I seen some pretty big numbers for new and used automobiles, too.captkirk said:

Inflation surges 7% in December, highest rate in 40 years

8,495 Views |

111 Replies |

Last: 3 yr ago by infinity ag

Tom Kazansky 2012 said:StandUpforAmerica said:I Have Spoken said:

I fought to make the floor on raises for my people 6%. I was able to get it. Tough sledding out there right now though in the labor market. It is definitely not keeping up.Inflation running at 7%

— Christopher Weihs (@chrisweihs_) January 12, 2022

But don’t overlook this: “Real average hourly earnings decreased 2.4 percent, seasonally adjusted, from December 2020 to December 2021.”

Prices are up, & worker pay is not keeping pace https://t.co/CEsx9aiueU

This. At my company we are legitimately trying to find a way to pay all our employees at least 10% more, but the materials we need are rising and harder to find, along with what was healthy debt now trending on unhealthy, and the new hires we need to make are saying no due to us not paying enough.

Small business America, especially manufacturing like ours, is tough sledding. This is also with a 300% increase in sales last year and expecting 200% increase for this year. Still isn't enough even with us raising our prices by about 15%.

Which is EXACTLY WHAT INFLATION IS.

once there is the spiral of more money being pumped in by the USG and chasing fewer supplies, and dollars worth less then everyone has to raise costs/salaries to then cover everyone else raising prices.

so because it costs more for food, your company has to raise salaries, which then increases the price of food because the producers have to pay THEIR employees. and the death spiral never stops.

Let's Go Brandon!

UTExan said:Cromagnum said:

Pretty bad luck if you are in your retirement years right now.

Retirees should have a decent portfolio if they have saved, invested during the past 15-30 years. If your financial advisor is not putting you in a position to outpace inflation, look for better options. Retirees should have that plus Social Security for a better standard of living than most working folks. The great sin of our modern educational system is not educating people with regard to both nutritional health and the power of investing for financial security.

I have to disagree completely. There is very little that can be guaranteed to outpace a 7% annual rate.

You want everyone's 401K to be invested in high risk equities which have dropped 20% the last year? What are you suggesting that pays a 7% rate with little risk to old retirees?

The entire point is that the Fed Reserve has been FORCING the elderly to become less and less risk averse to try to keep up with inflation-

so what happens when the stock market continues to drop further once Fed rate increases begin next month?

Quote:

You want everyone's 401K to be invested in high risk equities which have dropped 20% the last year?

I agreed with you on everything but this.

I don't know what 401k plan you were invested in, but I had a return of 20% in 2021. Certainly not -20%.

CDUB98 said:Quote:

You want everyone's 401K to be invested in high risk equities which have dropped 20% the last year?

I agreed with you on everything but this.

I don't know what 401k plan you were invested in, but I had a return of 20% in 2021. Certainly not -20%.

Agreed- I am talking about high risk equities

Look at the ARKK and all the Cathy Woods funds, there are a ton of NASDAQ stocks that have been trailing the market. What is keeping the major indices afloat is

MSFT META/FB AMZN TSLA ALPHABET

lots of losers in the equity markets- which is why no financial planner would tell retirees to put their major portfolio into riskier equities over bonds/municipal paper/treasury notes

Americans give President Joe Biden a negative 33 53 percent job approval rating, while 13 percent did not offer an opinion. In November 2021, Americans gave Biden a negative 36 53 percent job approval rating with 10 percent not offering an opinion.

Among Democrats in today's poll, 75 percent approve, 14 percent disapprove and 11 percent did not offer an opinion.

Among Democrats in November's poll, 87 percent approved, 7 percent disapproved and 6 percent did not offer an opinion.

Among registered voters in today's poll, Biden receives a negative 35 54 percent job approval rating with 11 percent not offering an opinion.

Quinnipiac Poll www.hotair.com

Among Democrats in today's poll, 75 percent approve, 14 percent disapprove and 11 percent did not offer an opinion.

Among Democrats in November's poll, 87 percent approved, 7 percent disapproved and 6 percent did not offer an opinion.

Among registered voters in today's poll, Biden receives a negative 35 54 percent job approval rating with 11 percent not offering an opinion.

Quinnipiac Poll www.hotair.com

I don't understand this. Where can I go to get the positive spin on how wonderful this inflation is why so many approve of the amazing job Biden is doing?LMCane said:

Americans give President Joe Biden a negative 33 53 percent job approval rating, while 13 percent did not offer an opinion. In November 2021, Americans gave Biden a negative 36 53 percent job approval rating with 10 percent not offering an opinion.

Among Democrats in today's poll, 75 percent approve, 14 percent disapprove and 11 percent did not offer an opinion.

Among Democrats in November's poll, 87 percent approved, 7 percent disapproved and 6 percent did not offer an opinion.

Among registered voters in today's poll, Biden receives a negative 35 54 percent job approval rating with 11 percent not offering an opinion.

Quinnipiac Poll www.hotair.com

Jen Psaki press conference

:format(jpeg)/cdn.vox-cdn.com/uploads/chorus_image/image/49493993/this-is-fine.0.jpg)

:format(jpeg)/cdn.vox-cdn.com/uploads/chorus_image/image/49493993/this-is-fine.0.jpg)

Tips are guaranteed to keep pace with the official

Inflation rate.

Some commodities and real estate often do well in high inflation

Cryptocurrency should as well

Not a whole lot of guarantees but that's always true.

Inflation rate.

Some commodities and real estate often do well in high inflation

Cryptocurrency should as well

Not a whole lot of guarantees but that's always true.

Inflation is out of control. Everything that I buy at the grocery store seems to be a LOT higher, more than 7% if you ask me.infinity ag said:

Is this the end of Joe Biden?

I can feel the inflation when I visit restaurants or grocery stores. I am in the process of switching jobs and I wonder if the new offer would be 10% more than my current one. In that case I am okay but if I stay here, I am expecting another 1-3% raise so that is effectively a paycut.

https://www.foxbusiness.com/economy/december-inflation-consumer-price-indexQuote:

Inflation rose at the fastest pace in nearly four decades in December, as rapid price gains fueled consumer fears about the economy and sent President Biden's approval rating tumbling.

The consumer price index rose 7% in December from a year ago, according to a new Labor Department report released Wednesday, marking the fastest increase since June 1982, when inflation hit 7.1%. The CPI which measures a bevy of goods ranging from gasoline and health care to groceries and rents jumped 0.5% in the one-month period from November.

Economists expected the index to show that prices surged 7% in December from the year-ago period and 0.4% from the previous month.

So-called core prices, which exclude more volatile measurements of food and energy, soared 5.5% in December from the previous year a sharp increase from November, when it rose 4.9%. It was the steepest 12-month increase since 1982.

***

Coming soon:

AE Ventures - sooner than soon

*Psychedelic Retreats

*Physical and mental exercises

*Addiction services

Step 3: property found

Step 4: set date

Step 5: plan agenda for participants, food, logistics etc, integration and counseling post-experience

Step 6: long-term planning

I am amped.

Coming soon:

AE Ventures - sooner than soon

*Psychedelic Retreats

*Physical and mental exercises

*Addiction services

Step 3: property found

Step 4: set date

Step 5: plan agenda for participants, food, logistics etc, integration and counseling post-experience

Step 6: long-term planning

I am amped.

The two of us make enough combined income to eat out at restaurants anytime we want. But we don't. In face, we have cooked at home every evening this year. I figure it this way. Aside from what the government steals from me, it's MY money, and I can spend it or NOT spend it however I wish. We have decided to eat out less, safe a crapload of money, avoid paying servers and footing the bill for expensive alcohol, and put the saved money in a set-aside vacation fund. That won't stimulate the economy, but it's best for us. Btw, Spain this past December was amazing.

But wait, there's more! PPI comes out tomorrow!!!

Weeeeeeeeeeeeeeeeee!

Weeeeeeeeeeeeeeeeee!

got any charts on how Sweden is handled covid...good to see you backac04 said:SS cost of living adjustment for 2022 will be 5.9%. so unfortunately no, they didn't. still short of the reported CPI which is itself 100% false.Marcus Brutus said:Cromagnum said:

Pretty bad luck if you are in your retirement years right now.

Well, the good news is that SS is tied to inflation, so they got a gigantic raise.

Carter quality failure! Well done Brandon!

Make Mental Asylums Great Again!

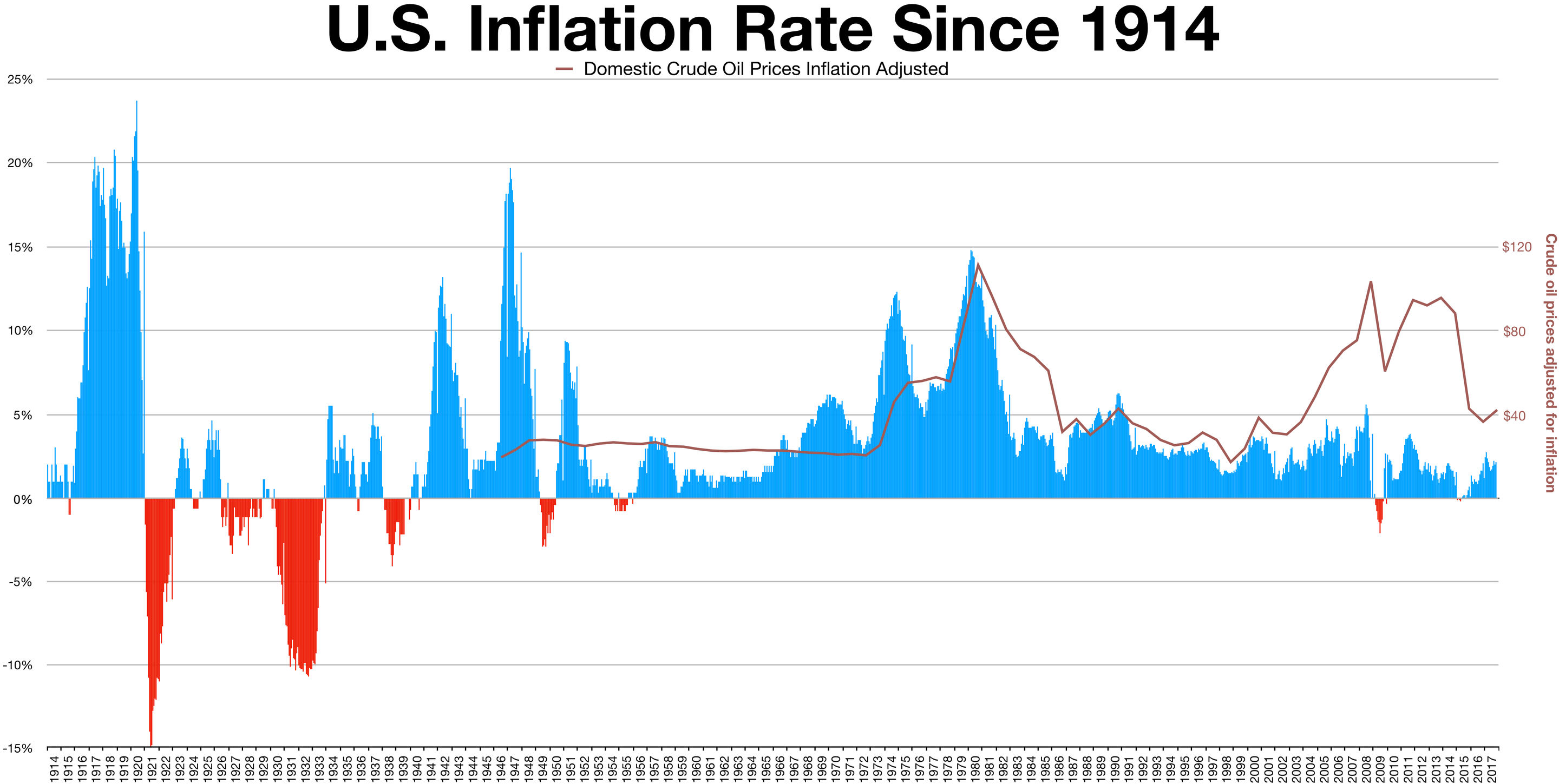

Nine periods in US History over 10%? All during or after wars (depending on what you count the end of Vietnam War) if I am reading that correct.

More detailed chart since 1914

Bold text done by me. Yep, it creates stress that I have seen to be medically injurious to patients.LMCane said:UTExan said:Cromagnum said:

Pretty bad luck if you are in your retirement years right now.

Retirees should have a decent portfolio if they have saved, invested during the past 15-30 years. If your financial advisor is not putting you in a position to outpace inflation, look for better options. Retirees should have that plus Social Security for a better standard of living than most working folks. The great sin of our modern educational system is not educating people with regard to both nutritional health and the power of investing for financial security.

I have to disagree completely. There is very little that can be guaranteed to outpace a 7% annual rate.

You want everyone's 401K to be invested in high risk equities which have dropped 20% the last year? What are you suggesting that pays a 7% rate with little risk to old retirees?

The entire point is that the Fed Reserve has been FORCING the elderly to become less and less risk averse to try to keep up with inflation-

so what happens when the stock market continues to drop further once Fed rate increases begin next month?

Many Boomers are living on the "edge" financially, and the dearth of low risk investment interest income in the recent past has devastated their once comfortable retirement plans. Add the burden of trying to financially help their unemployed/underemployed children and it compounds their pain.

Grammar edit

Managed expectations they are forcing all the markets higher and higher to offset this debacle so folks don't really go crazy. If the stock market fell off 30% and we had the inflation we are seeing everyone would be up in arms... instead we get the FED rigging all markets and all outcomes so we live in literally a simulation.

Thanks government for allowing this bull**** to happen. Leave the damn markets alone. This is how we end up with the FED owning everything.

Thanks government for allowing this bull**** to happen. Leave the damn markets alone. This is how we end up with the FED owning everything.

While this administration disgusts me, major inflation has been baked into the cake for a long time now. The truth is, they're all to blame for this. Every year we get more government and more wasteful spending. All of that spending is financed by debt and monetized by the fed.

This was inevitable to anyone paying attention with even a basic understanding of sound money. The citizenry isn't innocent in this either. A politician running on a platform of the drastic cuts that need to be made would be the most unpopular politician in recent history.

The name of the game in current politics is enrich yourself and find a chair before the music stops. That game has been playing for a very long time. And the music is about to stop.

This was inevitable to anyone paying attention with even a basic understanding of sound money. The citizenry isn't innocent in this either. A politician running on a platform of the drastic cuts that need to be made would be the most unpopular politician in recent history.

The name of the game in current politics is enrich yourself and find a chair before the music stops. That game has been playing for a very long time. And the music is about to stop.

Ironic (or fitting) user name.Helicopter Ben said:

While this administration disgusts me, major inflation has been baked into the cake for a long time now. The truth is, they're all to blame for this. Every year we get more government and more wasteful spending. All of that spending is financed by debt and monetized by the fed.

This was inevitable to anyone paying attention with even a basic understanding of sound money. The citizenry isn't innocent in this either. A politician running on a platform of the drastic cuts that need to be made would be the most unpopular politician in recent history.

The name of the game in current politics is enrich yourself and find a chair before the music stops. That game has been playing for a very long time. And the music is about to stop.

Keynesians are to blame for this and every president who nominated them.

Quote:

Producer Prices Surge To Record High As Services Costs Soar

Following the 39-year-high CPI print, analysts expected producer prices to continue accelerating to a 9.8% YoY surge in December, but while PPI rose for the 20th straight month, it was up slightly less than expected at 9.7% YoY - still a record high.

https://www.zerohedge.com/personal-finance/producer-prices-surge-record-high-services-costs-soar

?fit=445%2C250&ssl=1

?fit=445%2C250&ssl=1sharpdressedman said:Bold text done by me. Yep, it creates stress that I have seen to be medically injurious to patients.LMCane said:UTExan said:Cromagnum said:

Pretty bad luck if you are in your retirement years right now.

Retirees should have a decent portfolio if they have saved, invested during the past 15-30 years. If your financial advisor is not putting you in a position to outpace inflation, look for better options. Retirees should have that plus Social Security for a better standard of living than most working folks. The great sin of our modern educational system is not educating people with regard to both nutritional health and the power of investing for financial security.

I have to disagree completely. There is very little that can be guaranteed to outpace a 7% annual rate.

You want everyone's 401K to be invested in high risk equities which have dropped 20% the last year? What are you suggesting that pays a 7% rate with little risk to old retirees?

The entire point is that the Fed Reserve has been FORCING the elderly to become less and less risk averse to try to keep up with inflation-

so what happens when the stock market continues to drop further once Fed rate increases begin next month?

Many Boomers are living on the "edge" financially, and the dearth of low risk investment interest income in the recent past has devastated their once comfortable retirement plans. Add the burden of trying to financially help their unemployed/underemployed children and it compounds their pain.

Grammar edit

This.

A large % of my customers are this age bracket. I think about this problem a lot.

Are you researching any options or potential solutions for this? If there are, I want to make sure to bring it to their attention. Many just lost their spouse and, it's really heartbreaking, I need to help if there's opportunity.

I agree it's borderline elder abuse, and the Cantillion Effect benefactors are robbing these people blind.

The anger and fury I feel towards those responsible [some of which are the elderly themselves for voting away their responsibilities and complacency towards politics] is quite ferocious.

But solutions need to be presented. I'd love to hear from anyone that's addressing this issue.

Cryptohemp at gmail

I created my forum handle in college when he was chairman. It was around that time when I started really paying attention to this stuff. Keynesian thinking simply defies all logic so I started reading the Austrians and my eyes were opened. Have been preparing for high inflation ever since.

As a starry-eyed college kid, I had hopes that we would correct course. Then we got yellen and Powell. Maybe I've grown cynical, but I now have zero faith in anyone in power. I don't think most of the people in power truly believe this crap. Keynesian economics is just a good backwards rationalization for all of the spending and corruption that comes along with it.

As a starry-eyed college kid, I had hopes that we would correct course. Then we got yellen and Powell. Maybe I've grown cynical, but I now have zero faith in anyone in power. I don't think most of the people in power truly believe this crap. Keynesian economics is just a good backwards rationalization for all of the spending and corruption that comes along with it.

I think everyone in the know knows it's not a problem that can be governmented away. But the presentation to the public is always "jobs and solutions" like the public is anything but children to be handwaved away.

The fiscall cliff looms, and China social credit system is awaiting us at the bottom.

The fiscall cliff looms, and China social credit system is awaiting us at the bottom.

Well done Joe Biden.joerobert_pete06 said:

My HR rep says inflation is at 4.6%. What should I believe ?

https://tradingeconomics.com/united-states/inflation-cpi

The same HR department that determines pay raises? Pretty sure you know the answer of what to believe.

You learned well.Helicopter Ben said:

I created my forum handle in college when he was chairman. It was around that time when I started really paying attention to this stuff. Keynesian thinking simply defies all logic so I started reading the Austrians and my eyes were opened. Have been preparing for high inflation ever since.

As a starry-eyed college kid, I had hopes that we would correct course. Then we got yellen and Powell. Maybe I've grown cynical, but I now have zero faith in anyone in power. I don't think most of the people in power truly believe this crap. Keynesian economics is just a good backwards rationalization for all of the spending and corruption that comes along with it.

Spent 40 dollars filling up each week under Trump. 2,080 total a year.

Biden popped that up to almost 4,160 a year.

Thank you Asshat

And I won't be able to buy a truck for at least another 2 years until the prices go down significantly like they were under Trump.

Thank you Asshat

Biden popped that up to almost 4,160 a year.

Thank you Asshat

And I won't be able to buy a truck for at least another 2 years until the prices go down significantly like they were under Trump.

Thank you Asshat

infinity ag said:Well done Joe Biden.joerobert_pete06 said:

My HR rep says inflation is at 4.6%. What should I believe ?

https://tradingeconomics.com/united-states/inflation-cpi

depends on what data she's looking at.

https://www.usinflationcalculator.com/inflation/historical-inflation-rates/

2021 - Monthly inflation rate.

1.4

1.7

2.6

4.2

5.0

5.4

5.4

5.3

5.4

6.2

6.8

7.0

2021 average = 4.7

It is a game to get the right compensation ... if company is not keeping up and you can improve... up to you to obtain a new offer and negotiate.

It is rare that a company takes proper care of employees.

And always remember HR is for the company not the employees. HR is not your friend.

--- Edit Grammar and content.

- When market conditions go down, the company always pulls you down.

- When market conditions go up... you almost always have to pull yourself up.

It is rare that a company takes proper care of employees.

And always remember HR is for the company not the employees. HR is not your friend.

--- Edit Grammar and content.

I don't think you average it, it's compounded to get the YOY delta right?

Liestenign to Quoth the Raven interview Peter Schiff and PS makes a good point. Inflation peaked in the 80's at like 12%. Were in "trough" inflation right now. Many are denying it's happening or trying to call it good when we're just getting started and have a long way to go until peak.

Liestenign to Quoth the Raven interview Peter Schiff and PS makes a good point. Inflation peaked in the 80's at like 12%. Were in "trough" inflation right now. Many are denying it's happening or trying to call it good when we're just getting started and have a long way to go until peak.

The link has the monthly inflation rate going back to 1914. Avg rate is calculated in there.

Guessing she's getting it somewhere like the link.

Guessing she's getting it somewhere like the link.

If you believe those rates are correct, I have some ocean front property to sell you... the manipulation they use to get that 7% is borderline criminal IMHO.

Featured Stories

See All

Top-ranked Texas A&M picked to win SEC in preseason coaches poll

by Richard Zane

12:54

1d ago

6.0k

11:59

47m ago

422

Offering a behind-the-scenes a look at February signees of the past

by Ryan Brauninger

.png)