Anyone looked at ROOT? Goal post volumes from a couple months ago and has done nothing but drop since. Recent IPO which is hard but sure seems like upside whenever it shows a reversal

Stock Markets

26,687,908 Views |

238008 Replies |

Last: 1 min ago by EnronAg

Prognightmare said:

Good buy?

I dunno..

The Feb 2.5C on WWR is 1.65-1.85. Is this a good option to buy or is it preferred to buy shares or both?

BaylorSpineGuy said:

The Feb 2.5C on WWR is 1.65-1.85. Is this a good option to buy or is it preferred to buy shares or both?

If true on Monday I'm selling the **** out of it.

cisgenderedAggie said:BaylorSpineGuy said:

The Feb 2.5C on WWR is 1.65-1.85. Is this a good option to buy or is it preferred to buy shares or both?

If true on Monday I'm selling the **** out of it.

You're selling the covered calls? What's your cost basis?

Mine is $5.86 so I don't think I have that option. I end up losing money if I sell mine at 2.50 plus 1.70.

Eh, I need to put down the drinks and drugs. Thought he said puts.

cisgenderedAggie said:BaylorSpineGuy said:

The Feb 2.5C on WWR is 1.65-1.85. Is this a good option to buy or is it preferred to buy shares or both?

If true on Monday I'm selling the **** out of it.

Wait what? That seems like terrible premium unless you expect WWR to stay below $4.50 all the way to February. Your cost would have to be below $4 to make that worth it

Agree. I sold $5 puts feb 22 for 1.80.

BaylorSpineGuy said:

The Feb 2.5C on WWR is 1.65-1.85. Is this a good option to buy or is it preferred to buy shares or both?

The lowest risk is to buy shares and sell covered calls on the shares you own.

Example: shares are 4.50/share. You buy 1000 costing you $4500. Your cost basis is $4.50/share.

If you sell covered calls with a strike price of $2.50 for a premium of $1.50. You will lose money.

Sell 10 covered calls for $1.50 nets you $1500.

Your shares will get called out (or sold) at $2.50 per share or $2,500.

So you earned $1,500 in selling covered calls and $2,500 for your shares, giving you $4,000...or a $500 LOSS.

Instead, sell the 7.50 strike price for a premium of $0.50.

You receive $500 for selling 10 covered calls now. The expiration arrives and the shares never meet the strike price. You pocket the $500 you made for covered calls and you still have the 1000 shares to do that same transaction all over again.

Your cost basis drops here from $4.50 down to $4.00 because you earned $0.50 per share in selling the covered call and you kept the shares because the strike price was never met.

Make sense?

I understand. I followed a guy on twitter a while back @nstocks96. He uses option flow and develops pivots off of them. Dude's levels have been nails. Trying to find my niche.$30,000 Millionaire said:

I don't use any of these types of things for what it's worth.

irish pete ag06 said:I understand. I followed a guy on twitter a while back @nstocks96. He uses option flow and develops pivots off of them. Dude's levels have been nails. Trying to find my niche.$30,000 Millionaire said:

I don't use any of these types of things for what it's worth.

Nick is a FANTASTIC follow

Saturday weeklies:

— No Bad Daze (@nobad_daze) July 25, 2021

A set of bullish engulfing candles. All have earnings soon, except $CRWD so act accordingly$ROKU trendline bounce$QCOM trendline bounce inside consolidation$CRWD wants ATH$SHOP breakout from consolidation$SQ MASSIVE engulfing$COOP 12 wk consolidation pic.twitter.com/tcFTDY060B

He is. I decided to take the plunge into learning cheddar from his recommendation.McInnis 03 said:irish pete ag06 said:I understand. I followed a guy on twitter a while back @nstocks96. He uses option flow and develops pivots off of them. Dude's levels have been nails. Trying to find my niche.$30,000 Millionaire said:

I don't use any of these types of things for what it's worth.

Nick is a FANTASTIC follow

https://finance.yahoo.com/news/cassava-sciences-stock-could-worth-205324252.html

Buckle up for a crazy week. SAVA players should read this article.

Buckle up for a crazy week. SAVA players should read this article.

Blow off top on SPX/NDX or pullback here?

You don’t trade for money, you trade for freedom.

Probably good for another 5% upside

Prog, Any thoughts on how you are protecting gains as we head into earnings for TTD? I know we're up nicely since your original buy signal. Just curious if you're looking to buy puts in case of a post earnings sell off or taking profits at some point to rebuy again lower.

I know this is a long term hold, but the thought that it could sell off similar to the last earnings would be tough to watch.

I know this is a long term hold, but the thought that it could sell off similar to the last earnings would be tough to watch.

Confirmed, Powell speaks Wednesday afternoon. FOMC meeting is Tuesday-Wednesday with Powell giving a press conference after the meeting ends Wednesday. No major changes are expected but stay on your toes.Double_Bagger said:I tried finding the schedule but couldn't. Assuming Wednesday until someone can find the schedule.FJ43 said:

When is the Fed speaking next week?

Probably going to rip to 5000 and blow more of my **** up.$30,000 Millionaire said:

Blow off top on SPX/NDX or pullback here?

Trying the fight the "Technical Analysis is just more bull****" feeling.

Austin just went back to stage 4 and recommending mask for all people regardless of Vax status. I went to HEB today and was expecting 90% masked up , to my surprise only 40% to 50 % had mask.

I think most people realize it's a big nothing burger.

I think most people realize it's a big nothing burger.

SF2004 said:Probably going to rip to 5000 and blow more of my **** up.$30,000 Millionaire said:

Blow off top on SPX/NDX or pullback here?

Trying the fight the "Technical Analysis is just more bull****" feeling.

I need more TA in my life. This fintwit + unusual options + paid newsletter recommendations is not cutting it for me anymore. Will watch the initial Zoom call again tonight. Determined to make it.

Bosco said:SF2004 said:Probably going to rip to 5000 and blow more of my **** up.$30,000 Millionaire said:

Blow off top on SPX/NDX or pullback here?

Trying the fight the "Technical Analysis is just more bull****" feeling.

I need more TA in my life. This fintwit + unusual options + paid newsletter recommendations is not cutting it for me anymore. Will watch the initial Zoom call again tonight. Determined to make it.

You can make it. Find your lane and be disciplined. Everyone has good and bad days, weeks, months, etc.

Staying disciplined to your process is often the hardest part. Too many bright and shiny objects passing by that suck all of us in at one time or another.

CrazyRichAggie said:

Austin just went back to stage 4 and recommending mask for all people regardless of Vax status. I went to HEB today and was expecting 90% masked up , to my surprise only 40% to 50 % had mask.

I think most people realize it's a big nothing burger.

As of this moment you wouldn't know there is anything different in Knoxville. Occasionally see someone wearing a mask but that hasn't ever stopped.

Austin Ag06 said:

Prog, Any thoughts on how you are protecting gains as we head into earnings for TTD? I know we're up nicely since your original buy signal. Just curious if you're looking to buy puts in case of a post earnings sell off or taking profits at some point to rebuy again lower.

I know this is a long term hold, but the thought that it could sell off similar to the last earnings would be tough to watch.

I'm not concerned in my mother's and son's account because they don't have options ability but covered calls into earnings wouldn't be a bad play. People are up over 50% in just over 2 months, so don't gamble if you find a CC you'd be happy with.

Anyone happen to remember what page that zoom call was on? I thought I had bookmarked it for later but I can't seem to find it. Wanted to watch this evening while I have some down time.Bosco said:SF2004 said:Probably going to rip to 5000 and blow more of my **** up.$30,000 Millionaire said:

Blow off top on SPX/NDX or pullback here?

Trying the fight the "Technical Analysis is just more bull****" feeling.

I need more TA in my life. This fintwit + unusual options + paid newsletter recommendations is not cutting it for me anymore. Will watch the initial Zoom call again tonight. Determined to make it.

ETA: When in doubt check the first page.

— Investing.com (@Investingcom) July 25, 2021

Perhaps a headline to fade soon.

You don’t trade for money, you trade for freedom.

ThetaWarrior calling out NIO, thoughts?

Watching it again now.starting to come together now thanks to my own independent study of the definitions and concepts.

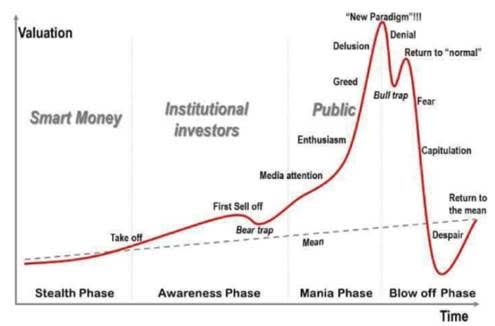

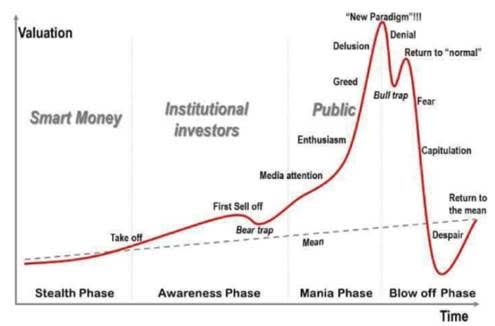

I think we are in the delusion phase, approaching new paradigm. You are seeing it in the tech companies: expanding multiples, belief they are invincible, independent of the lower economy (which by the way is fed supported), and will not be impacted be either inflation or legislation. That is all bunk.

Without a meaningful 5% plus correction, I believe we are setting up a spectacular blow off top here that will occur around 4700 for SPX and about 16,000 for the Nasdaq. I do not know what will be the catalyst and when, none of us do, but remember that the market is forward looking and when they believe the easy fed money will disappear, things will drop. I am not expecting a "crash", I am expecting -10%. For those that can't distinguish: this doesn't make me bearish and yearning for 1800 on the S&P and it doesn't mean I am positioned net short because I think this thing is bloated and heading for a top. It means I'm cautious. It is stupid to view 'bears' as so one dimensional.

'They know that overstaying the festivities that is, continuing to speculate in companies that have gigantic valuations relative to the cash they are likely to generate in the future will eventually bring on pumpkins and mice. But they nevertheless hate to miss a single minute of what is one helluva party. Therefore, the giddy participants all plan to leave just seconds before midnight. There's a problem, though: They are dancing in a room in which the clocks have no hands.' - Warren Buffett

Without a meaningful 5% plus correction, I believe we are setting up a spectacular blow off top here that will occur around 4700 for SPX and about 16,000 for the Nasdaq. I do not know what will be the catalyst and when, none of us do, but remember that the market is forward looking and when they believe the easy fed money will disappear, things will drop. I am not expecting a "crash", I am expecting -10%. For those that can't distinguish: this doesn't make me bearish and yearning for 1800 on the S&P and it doesn't mean I am positioned net short because I think this thing is bloated and heading for a top. It means I'm cautious. It is stupid to view 'bears' as so one dimensional.

'They know that overstaying the festivities that is, continuing to speculate in companies that have gigantic valuations relative to the cash they are likely to generate in the future will eventually bring on pumpkins and mice. But they nevertheless hate to miss a single minute of what is one helluva party. Therefore, the giddy participants all plan to leave just seconds before midnight. There's a problem, though: They are dancing in a room in which the clocks have no hands.' - Warren Buffett

You don’t trade for money, you trade for freedom.

/ES once again well above it's 8 and 21 EMA, but the distance between 8 and 21 is not as extreme as it was when we have our mini puke to the 55 EMA.

We are just below +2 ATR but we did touch it in Friday's session (4410 on ES). +3 ATR is 4460. If we rally into the fed, I will seek to take a tactical short there.

We are just below +2 ATR but we did touch it in Friday's session (4410 on ES). +3 ATR is 4460. If we rally into the fed, I will seek to take a tactical short there.

You don’t trade for money, you trade for freedom.

/NQ is more vulnerable than the S&P in my opinion. It's got a decent gap between the 8/21 and it is also pretty far above the 8. Sideways trading for the 8 to catch up is most likely. It's above +2 ATR.

For those saying that the indexes don't respect +3 and -3ATR, you are not correct. You had to hold through pain if you shorted, but NQ dipped to at least +1 ATR within 3 trading days of touching +3 ATR. The tweezer top on 7/13 and 7/14 generated a lot of alpha if you weren't greedy with your shorts. I had one of my best trading weeks of the year with taking that short, and I will do it again.

+3 ATR from here is 15239, so we have some room to go up.

I should have said this previously, but watch the fed. They can say something to invoke a major sell off. I think playing to the long side is appropriate this week, just have one foot by the exit.

I will also go to pains to say that if bond yields keep going up and the Russell continues to decline, the Nasdaq will be held by a boat anchor.

For those saying that the indexes don't respect +3 and -3ATR, you are not correct. You had to hold through pain if you shorted, but NQ dipped to at least +1 ATR within 3 trading days of touching +3 ATR. The tweezer top on 7/13 and 7/14 generated a lot of alpha if you weren't greedy with your shorts. I had one of my best trading weeks of the year with taking that short, and I will do it again.

+3 ATR from here is 15239, so we have some room to go up.

I should have said this previously, but watch the fed. They can say something to invoke a major sell off. I think playing to the long side is appropriate this week, just have one foot by the exit.

I will also go to pains to say that if bond yields keep going up and the Russell continues to decline, the Nasdaq will be held by a boat anchor.

You don’t trade for money, you trade for freedom.

AG 2000' said:

ThetaWarrior calling out NIO, thoughts?

Hope it booms this week, I bought a bunch of $45 7/30 calls on fridays dip!

It seems many macro traders are expecting a melt up driven by hedge covering. That would align with a 170 SKEW and subsequent rally.

My concern woul be that the taper on Fed asset purchases get delayed with the variant news. Guess it's better to wait for confirmation than trying to time a top.

My concern woul be that the taper on Fed asset purchases get delayed with the variant news. Guess it's better to wait for confirmation than trying to time a top.

$COIN this has powered off of $212.

Watch for signs of confirmed reversal here. I think a 7/30 225/220 put credit spread looks attractive.

Watch for signs of confirmed reversal here. I think a 7/30 225/220 put credit spread looks attractive.

You don’t trade for money, you trade for freedom.

Featured Stories

See All

Texas A&M third baseman Gavin Grahovac to miss remainder of 2025

by Richard Zane

38:04

3h ago

1.7k

Baseball Thoughts: Analyzing A&M's 'choppy' start through six games

by Ryan Brauninger

21:49

4h ago

1.6k

gkharmon98

Did anyone else just get that breaking news push notification?

in Billy Liucci's TexAgs Premium

36