TA rook here, just started reading Handbook on TA in OP.

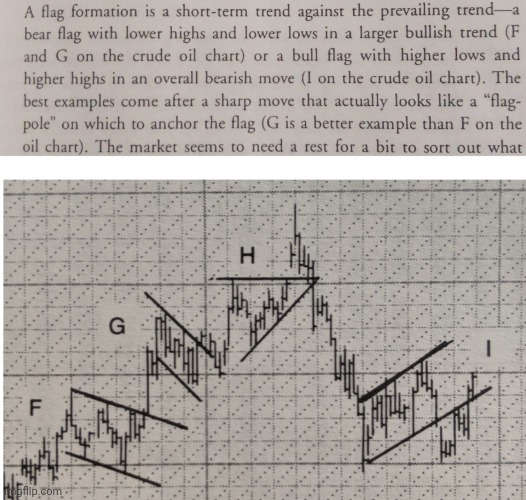

I got stuck on basic bear vs bull flag. In Ch 2, it defines a "bear flag with lower highs and lower lows in a larger bull trend" and a "bull flag with higher lows and higher highs in overall bearish move".

I always thought bull flags indicate continuation of bull trend and bear flags continuation of bear trend. So basically the opposite of handbook. What am I missing?!

I got stuck on basic bear vs bull flag. In Ch 2, it defines a "bear flag with lower highs and lower lows in a larger bull trend" and a "bull flag with higher lows and higher highs in overall bearish move".

I always thought bull flags indicate continuation of bull trend and bear flags continuation of bear trend. So basically the opposite of handbook. What am I missing?!