Stock Markets

26,268,434 Views |

236241 Replies |

Last: 13 min ago by ReturnOfTheAg

Trading View is pretty good.

oldarmy1 said:

I'll agree to a 30 minute conference call if the Palk's GoFundMe hits over $20k this weekend.

https://www.gofundme.com/f/bq485-let039s-support-the-palk-family

Donated. It is over $20k now.

As someone who's very suspect of Tesla's financials, this article is interesting

They look like they have what I need...thank you sir!jmcfar_98 said:

Trading View is pretty good.

Per CNBC.com, Trump jacking up tariffs on China on Friday. Let's see how markets react.

China will cave on the talks (they have more to lose), I expect a deal will be made.

Well, that figures...

Excellent stuff Ags! Stan was moved by your generosity.

Let's talk about a call time. I have Tuesday anytime after 3pm. Wednesday 1-2:30pm. Maybe Thursday late afternoon.

See what consensus is by end of day Monday and we'll get a bridge # posted.

Let's talk about a call time. I have Tuesday anytime after 3pm. Wednesday 1-2:30pm. Maybe Thursday late afternoon.

See what consensus is by end of day Monday and we'll get a bridge # posted.

oldarmy1 said:

Excellent stuff Ags! Stan was moved by your generosity.

Let's talk about a call time. I have Tuesday anytime after 3pm. Wednesday 1-2:30pm. Maybe Thursday late afternoon.

See what consensus is by end of day Monday and we'll get a bridge # posted.

Yikes. Dow futures drop 450 points after Trump's tariff threat catches traders expecting a deal off guard. https://www.cnbc.com/2019/05/05/traders-brace-for-sharp-sell-off-on-trumps-tariff-threat.html?

I guess ill close out all long positions in the morning ...this crap is annoying

Well my QCOM puts may come in the money now. But it won't make up for the rest of my stuff.

Sold off my "fun money" position in Five Below during the afternoon rally Friday. Just feels like we are due for a bit of a sell off/pull back...

There was never going to be a meaningful deal. China can just wait for the next guy and Trump won't risk reelection.

https://www.cnbc.com/2019/05/05/traders-brace-for-sharp-sell-off-on-trumps-tariff-threat.html

Quote:

The Wall Street Journal reported that China is considering cancelling its trade talks with the U.S. this week in light of Trump's latest threats. Citing a source, the Journal said Beijing had been surprised by the new threats.

The apparent about-face in trade sentiment left some Wall Street insiders worried about the effect on the U.S. equity market, fresh off record highs.

"Another turn of the screw tighter Sunday from the President's hard-ball tactics with the China trade talks, and his pair of tweets look like they could unleash a sharp stock market correction," said Chris Rupkey, chief financial economist at MUFG Union Bank, in a note. "For weeks now markets have been lulled to sleep on the US trade war with China thinking an agreement was imminent. No more."

"This has all the makings of a complete disaster that could lead the stock market to crater this week and send those external risks to the US economic outlook soaring," he added.

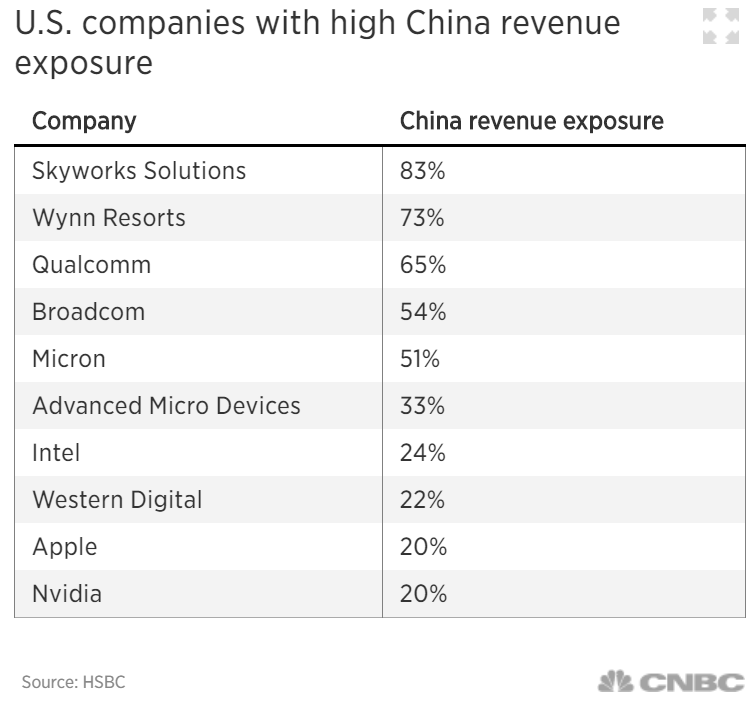

Shares of U.S. companies with big sales in China may lead the market's losses on Monday including Apple, Wynn Resorts and various chipmakers on fears China may retaliate.

*buckles seatbelt*

Guess it'll be an interesting week.

Guess it'll be an interesting week.

No material on this site is intended to be a substitute for professional medical advice, diagnosis or treatment. See full Medical Disclaimer.

S&P down 55

Doesn't seem like China can really afford a trade war.

Wowza

PeekingDuck said:

Doesn't seem like China can really afford a trade war.

I think they could stomach a trade war going into the 2020 election more so than Trump, i hope im wrong

Impossible to know how personalities play this out. Trump could clarify his statement before markets open and the script flips.

We could really heat up the selling and go an additional 50+ down which would close the 2835 gap.

China could blink.

All a big show impacting billions of dollars.

We could really heat up the selling and go an additional 50+ down which would close the 2835 gap.

China could blink.

All a big show impacting billions of dollars.

my guess is trump blinks and does a half assed deal. north korea rattling, israel/iran, etc. could be a tough stretch coming.

I really hope the deal happens quick, bought a ton of spy 298-305 calls for end of may/June.

Hoping the good earnings and China deal would spark a shoot up

Hoping the good earnings and China deal would spark a shoot up

It's still concerning that Trump keeps tweeting that it's the Chinese who pay for the tariffs. Does he really believe that or does he think his target constituents are dumb?

China has canceled their delegation to DC this week for the trade talks.

If NVDA flashes down to 165, would that be a good spot to go long calls again?

I feel bad for the BMA who bought 11k worth of those CSCO 55.5 calls last Friday. Snatching defeat out of the jaws of victory

I hate that Trump dropped that tweet, but as someone that has been through a lot of negotiations with Chinese, this could very well have needed to be said. They love stalling and/or changing the agreement right before everyone is ready to sign. If you don't get up and walk away sometimes, they'll never stop pulling *****

Shanghai exchange down over 5% and Shenzhen exchange down over 7%. Yet to be seen about US markets, but S&P futures currently down "only" about 1.5%. Anything to read into this? Is the market sentiment that this does in fact hit China harder - and they may blink?

Or nothing can be read into it at all?

Or nothing can be read into it at all?

Trump's tax breaks gave him the opportunity to wage this war. The Chinese don't have the same luxury. It is hitting them much harder than it is hitting us. At the beginning of April, they dropped their VAT from 16% to 13%. It didn't even move their needle. I'll give you a quick example of how the Chinese operate and why exports and foreign markets are so vital to them.Gigemags382 said:

Shanghai exchange down over 5% and Shenzhen exchange down over 7%. Yet to be seen about US markets, but S&P futures currently down "only" about 1.5%. Anything to read into this? Is the market sentiment that this does in fact hit China harder - and they may blink?

Or nothing can be read into it at all?

I have manufacturing in China. I sell Product A to a company in the Philippines for $2.50USD/kg. The Chinese gov't gives us a rebates for selling the product outside of the country. Now, that same Product A if I were to sell it to a Chinese company costs ~$3.25USD/kg (All Chinese sales have to be done in Yuan, so that is approximate)!! It literally costs more money to sell the product into their own country because we have to pay the VAT and we lose export rebates that we bake into our export pricing. So, the US tacking on the tariffs is hurting them far more than it hurts us right now. Xi has a lot of power, but the villagers are starting to yell a little louder.

My WAG on the Chinese issue is that it's not going to be resolved for quite a while. Both countries view themselves as alpha dogs and will not accept the perception they got the short end of any deal. We will only get a deal once each country realizes that they will have to lose in areas they previously felt were non-negotiable. The Chinese may just wait until a dem president takes over and gives them everything they want.

As far as the markets go, I bet any Chinese fears are quickly tossed aside as soon as a bigger story comes out.

As far as the markets go, I bet any Chinese fears are quickly tossed aside as soon as a bigger story comes out.

IrishTxAggie said:Trump's tax breaks gave him the opportunity to wage this war. The Chinese don't have the same luxury. It is hitting them much harder than it is hitting us. At the beginning of April, they dropped their VAT from 16% to 13%. It didn't even move their needle. I'll give you a quick example of how the Chinese operate and why exports and foreign markets are so vital to them.Gigemags382 said:

Shanghai exchange down over 5% and Shenzhen exchange down over 7%. Yet to be seen about US markets, but S&P futures currently down "only" about 1.5%. Anything to read into this? Is the market sentiment that this does in fact hit China harder - and they may blink?

Or nothing can be read into it at all?

I have manufacturing in China. I sell Product A to a company in the Philippines for $2.50USD/kg. The Chinese gov't gives us a rebates for selling the product outside of the country. Now, that same Product A if I were to sell it to a Chinese company costs ~$3.25USD/kg (All Chinese sales have to be done in Yuan, so that is approximate)!! It literally costs more money to sell the product into their own country because we have to pay the VAT and we lose export rebates that we bake into our export pricing. So, the US tacking on the tariffs is hurting them far more than it hurts us right now. Xi has a lot of power, but the villagers are starting to yell a little louder.

Thanks for the detailed post. That makes sense.

What about everyone basically saying that Trump is an idiot for not realizing that the tariffs are ultimately paid by Americans? From my recollection, that is how tariffs end up working.

Well, what goes up must come down.... now the question is what stocks do we gobble up at a discount

Featured Stories

See All

27:33

23h ago

9.6k

9:44

1h ago

1.4k

28:58

3h ago

925

Reed Report: Elston Turner 'humbled' by earning SEC Legend status

by Luke Evangelist

12:43

6m ago

74

39:02

51m ago

230

The Fan Show sponsored by PrizePicks

by David Nuño