I bought SFIX at 22.20

Stock Markets

26,068,650 Views |

235536 Replies |

Last: 6 hrs ago by zgolfz85

Quote:

Roku Stock's Biggest Bull Prefers It Over Netflix. Here's Why. -- Barrons.com

9:40 am ET August 12, 2019 (Dow Jones) Print

By David Marino-Nachison

Buy Roku, not Netflix, says the analyst who is now the biggest Roku bull on Wall Street.

Roku stock (ticker: ROKU), up 309% in 2019 through Friday's close, was up 4.6% to $131.11 shortly after Monday's open. Needham analyst Laura Martin reiterated a Buy rating on the shares on Monday, boosting her price target by $30 to $150, above FactSet's roughly $115 average and the highest tracked by FactSet.

Both Roku and Netflix (NFLX) stocks, Martin said, trade near 8 times her estimates of 2020 revenue. "Given similar valuations, we prefer Roku," she wrote.

The companies both look to benefit from increasing consumer migration to streaming services, but Roku, as a platform that aggregates content and resells other services, means it doesn't need to compete on content or on monthly fees.

Read: Here's Why Netflix's Problems Have Only Just Begun

Roku "is an arms dealer," Martin wrote. "It is indifferent about which over-the-top services or business models win. Roku negotiates a 20-30% revenue share from every over-the-top service that wants access to its 30 million homes. At 3.5 hours a day per household of viewing in the second quarter of 2019, it would be impossible...to launch a new over-the-top service without access to Roku's 36% of connected TV homes."

Roku's shares rose last week after the company reported second-quarter financial results and an updated outlook that encouraged investors. Several bullish analysts quickly boosted their share price targets after the results were released, and one bear said his valuation was "under review."

Shares of Netflix were up 15% in 2019 through Friday's close. They were down 1% at $305.93 shortly after Monday's open. The S&P 500 was down 0.6%. The company's latest quarterly numbers, which included a domestic subscriber loss, worried some investors.

I got into ROKU at $41 and got out completely at $72. Hindsight can hurt.gougler08 said:IrishTxAggie said:

ROKU got a rocket up it's ass premarket. Up almost 3% on Needham's upgrade to $150.

My worst no trade so far...was trying to let it get down to $35 a while back (got to $36) and never executed my buys

The gaps on this thing over 5 DAYS

Yes ---plus they have a buyback program going on.Aggie_2463 said:So you're saying buyoldarmy1 said:

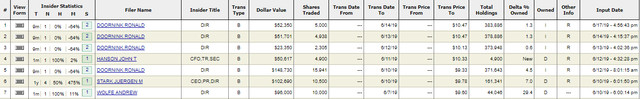

Look at the HEAR insider buys above the current price.

I couldn't actually read your graphic it was too small, but I assumed that's what you were showing lololdarmy1 said:Yes ---plus they have a buyback program going on.Aggie_2463 said:So you're saying buyoldarmy1 said:

Look at the HEAR insider buys above the current price.

I hope you're right! I have some cash to throw at it.IrishTxAggie said:Hopefully this week...Prognightmare said:

You, me, Irish and Ragoo have been on this board awhile now, so I'm just ribbing a brother.

ETA: FWIW I think it will pullback to $110-113 when all the excitement dies down

2894 key on S&P short term. We flashed below it but started this bounce. Bull/Bear line of direction is on that mark.

Market feels heavy....we get rips below 2894 and we likely are going for a serious correction.

ROKU isn't in the S&P 500 yet, is it? If not, when it get's added, it will really explode.

2nd support bounce on below 2894 flash doe to 2892.63.

HEAR up to $9.18..

$9.18Aggie_2463 said:

HEAR up to $9.14

There is a seller above $9.15 last 2 days.

COOP creeping up to top of resistance.

Looks like this will be pretty solid today.oldarmy1 said:

2nd support bounce on below 2894 flash doe to 2892.63.

Our favorite penny stock, TRNX, is up ~12% today

Looks like ROKU finally found it's resistance at $135.5

I went Sept 20 $24 calls.Prognightmare said:

I bought SFIX at 22.20

COOP breaking out

oldarmy1 said:

COOP breaking out

I know this is one of your long-term accumulation favorites. Do you have a target sell price, or do you just continue to accumulate when it's down in that $9.00 range?

IrishTxAggie said:

Looks like ROKU finally found it's resistance at $135.5

$136.07 now. Shooting up again.

"Give me an army of West Point graduates and I'll win a battle. Give me a handful of Texas Aggies, and I'll win the war.”

- General George S. Patton

- General George S. Patton

oldarmy1 said:I went Sept 20 $24 calls.Prognightmare said:

I bought SFIX at 22.20

What's your price target for those?

"Give me an army of West Point graduates and I'll win a battle. Give me a handful of Texas Aggies, and I'll win the war.”

- General George S. Patton

- General George S. Patton

Argentina market has crashed after Marci got beat like a red-headed stepchild in the primary.

This is mind boggling to me.WestTexAg12 said:IrishTxAggie said:

Looks like ROKU finally found it's resistance at $135.5

$136.07 now. Shooting up again.

$3.25WestTexAg12 said:oldarmy1 said:I went Sept 20 $24 calls.Prognightmare said:

I bought SFIX at 22.20

What's your price target for those?

JD buyers using the down day to sneak it higher against macro market sellers..

WORK breaking out of its support level. I'm a buyer

Stock or options on WORK?

Sept 20 $35spud1910 said:

Stock or options on WORK?

oldarmy1 said:

JD buyers using the down day to sneak it higher against macro market sellers..

Touched a few times at $27.24 and has a flash above. Looks like resistance to me.

"Give me an army of West Point graduates and I'll win a battle. Give me a handful of Texas Aggies, and I'll win the war.”

- General George S. Patton

- General George S. Patton

DXC

Money pouring into this one now

Money pouring into this one now

Featured Stories

See All

75:17

1d ago

7.4k

No. 11 A&M looks to right the ship on Saturday night vs. LSU at Reed

by Olin Buchanan

11:35

6h ago

1.5k

Aggie ace Ryan Prager feels 'great' as he builds toward Opening Day

by Ryan Brauninger

7:49

4h ago

1.4k

Transfer infielder Wyatt Henseler ready to make his Texas A&M debut

by Ryan Brauninger

Keys to the Game: No. 11 Texas A&M vs. Louisiana State

by Luke Evangelist