in on some 291 spy puts for Monday

no sig

Just give me a name other than WLL, lol. Fortunately I cut my losses before it got a lot worse. Currently at $9! crazy cheap.Prognightmare said:

I'm going to start buying some names with a portion of my trading profits. The prices of some of these are ridiculous.

BREwmaster said:Just give me a name other than WLL, lol. Fortunately I cut my losses before it got a lot worse. Currently at $9! crazy cheap.Prognightmare said:

I'm going to start buying some names with a portion of my trading profits. The prices of some of these are ridiculous.

Good morning fam,Quote:

Aug 05, 2019 (Stock Traders Daily via COMTEX) -- The Transocean RIG, -5.46% update and the technical summary table below can help you manage risk and optimize returns. We have day, swing, and longer-term trading plans for RIG, and 1300 other stocks too, updated in real time for our trial subscribers. The data below is a snapshot, but updates are available now.

Technical Summary

The Technical Summary and Trading Plans for RIG help you determine where to buy, sell, and set risk controls. The data is best used in conjunction with our Market Analysis and Stock Correlation Filters too, because those help us go with the flow of the market as well. Going with the flow is extremely important, so review our Market Analysis with this RIG Report.

The technical summary data tells us to buy RIG near 4.34 with an upside target of 6.31. This data also tells us to set a stop loss @ 4.08 to protect against excessive loss in case the stock begins to move against the trade. 4.34 is the first level of support below 4.95 , and by rule, any test of support is a buy signal. In this case, support 4.34 would be being tested, so a buy signal would exist.

The technical summary data is suggesting a short of RIG as it gets near 6.31 with a downside target of 4.34. We should have a stop loss in place at 6.57 though. 6.31 is the first level of resistance above 4.95, and by rule, any test of resistance is a short signal. In this case, if resistance 6.31 is being tested, so a short signal would exist.

Quote:

Aug 05, 2019 (Stock Traders Daily via COMTEX) -- The Patterson-uti Energy PTEN, -5.95% update and the technical summary table below can help you manage risk and optimize returns. We have day, swing, and longer-term trading plans for PTEN, and 1300 other stocks too, updated in real time for our trial subscribers. The data below is a snapshot, but updates are available now.

The Technical Summary and Trading Plans for PTEN help you determine where to buy, sell, and set risk controls. The data is best used in conjunction with our Market Analysis and Stock Correlation Filters too, because those help us go with the flow of the market as well. Going with the flow is extremely important, so review our Market Analysis with this PTEN Report.

The technical summary data tells us to buy PTEN near 8.61 with an upside target of 11.77. This data also tells us to set a stop loss @ 8.35 to protect against excessive loss in case the stock begins to move against the trade. 8.61 is the first level of support below 10.03 , and by rule, any test of support is a buy signal. In this case, support 8.61 would be being tested, so a buy signal would exist.

The technical summary data is suggesting a short of PTEN as it gets near 11.77 with a downside target of 8.61. We should have a stop loss in place at 12.03 though. 11.77 is the first level of resistance above 10.03, and by rule, any test of resistance is a short signal. In this case, if resistance 11.77 is being tested, so a short signal would exist.

boyz05 said:

China's next trade tit-for-tat move will be oil imports from US. Look for prices to move even lower in coming weeks.

IrishTxAggie said:

Futures aren't pretty so far this morning. Down 23.5. Might be some good weekly opportunities today.

IrishTxAggie said:

ROKU got a rocket up it's ass premarket. Up almost 3% on Needham's upgrade to $150.

gougler08 said:IrishTxAggie said:

ROKU got a rocket up it's ass premarket. Up almost 3% on Needham's upgrade to $150.

My worst no trade so far...was trying to let it get down to $35 a while back (got to $36) and never executed my buys

Quote:

Needham pushes Roku's (NASDAQ:ROKU) target from $120 to $150 and affirms it as the firm's top mid-cap pick for 2019.

Analyst Laura Martin cites ROKU's "dominant" market position, comparing the company to YouTube's position for user-generated content. Martin says the "value proposition to advertisers is growing."

Needham maintains a Buy rating. Roku has an Outperform average Sell Side rating.

ROKU shares are up 0.2% pre-market to $125.56.

Hopefully this week...Prognightmare said:

You, me, Irish and Ragoo have been on this board awhile now, so I'm just ribbing a brother.

ETA: FWIW I think it will pullback to $110-113 when all the excitement dies down

So you're saying buyoldarmy1 said:

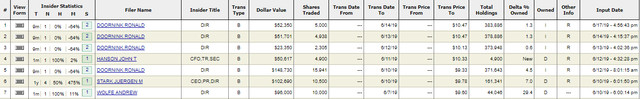

Look at the HEAR insider buys above the current price.