away in the other direction. And the number one strategy to fixing the issue you have is to purchase a higher quantity up front. Then, when you hit that original goal, you can offload 75%+ and leave a runner or two for that homerun.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

First, re-read this post I made, specifically the part about the value of gold vs the value of steak.

Stock Markets - Page 6027 | TexAgs

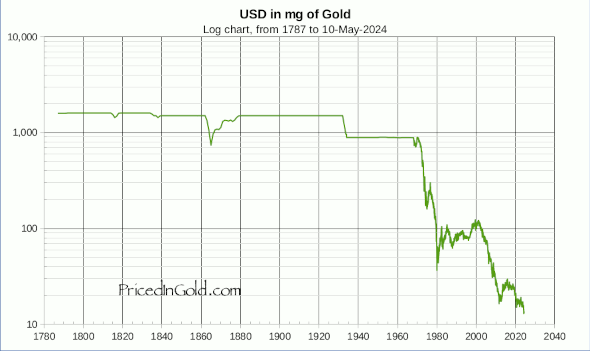

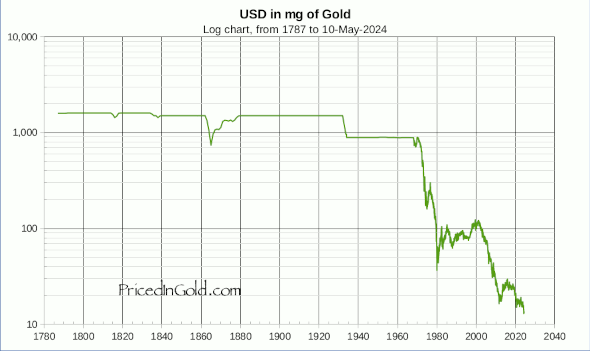

Second, check out this website, though I will quote the main focus and post the chart below.

The time period you asked about is the exact time that the cartel relationship between big banking and US government decided to go all in on Keynsian modern monetary fractional banking. It was the evolutionary next step after creating an unelected entity and giving the people's power over minting and controlling the value of money to them. And as you can see, the day we left the gold standard spelled doom for the dollar. Each time the devalue it (and there will be another one), the gaps between devaluations, and the severity of market reactions to it get smaller and worse.

Gold has held its value. Maybe even gained a tiny bit against some staples while losing a little against other staples. That's general market forces at work. What HASN'T happened is gold skyrocketing. It's an illusion. Your dollar is being decimated constantly over history. And if you aren't storing wealth in something that rises at a pace faster than the devaluation of the dollar, or something that holds its value in something other than in dollars, then you are losing.

Stock Markets - Page 6027 | TexAgs

Second, check out this website, though I will quote the main focus and post the chart below.

Quote:

US Dollar

The charts below show clearly just how far the once mighty US Dollar has fallen. Until 1933, people carried gold coins in their pockets, and paper bills were exchangable for gold and silver coins at any bank. Prices were remarkably stable, and had been for a hundred years or more, except for periods of war or other calamities. In 1933, US citizen's gold was confiscated by the government, the dollar was devalued by 41%, and we entered a period in which the treasury attempted to hold the value of the dollar at 1/35 of an ounce of gold.

As you can see, this was largely successful until the late 1960s, when so much gold was required to buy up all the dollars foreign countries were selling that the US government simply gave up, and "closed the gold window" in 1971. The value of the dollar collapsed over the next 10 years, hitting bottom in 1980. By paying high rates of interest and reducing taxes, the dollar slowly recovered some of it's value over the next 20 years, but expansive money policy in the 1990s eventually caught up with the dollar in 1999.

Since 1999, the dollar has fallen in value from about 123 mg of gold to less than 21 mg today a drop of more than 80%. Overall, from 1900 to 2010, the dollar fell from 1500 mg to 25 mg, losing over 98% of it's purchasing power. Penny candy now costs 50 cents. The "Five and Dime" is now the Dollar Store.

The future, however, looks even bleaker. Recent comments from the Federal Reserve indicate that near-zero interest rates and "quantitative easing" (Fed-speak for money printing) can be expected to continue "for an extended period".

The time period you asked about is the exact time that the cartel relationship between big banking and US government decided to go all in on Keynsian modern monetary fractional banking. It was the evolutionary next step after creating an unelected entity and giving the people's power over minting and controlling the value of money to them. And as you can see, the day we left the gold standard spelled doom for the dollar. Each time the devalue it (and there will be another one), the gaps between devaluations, and the severity of market reactions to it get smaller and worse.

Gold has held its value. Maybe even gained a tiny bit against some staples while losing a little against other staples. That's general market forces at work. What HASN'T happened is gold skyrocketing. It's an illusion. Your dollar is being decimated constantly over history. And if you aren't storing wealth in something that rises at a pace faster than the devaluation of the dollar, or something that holds its value in something other than in dollars, then you are losing.

"H-A: In return for the flattery, can you reduce the size of your signature? It's the only part of your posts that don't add value. In its' place, just put "I'm an investing savant, and make no apologies for it", as oldarmy1 would do."

- I Bleed Maroon (distracted easily by signatures)

- I Bleed Maroon (distracted easily by signatures)

NVDA earning tomorrow after hours

SMCI up 22% today

market is thriving today. awfully quiet around here.

Mara

Ags2013 said:

market is thriving today. awfully quiet around here.

Project is kicking my ass so I've been covered up and why I wasn't able to post my SMCI points last weekend but still am planning to do so.

Might wanna check that again. Try about 9%…

Got my entry point for CROX on a dip this morning, looking to cut some after first gap close at $117-118 and then balance at $140 for 2nd gap closure

Glad I bought some more SMCI yesterday.

Share price up 6.5% since I bought. Looks like it has some juice to it if the market doesn't tank.Orlando Ayala Cant Read said:Ags2013 said:

I've been noting a lot of attention on PYPL. Near 52 Wk Low and looks to have a typically decent bounce at this level. I don't read charts quite as well as ya'll but it looks like an opportunity.

Been thinking about moving on this one and just did a Sep 15 $57c. Seems safe, but some of the ones that seem the safest often end up in the red but lets see.

$23txaggie_08 said:

Might wanna check that again. Try about 9%…

Ags2013 said:Share price up 6.5% since I bought. Looks like it has some juice to it if the market doesn't tank.Orlando Ayala Cant Read said:Ags2013 said:

I've been noting a lot of attention on PYPL. Near 52 Wk Low and looks to have a typically decent bounce at this level. I don't read charts quite as well as ya'll but it looks like an opportunity.

Been thinking about moving on this one and just did a Sep 15 $57c. Seems safe, but some of the ones that seem the safest often end up in the red but lets see.

Ya I'm holding 2 separate calls. One is +53% the other +7%. I'm thinking of closing the former as a disciplined trader would.

AMC gonna fall below $1 soon?

The hype around this ER is reminiscent of Cisco around 2000, borderline silliness.EngrAg14 said:

NVDA earning tomorrow after hours

Huang is going to have to say AI in every other sentence during the call to keep the stock going.

Ag CPA said:The hype around this ER is reminiscent of Cisco around 2000, borderline silliness.EngrAg14 said:

NVDA earning tomorrow after hours

Huang is going to have to say AI in every other sentence during the call to keep the stock going.

Hope NVDA took some Yak loin before earnings.

Looks like OSTK is finding bottom. 200 dma is 22.9 and RSI is now 30. I THINK it's time to buy and hold for a while. BBBY Aquisition is not being priced in and their revenue has gone up significantly. How would I know? Their orders are numbered in sequential order. I've been buying items every week to get an idea of their volume. Looks good.

These paper hands sold my one NVDA $460 8/25 call before close to ensure a $400 profit...

Where do you see it finding a bottom? Last 2 green days have been followed by heavy selling...need to see some volume or some continuation to feel good about entryChilifest said:

Looks like OSTK is finding bottom. 200 dma is 22.9 and RSI is now 30. I THINK it's time to buy and hold for a while. BBBY Aquisition is not being priced in and their revenue has gone up significantly. How would I know? Their orders are numbered in sequential order. I've been buying items every week to get an idea of their volume. Looks good.

SMCI $300 AH

OSTK was $24.22 at the time of this post.Chilifest said:

Looks like OSTK is finding bottom. 200 dma is 22.9 and RSI is now 30. I THINK it's time to buy and hold for a while. BBBY Aquisition is not being priced in and their revenue has gone up significantly. How would I know? Their orders are numbered in sequential order. I've been buying items every week to get an idea of their volume. Looks good.

Buying products to track serial numbers and predict sales volume........I'm gonna need to see some receipts

lee ainslie at maverick capital talks about doing this very thing. Invest Like The Best podcast.Triple_Bagger said:OSTK was $24.22 at the time of this post.Chilifest said:

Looks like OSTK is finding bottom. 200 dma is 22.9 and RSI is now 30. I THINK it's time to buy and hold for a while. BBBY Aquisition is not being priced in and their revenue has gone up significantly. How would I know? Their orders are numbered in sequential order. I've been buying items every week to get an idea of their volume. Looks good.

Buying products to track serial numbers and predict sales volume........I'm gonna need to see some receipts

drafting off of NVDA...hell, everything AI related is being pulled up AH from NVDA earnings...

Yep. PLTR up decent as well.

That SMCI gap looking damn good right now.

I don't know why anyone would not be fully invested in NVDA. This is AAPL 16 years ago (maybe even better).

Featured Stories

See All

LIVE: No. 7 Texas A&M at No. 21 Mississippi State

by Luke Evangelist

Aggies meet Bulldogs in Starkville for another ranked SEC showdown

by Olin Buchanan

Presenting Texas Aggies United's 'Florida Slam Dunk' Sweepstakes!

by Texas Aggies United

20:19

9h ago

3.1k

AggieCVQ

Aaron Torres Podcast: Blow Hard Guest With Harsh Words For Buzz Williams

in Billy Liucci's TexAgs Premium

54