Any good option book recommendations?

Stock Markets

26,777,317 Views |

238384 Replies |

Last: 1 min ago by BrokeAssAggie

Another point, depending on your brokerage, one strategy to "close out" a position is to sell another option.

Example, you buy a $105 call when a stock is $100. The stock goes to $110 and expiration is this coming Friday. Maybe your $105 call doesnt have much time value (ie, its trading around $5) and you want more, You can sell a $108, $109, or $110 and collect the premium. Note, that in doing so, you have sold away any potential gains if the stock continues upward. If the stock closes on Friday at $110 and you still have your $105 and you sold a $108, you will get the $3 plus the premium from the $108 (less any exercise fees), and both options will get exercised (no shares will be assigned or called away from you as they net to zero).

Example, you buy a $105 call when a stock is $100. The stock goes to $110 and expiration is this coming Friday. Maybe your $105 call doesnt have much time value (ie, its trading around $5) and you want more, You can sell a $108, $109, or $110 and collect the premium. Note, that in doing so, you have sold away any potential gains if the stock continues upward. If the stock closes on Friday at $110 and you still have your $105 and you sold a $108, you will get the $3 plus the premium from the $108 (less any exercise fees), and both options will get exercised (no shares will be assigned or called away from you as they net to zero).

flyingaggie12 said:

Any good option book recommendations?

I literally just bought "Option Volatility and Pricing" - Sheldon Natenberg.

They described it as the bible of options trading.

If you have that options level authorizationjamaggie06 said:

Another point, depending on your brokerage, one strategy to "close out" a position is to sell another option.

Example, you buy a $105 call when a stock is $100. The stock goes to $110 and expiration is this coming Friday. Maybe your $105 call doesnt have much time value (ie, its trading around $5) and you want more, You can sell a $108, $109, or $110 and collect the premium. Note, that in doing so, you have sold away any potential gains if the stock continues upward. If the stock closes on Friday at $110 and you still have your $105 and you sold a $108, you will get the $3 plus the premium from the $108 (less any exercise fees), and both options will get exercised (no shares will be assigned or called away from you as they net to zero).

Can't you sell the call before expiration?AGSmith said:

If you buy a SPY call and you hold it when it expires in the money your broker will exercise your option to buy 100 SPY shares at the strike price unless you expressly direct them otherwise. Today, for example, if you held the 5/22 SPY 295, it would've closed in the money (SPY closed at 295.44), so your broker would exercise the option and buy you 100 shares at $295ea ($29,500)

The world needs mean tweets

My Pronouns Ultra and MAGA

Trump 2024

My Pronouns Ultra and MAGA

Trump 2024

Replying to bookmark your post with book title.

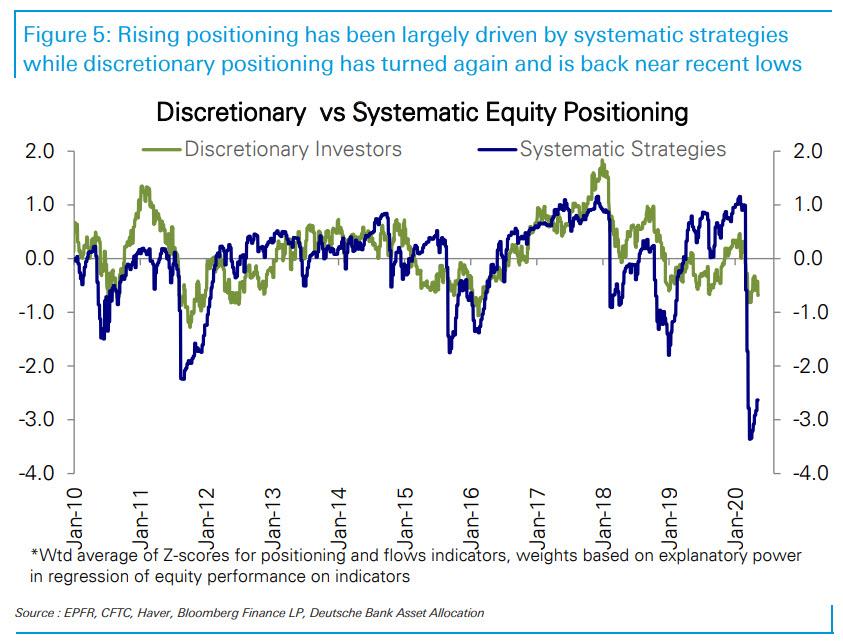

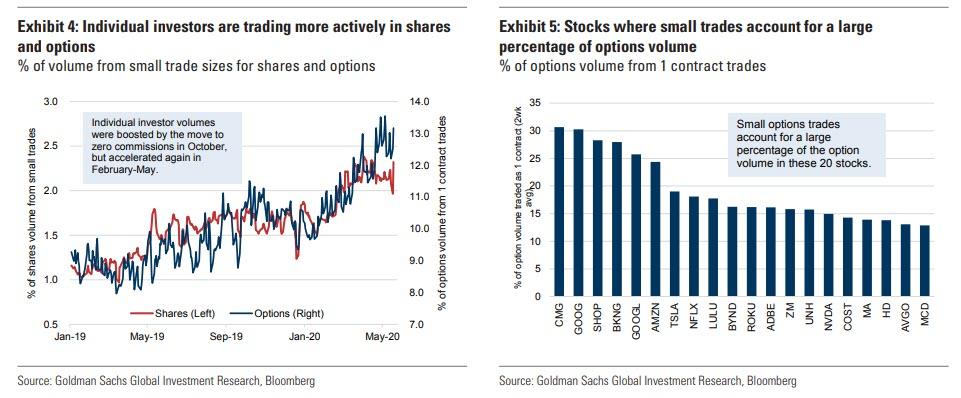

Retail is all that's fueling the markets up here. It's going to end badly.

claym711 said:

Retail is all that's fueling the markets up here. It's going to end badly.

I'm with you on mal investments due to liquidity injections, but pertaining to stocks... don't fight the Fed yet.

$PTON holding that $45 FIB level pretty well. Looks favorable for a move up next week. Any of you guys in this one?

I'm waiting. I want to make some money in a full / partial retest and then flip back to a more long position.

Clay, thanks for sharing that.

You can sell it, but the question I was responding to was what happens if you hold it at expiration

claym711 said:?itok=EDhR8dOA

You can chart the velocity/momentum of the rally against the Fed pump. The further it tapers, the slower we gonna move

Great find. Do you know of a live link or source of this pump intensity to monitor ?

claym711 said:

Retail is all that's fueling the markets up here. It's going to end badly.

Algos feed on liquidity and the only liquidity is retail stop losses. Be ready lol

***If this post is on Business and Investing, take it with a grain of salt. I am wrong way more than I am right (but I am less wrong than I used to be) and if you follow me you will be too.***

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

McInnis 03 said:claym711 said:

Retail is all that's fueling the markets up here. It's going to end badly.

Algos feed on liquidity and the only liquidity is retail stop losses. Be ready lol

When do you think we see that downward momentum come through?

Aggies1322 said:McInnis 03 said:claym711 said:

Retail is all that's fueling the markets up here. It's going to end badly.

Algos feed on liquidity and the only liquidity is retail stop losses. Be ready lol

When do you think we see that downward momentum come through?

If I knew I'd post for us all to get paiiiiiddddd

***If this post is on Business and Investing, take it with a grain of salt. I am wrong way more than I am right (but I am less wrong than I used to be) and if you follow me you will be too.***

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

McInnis 03 said:Aggies1322 said:McInnis 03 said:claym711 said:

Retail is all that's fueling the markets up here. It's going to end badly.

Algos feed on liquidity and the only liquidity is retail stop losses. Be ready lol

When do you think we see that downward momentum come through?

If I knew I'd post for us all to get paiiiiiddddd

Haha no doubt. I was just curious if you thought it was more short term crisis or 2-3 years down the road.

https://www.newyorkfed.org/markets/domestic-market-operations/monetary-policy-implementation/treasury-securities/treasury-securities-operational-details

The NY fed posts their market and policy implementation on their website

The NY fed posts their market and policy implementation on their website

No material on this site is intended to be a substitute for professional medical advice, diagnosis or treatment. See full Medical Disclaimer.

I've thought we are due for a downdraft since mid April, especially since the April high. Could go to SPY 310-315 before we turn back, but feels like we will.

Man I have no clue when it occurs, but will keep sharing when I see something indicative of a deeper move down. Right now market is mostly behaving as if VIX is or should be 15, not 30.

Y'all bears just let me know when I need to move to bonds in 401k and all cash in investment fund. Preferably the day before the rug pull mmmkk thanks

Howdy gang,

I love to cook and if you do too, y'all should give these a try. They're really good and easy to make.

https://chilledmagazine.com/crown-royal-infused-hot-wings

Trading stocks and cooking are 2 of my passions.

I love to cook and if you do too, y'all should give these a try. They're really good and easy to make.

https://chilledmagazine.com/crown-royal-infused-hot-wings

Trading stocks and cooking are 2 of my passions.

I buy the ARK funds because Cathie is freaking awesome at making money.

***If this post is on Business and Investing, take it with a grain of salt. I am wrong way more than I am right (but I am less wrong than I used to be) and if you follow me you will be too.***

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

Well that makes the weekend better for any guy that bought $115 roku calls with 6/4 expiry (as one of his first option trades) $3 premium.

McInnis 03 said:

I buy the ARK funds because Cathie is freaking awesome at making money.

You're ours know.

RPMag said:

$PTON holding that $45 FIB level pretty well. Looks favorable for a move up next week. Any of you guys in this one?

I have some July $50 calls.

Every knee shall bow and every tongue shall confess

I despise Marxists... the most repugnant people alive.

Prognightmare said:

Howdy gang,

I love to cook and if you do too, y'all should give these a try. They're really good and easy to make.

https://chilledmagazine.com/crown-royal-infused-hot-wings

Trading stocks and cooking are 2 of my passions.

Amen prog! I love me some cooking (not baking). Grilled wings is one of the simplest things to make and it makes them taste 10x better. People are always amazed how good mine turn out and I'm just like "I dried them, S&P them, and then grill em."

I have done this but with Pappy instead of the crown.

I would have believed this if oa posted.drred4 said:

I have done this but with Pappy instead of the crown.

drred4 said:

I have done this but with Pappy instead of the crown.

#humblebrag

Does anyone like the 8/21 DKNG $30c? I feel like they could see some momentum with positive news on the sports reopening.

Featured Stories

See All

8:50

8h ago

1.5k

Detailing important departures from Texas A&M's top 2025 opponents

by Olin Buchanan

10:42

19h ago

1.8k

16:23

21h ago

4.0k

Running Thread: Three Ags participating in 2025 NFL Scouting Combine

by Matthew Dawson

aggie67,74&76

Ags run-rule Texas State, Peters blanks Princeton in Thursday twin bill

in Billy Liucci's TexAgs Premium

5