Stock Markets

For this week or next?FJ43 said:

Added a few to the SPY 435P I held over. These are just in case as partial insurance against trades.

If they turn into red then my trades should easily offset.

This 7/16AG 2000' said:For this week or next?FJ43 said:

Added a few to the SPY 435P I held over. These are just in case as partial insurance against trades.

If they turn into red then my trades should easily offset.

I just gave you an advanced option strategy that has the potential to make you thousands. Even at 10 calls and 500 shares short you are positioned to score a huge gain.

— 2021 Opportunity Stocks Knock (@oldarmy1) July 13, 2021

If you have 50 calls or more and 2500 shares+ then at +0.70 on the short you can cover 20% to even the trade

Colt98 said:

what i posted above

So he bought 7/16 $436 calls and shorted SPY?

$30,000 Millionaire said:

I'll explain OA's tweet a bit later.

Too late to get in?

Colt98 said:

yes

Well poo

SPY end of day.

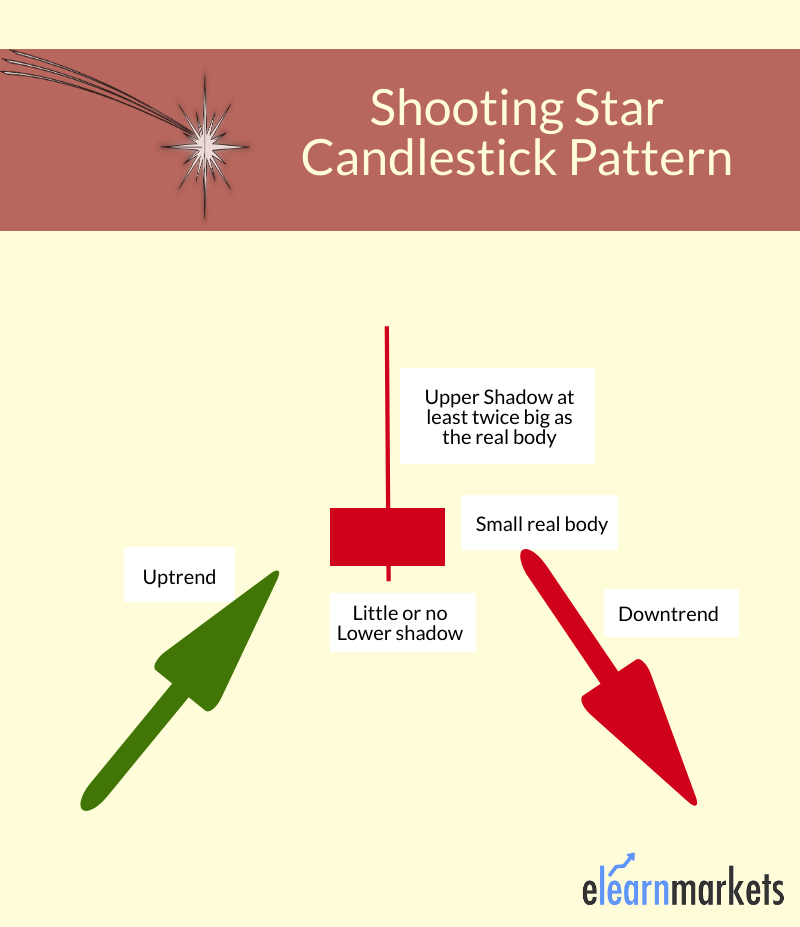

Possible Shooting Star Candle

QQQ end of day.

Same. Possible Shooting Star candle with alternative graphic.

I think we hit the high for the week. Either trade sideways or downward rest of this week before resuming up trend next week. I closed all of my calls this morning except for 7/23 AAPL C150s. I actually sold the AAPL calls but couldn't resist buying them back on that dip around lunchtime. I'll probably sit out the rest of this week unless something promising emerges.FJ43 said:

SPY end of day.

Possible Shooting Star Candle

I could see us fall back into the trend lines and consolidate within the highlighted section before next leg up.Double_Bagger said:I think we hit the high for the week. Either trade sideways or downward rest of this week before resuming up trend next week. I closed all of my calls this morning except for 7/23 AAPL C150s. I actually sold the AAPL calls but couldn't resist buying them back on that dip around lunchtime. I'll probably sit out the rest of this week unless something promising emerges.FJ43 said:

SPY end of day.

Possible Shooting Star Candle

Below 428ish and I think we are back to 420ish.

SPY

QQQ

Below 352.50ish and different story. This all assumes we just don't continue up.

CrazyRichAggie said:

What's the set up here?I just gave you an advanced option strategy that has the potential to make you thousands. Even at 10 calls and 500 shares short you are positioned to score a huge gain.

— 2021 Opportunity Stocks Knock (@oldarmy1) July 13, 2021

If you have 50 calls or more and 2500 shares+ then at +0.70 on the short you can cover 20% to even the trade

I never saw the bat signal to buy the 436c, and his methods are NOT for everyone, you can't even do it in an IRA or 401k....

but he usually does this...

1) Buy calls (ie: 436c here)

2) SHORT SHARES OF EQUITY ABOVE CALL (Short SPY shares above $436....probably .50mx worth, ie short 500 shares on 10 calls)

Ideally your short gains cover the cost of the remaining calls you're holding....you're playing with net free positions?

Am I wrong on that last part?

Drill down to see the replies:

I like to buy $436 calls here under $1 and if it breaks above $436 I short shares on half of the calls. Take risk out of the trade.

— 2021 Opportunity Stocks Knock (@oldarmy1) July 13, 2021

IMO 30k may be best positioned for potential downside play tomorrow. Outside of OA of course.

This is correct. The risk on the trade was counting on that last wave above $436 after entering the calls when it was at $435.50. And depending on how many short shares you are able to short on your account I cover 15-20% of the short on the pullback banking $0.70/share and that makes the trade net neutral between calls held and short shares total cost. The trade is therefore 100% risk free. No way to lose even if it held exactly static (would be breakeven).McInnis 03 said:CrazyRichAggie said:

What's the set up here?I just gave you an advanced option strategy that has the potential to make you thousands. Even at 10 calls and 500 shares short you are positioned to score a huge gain.

— 2021 Opportunity Stocks Knock (@oldarmy1) July 13, 2021

If you have 50 calls or more and 2500 shares+ then at +0.70 on the short you can cover 20% to even the trade

I never saw the bat signal to buy the 436c, and his methods are NOT for everyone, you can't even do it in an IRA or 401k....

but he usually does this...

1) Buy calls (ie: 436c here)

2) SHORT SHARES OF EQUITY ABOVE CALL (Short SPY shares above $436....probably .50mx worth, ie short 500 shares on 10 calls)

Ideally your short gains cover the cost of the remaining calls you're holding....you're playing with net free positions?

Am I wrong on that last part?

I haven't trusted these surges to new highs after $434 one bit. We'll have to wait and see if that Shooting Star FJ posted confirms at least a short term top. Several indicators on close I watch for is the large green candles that are like eye candy to traders. They think they are buying the bottom right now along with over 2M shares. The second is the two short trigger spikes we had. Those are generally to run off weak short holders ahead of a larger drop. We'll have to wait for all to confirm.

- you can instantly exercise the call after you've sold short the shares which locks your gains

- you can wait until expiration

- you can see if TSLA stock declines (maybe even to 630, where you can cover your short for $70 per share and then you have a free call to work with

wanderer said:

I've read this post and the tweets/replies many times, but I still can't wrap my head around how this becomes a risk-free strategy. (This is in no way doubting you or the trade)

Me too

So let's play a fantasy game (this will never happen ever again) and say that the market limits down to -5%. I bought some QQQ 362P at the 2:45 PM spike today for about $2. In pre-market, QQQ would trade around $344. I would buy # contracts x 100 shares at $344, which gives me a guaranteed profit of $16/contract or $1,600.

I could then do the following:

- do nothing and let it expire how it expires

- Keep the shares and sell the put for a tidy profit of $14 per contract

- Sell ITM calls against the shares to allow for more downside protection (e.g. sell QQQ 320 calls)

- Sell ATM/OTM calls against the shares and then use the premium to buy more puts or put debit spreads at a lower strike price

The poor mans way to do this, by the way, is to sell puts against your long puts. So you gap down and you sell a an OTM put for greater than or equal to what your original put cost you. This creates a free trade where you can benefit from further downside and in the worst case of a full bounce, you break even. I wouldn't recommend this by the way, but it is an option.$30,000 Millionaire said:

you would do the inverse of this on a put, by the way.

So let's play a fantasy game (this will never happen ever again) and say that the market limits down to -5%. I bought some QQQ 362P at the 2:45 PM spike today for about $2. In pre-market, QQQ would trade around $344. I would buy # contracts x 100 shares at $344, which gives me a guaranteed profit of $16/contract or $1,600.

I could then do the following:

- do nothing and let it expire how it expires

- Keep the shares and sell the put for a tidy profit of $14 per contract

- Sell ITM calls against the shares to allow for more downside protection (e.g. sell QQQ 320 calls)

- Sell ATM/OTM calls against the shares and then use the premium to buy more puts or put debit spreads at a lower strike price

Ex.

Buy 10 436 C for $1.00 Cost $1,000 If the calls were executed this could purchase you 1000 shares at $436 per share for a cost of $436,000.

Now sell 500 shares at $436.20. This gets you $218,100. But you don't need to pay back the amount just the 500 shares.

Next SPY dropped to $435.50. Buy 100 shares of SPY to cover 100 of the 500 shares you borrowed. The 100 shares cost $43,550. $218,100 - $43,550 leaves you with $174,500 in your account and 400 shares outstanding.

The above was the setup.

Now for the outcome

If SPY goes up:

If you execute 4 of your 436C that would cost you $174,400. Meaning you execute those calls and cover your outstanding shares and still have $100. Plus you still have 6 436 C. Also, if you had to execute your calls then SPY went up, which means the premium on your calls also went up.

So in this case if SPY went to $438 you would execute your 4 calls and cover the outstanding shares. So your short netted you $100. Also, you have 6 $436C remaining. and at $438 they'd be around $2.30. You could sell the 6 calls for $1,380. Total trade netting you $480.

If SPY goes down:

If SPY drops to $428 and you purchase 400 shares for $171,200. You'd be left with $3,400 in your account. At this point the calls are worth nothing or ($1,000) so you would net $2,400 on the whole trade.

Either way you stand to profit post setup.

This is what I understand.

can't short stocks

assuming buying Puts can accomplish the goal here?

- Re: OAs Calls while also shorting stock

what were the details behind this MA? looking to add another next to WWR as I only discovered this thread earlier this year.RenoAg said:

MBIO below 3 again if anyone is looking to add for MA.

or UWMC for that matter if anyone else has thoughts? Trying to decide on which one!

jimmo said:

I trade in an IRA

can't short stocks

assuming buying Puts can accomplish the goal here?

- Re: OAs Calls while also shorting stock

The rough equivalent would be to buy 10 calls, sell calls on a spike, use profits to buy puts.