Support here at ~2612? See if it breaks.

Stock Markets

29,451,198 Views |

248085 Replies |

Last: 2 hrs ago by Brian Earl Spilner

Loaded up at $2 and $2.5 4/20 strikes.

For you experienced investors here, I have never shorted a stock before and know next to nothing about the risks involved. Can anyone give an explanation of how risky it is and whether shorting Facebook could be valuable? Especially considering the upcoming testimony from Zuck and the possibility of him being forced out?

Highly unlikely Zuck will be forced out... Sandberg on the other hand may be the scapegoat.

I don't understand the volume. Zoomed in on 1 min to see the volume better.

So there were a bunch of buyers or a large order causing the spike? Price started increasing. Then when it came back there appeared to be resistance again at that level. Is there anything else to learn from that volume spike.

So there were a bunch of buyers or a large order causing the spike? Price started increasing. Then when it came back there appeared to be resistance again at that level. Is there anything else to learn from that volume spike.

There we go

The reason why you have colored volume bars is to know the bid/ask results. What that red bar tells you is that as the shares were beginning to push higher a seller hit the bids for the majority of that 1 minute VERSUS buyers having to move to the ask. So in the chart pattern it would look like the seller was attempting to kill the bounce but failed which is why the green candles preceded and succeeds the red candle were buyers absorbing the sells and continuing their buys at the ask. Make sense?FriscoKid said:

I don't understand the volume. Zoomed in on 1 min to see the volume better.

So there were a bunch of buyers or a large order causing the spike? Price started increasing. Then when it came back there appeared to be resistance again at that level. Is there anything else to learn from that volume spike.

Yesterdays attempt to fill the March 22nd not being successful is bearish. On big rebound days they almost always reach gap fill as a rule.

Come to me FB

Even though the volume was the largest of the day? That doesn't matter?FriscoKid said:

I don't understand the volume. Zoomed in on 1 min to see the volume better.

So there were a bunch of buyers or a large order causing the spike? Price started increasing. Then when it came back there appeared to be resistance again at that level. Is there anything else to learn from that volume spike.oldarmy1 said:The reason why you have colored volume bars is to know the bid/ask results. What that red bar tells you is that as the shares were beginning to push higher a seller hit the bids for the majority of that 1 minute VERSUS buyers having to move to the ask. So in the chart pattern it would look like the seller was attempting to kill the bounce but failed which is why the green candles preceded and succeeds the red candle were buyers absorbing the sells and continuing their buys at the ask. Make sense?

I need to think about the bid/ask for a while, but I'm pretty sure that I got it. Thanks!

Need to hold this level...

Well if you are asking from a day trader perspective then it absolutely matters in terms of decision to enter or not. If that candle had crushed the 5 minute bar then you'd actually trade it to the downside as a day trader. If it stays above the 5 minute bar then that is a clean entry looking for continued support on the next minute bar.

Look at GE minute bars right now. Bulls tried to hold above 13.15 all day and it failed and quickly hit below $13. Check the volume selling that flooded in for 2 solid minutes. Then the second volume bars are support attempt coming in.

Would you be buying QQQ now?

I'd only be buying options for pretty much anything in terms of trade. Only stock shares I bought were a bunch of AVEO under $2 but when market was turning I quickly sold $2 covered calls against half the shares, so if it fails on the recovery attempt or if I get called out I cut my holding share price.0708aggie said:

Would you be buying QQQ now?

And remember there is a pretty good rule of thumb on market directions. The wedge broke to the down side and we quickly went to a retest. However we haven't broken down in two tries since then. The rule is that markets DO NOT like to hang down at value buy levels for extended periods. It is much more likely to eventually fail - especially when you add the trend break.

Thin THIN THIN

If you have Puts you pull your cost back out when you can do so selling 50% or less of those. If you are short you let them ride or if up big you buy a cheap Call option back upwards close to 50% of your entry. That way you guarantee your return yet are golden if the markets do finally break through and plummet.

Thin THIN THIN

If you have Puts you pull your cost back out when you can do so selling 50% or less of those. If you are short you let them ride or if up big you buy a cheap Call option back upwards close to 50% of your entry. That way you guarantee your return yet are golden if the markets do finally break through and plummet.

I bought 100 GE $13.50 April 13.50 calls at 11 cents

I have been nothing but short since March 19 at 2741. 4 Short signals in that time, including today's open.

Good move!claym711 said:

I have been nothing but short since March 19 at 2741. 4 Short signals in that time, including today's open.

Yeah I've been heavily weighted on the short side from our initial bounce attempt but all the shorter term trading I've done has mostly been taking positions on major support testing.

Sh*t, wonder if too late to pull back my retirement papers for end of month.

j/k kind of

j/k kind of

rolling over again

And then support volume floods in. Bulls are not gonna lay down on it easy.FriscoKid said:

rolling over again

Why April 13? Pretty quick expiration

I am trading the major support so looking for quick bounce for 70% gain.AggiePeeps06 said:

Why April 13? Pretty quick expiration

Sorry was making another trade. Main reasons are 1) Approaching major support for both markets and share price. 2) THIN THIn THIN - Cheap premiums on high risk moments in markets - easily could break down and all Calls would be worthless in a matter of a day.

This is beautiful. Love volatility.

I like the thought process I just worry about the weekend time decay

No doubt. Strictly a trade based on volume support leading to a bounce day Monday.AggiePeeps06 said:

I like the thought process I just worry about the weekend time decay

Yep, the support does look strong generally around 13 as well. And with only a week left, I guess time decay won't hurt as much

Fun day

Volatility is going to be extreme for some time IMO. The post election rocket that broke free from the 2015 and 2016 market tops, as well an unprecedented lack of volatility, left pockets of butter a hot knife will slice right through. It's going to be a wild year, no stop is safe.

claym711 said:

Volatility is going to be extreme for some time IMO. The post election rocket that broke free from the 2015 and 2016 market tops, as well an unprecedented lack of volatility, left pockets of butter a hot knife will slice right through. It's going to be a wild year, no stop is safe.

Hope you are right. Up or down will be great.

OldArmy and Friends,

I'm looking at WFC April 13th 52.50 call options. I see low IV, premiums and lots of potential. I don't see WFC ever dipping below $52 much, even on the bad days. I know financials have been meh lately but it's hard to see why this trade is bad....especially with earning season starting that day. Only down side I can see is poor growth as a result on the limits placed by the federal reserve. The upside just needs the 2% gain in underlying to make it profitable...which can be achieved by the run up before earnings or average/positive news

Would anyone else think it's a decent idea worth exploring? Probably have to buy the options quickly early Monday if it looks like we are going to have a Green Day. But other than that, I don't see much more that could take it down.

I'm looking at WFC April 13th 52.50 call options. I see low IV, premiums and lots of potential. I don't see WFC ever dipping below $52 much, even on the bad days. I know financials have been meh lately but it's hard to see why this trade is bad....especially with earning season starting that day. Only down side I can see is poor growth as a result on the limits placed by the federal reserve. The upside just needs the 2% gain in underlying to make it profitable...which can be achieved by the run up before earnings or average/positive news

Would anyone else think it's a decent idea worth exploring? Probably have to buy the options quickly early Monday if it looks like we are going to have a Green Day. But other than that, I don't see much more that could take it down.

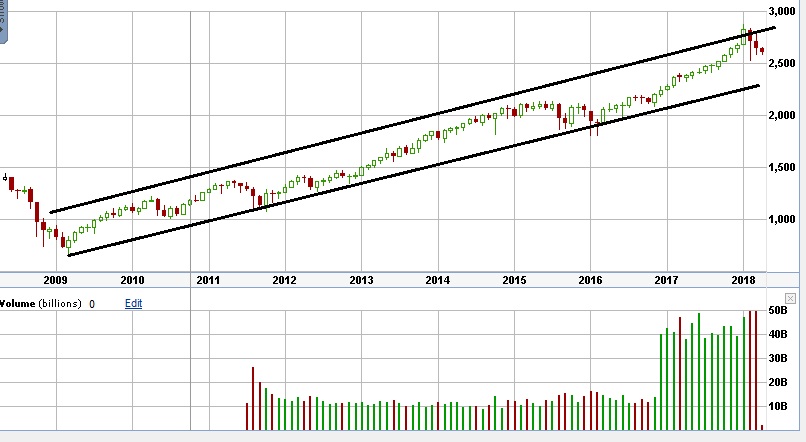

I love this stuff. It's like an engineering/math problem. Here is the past 2 years on a daily chart. It's interesting to see that the election really didn't do anything to the markets good or bad. The tax cuts did for sure but now we have the tariffs to worry about.

I think it looks like the market is trying to break out lower on a two year pretty well defined trend. There is definitely a wedge developing at the top. Maybe we just break out of the wedge and continue the bull run.

I'd be really worried about it pulling back 20% if we break the support though from feb lows. We keep flirting with it. I'd love others to chime in and give thoughts.

I think it looks like the market is trying to break out lower on a two year pretty well defined trend. There is definitely a wedge developing at the top. Maybe we just break out of the wedge and continue the bull run.

I'd be really worried about it pulling back 20% if we break the support though from feb lows. We keep flirting with it. I'd love others to chime in and give thoughts.

...and the 10 year. A 20% pullback would put us at 2298 and still possibly at the bottom trend line and still trending up overall. Again, I like looking at this like a math problem. Would be great to hear what you guys think.

Featured Stories

See All

127:22

1d ago

5.3k

25 Players in 25 Days: Looking back on the full list

by TexAgs Live

23:16

1d ago

3.6k

9:36

13h ago

1.8k

Taylor Jernigan's 86th-minute goal claims 2-1 win over UConn

by Samuel Sidarous

Stowers reviving her career at A&M after previous medical retirement

by Olivia Rodriguez

beerad12man

"Operation: Blackout" set for Oct. 4 vs. Missisippi State

in Billy Liucci's TexAgs Premium

43

DeepEastTxAg

"Operation: Blackout" set for Oct. 4 vs. Missisippi State

in Billy Liucci's TexAgs Premium

26

Keoni721

"Operation: Blackout" set for Oct. 4 vs. Missisippi State

in Billy Liucci's TexAgs Premium

12