Now is when you invest in oil!!

Stock Markets

25,931,929 Views |

235318 Replies |

Last: 12 min ago by SW AG80

Aaple, Amazon? What's the third A?

nvmnd...alphabet

nvmnd...alphabet

***If this post is on Business and Investing, take it with a grain of salt. I am wrong way more than I am right (but I am less wrong than I used to be) and if you follow me you will be too.***

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

i'm not falling for that, Mortimer!jj9000 said:Oil?IrishTxAggie said:

Now is when you invest in oil!!

Orange Juice Futures is where its at!!

Alphabet

we had 5 post about ois? No justification?

trying to pump and dump

trying to pump and dump

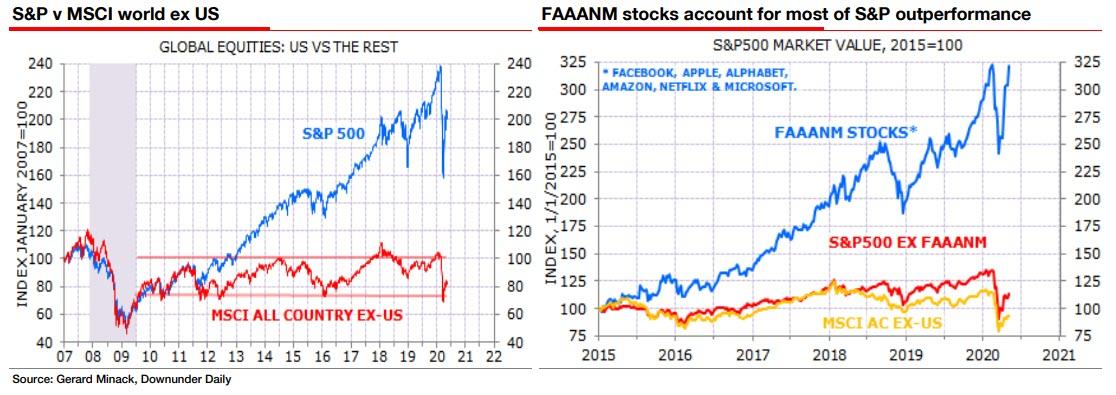

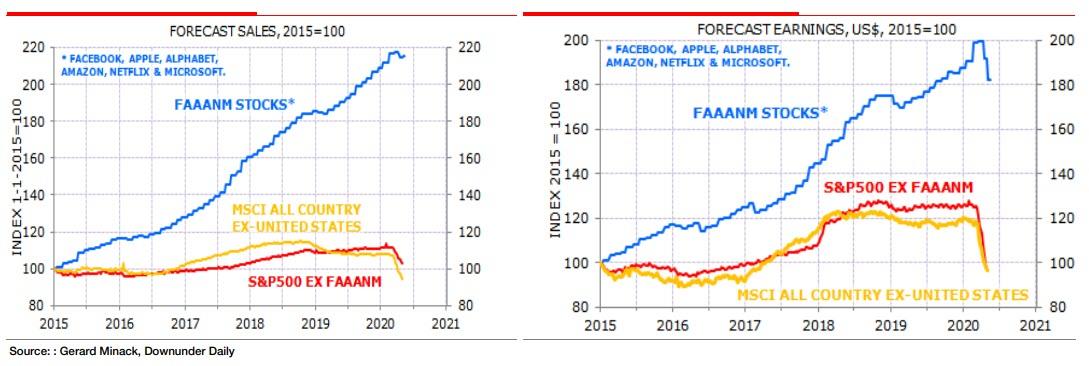

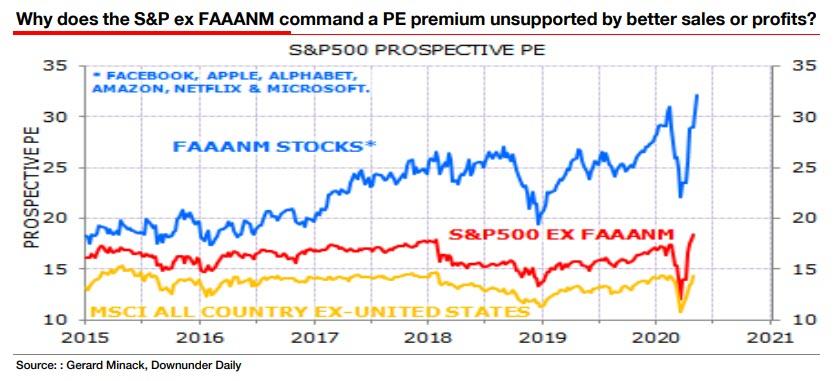

FAANG or FANGMAN or FAANM or whatever it's being called is at risk of regulatory disruption. I think a democrat based congress and president is likely to highly limit these companies, especially those where the user is the product (Facebook, Google). Facebook/Google will have to figure out new revenue streams beyond advertising. Google is getting soft, they'll likely enter the "trough" that Microsoft went through 10 years ago. Microsoft is the most insulated and Azure will serve them well for years to come. Amazon I think is pretty safe given how diversified they are and the segments that they serve. I tend to think the biggest risk there is erosion of public trust or the belief that they have become too ubiquitous. AWS is an outstanding product and the people that work for Amazon are all top notch. Netflix is vulnerable to Disney, HBO, and Amazon. I am a big Apple fan, but I am unclear how the expansion into services will go to offset declining profit pools in other areas. Their hardware innovation is very incremental at this point. Apple TV and their content isn't crushing it yet. Feels like they're at risk when the value players get better and Apple doesn't push ahead.

Very good analysis.

Wait you think democrats are going to reign in FAANG? Democrats are big tech. Big tech are democrats.

AAPL is my largest holding. You underestimate the value of a blue text. It is an addiction product like FB.$30,000 Millionaire said:

FAANG or FANGMAN or FAANM or whatever it's being called is at risk of regulatory disruption. I think a democrat based congress and president is likely to highly limit these companies, especially those where the user is the product (Facebook, Google). Facebook/Google will have to figure out new revenue streams beyond advertising. Google is getting soft, they'll likely enter the "trough" that Microsoft went through 10 years ago. Microsoft is the most insulated and Azure will serve them well for years to come. Amazon I think is pretty safe given how diversified they are and the segments that they serve. I tend to think the biggest risk there is erosion of public trust or the belief that they have become too ubiquitous. AWS is an outstanding product and the people that work for Amazon are all top notch. Netflix is vulnerable to Disney, HBO, and Amazon. I am a big Apple fan, but I am unclear how the expansion into services will go to offset declining profit pools in other areas. Their hardware innovation is very incremental at this point. Apple TV and their content isn't crushing it yet. Feels like they're at risk when the value players get better and Apple doesn't push ahead.

FB is my second largest.

INTC is the third. Numbers don't lie.

If you look closely, they buy both sides of the aisle.texagbeliever said:

Wait you think democrats are going to reign in FAANG? Democrats are big tech. Big tech are democrats.

Tumble Weed said:If you look closely, they buy both sides of the aisle.texagbeliever said:

Wait you think democrats are going to reign in FAANG? Democrats are big tech. Big tech are democrats.

Yeah but outsiders dont like them like the current man in office. He is also just crazy enough to bring back antitrust laws

this x eleventy billion... especially in a small-ish daytrading account like I have. I'm at 3x though from initial investment in just 7 or 8 trading daysPrognightmare said:

With the market sell off at the end because Trump will speak about China tomorrow, everyone should be cautious. If he announces sanctions then China could respond over the weekend. With the market so high from the lows, don't take unnecessary risk into the weekend. JMO

Premium decay is another reason I don't like to hold much into the weekend. If I buy anything on Friday it's further out expirations.

doubled my ROKU calls today though before it started popping!

Those AZN calls gonna be huge tomorrow

I think it is inevitable, but I think it could happen sooner with the democrats. The people that work for big tech are liberal leaning, but their behavior for the most part is strictly capitalist. Jeff Bezos is John Rockefeller or J.P. Morgan ruthless. We all know liberals want to have laws for everything.texagbeliever said:

Wait you think democrats are going to reign in FAANG? Democrats are big tech. Big tech are democrats.

Themes I think show up:

- Privacy and ability to opt-in or out of areas that are core revenue drivers for these companies

- Awareness of the profile / information these companies have on you

- Antitrust in centralized and borderline monopoly areas (search)

- Foreign tampering and associated controls (e.g. China/Russia)

- Consumer protections and limits on what can be sold or associated

- Third party linkages and/or group data

- Child access and protection for minors

- Moderation, filtering, free speech and 1st amendment concerns

Twitter is a good example of the two I've bolded above.

Am I the only one who thinks Netflix doesn't belong in the same group as the others? All the others are significantly more diversified and have a bajillion revenue streams.

I walk into a meeting at 1:30 with my Roku $111c and SPY $305c rocking. Walkout at 3:15 and nearly have a heart attack.

Tumble Weed said:AAPL is my largest holding. You underestimate the value of a blue text. It is an addiction product like FB.$30,000 Millionaire said:

words

FB is my second largest.

INTC is the third. Numbers don't lie.

Apple is my #1, Amazon is my #2.

DDSO said:

I walk into a meeting at 1:30 with my Roku $111c and SPY $305c rocking. Walkout at 3:15 and nearly have a heart attack.

Your calls to you after your meeting.

Haha. That's great. Yeah I watch all day and step away for a bit and everything goes south. What the heck happened?

DDSO said:

I walk into a meeting at 1:30 with my Roku $111c and SPY $305c rocking. Walkout at 3:15 and nearly have a heart attack.

Protip from similar experience; never leave open positions on short term plays if you can't actively babysit them.

My thoughts on what happened today:

1. Algos had a triggered sale with the tweet on Trump giving a message to China.

2. Human traders had 2 choices

A. Fight the algo sell off (unlikely because it is now bears + algos vs bulls)

B. Sell into it hard and trigger retail traders to sell or hit their stop losses.

3. Today plan b was executed. This allowed the opportunity for big money to absorb shares at discount prices. Bears might have seen the opportunity to cash in their shorts and flip sides.

4. To prevent a bigger selloff and crushing the newly acquired discounted shares big money bulls fought to keep close to the index at close.

5. This sets us up for an interesting friday.

A. Market opens close to flat and trends down early. Trump's message isnt too critical and the market sees a quick rebound to 305.

B. Market opens up down a percent or 2. It keeps a tight band up and down before breaking up following Trumps press conference. Close around 303 or 304

1. Algos had a triggered sale with the tweet on Trump giving a message to China.

2. Human traders had 2 choices

A. Fight the algo sell off (unlikely because it is now bears + algos vs bulls)

B. Sell into it hard and trigger retail traders to sell or hit their stop losses.

3. Today plan b was executed. This allowed the opportunity for big money to absorb shares at discount prices. Bears might have seen the opportunity to cash in their shorts and flip sides.

4. To prevent a bigger selloff and crushing the newly acquired discounted shares big money bulls fought to keep close to the index at close.

5. This sets us up for an interesting friday.

A. Market opens close to flat and trends down early. Trump's message isnt too critical and the market sees a quick rebound to 305.

B. Market opens up down a percent or 2. It keeps a tight band up and down before breaking up following Trumps press conference. Close around 303 or 304

Yeah it was definitely my fault, I didn't think I would be away that long.

I was just making a funny and no one anticipated the Trump press conference regarding China tomorrow, that's what caused the selloff.DDSO said:

Yeah it was definitely my fault, I didn't think I would be away that long.

Like Irish said, don't have open short term options if you can't watch because it can really hurt you. Owning or short the stock outright won't hurt as much as the carnage options can cause you.

Thoughts on holding onto MU thru the China sanctions? If I remember correctly, Huawei is one of if not their largest customer.

#INSOJ

***If this post is on Business and Investing, take it with a grain of salt. I am wrong way more than I am right (but I am less wrong than I used to be) and if you follow me you will be too.***

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

Huawei is the head of the snake in Trump's eyes. He's going to chop them off.BB675 said:

Thoughts on holding onto MU thru the China sanctions? If I remember correctly, Huawei is one of if not their largest customer.

Prognightmare said:Huawei is the head of the snake in Trump's eyes. He's going to chop them off.BB675 said:

Thoughts on holding onto MU thru the China sanctions? If I remember correctly, Huawei is one of if not their largest customer.

Most likely. I at least sold covered calls in MU in yesterday's run up to make something off what most likely means a downturn for them in the short term

McInnis 03 said:To be perfectly honest, it is truly just another thing to look out; however, somtimes you'll see an outlier like this where someone/something has made a major move on one specific strike......sometimes you can look at that and decide if you want to follow the money.tsuag10 said:

That's what I'm starting to think too. After looking at it more, there's actually more OI on the call side. So looking at volume was throwing me off.

IE: yesterday with Astrazeneca the $53c for next week got a significant play, higher than normal.

Sometimes people will follow a move like this on the notion that "somebody knows something". These plays do not always work out, but it's more than just a "hunch" in some instances.

Hey dumbass (me) when you see this and know it's happening, let it play out instead of bailing out, up a tiny bit

***If this post is on Business and Investing, take it with a grain of salt. I am wrong way more than I am right (but I am less wrong than I used to be) and if you follow me you will be too.***

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

I have 1 contract of the 53c left (only bought 2, and sold 1 up ~30%). Hoping it holds up until tomorrow.

OverSeas AG said:

I am not a Will Meade fan, but he was showing the top traded stocks on Robinhood last night (I think someone posted that on here as well) and said he thinks people should long MRNA this morning and short SAVE. could be an interesting thing to watch.

So go check some of these. At open the decreases jumped and the longs dropped.

The algos may be triggering retail stops here

***If this post is on Business and Investing, take it with a grain of salt. I am wrong way more than I am right (but I am less wrong than I used to be) and if you follow me you will be too.***

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

AgEng06 said:

I have 1 contract of the 53c left (only bought 2, and sold 1 up ~30%). Hoping it holds up until tomorrow.

I hope so too! Someone needs to win!

***If this post is on Business and Investing, take it with a grain of salt. I am wrong way more than I am right (but I am less wrong than I used to be) and if you follow me you will be too.***

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

B&I Key:

ETH - Extended Trading Hours --- RTH - Regular Trading Hours

ORH - Opening Range (1st 30min) High --- ORL - Opening Range Low

R1, R2, R3 - Resistance 1, 2, or 3 --- S1, S2, S3 - Support 1, 2 or 3

I have our next options trade spotted, if markets set up correctly.

PENN

June 19 $33 calls

Gotta wait for my signal

PENN

June 19 $33 calls

Gotta wait for my signal

Featured Stories

See All

12:36

12m ago

346

2:58

1d ago

2.5k

State champion Chace Sims wrapped up senior year as an All-American

by Cade Draughon

22:11

1h ago

318

5 Thoughts: No. 5 Alabama 94, No. 10 Texas A&M 88

by Luke Evangelist