sts7049 said:

imagine if this were a ticker𝐔𝐧𝐫𝐞𝐚𝐥. pic.twitter.com/2kf85NgSHd

— SportsCenter (@SportsCenter) January 24, 2022

I clearly see where Zack Morris and Atlas tweeted it out

sts7049 said:

imagine if this were a ticker𝐔𝐧𝐫𝐞𝐚𝐥. pic.twitter.com/2kf85NgSHd

— SportsCenter (@SportsCenter) January 24, 2022

mazag08 said:

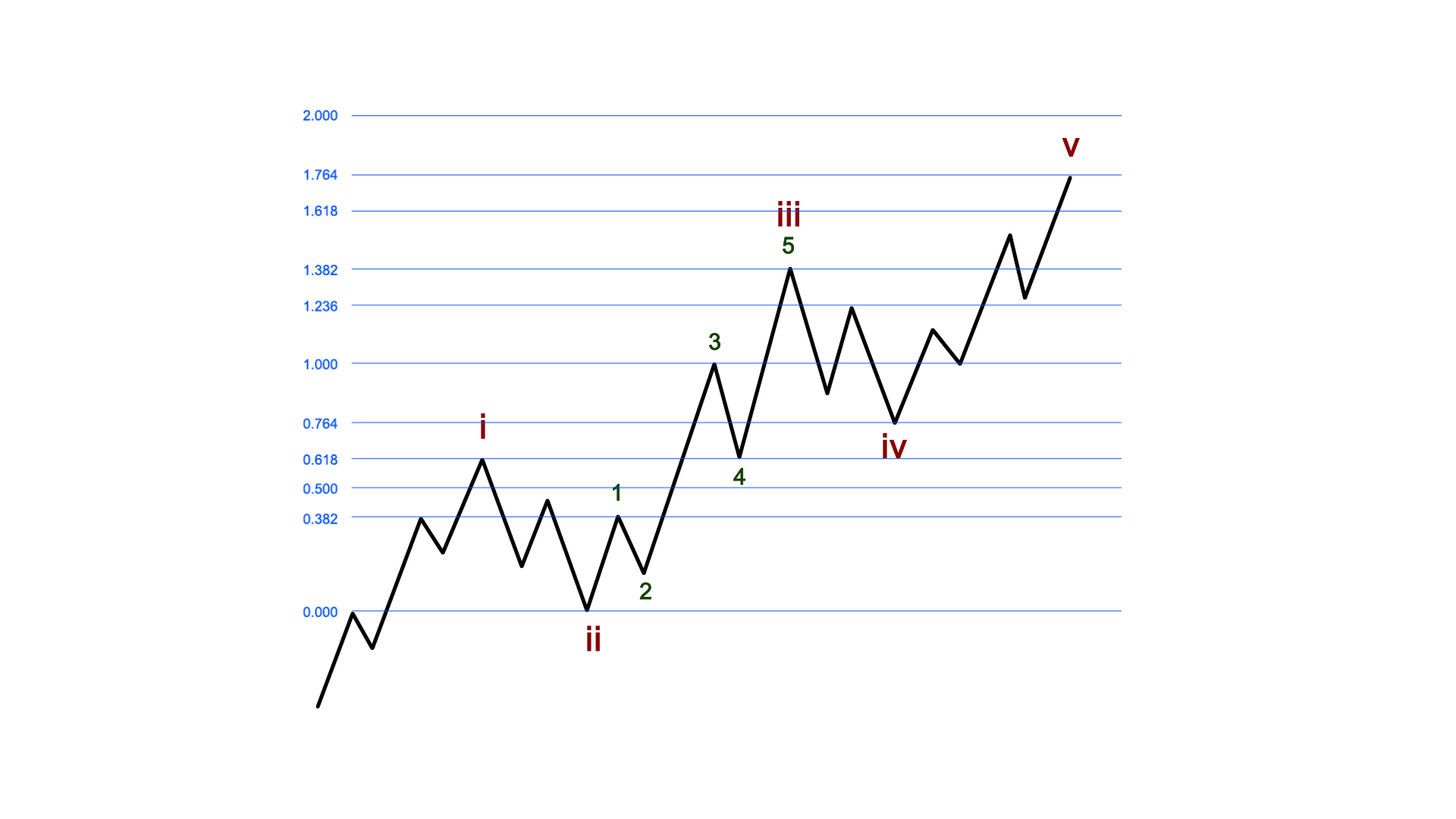

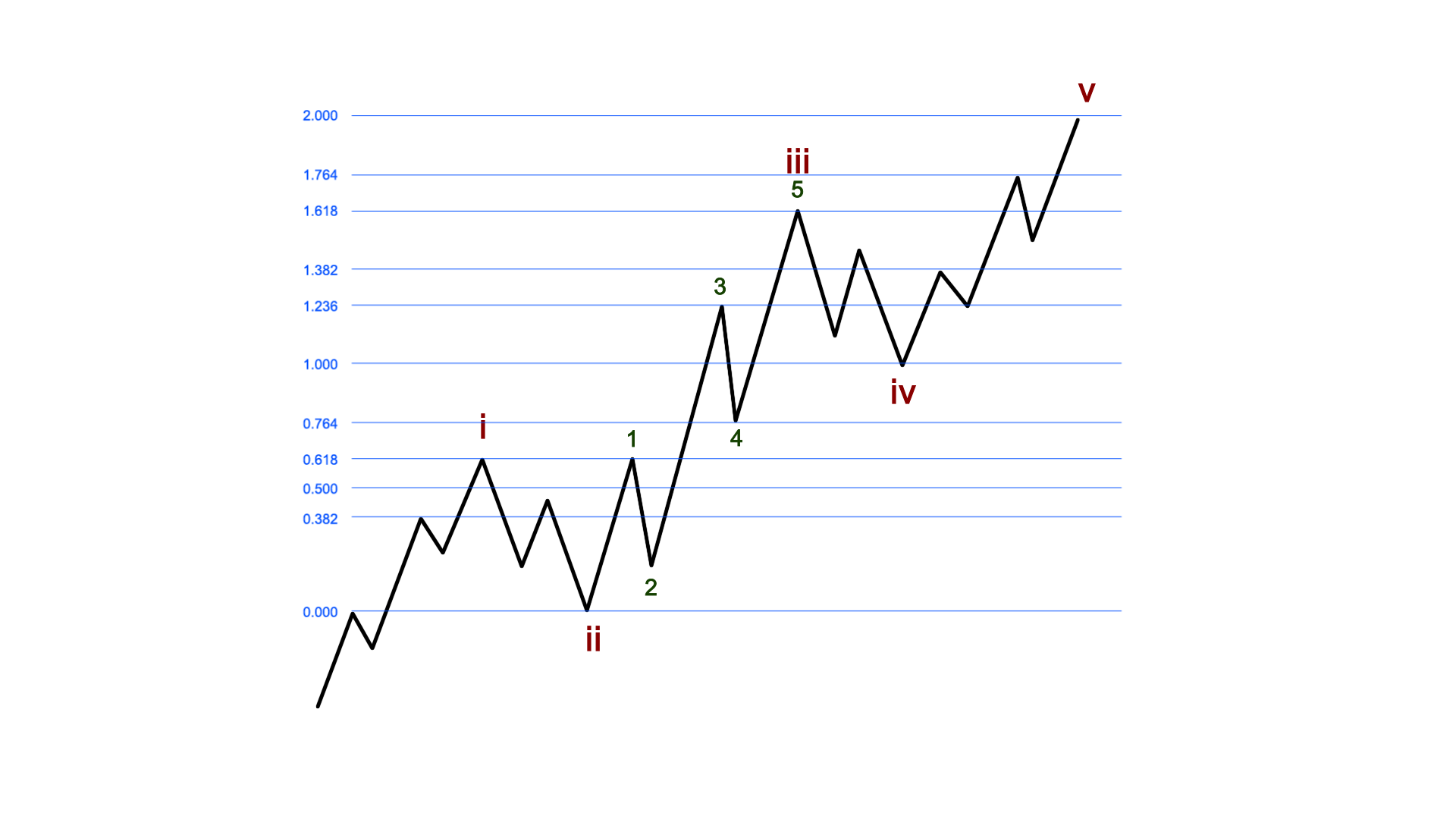

I know some of yall don't care for my EW theory, but I really think the Nasdaq is about to front run all indexes and will be on a massive bull run starting Monday and ending around April at $18,100 followed by a 15-20% drop.

McInnis 03 said:mazag08 said:

I know some of yall don't care for my EW theory, but I really think the Nasdaq is about to front run all indexes and will be on a massive bull run starting Monday and ending around April at $18,100 followed by a 15-20% drop.

Don't stop.

I bet many hate my schtick, we're still here.

I like your EW posts and I'd urge against others discounting it. It's not my preferred method and that's why I haven't dove into the finer intricacies of EW theory. That being said, when you post something that goes against what I'm seeing, I do look deeper into what I'm seeing. That's the good and bad of technical analysis, you can find anything to justify the reason you make a decision. I like looking at things from different angles.mazag08 said:

I know some of yall don't care for my EW theory, but I really think the Nasdaq is about to front run all indexes and will be on a massive bull run starting Monday and ending around April at $18,100 followed by a 15-20% drop.

To illustrate..mazag08 said:

I know some of yall don't care for my EW theory, but I really think the Nasdaq is about to front run all indexes and will be on a massive bull run starting Monday and ending around April at $18,100 followed by a 15-20% drop.

McInnis 03 said:

Risk off resumption this morning.

Despite 6 straight red days for #ES_F, "sell the bounce" took no time to start back up with overnight bounce failing. Was looking for 4320-30 & en route

— Adam Mancini (@AdamMancini4) January 24, 2022

Plan today: Unless ~4385 recaptures 1st, looking to 4320-30 then good bounce. That fails & ES may see Feb 2020 style drop https://t.co/VfnhusBZ7B

$30,000 Millionaire said:

Fear will be strong at the open