I started playing small lottos on SAVA. Pretty much all week it has been a red to green daily. I started buying just OTM calls in the morning when it was red and flipping when it went green. It was a good week.Prognightmare said:

This market today was so boring. To borrow a saying from my late Dad, " this is like watching two old people ****".

Stock Markets

26,668,591 Views |

237929 Replies |

Last: 19 min ago by infinity ag

Oof.AG 2000' said:SESN The FDA has determined that it cannot approve the BLA for Vicineum in its present form and has provided recommendations specific to additional clinical/statistical data and analyses in addition to Chemistry, Manufacturing and Controls (CMC) issues pertaining to a recent pre-approval inspection and product quality.McInnis 03 said:

SESN

The product quality issue could mean they most likely have either stability or impurity issues.

The pre-approval inspection 483 could be a whole host of things ranging from analytical method validations, manufacturing validation state, data fidelity, etc... Their PAI prep should have identified all of these CMC issues prior to submitting the NDA. I've been in their shoes before and it's not fun.

That being said, I'm going to take a look at their investor package and may buy the dip if the clinical data looks promising.

really only had success with day trading SNOW today, but it was a couple of good ones.

Please let us know what you find. I was considering buying today just because I assumed it would be oversold, but I set my buy order a little too low. Would have loved to get those shares at $0.70.Aggie Pharmer said:Oof.AG 2000' said:SESN The FDA has determined that it cannot approve the BLA for Vicineum in its present form and has provided recommendations specific to additional clinical/statistical data and analyses in addition to Chemistry, Manufacturing and Controls (CMC) issues pertaining to a recent pre-approval inspection and product quality.McInnis 03 said:

SESN

The product quality issue could mean they most likely have either stability or impurity issues.

The pre-approval inspection 483 could be a whole host of things ranging from analytical method validations, manufacturing validation state, data fidelity, etc... Their PAI prep should have identified all of these CMC issues prior to submitting the NDA. I've been in their shoes before and it's not fun.

That being said, I'm going to take a look at their investor package and may buy the dip if the clinical data looks promising.

BTFD

It's Friday so I wanted y'all's opinion on this.AG 2000' said:Prognightmare said:I don't think it pertains to news. Anyone that has done their own DD on it knows that SAVA would have to really mess something up for them NOT to get FDA approval for their drug. It will be volatile because it's a small float company, but I think it grinds higher as the months go by.AG 2000' said:Prognightmare said:

Someone is buying SAVA

ETA: I meant retail, not being acquired. Sorry for any misunderstanding.

Yeah feels like news is incoming. Up 10% already?

In the earnings call they mentioned announcing an infusion of non-dilutive capital in the coming weeks or months.

I figured there would be a run ahead of that announcement or in conjunction with it.

I don't think there will be any study related news until they have twelve month data to share.

After you posted this, I remember reading that in their earnings report. I thought about this and have a hypothesis and wanted to know if I'm way off base or if you (everyone) think it's probable. I'm a small business owner now, not in the corporate world at a huge company, but many in here are. Even if you're only a lurker but have an opinion, please opine. Bluntly telling me that I'm dumbass wrong and should just go pour a drink will not offend me.

Here it is:

Why would a company infuse capital without diluting the shares and owning a part of SAVA?

I'm confident that they will get FDA approval for their drug when phase 3 is complete, but there are no guarantees. SAVA is also a small company that I assume does not have an extensive salesforce, or any at all. If a major company did take an ownership stake (shares) in SAVA, this would have to be disclosed. What if it's one of the big pharma companies, that all have an extensive salesforce, is paying for the right of first refusal? If SAVA's drug fails and doesn't get FDA approval then their contribution would equate to a rounding error on their earnings report. However, when SAVA does get FDA approval then their contribution could be applied to the future cost should they want to acquire SAVA. If they don't want to acquire them, it would at least give them favored status in a partnership to have their reps sell SAVA's drug for them, for a fee of course.

I was just thinking outside the box and didn't want to bring this up during a trading day.

All input is welcome,

Prog

I'm going with this is stocks related since I've been smoked lately.

Just want to thank my family and GOD for this decision…… COMMITTED TO TEXAS A&M pic.twitter.com/nCIA8k04uF

— CountedOut3️⃣🖤 (@BouieDeyon) August 13, 2021

I sold my ANY today when it peaked.....but I'mma buy it back Monday.

Your hunch is a possibility, but I think it's more likely that this infusion of capital is another grant from the NIH.Prognightmare said:It's Friday so I wanted y'all's opinion on this.AG 2000' said:Prognightmare said:I don't think it pertains to news. Anyone that has done their own DD on it knows that SAVA would have to really mess something up for them NOT to get FDA approval for their drug. It will be volatile because it's a small float company, but I think it grinds higher as the months go by.AG 2000' said:Prognightmare said:

Someone is buying SAVA

ETA: I meant retail, not being acquired. Sorry for any misunderstanding.

Yeah feels like news is incoming. Up 10% already?

In the earnings call they mentioned announcing an infusion of non-dilutive capital in the coming weeks or months.

I figured there would be a run ahead of that announcement or in conjunction with it.

I don't think there will be any study related news until they have twelve month data to share.

After you posted this, I remember reading that in their earnings report. I thought about this and have a hypothesis and wanted to know if I'm way off base or if you (everyone) think it's probable. I'm a small business owner now, not in the corporate world at a huge company, but many in here are. Even if you're only a lurker but have an opinion, please opine. Bluntly telling me that I'm dumbass wrong and should just go pour a drink will not offend me.

Here it is:

Why would a company infuse capital without diluting the shares and owning a part of SAVA?

I'm confident that they will get FDA approval for their drug when phase 3 is complete, but there are no guarantees. SAVA is also a small company that I assume does not have an extensive salesforce, or any at all. If a major company did take an ownership stake (shares) in SAVA, this would have to be disclosed. What if it's one of the big pharma companies, that all have an extensive salesforce, is paying for the right of first refusal? If SAVA's drug fails and doesn't get FDA approval then their contribution would equate to a rounding error on their earnings report. However, when SAVA does get FDA approval then their contribution could be applied to the future cost should they want to acquire SAVA. If they don't want to acquire them, it would at least give them favored status in a partnership to have their reps sell SAVA's drug for them, for a fee of course.

I was just thinking outside the box and didn't want to bring this up during a trading day.

All input is welcome,

Prog

BTFD

Thank you for your reply and I considered this. Several Alzheimer's drugs are in development by some big players. DC is corrupt, why would the NIH give money to a company that isn't a huge lobbyist?Double_Bagger said:Your hunch is a possibility, but I think it's more likely that this infusion of capital is another grant from the NIH.Prognightmare said:It's Friday so I wanted y'all's opinion on this.AG 2000' said:Prognightmare said:I don't think it pertains to news. Anyone that has done their own DD on it knows that SAVA would have to really mess something up for them NOT to get FDA approval for their drug. It will be volatile because it's a small float company, but I think it grinds higher as the months go by.AG 2000' said:Prognightmare said:

Someone is buying SAVA

ETA: I meant retail, not being acquired. Sorry for any misunderstanding.

Yeah feels like news is incoming. Up 10% already?

In the earnings call they mentioned announcing an infusion of non-dilutive capital in the coming weeks or months.

I figured there would be a run ahead of that announcement or in conjunction with it.

I don't think there will be any study related news until they have twelve month data to share.

After you posted this, I remember reading that in their earnings report. I thought about this and have a hypothesis and wanted to know if I'm way off base or if you (everyone) think it's probable. I'm a small business owner now, not in the corporate world at a huge company, but many in here are. Even if you're only a lurker but have an opinion, please opine. Bluntly telling me that I'm dumbass wrong and should just go pour a drink will not offend me.

Here it is:

Why would a company infuse capital without diluting the shares and owning a part of SAVA?

I'm confident that they will get FDA approval for their drug when phase 3 is complete, but there are no guarantees. SAVA is also a small company that I assume does not have an extensive salesforce, or any at all. If a major company did take an ownership stake (shares) in SAVA, this would have to be disclosed. What if it's one of the big pharma companies, that all have an extensive salesforce, is paying for the right of first refusal? If SAVA's drug fails and doesn't get FDA approval then their contribution would equate to a rounding error on their earnings report. However, when SAVA does get FDA approval then their contribution could be applied to the future cost should they want to acquire SAVA. If they don't want to acquire them, it would at least give them favored status in a partnership to have their reps sell SAVA's drug for them, for a fee of course.

I was just thinking outside the box and didn't want to bring this up during a trading day.

All input is welcome,

Prog

Normal business loans or other financing arrangements could be deemed capital infusion without share dilution. Also if the execs work out a deal to sell their personal shares or to sell shares that have technically been issued but were not currently in public circulation, that could be considered the same.

If I were getting a loan or wanted to add a large partner like that under an agreed amount of current shares, I'd also make that announcement. That way when it executed and stocktwits freaks out you could quell that with "Yeah we already released that information two months ago."

If I were getting a loan or wanted to add a large partner like that under an agreed amount of current shares, I'd also make that announcement. That way when it executed and stocktwits freaks out you could quell that with "Yeah we already released that information two months ago."

Or a grant, as double bagger said.

By the way, I'm wanting to get him in the nomination queue for Stock Trading thread newcomer of the year. I really enjoy reading his thoughts. And I'm assuming he's a he because he hasn't posted his cans.

By the way, I'm wanting to get him in the nomination queue for Stock Trading thread newcomer of the year. I really enjoy reading his thoughts. And I'm assuming he's a he because he hasn't posted his cans.

Wouldn't a publicly traded company have to disclose those shares on one of their filings?Tomas Hermensa said:

Normal business loans or other financing arrangements could be deemed capital infusion without share dilution. Also if the execs work out a deal to sell their personal shares or to sell shares that have technically been issued but were not currently in public circulation, that could be considered the same.

If I were getting a loan or wanted to add a large partner like that under an agreed amount of current shares, I'd also make that announcement. That way when it executed and stocktwits freaks out you could quell that with "Yeah we already released that information two months ago."

Yes, bit this announcement ahead of that could be the way to make sure it gets framed as a positive instead of a negative. They get a "we wanted more capital for the next progression of monetizing this amazing product and we did it without diluting the ownership of our share holders cause we love you so much and Gig'em." Instead of the "The company or their executives are selling shares, this must really suck," line from shorts and impatient shareholders. Just my thoughts.

FWIW, in the world we live in now, I think SAVA top brass know they will get FDA approval (and have been guaranteed it). I don't think it's a question at all. The stock price also reflects it.

just my 2 cents - signed (some guy that bought the $70 dip on SAVA).

just my 2 cents - signed (some guy that bought the $70 dip on SAVA).

So the question is what the Phase 3 trial will compare:

Drug vs placebo or drug vs placebo vs memantine (Namenda)?

The baseline avg ADAS Cog-11 score was about 15.5-16 for the SAVA drug. The baseline ADAS Cog-11 score when Namenda was trialed against placebo for vascular dementia was slightly more than 20.

The SAVA drug showed improvement of like 3 points (16 to 13 they reported 29% improvement) at 6 months, but Namenda showed a very mild improvement too (0.4 pts) at 28 wks.

I'm generally not too enthusiastic about this drug. It looks like a fairly simple drug with a pretty straightforward mechanism of action. Why did it take so long to finally discover this?

Forget not that as bull markets become more and more bullish, even garbage ideas are lauded as incredible. Just one neurosurgeon's hot take. I just see a lot of folks with dementia, and I can't imagine one pill taking these folks back to meaningful quality of life. Our bodies degenerate over time, and one drug I can't imagine is gonna reverse all of that.

Hope I'm wrong for all of your's sakes and the families and patients that suffer with this condition, but I'm just not buying the hype.

Drug vs placebo or drug vs placebo vs memantine (Namenda)?

The baseline avg ADAS Cog-11 score was about 15.5-16 for the SAVA drug. The baseline ADAS Cog-11 score when Namenda was trialed against placebo for vascular dementia was slightly more than 20.

The SAVA drug showed improvement of like 3 points (16 to 13 they reported 29% improvement) at 6 months, but Namenda showed a very mild improvement too (0.4 pts) at 28 wks.

I'm generally not too enthusiastic about this drug. It looks like a fairly simple drug with a pretty straightforward mechanism of action. Why did it take so long to finally discover this?

Forget not that as bull markets become more and more bullish, even garbage ideas are lauded as incredible. Just one neurosurgeon's hot take. I just see a lot of folks with dementia, and I can't imagine one pill taking these folks back to meaningful quality of life. Our bodies degenerate over time, and one drug I can't imagine is gonna reverse all of that.

Hope I'm wrong for all of your's sakes and the families and patients that suffer with this condition, but I'm just not buying the hype.

BaylorSpineGuy said:

Hope I'm wrong for all of your's sakes and the families and patients that suffer with this condition, but I'm just not buying the hype.

You don't need to buy the hype. Just keep buying the dips.

Thanks for the contrary thoughts. Always good to hear.

My plan is to wait for upper $130s and sell CCs on or outright sell shares for the extra shares I picked back up on that dip below $80. I'll keep the others since they are amazingly net free already.

My plan is to wait for upper $130s and sell CCs on or outright sell shares for the extra shares I picked back up on that dip below $80. I'll keep the others since they are amazingly net free already.

You must not have seen Star Trek: The Journey Home.

Your input and knowledge regarding Alzheimer's treatment is appreciated by many but I think you're looking at SAVA different than I, and maybe others, may be.BaylorSpineGuy said:

So the question is what the Phase 3 trial will compare:

Drug vs placebo or drug vs placebo vs memantine (Namenda)?

The baseline avg ADAS Cog-11 score was about 15.5-16 for the SAVA drug. The baseline ADAS Cog-11 score when Namenda was trialed against placebo for vascular dementia was slightly more than 20.

The SAVA drug showed improvement of like 3 points (16 to 13 they reported 29% improvement) at 6 months, but Namenda showed a very mild improvement too (0.4 pts) at 28 wks.

I'm generally not too enthusiastic about this drug. It looks like a fairly simple drug with a pretty straightforward mechanism of action. Why did it take so long to finally discover this?

Forget not that as bull markets become more and more bullish, even garbage ideas are lauded as incredible. Just one neurosurgeon's hot take. I just see a lot of folks with dementia, and I can't imagine one pill taking these folks back to meaningful quality of life. Our bodies degenerate over time, and one drug I can't imagine is gonna reverse all of that.

Hope I'm wrong for all of your's sakes and the families and patients that suffer with this condition, but I'm just not buying the hype.

We know that this drug will not be a cure, but this has the potential to become a home run. If/when they get FDA approval, then a massive move should ensue. At that time, I'll close out all my positions for a life changing profit. Look at the charts on Biogen (BIIB) and Lilly (LLY) when they received FDA approval. BIIB should have never received approval according to my research. However, it went from $285 to almost $450 in a day. LLY went from $195 to almost $240 in day. Both of those stocks are significantly larger float wise compared to SAVA. When SAVA is approved, then just imagine that one day move. I wish there was a cure for Alzheimer's because I lived through it, but there isn't. However, a strong treatment will make this stock explode and I will be selling everything out when it does. This is a trade and that's what I'm focusing on.

Carlo4 said:lol all my bullets are fired for this one. Earnings AH so let's see how it goes.FAT SEXY said:Carlo4 said:

ELOX

Buy signal

And of course earnings are now postponed til next week.

Yall I know I've been posting about GILD for long time now.

Remember we were in a long term ascending triangle. We finally had the impulsive move this week that confirmed we might be seeing a massive breakout.

Here's the initial trigger that led me to believe we might see a huge move up.

The time to trade is after it has confirmed an impulsive move up. So once it took it the three levels of resistance and continued above the upper resistance of the triangle, that was the time to buy shares / calls. We got lucky in that it came back down to test the 34 EMA and shake some people out who already had calls (me, I didn't fall for it). So there was another buying opportunity yesterday. Today it continued higher before consolidating some. After hours it had a huge impulse to re-test our current resistance. There wasn't much volume with the move, but you can see how the 8 EMA bounced off the 34. That's a good sign of a higher continuation.

How far can it ultimately go? Who knows! I have a very simple method which is a standard technical analysis method of determining a possible gain from an impulse up above an ascending triangle. You simply draw a line straight up and down from the lowest confirmed point of the triangle to the upper resistance line. Then take that measurement and apply it to your initial break of resistance in your impulse move.

This is by no means a guarantee. It simply calculates the POTENTIAL max gain.

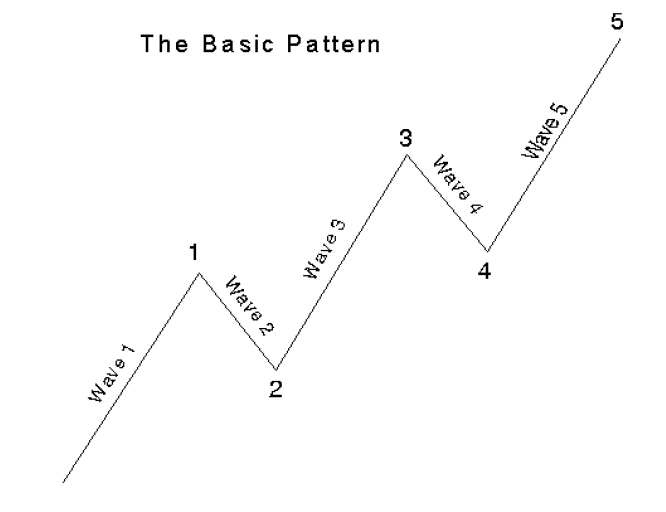

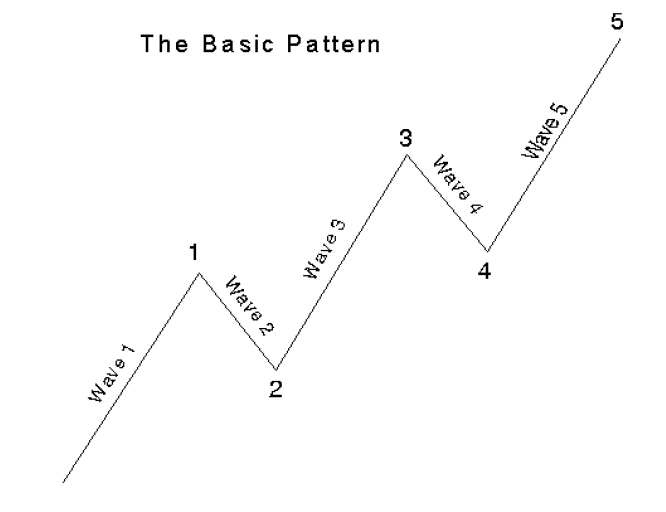

The other way I chart it (which I much prefer) is to apply Elliot Wave Theory. I'm not going to go crazy in depth because there's A LOT to EW theory. I'm still learning every day. But essentially, an impulsive move consists of 5 subwaves (1-2-3-4-5). Waves 1, 3, and 5 are "impulsive" waves moving in the direction of the overall larger wave which in this case is up (and can also be subdivided into their own 5 wave structures. Waves are fractal and can always be subdivided all the way down to the unreliable 1 min chart). Waves 2 and 4 are "corrective" and moving in the opposite direction of the larger wave trend which is down in this case.

How do we know if we are in an impulsive 5 wave structure and how do we know where the waves are? Well.. we have to go back in time and chart out the larger wave structure that the stock is currently in. Not all stocks fall neatly into wave structure. EW depends on market sentiment. So a stock has to have sentiment that actually cares about it, trades it, and enough volume. GILD has that. Looking back, it seems as if GILD completed a wave structure on May of 2015. After 5 waves are completed, you wll get an a-b-c corrective retracement down which we seem to have ending in December of last year. That's when our ascending triangle starts.

So starting at the bottom of "c", we can begin to chart a new 5 wave structure. We locate our potential waves 1 and 2 and plot our Fibonacci extensions from the beginning of 1, to the end of 1, then to the end of 2. From there, we can expect the wave (1) our wave 3 we are in to hit between the 38.2% and 61.8% extensions. Depending on which ones it hits can alter every move after. GILD seems to have hit the 61.8% level. So knowing that, we expect the wave (2) of our wave 3 to retrace down between the 23.6% and 38.2 levels. GILD hit the 23.6%. Wave (3) of our wave 3 which usually aims for the 100% extension will now attack two fib levels higher, since wave 1 of 3 was extended by two fib levels (61.8% instead of 38.2%). This 138.2% extension that we expect wave (3) of wave 3 to hit just so happens to coincide right under $80 at about $79.5. Crazy huh? From there we will have a wave (4) down between the 76.4% and 100% levels and then a wave (5) of wave 3 between the 176.4% and 200% levels. But let's make sure our move continues as we expect before we start charting out even higher moves. It could all invalidate in the blink of an eye.

Long term GILD chart showing the initial wave. This is our long term wave i. You can then see the a-b-c down to wave ii.

Looking at the 1 year timeframe now where we have our triangle. We know wave ii bottomed. So we begin to chart the long term wave iii. Here you can see waves 1 and 2 of iii. Since we are in wave 3 of iii, I have subdivided further to project our near term levels. So you can also see the waves (1) and (2) of wave 3 of iii. The paragraph above goes through this wave scenario. You can also see how it lines up with our other technical analysis of the triangle and green max gain near term.

Sorry for the long post. I hope you learned something and how multiple techniques can be used simultaneously to identify, confirm, and chart plays. Also, if you decided to jump in on GILD for the potential run to $80, do NOT try and measure timing from my charts. Fib analysis merely projects price points. Timing is UNPREDICTABLE. If this thing does hit $80, it could happen any time in the next 3 months. Trade at your own risk.

Remember we were in a long term ascending triangle. We finally had the impulsive move this week that confirmed we might be seeing a massive breakout.

Here's the initial trigger that led me to believe we might see a huge move up.

The time to trade is after it has confirmed an impulsive move up. So once it took it the three levels of resistance and continued above the upper resistance of the triangle, that was the time to buy shares / calls. We got lucky in that it came back down to test the 34 EMA and shake some people out who already had calls (me, I didn't fall for it). So there was another buying opportunity yesterday. Today it continued higher before consolidating some. After hours it had a huge impulse to re-test our current resistance. There wasn't much volume with the move, but you can see how the 8 EMA bounced off the 34. That's a good sign of a higher continuation.

How far can it ultimately go? Who knows! I have a very simple method which is a standard technical analysis method of determining a possible gain from an impulse up above an ascending triangle. You simply draw a line straight up and down from the lowest confirmed point of the triangle to the upper resistance line. Then take that measurement and apply it to your initial break of resistance in your impulse move.

This is by no means a guarantee. It simply calculates the POTENTIAL max gain.

The other way I chart it (which I much prefer) is to apply Elliot Wave Theory. I'm not going to go crazy in depth because there's A LOT to EW theory. I'm still learning every day. But essentially, an impulsive move consists of 5 subwaves (1-2-3-4-5). Waves 1, 3, and 5 are "impulsive" waves moving in the direction of the overall larger wave which in this case is up (and can also be subdivided into their own 5 wave structures. Waves are fractal and can always be subdivided all the way down to the unreliable 1 min chart). Waves 2 and 4 are "corrective" and moving in the opposite direction of the larger wave trend which is down in this case.

How do we know if we are in an impulsive 5 wave structure and how do we know where the waves are? Well.. we have to go back in time and chart out the larger wave structure that the stock is currently in. Not all stocks fall neatly into wave structure. EW depends on market sentiment. So a stock has to have sentiment that actually cares about it, trades it, and enough volume. GILD has that. Looking back, it seems as if GILD completed a wave structure on May of 2015. After 5 waves are completed, you wll get an a-b-c corrective retracement down which we seem to have ending in December of last year. That's when our ascending triangle starts.

So starting at the bottom of "c", we can begin to chart a new 5 wave structure. We locate our potential waves 1 and 2 and plot our Fibonacci extensions from the beginning of 1, to the end of 1, then to the end of 2. From there, we can expect the wave (1) our wave 3 we are in to hit between the 38.2% and 61.8% extensions. Depending on which ones it hits can alter every move after. GILD seems to have hit the 61.8% level. So knowing that, we expect the wave (2) of our wave 3 to retrace down between the 23.6% and 38.2 levels. GILD hit the 23.6%. Wave (3) of our wave 3 which usually aims for the 100% extension will now attack two fib levels higher, since wave 1 of 3 was extended by two fib levels (61.8% instead of 38.2%). This 138.2% extension that we expect wave (3) of wave 3 to hit just so happens to coincide right under $80 at about $79.5. Crazy huh? From there we will have a wave (4) down between the 76.4% and 100% levels and then a wave (5) of wave 3 between the 176.4% and 200% levels. But let's make sure our move continues as we expect before we start charting out even higher moves. It could all invalidate in the blink of an eye.

Long term GILD chart showing the initial wave. This is our long term wave i. You can then see the a-b-c down to wave ii.

Looking at the 1 year timeframe now where we have our triangle. We know wave ii bottomed. So we begin to chart the long term wave iii. Here you can see waves 1 and 2 of iii. Since we are in wave 3 of iii, I have subdivided further to project our near term levels. So you can also see the waves (1) and (2) of wave 3 of iii. The paragraph above goes through this wave scenario. You can also see how it lines up with our other technical analysis of the triangle and green max gain near term.

Sorry for the long post. I hope you learned something and how multiple techniques can be used simultaneously to identify, confirm, and chart plays. Also, if you decided to jump in on GILD for the potential run to $80, do NOT try and measure timing from my charts. Fib analysis merely projects price points. Timing is UNPREDICTABLE. If this thing does hit $80, it could happen any time in the next 3 months. Trade at your own risk.

I enjoyed reading that. Thanks!

Red Red Wine said:

I enjoyed reading that. Thanks!

No problem! I've been posting so much about it that I wanted to make sure it was known what I was seeing and how I was charting it. The last thing I want to do is post about something without showing my work.

Unfortunately my charting takes serious time and can get fairly complex. So it's hard to do an update like this for every play im following. And many are in the beginning stages of a setup or I'm tracking potential future setups. So nothing to confirm yet.

My next one will be on CHWY and why I think we see $120+ again. But I need to verify and clean up my charts first.

I enjoy reading your posts as well. I don't have as much faith in any medium term trends (either based on TA or EWT) these days due to Fed market manipulation. I do think EWT is another tool to look at, however. I've used it loosely in the past - like 2013 to 2018 timeframe - but have it as something I'd like to dig into more when time allows.

Thank you for your contribution to the conversation. Curious to see what you uncover on CHWY. I'd be willing to guess based on the indications of high ownership that many on this thread would enjoy seeing a similar charting and your observations on WWR. Probably ELOX too.

RenoAg said:

Thank you for your contribution to the conversation. Curious to see what you uncover on CHWY. I'd be willing to guess based on the indications of high ownership that many on this thread would enjoy seeing a similar charting and your observations on WWR. Probably ELOX too.

I've tried WWR numerous times. It's not really shaping out a wave structure at this time. Very hard to find any decent levels. I imagine the next big move will be the true beginning of a real wave structure with real sentiment.

Small pharmas like ELOX are even harder. Trials and phases move them so much. It might look like a wave is taking shape and then it completely invalidates.

I think these are the types you stick to normal technical analysis and follow your support and resistance levels, watch your EMA's, bollingers, volume, MACD, etc. You can still chart fib extensions and retracements from confirmed highs and lows, but they just won't likely fit in to any larger wave structure since sentiment is so low and inconsistent. Because of that, any fibs you are using to predict entry points or profit taking levels should be played conservatively and kept a close on.

Mancini post just now. Open up his chart and see the notes.

Have a great weekend! The melt up off the 50dma on July 19 continues in #ES_F: +240 points. Last three 50dma tests saw 260, 235 & 390 point runs before 3 day dips.Getting close

— Adam Mancini (@AdamMancini4) August 14, 2021

Plan: 4500 target if 4440 holds. Pullback there, but unless 4440 fails, it just sets up 4540 then 4640 pic.twitter.com/oRbjhaRT04

My plan this week is tactical trading vs swing setups.

Still in gold and if you went in, you should be profitable this week.

Still in gold and if you went in, you should be profitable this week.

bought quite a few UWMC 9/17 $8c at close friday. They report earnings before the bell tomorrow morning, and many think they are poised to post good numbers. we shall see

OPEX week, so anything can happen. Pretty much every OPEX week this year, we have hit an all time high, and then pulled back, except for May, where we pulled back earlier. We are of course at all time high entering this one.

From Brauny a few mins ago:

" Big news here as QB commit Conner Weigman has decided to forgo his senior spring at Bridgeland and enroll at Texas A&M in January.

This is something that Weigman and his family have been working on for quite a while behind the scenes. The move means two things:

1) Weigman will no longer be an MLB Draft candidate.

2) There's a chance he could impact the Aggie baseball team this spring.

Huge development for Jimbo Fisher, Jim Schlossnagle, and the 2022 recruiting classes for both sports."

" Big news here as QB commit Conner Weigman has decided to forgo his senior spring at Bridgeland and enroll at Texas A&M in January.

This is something that Weigman and his family have been working on for quite a while behind the scenes. The move means two things:

1) Weigman will no longer be an MLB Draft candidate.

2) There's a chance he could impact the Aggie baseball team this spring.

Huge development for Jimbo Fisher, Jim Schlossnagle, and the 2022 recruiting classes for both sports."

Prognightmare said:

From Brauny a few mins ago:

" Big news here as QB commit Conner Weigman has decided to forgo his senior spring at Bridgeland and enroll at Texas A&M in January.

This is something that Weigman and his family have been working on for quite a while behind the scenes. The move means two things:

1) Weigman will no longer be an MLB Draft candidate.

2) There's a chance he could impact the Aggie baseball team this spring.

Huge development for Jimbo Fisher, Jim Schlossnagle, and the 2022 recruiting classes for both sports."

How do I set up an option play? Long on horn tears, short on Bama futures?

OpEx week....everyone be careful with weekly or expiring options in the week ahead.

Same$30,000 Millionaire said:

My plan this week is tactical trading vs swing setups.

Still in gold and if you went in, you should be profitable this week.

Featured Stories

See All

LIVE from Blue Bell Park: No. 1 Texas A&M vs. Cal Poly (Sunday)

by Richard Zane

9:07

20h ago

5.6k

5 Thoughts: No. 6 Tennessee 77, No. 7 Texas A&M 69

by Luke Evangelist

LIVE: Texas A&M vs. Mississippi State

by Kay Naegeli

Outlaw0206

LIVE from Blue Bell Park: No. 1 Texas A&M vs. Cal Poly (Sunday)

in Billy Liucci's TexAgs Premium

26

AggieBucksJB

LIVE from Blue Bell Park: No. 1 Texas A&M vs. Cal Poly (Sunday)

in Billy Liucci's TexAgs Premium

24