I've spent over 30 years in specialty agriculture. I currently own a sales consultancy for growers, am the director of bizdev for a fresh food-focused 3pl, and farm 25 acres of squash/cucumbers the east coast. I think the assessment is pretty spot on.

1) Cost of Inputs - labor, fertilizer, plastic/drip tape, etc. have all increased substantially. Biggest increase is in labor. We've gone from minimum wage to above $20/hr, and that's if you can get workers. H2A/B is an option, but the costs are still north of $20/hr. and you have to have housing assets to make that work. Labor contractors cost about the same but are much less reliable than they used to be. They just won't show up sometimes and when you're in harvest, that's a problem.

2) Market Prices - COVID changed the retail buyer's mindset. Markets used to have a pretty high upside. You'd lose on a few years, break even on a few, and win big on a couple to make it all work out. The win big years have been driven out of the system because retailers will just stop buying and be short to avoid paying higher prices. If strawberries are high, they'll market the hell out of raspberries or blueberries, whatever is cheap. They no longer participate in the market when availability is low and prices are elevated. Before COVID, when prices were high you were choosing who to cover. Nowadays I've had folks call me in extremely short markets with no one to sell to. It's important to note that in produce when prices are high, quality is generally lower because the low availability is caused by poor growing conditions.

3) Marketing Companies/Shippers - These companies have thrived off living in the middle of the supply chain by bringing a network of smaller/regional growers together to build a competitive program. They have historically carried the receivables so growers can get paid quickly to pay labor and notes. Those days are over. PACA payment terms aren't enforced because they can't be, there isn't enough money in the system to do so. Given consolidation in the wholesaler, processor, retail and distributor space there's less competition in the market and shippers have to woo the buyer to stay in good graces. If not, they'll drop you and you're stuck with a pile with nowhere to send it (which drives prices down as they drop their pants on price to avoid the loss). That enables buyers to arbitrarily short pay invoices or demand credits they never would have gotten before.

4) Market Pricing - Market pricing has not increased in line with costs. It's largely been a result of desperation and competition as marketers struggle for orders and contracts. Marketers/shippers take a fee and pass returns minus commissions to the grower. Increased demand for value added services such as overwrapping, bagging, etc. have added cost to the system the grower absorbs.

The biggest issue is a debt balloon that's about to pop. More and more growers are in receivership every season hoping for a good market and many of them are at the end of that rope. To make it worse, 90% that aren't in financial trouble are aging and their kids have no interest in getting into farming. Smaller marketers have lost supply due to a shrinking grower network and poor growing conditions, which has resulted in them getting behind on their payments. Banks are now having to decide whether to extend a loan they'd never think of extending before because if they don't prop up one actor in the system it will take down everyone else in the process.

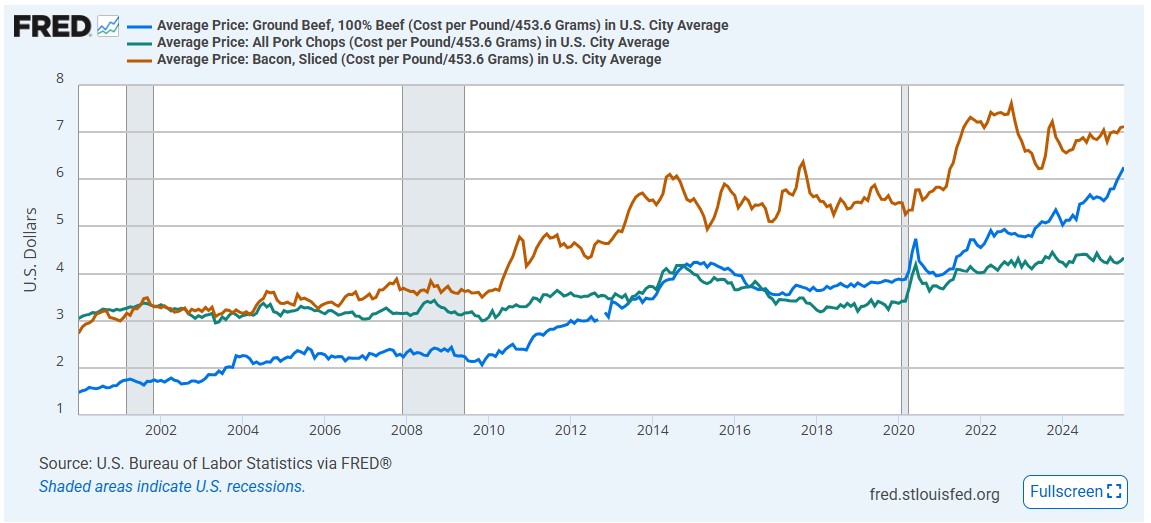

It's a ticking time bomb. I'm contemplating repurposing our farmland to run cattle as we speak for these very reasons. It just seems like a safer way to put our land and money to work based on how farming is trending. It's nearly impossible for the smaller grower to make money in the farming game anymore, and the cost of startup makes it nearly impossible for someone new to get in.