Earnings are a carpshoot, but I've liked the FDX for awhile and have been in it for a few weeks now. Think we see a sizable move on ER. That isn't just chump change on weeklies 10% out of the money.

Then again, maybe I'm wrongCreakinDeacon said:You'd be looking for a ~50% move in ~90 days. Much better value out there.texagbeliever said:

Thoughts on WYNN $120 strike out through Dec 18. It can be had for around $2.

I'm looking at Penn & CZR both are taking off big time. MGM looks like it could be close to a breakout session so thinking it might be a good time to put a long term bet on Wynn and see if money will rotate into it over the next few weeks. I

Well i had already bought those calls, and some 10/16 $100s so i was hoping for confirmation. But i like that sign. Just feel like once the CZR Penn trains run out of steam it is going to switch to the MGM & WYNN show.CreakinDeacon said:Then again, maybe I'm wrongCreakinDeacon said:You'd be looking for a ~50% move in ~90 days. Much better value out there.texagbeliever said:

Thoughts on WYNN $120 strike out through Dec 18. It can be had for around $2.

I'm looking at Penn & CZR both are taking off big time. MGM looks like it could be close to a breakout session so thinking it might be a good time to put a long term bet on Wynn and see if money will rotate into it over the next few weeks. I

oofwanderer said:

TSLA

look out! filled that gap from yesterday, still another one to fill down at 335, if we get there.BREwmaster said:yeah, can't break 280+, still range bound$30,000 Millionaire said:

NDX/QQQ looks to be stalling out

bear flags now on QQQ and SPY 5 min...damn that didn't take long.

Ragoo said:oofwanderer said:

TSLA

what a roller coastertramaro1 said:Ragoo said:oofwanderer said:

TSLA

Right back up, what 20 point dip lol

McInnis 03 said:

They've got some work to do if they want those 260 calls not to be zeroed. I know alllllllll about zeroing OTM calls.

Now if someone can just send smoke signals to MARA to follow Bitcoin back up that would help.fooz said:

Well, QD closed above my avg cost, so I've got that going for me.

Some stupid reason they will be worthless by opening. Makes no sense besides 2020Agzonfire said:

FDX up big after hours. I'm holding 2 $260 9/18 Calls. Looking to sell at open

historyrepeats said:

Hopefully they go ITM by market open tomorrow and you can sell for profit, otherwise might be better to hold them?

Agzonfire said:historyrepeats said:

Hopefully they go ITM by market open tomorrow and you can sell for profit, otherwise might be better to hold them?

If I bought them at 4 this afternoon, and can sell at 8 tomorrow what does it matter?

AgShaun00 said:Some stupid reason they will be worthless by opening. Makes no sense besides 2020Agzonfire said:

FDX up big after hours. I'm holding 2 $260 9/18 Calls. Looking to sell at open

MaroonDynasty said:

MGNI

it is real because the unknown is now known. The what was once implied volatility is no longer implies.McInnis 03 said:AgShaun00 said:Some stupid reason they will be worthless by opening. Makes no sense besides 2020Agzonfire said:

FDX up big after hours. I'm holding 2 $260 9/18 Calls. Looking to sell at open

It's called IV crush. It's real.

Jet Black said:

Does premarket trading and ah trading hurt the average investor?

Second that....Bob Knights Liver said:MaroonDynasty said:

MGNI

I'm not greedy, I just want another pop above 12.

The only premarket or AH trading I've done is a buy at a 'hopeful' price that I've set a limit order at to average down/accumulate or selling a position at my target if the stock has some history of AH spikes. Both sides have worked but rare for me anyway.Jet Black said:

Does premarket trading and ah trading hurt the average investor?

Prognightmare said:

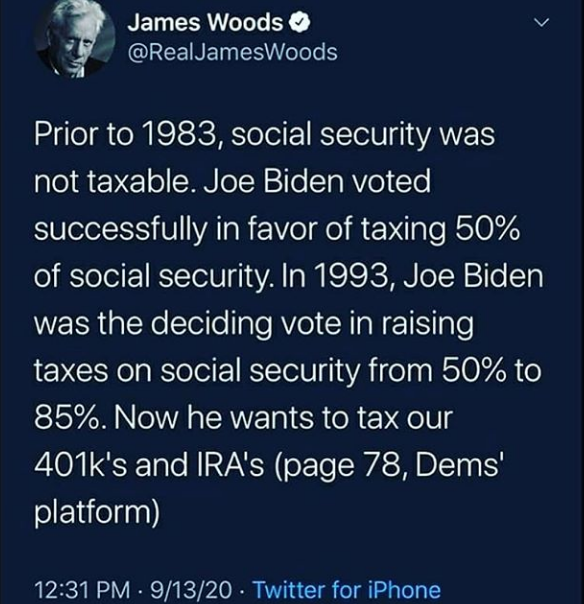

I haven't looked into the validity of this claim, but if true, it will have a profound outcome on the markets.

Vote accordingly.