Thanks for the confession. You have no life experience and your opinions on pretty much everything should be completely dismissed.Oldag2020 said:

Not sure if this was a shot? What college student isn't a dependent?

No inflation, nothing to see here

18,609 Views |

303 Replies |

Last: 2 days ago by Heineken-Ashi

Which is why we are screwed. Modern monetary theory is naive and wrong as hell. Volcker (the last Fed chair with a clue) pulled us out of stagflation of the 70s and early 80s by increasing interest rates. That is exactly what we need. The fact that you think near 0 interst rates long term are good shows that you have no clue. You need to read more (real sources.. not within your Keysian bubble).Oldag2020 said:

We aren't going to raise interest rates. Modern monetary theory proponents are perfectly fine with spending to get out of a hole, but keep a lid on inflation with taxes being the lever.

Remember the roaring 20's? As in the 1920's, the moments that lead up to the great depression?

Why were they roaring? The fed was allowing easy, cheap money.

https://fee.org/articles/what-caused-the-great-depression/

"The Four Phases of the Great Depression

When you think of the Great Depression, probably the first thing that comes to mind is the massive stock market crash of 1929, when stock prices plummeted spectacularly and investors dumped their stocks as fast as they could. The ensuing panic was memorable indeed, but it was only one aspect of the Depression. In fact, the Depression had four distinct phases:

[ol]

The government's "easy money" policies caused an artificial economic boom and a subsequent crash. President Herbert Hoover's interventionist policies after the crash suppressed the self-adjusting aspect of the market, thus preventing recovery and prolonging the recession. After Hoover left office, Franklin Delano Roosevelt's "New Deal" expanded Hoover's interventionism into nearly every aspect of the American economy, thus deepening the Depression and extending it ever longer. Labor laws such as the Wagner Act struck the final blow to the remaining healthy sectors of the economy, dragging the last remaining bulwarks of productivity to their knees. [/ol]Each of these phases are marked by distinct events, and each had their own specific causes. Together they produced one common result: business stagnation and unemployment on a scale never before seen in the United States. "

We're in stage 1. If you are dumb enough to think it can't happen again, then return your diploma and ring, you haven't learned anything.

"1. Easy Money: A Series of False Signals

The first phase of the Great Depression was a massive boom during the "Roaring 20's," which inevitably burst in 1929. In order to understand this crash, we first have to understand the boom and how it happened.

For various reasons, the government in the 1920's created monetary policies that ballooned the quantity of money and credit in the economy. A great boom resulted, followed soon after by a painful day of reckoning. None of America's depressions prior to 1929, however, lasted more than four years and most of them were over in two. The Great Depression lasted for a dozen years because the government compounded its monetary errors with a series of harmful interventions. But how exactly did the government inflate the economy, and how did that cause the boom and inevitable bust?"

And why can it happen again? Due to the arrogant hubris that we're now 'too smart' and can manipulate the market without consequences. During the first CPI report/spike the fed was 'surprised'. That ought to scare the ever loving **** out of anyone with half a functional brain. This happens over and over and over again throughout history.

And don't forget, the stock market crashed. Wiping everyone out.

Why were they roaring? The fed was allowing easy, cheap money.

https://fee.org/articles/what-caused-the-great-depression/

"The Four Phases of the Great Depression

When you think of the Great Depression, probably the first thing that comes to mind is the massive stock market crash of 1929, when stock prices plummeted spectacularly and investors dumped their stocks as fast as they could. The ensuing panic was memorable indeed, but it was only one aspect of the Depression. In fact, the Depression had four distinct phases:

[ol]

We're in stage 1. If you are dumb enough to think it can't happen again, then return your diploma and ring, you haven't learned anything.

"1. Easy Money: A Series of False Signals

The first phase of the Great Depression was a massive boom during the "Roaring 20's," which inevitably burst in 1929. In order to understand this crash, we first have to understand the boom and how it happened.

For various reasons, the government in the 1920's created monetary policies that ballooned the quantity of money and credit in the economy. A great boom resulted, followed soon after by a painful day of reckoning. None of America's depressions prior to 1929, however, lasted more than four years and most of them were over in two. The Great Depression lasted for a dozen years because the government compounded its monetary errors with a series of harmful interventions. But how exactly did the government inflate the economy, and how did that cause the boom and inevitable bust?"

And why can it happen again? Due to the arrogant hubris that we're now 'too smart' and can manipulate the market without consequences. During the first CPI report/spike the fed was 'surprised'. That ought to scare the ever loving **** out of anyone with half a functional brain. This happens over and over and over again throughout history.

And don't forget, the stock market crashed. Wiping everyone out.

aTm '99

Yep. "Don't fight the fed" is a very true adage, but equally true is "don't let the inflation genie out of the bottle".Deputy Travis Junior said:Oldag2020 said:

We aren't going to raise interest rates. Modern monetary theory proponents are perfectly fine with spending to get out of a hole, but keep a lid on inflation with taxes being the lever.

I know we aren't going to raise rates. That's the point. For all its complicated analysis, monetary policy really comes down to managing 1) the money supply and 2) interest rates. Well, We've accumulated so much debt and are running such high deficits that the fed can no longer use the second freely, which means it only has the first. And a proven (common sense?) consequence of money supply expansion is inflation.

Don't take my word for it, the fed itself said it would no longer try to stick to its traditional 2% inflation target.

Taxes are a bludgeon not a lever.Oldag2020 said:

We aren't going to raise interest rates. Modern monetary theory proponents are perfectly fine with spending to get out of a hole, but keep a lid on inflation with taxes being the lever.

Trying to control the economy through taxation is like trying to stop your car with a wall

The world needs mean tweets

My Pronouns Ultra and MAGA

Trump 2024

My Pronouns Ultra and MAGA

Trump 2024

bow down to daddy government! The government knows what's best for us! F****** clownOldag2020 said:

Everything you listed is increasing in price due to temporary supply imbalances. ie it is transitory and will not continue for the foreseeable future.

Rule #1 don't fight the fed

The fed isn't worried and neither am I

Inflation is hedged by equity. This is not a theory, it's a fact. Stock prices rise when earnings increase. Earnings increase when prices of goods and services rise. It's that simple.

Also, the markets are pricing in the transitory view on inflation. Therefore, stocks are properly priced. There will be no negative impact on the stock market (as a whole) when inflation decreases to pre transitory levels.

Also, the markets are pricing in the transitory view on inflation. Therefore, stocks are properly priced. There will be no negative impact on the stock market (as a whole) when inflation decreases to pre transitory levels.

You can discuss that with Stephanie Kelton

Very true! I don't see inflation getting above 4% once the transitory levels reverse. In no way is that "letting the genie out of the bottle"mwp02ag said:Yep. "Don't fight the fed" is a very true adage, but equally true is "don't let the inflation genie out of the bottle".Deputy Travis Junior said:Oldag2020 said:

We aren't going to raise interest rates. Modern monetary theory proponents are perfectly fine with spending to get out of a hole, but keep a lid on inflation with taxes being the lever.

I know we aren't going to raise rates. That's the point. For all its complicated analysis, monetary policy really comes down to managing 1) the money supply and 2) interest rates. Well, We've accumulated so much debt and are running such high deficits that the fed can no longer use the second freely, which means it only has the first. And a proven (common sense?) consequence of money supply expansion is inflation.

Don't take my word for it, the fed itself said it would no longer try to stick to its traditional 2% inflation target.

I see you didn't read my post and prefer to stay within your bubble.Oldag2020 said:

You can discuss that with Stephanie Kelton

Stephanie Kelton

Absolute pure Keynesian garbage mixed with modern leftist political dogma. Again, absolute garbage.Quote:

The Deficit Myth

MODERN MONETARY THEORY AND THE BIRTH OF THE PEOPLE'S ECONOMY

The Deficit Myth empowers readers to break free of the broken thinking and fictitious constraints that have been holding our nation back.

Deficits can help us fight a myriad of problems that plague our economyinequality, poverty and unemployment, climate change, housing, health care, and more. But we can't use deficits to solve problems if we continue to think of the deficit itself as a problem.

And now the money shot..

I've challenged you to break outside of your academic bubble and to study some of the greatest events that affected our economy and some of the greatest economic minds in our history. You come back with Bernie's economic advisor. Unreal.Quote:

Stephanie Kelton (ne Bell; born October 10, 1969) is an American economist and academic. She is a professor at Stony Brook University and a Senior Fellow at the Schwartz Center for Economic Policy Analysis at the New School for Social Research. She was formerly a professor at the University of MissouriKansas City. She also served as an advisor to Bernie Sanders's 2016 presidential campaign.

Oldag2020 said:

Inflation is hedged by equity. This is not a theory, it's a fact. Stock prices rise when earnings increase. Earnings increase when prices of goods and services rise. It's that simple.

Also, the markets are pricing in the transitory view on inflation. Therefore, stocks are properly priced. There will be no negative impact on the stock market (as a whole) when inflation decreases to pre transitory levels.

That's not true. Earnings rise when more goods and services are sold, or cost of doing business goes down.

If prices rise because of inflation, then the cost of goods also rise; you know, the prices of the goods used to make the good/service, which means earnings do not rise. Sales revenue rises, but not earnings, which is all that matters.

I'm not sure if you are trolling at this point or you really are just hopelessly lost on the subject of basic economics.

I am not necessarily a supporter of MMT. I never said I was. I am simply sharing a point of view different than the norm on this site.mazag08 said:I see you didn't read my post and prefer to stay within your bubble.Oldag2020 said:

You can discuss that with Stephanie Kelton

Stephanie KeltonAbsolute pure Keynesian garbage mixed with modern leftist political dogma. Again, absolute garbage.Quote:

The Deficit Myth

MODERN MONETARY THEORY AND THE BIRTH OF THE PEOPLE'S ECONOMY

The Deficit Myth empowers readers to break free of the broken thinking and fictitious constraints that have been holding our nation back.

Deficits can help us fight a myriad of problems that plague our economyinequality, poverty and unemployment, climate change, housing, health care, and more. But we can't use deficits to solve problems if we continue to think of the deficit itself as a problem.

And now the money shot..I've challenged you to break outside of your academic bubble and to study some of the greatest events that affected our economy and some of the greatest economic minds in our history. You come back with Bernie's economic advisor. Unreal.Quote:

Stephanie Kelton (ne Bell; born October 10, 1969) is an American economist and academic. She is a professor at Stony Brook University and a Senior Fellow at the Schwartz Center for Economic Policy Analysis at the New School for Social Research. She was formerly a professor at the University of MissouriKansas City. She also served as an advisor to Bernie Sanders's 2016 presidential campaign.

Oldag2020 said:I am not necessarily a supporter of MMT. I never said I was. I am simply sharing a point of view different than the norm on this site.mazag08 said:I see you didn't read my post and prefer to stay within your bubble.Oldag2020 said:

You can discuss that with Stephanie Kelton

Stephanie KeltonAbsolute pure Keynesian garbage mixed with modern leftist political dogma. Again, absolute garbage.Quote:

The Deficit Myth

MODERN MONETARY THEORY AND THE BIRTH OF THE PEOPLE'S ECONOMY

The Deficit Myth empowers readers to break free of the broken thinking and fictitious constraints that have been holding our nation back.

Deficits can help us fight a myriad of problems that plague our economyinequality, poverty and unemployment, climate change, housing, health care, and more. But we can't use deficits to solve problems if we continue to think of the deficit itself as a problem.

And now the money shot..I've challenged you to break outside of your academic bubble and to study some of the greatest events that affected our economy and some of the greatest economic minds in our history. You come back with Bernie's economic advisor. Unreal.Quote:

Stephanie Kelton (ne Bell; born October 10, 1969) is an American economist and academic. She is a professor at Stony Brook University and a Senior Fellow at the Schwartz Center for Economic Policy Analysis at the New School for Social Research. She was formerly a professor at the University of MissouriKansas City. She also served as an advisor to Bernie Sanders's 2016 presidential campaign.

Ah, so this is the part where the brilliant college student with no life experience tries to pretend they're just proposing objective reality to the conservative troglodytes that have been living in darkness.

I've seen this episode before. It's a classic.

I don't need a point of view different than the norm. I don't care about the norm at all. I don't care what you think the general view is, nor do I care if you think you need to go against the grain. You have not posted on this thread to merely go against the grain. You have been posting your statements as facts and posting as an expert on inflation without any actual data, history, or experience to back you up.

Stop trying to go against the grain and take some of these comments to heart. There are a lot of extremely smart and experienced people on this board. Many have attempted to be civil with you and try and help you learn. Yet you continue to post the same drivel over and over. And again, you have nothing to go off of outside of academic study, books that align with your bubble, and online articles. It's because you haven't had a job yet, don't truly understand economics, and haven't the slightest clue what actually drives inflation, how harmful it can be, nor how to fight it. This isn't an insult. I was in your shoes in 2008.

Again, go read Milton Friedman with an open mind. I dare you.

Stop trying to go against the grain and take some of these comments to heart. There are a lot of extremely smart and experienced people on this board. Many have attempted to be civil with you and try and help you learn. Yet you continue to post the same drivel over and over. And again, you have nothing to go off of outside of academic study, books that align with your bubble, and online articles. It's because you haven't had a job yet, don't truly understand economics, and haven't the slightest clue what actually drives inflation, how harmful it can be, nor how to fight it. This isn't an insult. I was in your shoes in 2008.

Again, go read Milton Friedman with an open mind. I dare you.

Increasing the prices of goods and services sold IS a way to increase earnings. Obviously there are plenty of caveats to that(as you mention). Clearly it's not the only way to increase earnings, but it is an input in earnings.Cassius said:Oldag2020 said:

Inflation is hedged by equity. This is not a theory, it's a fact. Stock prices rise when earnings increase. Earnings increase when prices of goods and services rise. It's that simple.

Also, the markets are pricing in the transitory view on inflation. Therefore, stocks are properly priced. There will be no negative impact on the stock market (as a whole) when inflation decreases to pre transitory levels.

That's not true. Earnings rise when more goods and services are sold, or cost of doing business goes down.

If prices rise because of inflation, then the cost of goods also rise; you know, the prices of the goods used to make the good/service, which means earnings do not rise. Sales revenue rises, but not earnings, which is all that matters.

I'm not sure if you are trolling at this point or you really are just hopelessly lost on the subject of basic economics.

Just curious, how many people in U.S. have any savings let alone stocks? Your arguments are pixie dust.Oldag2020 said:

First off, stocks are a hedge against inflation. So if they have a properly allocated portfolio. (They do) there should be zero issue with their purchasing power.

Secondly, it's still possible to find cheap stocks. Yes, they are getting more expensive by the day, but there are plenty of value stocks that will protect your assets and allow you to buy in at a fair price.

Among the latter, under pretence of governing they have divided their nations into two classes, wolves and sheep.”

Thomas Jefferson, Letter to Edward Carrington, January 16, 1787

Thomas Jefferson, Letter to Edward Carrington, January 16, 1787

Let's see how this afternoons fed meeting shakes out. If I am wrong on inflation, I will read about his beliefs.mazag08 said:

I don't need a point of view different than the norm. I don't care about the norm at all. I don't care what you think the general view is, nor do I care if you think you need to go against the grain. You have not posted on this thread to merely go against the grain. You have been posting your statements as facts and posting as an expert on inflation without any actual data, history, or experience to back you up.

Stop trying to go against the grain and take some of these comments to heart. There are a lot of extremely smart and experienced people on this board. Many have attempted to be civil with you and try and help you learn. Yet you continue to post the same drivel over and over. And again, you have nothing to go off of outside of academic study, books that align with your bubble, and online articles. It's because you haven't had a job yet, don't truly understand economics, and haven't the slightest clue what actually drives inflation, how harmful it can be, nor how to fight it. This isn't an insult. I was in your shoes in 2008.

Again, go read Milton Friedman with an open mind. I dare you.

1:30 pm CT CNBC

Economics is not a grouping of viewpoints. That is an incredibly dangerous fallacy.Oldag2020 said:I am not necessarily a supporter of MMT. I never said I was. I am simply sharing a point of view different than the norm on this site.mazag08 said:I see you didn't read my post and prefer to stay within your bubble.Oldag2020 said:

You can discuss that with Stephanie Kelton

Stephanie KeltonAbsolute pure Keynesian garbage mixed with modern leftist political dogma. Again, absolute garbage.Quote:

The Deficit Myth

MODERN MONETARY THEORY AND THE BIRTH OF THE PEOPLE'S ECONOMY

The Deficit Myth empowers readers to break free of the broken thinking and fictitious constraints that have been holding our nation back.

Deficits can help us fight a myriad of problems that plague our economyinequality, poverty and unemployment, climate change, housing, health care, and more. But we can't use deficits to solve problems if we continue to think of the deficit itself as a problem.

And now the money shot..I've challenged you to break outside of your academic bubble and to study some of the greatest events that affected our economy and some of the greatest economic minds in our history. You come back with Bernie's economic advisor. Unreal.Quote:

Stephanie Kelton (ne Bell; born October 10, 1969) is an American economist and academic. She is a professor at Stony Brook University and a Senior Fellow at the Schwartz Center for Economic Policy Analysis at the New School for Social Research. She was formerly a professor at the University of MissouriKansas City. She also served as an advisor to Bernie Sanders's 2016 presidential campaign.

An illustration I often use is that economics is a lot like construction science. There are different methodologies and routes to accomplish end goals, but there are some hard, basic facts that are not up for negotiation nor are they optional.

Regardless of whether you are building a dog house or a sky scrapper, the basic fundamentals of foundational strength and structural integrity will always hold true and the absence of them will always result in failure. It's not negotiable.

While no one can predict exactly when and how the failures resulting from bad economic policy will happen, it is inevitable that they will happen.

If the majority of Americans were not trying to continuously "keep up with the Joneses" and instead were frugal with their money. many many more could be invested in the marketsrichardag said:Just curious, how many people in U.S. have any savings let alone stocks? Your arguments are pixie dust.Oldag2020 said:

First off, stocks are a hedge against inflation. So if they have a properly allocated portfolio. (They do) there should be zero issue with their purchasing power.

Secondly, it's still possible to find cheap stocks. Yes, they are getting more expensive by the day, but there are plenty of value stocks that will protect your assets and allow you to buy in at a fair price.

Cutting out the daily morning coffee gives the average American additional free cash of around $150 a month. That is plenty of money to begin saving and get ahead

You are wrong. There are many different economic theories. Economics and finance is an art, not a science. Is it becoming more scientific? Maybe? But can anyone actually predict what will happen tomorrow? No.96ags said:Economics is not a grouping of viewpoints. That is an incredibly dangerous fallacy.Oldag2020 said:I am not necessarily a supporter of MMT. I never said I was. I am simply sharing a point of view different than the norm on this site.mazag08 said:I see you didn't read my post and prefer to stay within your bubble.Oldag2020 said:

You can discuss that with Stephanie Kelton

Stephanie KeltonAbsolute pure Keynesian garbage mixed with modern leftist political dogma. Again, absolute garbage.Quote:

The Deficit Myth

MODERN MONETARY THEORY AND THE BIRTH OF THE PEOPLE'S ECONOMY

The Deficit Myth empowers readers to break free of the broken thinking and fictitious constraints that have been holding our nation back.

Deficits can help us fight a myriad of problems that plague our economyinequality, poverty and unemployment, climate change, housing, health care, and more. But we can't use deficits to solve problems if we continue to think of the deficit itself as a problem.

And now the money shot..I've challenged you to break outside of your academic bubble and to study some of the greatest events that affected our economy and some of the greatest economic minds in our history. You come back with Bernie's economic advisor. Unreal.Quote:

Stephanie Kelton (ne Bell; born October 10, 1969) is an American economist and academic. She is a professor at Stony Brook University and a Senior Fellow at the Schwartz Center for Economic Policy Analysis at the New School for Social Research. She was formerly a professor at the University of MissouriKansas City. She also served as an advisor to Bernie Sanders's 2016 presidential campaign.

An illustration I often use is that economics is a lot like construction science. There are different methodologies and routes to accomplish end goals, but there are some hard, basic facts that are not up for negotiation nor are they optional.

Regardless of whether you are building a dog house or a sky scrapper, the basic fundamentals of foundational strength and structural integrity will always hold true and the absence of them will always result in failure. It's not negotiable.

While no one can predict exactly when and how the failures resulting from bad economic policy will happen, it is inevitable that they will happen.

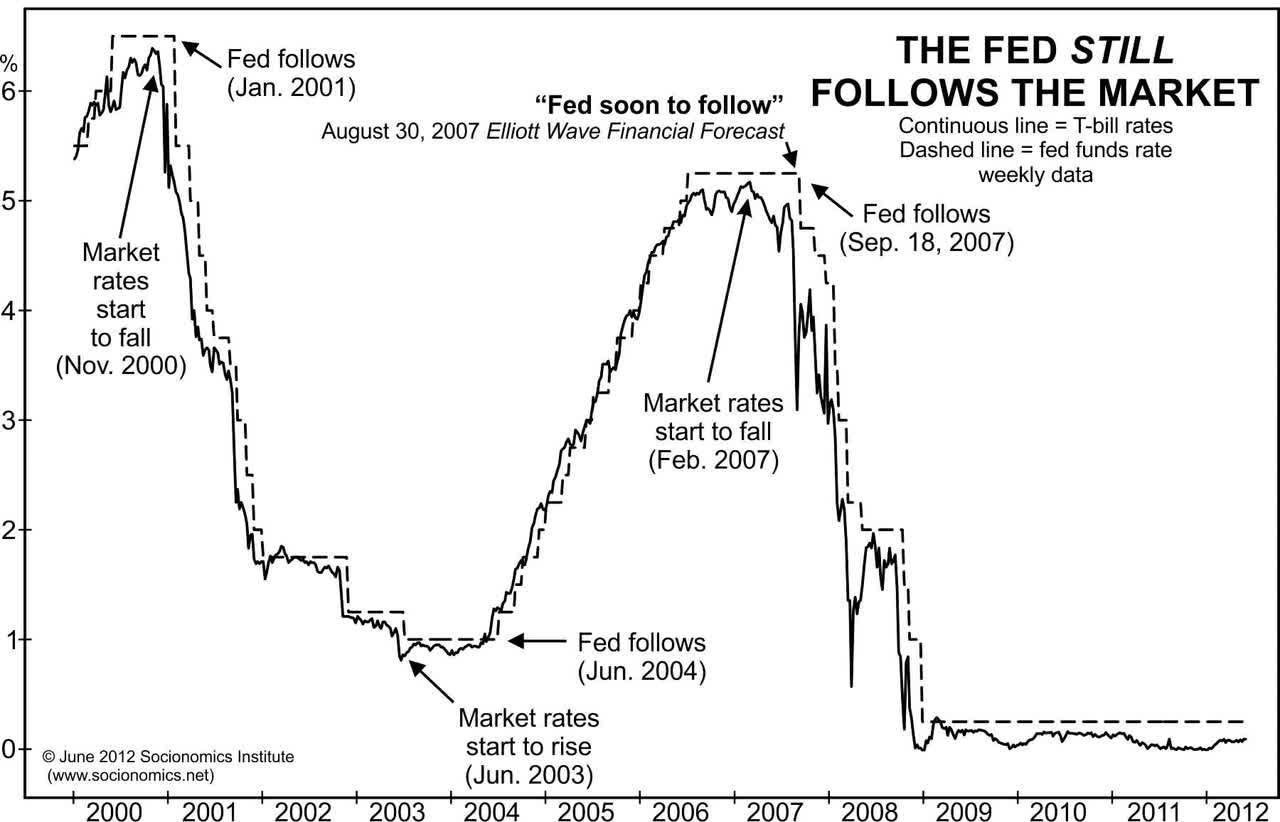

I understand you are FED true believer.Oldag2020 said:Let's see how this afternoons fed meeting shakes out. If I am wrong on inflation, I will read about his beliefs.mazag08 said:

I don't need a point of view different than the norm. I don't care about the norm at all. I don't care what you think the general view is, nor do I care if you think you need to go against the grain. You have not posted on this thread to merely go against the grain. You have been posting your statements as facts and posting as an expert on inflation without any actual data, history, or experience to back you up.

Stop trying to go against the grain and take some of these comments to heart. There are a lot of extremely smart and experienced people on this board. Many have attempted to be civil with you and try and help you learn. Yet you continue to post the same drivel over and over. And again, you have nothing to go off of outside of academic study, books that align with your bubble, and online articles. It's because you haven't had a job yet, don't truly understand economics, and haven't the slightest clue what actually drives inflation, how harmful it can be, nor how to fight it. This isn't an insult. I was in your shoes in 2008.

Again, go read Milton Friedman with an open mind. I dare you.

1:30 pm CT CNBC

Did you do what I said in my first post in this thread? Look up historical FED actions and see if they lead or follow the market? Because a FED that follows the market is doing nothing more than adding insult to injury after they failed to prevent the action.

Here.. I'll help you.

Sentiment Speaks: This Pavlovian Market Is Training You Well - But Prepare To Pay The Piper | Seeking Alpha

On point, concise, accurate and brutal truth.mazag08 said:I see you didn't read my post and prefer to stay within your bubble.Oldag2020 said:

You can discuss that with Stephanie Kelton

Stephanie KeltonAbsolute pure Keynesian garbage mixed with modern leftist political dogma. Again, absolute garbage.Quote:

The Deficit Myth

MODERN MONETARY THEORY AND THE BIRTH OF THE PEOPLE'S ECONOMY

The Deficit Myth empowers readers to break free of the broken thinking and fictitious constraints that have been holding our nation back.

Deficits can help us fight a myriad of problems that plague our economyinequality, poverty and unemployment, climate change, housing, health care, and more. But we can't use deficits to solve problems if we continue to think of the deficit itself as a problem.

And now the money shot..I've challenged you to break outside of your academic bubble and to study some of the greatest events that affected our economy and some of the greatest economic minds in our history. You come back with Bernie's economic advisor. Unreal.Quote:

Stephanie Kelton (ne Bell; born October 10, 1969) is an American economist and academic. She is a professor at Stony Brook University and a Senior Fellow at the Schwartz Center for Economic Policy Analysis at the New School for Social Research. She was formerly a professor at the University of MissouriKansas City. She also served as an advisor to Bernie Sanders's 2016 presidential campaign.

Among the latter, under pretence of governing they have divided their nations into two classes, wolves and sheep.”

Thomas Jefferson, Letter to Edward Carrington, January 16, 1787

Thomas Jefferson, Letter to Edward Carrington, January 16, 1787

I have a degree in economics from A&M and 25 years of money management experience. I assure you, I'm not wrong.Oldag2020 said:You are wrong. There are many different economic theories. Economics and finance is an art, not a science. Is it becoming more scientific? Maybe? But can anyone actually predict what will happen tomorrow? No.96ags said:Economics is not a grouping of viewpoints. That is an incredibly dangerous fallacy.Oldag2020 said:I am not necessarily a supporter of MMT. I never said I was. I am simply sharing a point of view different than the norm on this site.mazag08 said:I see you didn't read my post and prefer to stay within your bubble.Oldag2020 said:

You can discuss that with Stephanie Kelton

Stephanie KeltonAbsolute pure Keynesian garbage mixed with modern leftist political dogma. Again, absolute garbage.Quote:

The Deficit Myth

MODERN MONETARY THEORY AND THE BIRTH OF THE PEOPLE'S ECONOMY

The Deficit Myth empowers readers to break free of the broken thinking and fictitious constraints that have been holding our nation back.

Deficits can help us fight a myriad of problems that plague our economyinequality, poverty and unemployment, climate change, housing, health care, and more. But we can't use deficits to solve problems if we continue to think of the deficit itself as a problem.

And now the money shot..I've challenged you to break outside of your academic bubble and to study some of the greatest events that affected our economy and some of the greatest economic minds in our history. You come back with Bernie's economic advisor. Unreal.Quote:

Stephanie Kelton (ne Bell; born October 10, 1969) is an American economist and academic. She is a professor at Stony Brook University and a Senior Fellow at the Schwartz Center for Economic Policy Analysis at the New School for Social Research. She was formerly a professor at the University of MissouriKansas City. She also served as an advisor to Bernie Sanders's 2016 presidential campaign.

An illustration I often use is that economics is a lot like construction science. There are different methodologies and routes to accomplish end goals, but there are some hard, basic facts that are not up for negotiation nor are they optional.

Regardless of whether you are building a dog house or a sky scrapper, the basic fundamentals of foundational strength and structural integrity will always hold true and the absence of them will always result in failure. It's not negotiable.

While no one can predict exactly when and how the failures resulting from bad economic policy will happen, it is inevitable that they will happen.

If you'll read my whole post, you will see that I addressed your last question. No, we can't predict the when, but we have plenty of history to tell exactly the what.

This is absolutely wrong and whichever A&M economic prof taught you this should be fired.Oldag2020 said:You are wrong. There are many different economic theories. Economics and finance is an art, not a science. Is it becoming more scientific? Maybe? But can anyone actually predict what will happen tomorrow? No.96ags said:Economics is not a grouping of viewpoints. That is an incredibly dangerous fallacy.Oldag2020 said:I am not necessarily a supporter of MMT. I never said I was. I am simply sharing a point of view different than the norm on this site.mazag08 said:I see you didn't read my post and prefer to stay within your bubble.Oldag2020 said:

You can discuss that with Stephanie Kelton

Stephanie KeltonAbsolute pure Keynesian garbage mixed with modern leftist political dogma. Again, absolute garbage.Quote:

The Deficit Myth

MODERN MONETARY THEORY AND THE BIRTH OF THE PEOPLE'S ECONOMY

The Deficit Myth empowers readers to break free of the broken thinking and fictitious constraints that have been holding our nation back.

Deficits can help us fight a myriad of problems that plague our economyinequality, poverty and unemployment, climate change, housing, health care, and more. But we can't use deficits to solve problems if we continue to think of the deficit itself as a problem.

And now the money shot..I've challenged you to break outside of your academic bubble and to study some of the greatest events that affected our economy and some of the greatest economic minds in our history. You come back with Bernie's economic advisor. Unreal.Quote:

Stephanie Kelton (ne Bell; born October 10, 1969) is an American economist and academic. She is a professor at Stony Brook University and a Senior Fellow at the Schwartz Center for Economic Policy Analysis at the New School for Social Research. She was formerly a professor at the University of MissouriKansas City. She also served as an advisor to Bernie Sanders's 2016 presidential campaign.

An illustration I often use is that economics is a lot like construction science. There are different methodologies and routes to accomplish end goals, but there are some hard, basic facts that are not up for negotiation nor are they optional.

Regardless of whether you are building a dog house or a sky scrapper, the basic fundamentals of foundational strength and structural integrity will always hold true and the absence of them will always result in failure. It's not negotiable.

While no one can predict exactly when and how the failures resulting from bad economic policy will happen, it is inevitable that they will happen.

You are merely talking about normative economics, not economics. Normative economics focuses on what ought to be with an end goal of fairness. General economics doesn't give a flying **** about fair or what some academic theorist dreams up. Because in the end human nature and math will win. This isn't an opinion. It's a fact learned through history. If your goal is to be fair, the only way is to stipulate equal outcomes. A robust economy is not built on equal outcomes. It's built on equal opportunities.

A simple google search will back my statement many times over.mazag08 said:This is absolutely wrong and whichever A&M economic prof taught you this should be fired.Oldag2020 said:You are wrong. There are many different economic theories. Economics and finance is an art, not a science. Is it becoming more scientific? Maybe? But can anyone actually predict what will happen tomorrow? No.96ags said:Economics is not a grouping of viewpoints. That is an incredibly dangerous fallacy.Oldag2020 said:I am not necessarily a supporter of MMT. I never said I was. I am simply sharing a point of view different than the norm on this site.mazag08 said:I see you didn't read my post and prefer to stay within your bubble.Oldag2020 said:

You can discuss that with Stephanie Kelton

Stephanie KeltonAbsolute pure Keynesian garbage mixed with modern leftist political dogma. Again, absolute garbage.Quote:

The Deficit Myth

MODERN MONETARY THEORY AND THE BIRTH OF THE PEOPLE'S ECONOMY

The Deficit Myth empowers readers to break free of the broken thinking and fictitious constraints that have been holding our nation back.

Deficits can help us fight a myriad of problems that plague our economyinequality, poverty and unemployment, climate change, housing, health care, and more. But we can't use deficits to solve problems if we continue to think of the deficit itself as a problem.

And now the money shot..I've challenged you to break outside of your academic bubble and to study some of the greatest events that affected our economy and some of the greatest economic minds in our history. You come back with Bernie's economic advisor. Unreal.Quote:

Stephanie Kelton (ne Bell; born October 10, 1969) is an American economist and academic. She is a professor at Stony Brook University and a Senior Fellow at the Schwartz Center for Economic Policy Analysis at the New School for Social Research. She was formerly a professor at the University of MissouriKansas City. She also served as an advisor to Bernie Sanders's 2016 presidential campaign.

An illustration I often use is that economics is a lot like construction science. There are different methodologies and routes to accomplish end goals, but there are some hard, basic facts that are not up for negotiation nor are they optional.

Regardless of whether you are building a dog house or a sky scrapper, the basic fundamentals of foundational strength and structural integrity will always hold true and the absence of them will always result in failure. It's not negotiable.

While no one can predict exactly when and how the failures resulting from bad economic policy will happen, it is inevitable that they will happen.

You are merely talking about normative economics, not economics. Normative economics focuses on what ought to be with an end goal of fairness. General economics doesn't give a flying **** about fair or what some academic theorist dreams up. Because in the end human nature and math will win. This isn't an opinion. It's a fact learned through history. If your goal is to be fair, the only way is to stipulate equal outcomes. A robust economy is not built on equal outcomes. It's built on equal opportunities.

https://www.investopedia.com/articles/economics/09/why-economists-do-not-agree.asp

Good luck son, I really do wish you the best.Oldag2020 said:A simple google search will back my statement many times over.mazag08 said:This is absolutely wrong and whichever A&M economic prof taught you this should be fired.Oldag2020 said:You are wrong. There are many different economic theories. Economics and finance is an art, not a science. Is it becoming more scientific? Maybe? But can anyone actually predict what will happen tomorrow? No.96ags said:Economics is not a grouping of viewpoints. That is an incredibly dangerous fallacy.Oldag2020 said:I am not necessarily a supporter of MMT. I never said I was. I am simply sharing a point of view different than the norm on this site.mazag08 said:I see you didn't read my post and prefer to stay within your bubble.Oldag2020 said:

You can discuss that with Stephanie Kelton

Stephanie KeltonAbsolute pure Keynesian garbage mixed with modern leftist political dogma. Again, absolute garbage.Quote:

The Deficit Myth

MODERN MONETARY THEORY AND THE BIRTH OF THE PEOPLE'S ECONOMY

The Deficit Myth empowers readers to break free of the broken thinking and fictitious constraints that have been holding our nation back.

Deficits can help us fight a myriad of problems that plague our economyinequality, poverty and unemployment, climate change, housing, health care, and more. But we can't use deficits to solve problems if we continue to think of the deficit itself as a problem.

And now the money shot..I've challenged you to break outside of your academic bubble and to study some of the greatest events that affected our economy and some of the greatest economic minds in our history. You come back with Bernie's economic advisor. Unreal.Quote:

Stephanie Kelton (ne Bell; born October 10, 1969) is an American economist and academic. She is a professor at Stony Brook University and a Senior Fellow at the Schwartz Center for Economic Policy Analysis at the New School for Social Research. She was formerly a professor at the University of MissouriKansas City. She also served as an advisor to Bernie Sanders's 2016 presidential campaign.

An illustration I often use is that economics is a lot like construction science. There are different methodologies and routes to accomplish end goals, but there are some hard, basic facts that are not up for negotiation nor are they optional.

Regardless of whether you are building a dog house or a sky scrapper, the basic fundamentals of foundational strength and structural integrity will always hold true and the absence of them will always result in failure. It's not negotiable.

While no one can predict exactly when and how the failures resulting from bad economic policy will happen, it is inevitable that they will happen.

You are merely talking about normative economics, not economics. Normative economics focuses on what ought to be with an end goal of fairness. General economics doesn't give a flying **** about fair or what some academic theorist dreams up. Because in the end human nature and math will win. This isn't an opinion. It's a fact learned through history. If your goal is to be fair, the only way is to stipulate equal outcomes. A robust economy is not built on equal outcomes. It's built on equal opportunities.

https://www.investopedia.com/articles/economics/09/why-economists-do-not-agree.asp

That doesn't make economics an art. It doesn't make it an opinion.Oldag2020 said:A simple google search will back my statement many times over.mazag08 said:This is absolutely wrong and whichever A&M economic prof taught you this should be fired.Oldag2020 said:You are wrong. There are many different economic theories. Economics and finance is an art, not a science. Is it becoming more scientific? Maybe? But can anyone actually predict what will happen tomorrow? No.96ags said:Economics is not a grouping of viewpoints. That is an incredibly dangerous fallacy.Oldag2020 said:I am not necessarily a supporter of MMT. I never said I was. I am simply sharing a point of view different than the norm on this site.mazag08 said:I see you didn't read my post and prefer to stay within your bubble.Oldag2020 said:

You can discuss that with Stephanie Kelton

Stephanie KeltonAbsolute pure Keynesian garbage mixed with modern leftist political dogma. Again, absolute garbage.Quote:

The Deficit Myth

MODERN MONETARY THEORY AND THE BIRTH OF THE PEOPLE'S ECONOMY

The Deficit Myth empowers readers to break free of the broken thinking and fictitious constraints that have been holding our nation back.

Deficits can help us fight a myriad of problems that plague our economyinequality, poverty and unemployment, climate change, housing, health care, and more. But we can't use deficits to solve problems if we continue to think of the deficit itself as a problem.

And now the money shot..I've challenged you to break outside of your academic bubble and to study some of the greatest events that affected our economy and some of the greatest economic minds in our history. You come back with Bernie's economic advisor. Unreal.Quote:

Stephanie Kelton (ne Bell; born October 10, 1969) is an American economist and academic. She is a professor at Stony Brook University and a Senior Fellow at the Schwartz Center for Economic Policy Analysis at the New School for Social Research. She was formerly a professor at the University of MissouriKansas City. She also served as an advisor to Bernie Sanders's 2016 presidential campaign.

An illustration I often use is that economics is a lot like construction science. There are different methodologies and routes to accomplish end goals, but there are some hard, basic facts that are not up for negotiation nor are they optional.

Regardless of whether you are building a dog house or a sky scrapper, the basic fundamentals of foundational strength and structural integrity will always hold true and the absence of them will always result in failure. It's not negotiable.

While no one can predict exactly when and how the failures resulting from bad economic policy will happen, it is inevitable that they will happen.

You are merely talking about normative economics, not economics. Normative economics focuses on what ought to be with an end goal of fairness. General economics doesn't give a flying **** about fair or what some academic theorist dreams up. Because in the end human nature and math will win. This isn't an opinion. It's a fact learned through history. If your goal is to be fair, the only way is to stipulate equal outcomes. A robust economy is not built on equal outcomes. It's built on equal opportunities.

https://www.investopedia.com/articles/economics/09/why-economists-do-not-agree.asp

We have been living an increasingly Keynesian system, actively fighting against free market principles since Herbert Hoover. Just because we've persevered DESPITE Keynesian braces on our ankles doesn't mean that the Keynesians were sort of right.

When a WR picks up a football dropped by the RB and gains 5 yards.. was the play successful? Did the RB succeed? Was the goal of the play 5 yards, or a first down? Or a touchdown?

Economics is much an art as an impossible burger is a hamburger. Is it still edible? Sure. You any sane person honestly prefer it? No.

Tried to follow this thread but all the economics theory talk put me to sleep!

Jamie Dimon and JP Morgan are currently holding tons of cash on their balance sheet. Do you think they are worried about inflation? They aren't. Do you think they share the view of the fed? I would imagine they do. If economics was a science there would be zero disagreement, zero divergence in opinions, and everyone would be screaming at the top of their lungs that inflation was here to stay. That's not the case.mazag08 said:That doesn't make economics an art. It doesn't make it an opinion.Oldag2020 said:A simple google search will back my statement many times over.mazag08 said:This is absolutely wrong and whichever A&M economic prof taught you this should be fired.Oldag2020 said:You are wrong. There are many different economic theories. Economics and finance is an art, not a science. Is it becoming more scientific? Maybe? But can anyone actually predict what will happen tomorrow? No.96ags said:Economics is not a grouping of viewpoints. That is an incredibly dangerous fallacy.Oldag2020 said:I am not necessarily a supporter of MMT. I never said I was. I am simply sharing a point of view different than the norm on this site.mazag08 said:I see you didn't read my post and prefer to stay within your bubble.Oldag2020 said:

You can discuss that with Stephanie Kelton

Stephanie KeltonAbsolute pure Keynesian garbage mixed with modern leftist political dogma. Again, absolute garbage.Quote:

The Deficit Myth

MODERN MONETARY THEORY AND THE BIRTH OF THE PEOPLE'S ECONOMY

The Deficit Myth empowers readers to break free of the broken thinking and fictitious constraints that have been holding our nation back.

Deficits can help us fight a myriad of problems that plague our economyinequality, poverty and unemployment, climate change, housing, health care, and more. But we can't use deficits to solve problems if we continue to think of the deficit itself as a problem.

And now the money shot..I've challenged you to break outside of your academic bubble and to study some of the greatest events that affected our economy and some of the greatest economic minds in our history. You come back with Bernie's economic advisor. Unreal.Quote:

Stephanie Kelton (ne Bell; born October 10, 1969) is an American economist and academic. She is a professor at Stony Brook University and a Senior Fellow at the Schwartz Center for Economic Policy Analysis at the New School for Social Research. She was formerly a professor at the University of MissouriKansas City. She also served as an advisor to Bernie Sanders's 2016 presidential campaign.

An illustration I often use is that economics is a lot like construction science. There are different methodologies and routes to accomplish end goals, but there are some hard, basic facts that are not up for negotiation nor are they optional.

Regardless of whether you are building a dog house or a sky scrapper, the basic fundamentals of foundational strength and structural integrity will always hold true and the absence of them will always result in failure. It's not negotiable.

While no one can predict exactly when and how the failures resulting from bad economic policy will happen, it is inevitable that they will happen.

You are merely talking about normative economics, not economics. Normative economics focuses on what ought to be with an end goal of fairness. General economics doesn't give a flying **** about fair or what some academic theorist dreams up. Because in the end human nature and math will win. This isn't an opinion. It's a fact learned through history. If your goal is to be fair, the only way is to stipulate equal outcomes. A robust economy is not built on equal outcomes. It's built on equal opportunities.

https://www.investopedia.com/articles/economics/09/why-economists-do-not-agree.asp

We have been living an increasingly Keynesian system, actively fighting against free market principles since Herbert Hoover. Just because we've persevered DESPITE Keynesian braces on our ankles doesn't mean that the Keynesians were sort of right.

When a WR picks up a football dropped by the RB and gains 5 yards.. was the play successful? Did the RB succeed? Was the goal of the play 5 yards, or a first down? Or a touchdown?

Economics is much an art as an impossible burger is a hamburger. Is it still edible? Sure. You any sane person honestly prefer it? No.

I didn't say it was a science. It's the mathematical and statistical study of human nature. A poster above stated it more clearly than me, and he is correct.Oldag2020 said:Jamie Dimon and JP Morgan are currently holding tons of cash on their balance sheet. Do you think they are worried about inflation? They aren't. Do you think they share the view of the fed? I would imagine they do. If economics was a science there would be zero disagreement, zero divergence in opinions, and everyone would be screaming at the top of their lungs that inflation was here to stay. That's not the case.mazag08 said:That doesn't make economics an art. It doesn't make it an opinion.Oldag2020 said:A simple google search will back my statement many times over.mazag08 said:This is absolutely wrong and whichever A&M economic prof taught you this should be fired.Oldag2020 said:You are wrong. There are many different economic theories. Economics and finance is an art, not a science. Is it becoming more scientific? Maybe? But can anyone actually predict what will happen tomorrow? No.96ags said:Economics is not a grouping of viewpoints. That is an incredibly dangerous fallacy.Oldag2020 said:I am not necessarily a supporter of MMT. I never said I was. I am simply sharing a point of view different than the norm on this site.mazag08 said:I see you didn't read my post and prefer to stay within your bubble.Oldag2020 said:

You can discuss that with Stephanie Kelton

Stephanie KeltonAbsolute pure Keynesian garbage mixed with modern leftist political dogma. Again, absolute garbage.Quote:

The Deficit Myth

MODERN MONETARY THEORY AND THE BIRTH OF THE PEOPLE'S ECONOMY

The Deficit Myth empowers readers to break free of the broken thinking and fictitious constraints that have been holding our nation back.

Deficits can help us fight a myriad of problems that plague our economyinequality, poverty and unemployment, climate change, housing, health care, and more. But we can't use deficits to solve problems if we continue to think of the deficit itself as a problem.

And now the money shot..I've challenged you to break outside of your academic bubble and to study some of the greatest events that affected our economy and some of the greatest economic minds in our history. You come back with Bernie's economic advisor. Unreal.Quote:

Stephanie Kelton (ne Bell; born October 10, 1969) is an American economist and academic. She is a professor at Stony Brook University and a Senior Fellow at the Schwartz Center for Economic Policy Analysis at the New School for Social Research. She was formerly a professor at the University of MissouriKansas City. She also served as an advisor to Bernie Sanders's 2016 presidential campaign.

An illustration I often use is that economics is a lot like construction science. There are different methodologies and routes to accomplish end goals, but there are some hard, basic facts that are not up for negotiation nor are they optional.

Regardless of whether you are building a dog house or a sky scrapper, the basic fundamentals of foundational strength and structural integrity will always hold true and the absence of them will always result in failure. It's not negotiable.

While no one can predict exactly when and how the failures resulting from bad economic policy will happen, it is inevitable that they will happen.

You are merely talking about normative economics, not economics. Normative economics focuses on what ought to be with an end goal of fairness. General economics doesn't give a flying **** about fair or what some academic theorist dreams up. Because in the end human nature and math will win. This isn't an opinion. It's a fact learned through history. If your goal is to be fair, the only way is to stipulate equal outcomes. A robust economy is not built on equal outcomes. It's built on equal opportunities.

https://www.investopedia.com/articles/economics/09/why-economists-do-not-agree.asp

We have been living an increasingly Keynesian system, actively fighting against free market principles since Herbert Hoover. Just because we've persevered DESPITE Keynesian braces on our ankles doesn't mean that the Keynesians were sort of right.

When a WR picks up a football dropped by the RB and gains 5 yards.. was the play successful? Did the RB succeed? Was the goal of the play 5 yards, or a first down? Or a touchdown?

Economics is much an art as an impossible burger is a hamburger. Is it still edible? Sure. You any sane person honestly prefer it? No.

Regarding hoarding cash. You hoard cash when you expect a bottoming event so that you can invest at low points. We are about to enter a likely multi-month pullback wave in the markets before taking off again. We are in a long-term bull market that WILL end in its 5th wave, likely around S&P 6,000 in a year or two. Timing is impossible. But it's coming to an end and we will enter a severe recession. There's no way not to. The FED has no ammo, and once the market sentiment realizes that the gravy train is over, it's only pain on the other side.Quote:

Economics is not a grouping of viewpoints. That is an incredibly dangerous fallacy.

An illustration I often use is that economics is a lot like construction science. There are different methodologies and routes to accomplish end goals, but there are some hard, basic facts that are not up for negotiation nor are they optional.

Regardless of whether you are building a dog house or a sky scrapper, the basic fundamentals of foundational strength and structural integrity will always hold true and the absence of them will always result in failure. It's not negotiable.

While no one can predict exactly when and how the failures resulting from bad economic policy will happen, it is inevitable that they will happen.

In a truly free, un-manipulated market, you have normal ups and downs, normal booms and busts. But the market always corrects. Because human nature is self-preserving and when human capital is optimized, it finds the path of least resistance and highest fortune. When governments and monetary activists meddle in markets thinking they can sustain unending moderate prosperity, that's when you get the depressions that wipe out everything in their path.

Read your history.

mazag08 said:I didn't say it was a science. It's the mathematical and statistical study of human nature. A poster above stated it more clearly than me, and he is correct.Oldag2020 said:Jamie Dimon and JP Morgan are currently holding tons of cash on their balance sheet. Do you think they are worried about inflation? They aren't. Do you think they share the view of the fed? I would imagine they do. If economics was a science there would be zero disagreement, zero divergence in opinions, and everyone would be screaming at the top of their lungs that inflation was here to stay. That's not the case.mazag08 said:That doesn't make economics an art. It doesn't make it an opinion.Oldag2020 said:A simple google search will back my statement many times over.mazag08 said:This is absolutely wrong and whichever A&M economic prof taught you this should be fired.Oldag2020 said:You are wrong. There are many different economic theories. Economics and finance is an art, not a science. Is it becoming more scientific? Maybe? But can anyone actually predict what will happen tomorrow? No.96ags said:Economics is not a grouping of viewpoints. That is an incredibly dangerous fallacy.Oldag2020 said:I am not necessarily a supporter of MMT. I never said I was. I am simply sharing a point of view different than the norm on this site.mazag08 said:I see you didn't read my post and prefer to stay within your bubble.Oldag2020 said:

You can discuss that with Stephanie Kelton

Stephanie KeltonAbsolute pure Keynesian garbage mixed with modern leftist political dogma. Again, absolute garbage.Quote:

The Deficit Myth

MODERN MONETARY THEORY AND THE BIRTH OF THE PEOPLE'S ECONOMY

The Deficit Myth empowers readers to break free of the broken thinking and fictitious constraints that have been holding our nation back.

Deficits can help us fight a myriad of problems that plague our economyinequality, poverty and unemployment, climate change, housing, health care, and more. But we can't use deficits to solve problems if we continue to think of the deficit itself as a problem.

And now the money shot..I've challenged you to break outside of your academic bubble and to study some of the greatest events that affected our economy and some of the greatest economic minds in our history. You come back with Bernie's economic advisor. Unreal.Quote:

Stephanie Kelton (ne Bell; born October 10, 1969) is an American economist and academic. She is a professor at Stony Brook University and a Senior Fellow at the Schwartz Center for Economic Policy Analysis at the New School for Social Research. She was formerly a professor at the University of MissouriKansas City. She also served as an advisor to Bernie Sanders's 2016 presidential campaign.

An illustration I often use is that economics is a lot like construction science. There are different methodologies and routes to accomplish end goals, but there are some hard, basic facts that are not up for negotiation nor are they optional.

Regardless of whether you are building a dog house or a sky scrapper, the basic fundamentals of foundational strength and structural integrity will always hold true and the absence of them will always result in failure. It's not negotiable.

While no one can predict exactly when and how the failures resulting from bad economic policy will happen, it is inevitable that they will happen.

You are merely talking about normative economics, not economics. Normative economics focuses on what ought to be with an end goal of fairness. General economics doesn't give a flying **** about fair or what some academic theorist dreams up. Because in the end human nature and math will win. This isn't an opinion. It's a fact learned through history. If your goal is to be fair, the only way is to stipulate equal outcomes. A robust economy is not built on equal outcomes. It's built on equal opportunities.

https://www.investopedia.com/articles/economics/09/why-economists-do-not-agree.asp

We have been living an increasingly Keynesian system, actively fighting against free market principles since Herbert Hoover. Just because we've persevered DESPITE Keynesian braces on our ankles doesn't mean that the Keynesians were sort of right.

When a WR picks up a football dropped by the RB and gains 5 yards.. was the play successful? Did the RB succeed? Was the goal of the play 5 yards, or a first down? Or a touchdown?

Economics is much an art as an impossible burger is a hamburger. Is it still edible? Sure. You any sane person honestly prefer it? No.Regarding hoarding cash. You hoard cash when you expect a bottoming event so that you can invest at low points. We are about to enter a likely multi-month pullback wave in the markets before taking off again. We are in a long-term bull market that WILL end in its 5th wave, likely around S&P 6,000 in a year or two. Timing is impossible. But it's coming to an end and we will enter a severe recession. There's no way not to. The FED has no ammo, and once the market sentiment realizes that the gravy train is over, it's only pain on the other side.Quote:

Economics is not a grouping of viewpoints. That is an incredibly dangerous fallacy.

An illustration I often use is that economics is a lot like construction science. There are different methodologies and routes to accomplish end goals, but there are some hard, basic facts that are not up for negotiation nor are they optional.

Regardless of whether you are building a dog house or a sky scrapper, the basic fundamentals of foundational strength and structural integrity will always hold true and the absence of them will always result in failure. It's not negotiable.

While no one can predict exactly when and how the failures resulting from bad economic policy will happen, it is inevitable that they will happen.

In a truly free, un-manipulated market, you have normal ups and downs, normal booms and busts. But the market always corrects. Because human nature is self-preserving and when human capital is optimized, it finds the path of least resistance and highest fortune. When governments and monetary activists meddle in markets thinking they can sustain unending moderate prosperity, that's when you get the depressions that wipe out everything in their path.

Read your history.

By the same token, you absolutely DO NOT hoard cash if you expect runaway inflation.

Also, the 1929 depression only became a depression because of the ridiculous mismanagement by the fed. If the fed would have stepped up to the plate like they have ever since, the blow would've been much much softer. Free markets do work best, but only up to a certain point.

I don't think anyone is predicting inflation to skyrocket overnight.

But you were the one saying that what we have now is merely transitory, that it will come back down, and everything will be fine. Hoarding cash now to deploy in a couple months does not mean that you think inflation isn't an issue. It likely means that you have planned accordingly, exited some positions, and want to deploy your cash at the best possible point and to the best possible places before the boat leaves the dock. And for JP Morgan, that most likely means real estate which is the best long term hold to beat inflation.

But you were the one saying that what we have now is merely transitory, that it will come back down, and everything will be fine. Hoarding cash now to deploy in a couple months does not mean that you think inflation isn't an issue. It likely means that you have planned accordingly, exited some positions, and want to deploy your cash at the best possible point and to the best possible places before the boat leaves the dock. And for JP Morgan, that most likely means real estate which is the best long term hold to beat inflation.

Oldag2020 said:mazag08 said:I didn't say it was a science. It's the mathematical and statistical study of human nature. A poster above stated it more clearly than me, and he is correct.Oldag2020 said:Jamie Dimon and JP Morgan are currently holding tons of cash on their balance sheet. Do you think they are worried about inflation? They aren't. Do you think they share the view of the fed? I would imagine they do. If economics was a science there would be zero disagreement, zero divergence in opinions, and everyone would be screaming at the top of their lungs that inflation was here to stay. That's not the case.mazag08 said:That doesn't make economics an art. It doesn't make it an opinion.Oldag2020 said:A simple google search will back my statement many times over.mazag08 said:This is absolutely wrong and whichever A&M economic prof taught you this should be fired.Oldag2020 said:You are wrong. There are many different economic theories. Economics and finance is an art, not a science. Is it becoming more scientific? Maybe? But can anyone actually predict what will happen tomorrow? No.96ags said:Economics is not a grouping of viewpoints. That is an incredibly dangerous fallacy.Oldag2020 said:I am not necessarily a supporter of MMT. I never said I was. I am simply sharing a point of view different than the norm on this site.mazag08 said:I see you didn't read my post and prefer to stay within your bubble.Oldag2020 said:

You can discuss that with Stephanie Kelton

Stephanie KeltonAbsolute pure Keynesian garbage mixed with modern leftist political dogma. Again, absolute garbage.Quote:

The Deficit Myth

MODERN MONETARY THEORY AND THE BIRTH OF THE PEOPLE'S ECONOMY

The Deficit Myth empowers readers to break free of the broken thinking and fictitious constraints that have been holding our nation back.

Deficits can help us fight a myriad of problems that plague our economyinequality, poverty and unemployment, climate change, housing, health care, and more. But we can't use deficits to solve problems if we continue to think of the deficit itself as a problem.

And now the money shot..I've challenged you to break outside of your academic bubble and to study some of the greatest events that affected our economy and some of the greatest economic minds in our history. You come back with Bernie's economic advisor. Unreal.Quote:

Stephanie Kelton (ne Bell; born October 10, 1969) is an American economist and academic. She is a professor at Stony Brook University and a Senior Fellow at the Schwartz Center for Economic Policy Analysis at the New School for Social Research. She was formerly a professor at the University of MissouriKansas City. She also served as an advisor to Bernie Sanders's 2016 presidential campaign.

An illustration I often use is that economics is a lot like construction science. There are different methodologies and routes to accomplish end goals, but there are some hard, basic facts that are not up for negotiation nor are they optional.

Regardless of whether you are building a dog house or a sky scrapper, the basic fundamentals of foundational strength and structural integrity will always hold true and the absence of them will always result in failure. It's not negotiable.

While no one can predict exactly when and how the failures resulting from bad economic policy will happen, it is inevitable that they will happen.

You are merely talking about normative economics, not economics. Normative economics focuses on what ought to be with an end goal of fairness. General economics doesn't give a flying **** about fair or what some academic theorist dreams up. Because in the end human nature and math will win. This isn't an opinion. It's a fact learned through history. If your goal is to be fair, the only way is to stipulate equal outcomes. A robust economy is not built on equal outcomes. It's built on equal opportunities.

https://www.investopedia.com/articles/economics/09/why-economists-do-not-agree.asp

We have been living an increasingly Keynesian system, actively fighting against free market principles since Herbert Hoover. Just because we've persevered DESPITE Keynesian braces on our ankles doesn't mean that the Keynesians were sort of right.

When a WR picks up a football dropped by the RB and gains 5 yards.. was the play successful? Did the RB succeed? Was the goal of the play 5 yards, or a first down? Or a touchdown?

Economics is much an art as an impossible burger is a hamburger. Is it still edible? Sure. You any sane person honestly prefer it? No.Regarding hoarding cash. You hoard cash when you expect a bottoming event so that you can invest at low points. We are about to enter a likely multi-month pullback wave in the markets before taking off again. We are in a long-term bull market that WILL end in its 5th wave, likely around S&P 6,000 in a year or two. Timing is impossible. But it's coming to an end and we will enter a severe recession. There's no way not to. The FED has no ammo, and once the market sentiment realizes that the gravy train is over, it's only pain on the other side.Quote:

Economics is not a grouping of viewpoints. That is an incredibly dangerous fallacy.

An illustration I often use is that economics is a lot like construction science. There are different methodologies and routes to accomplish end goals, but there are some hard, basic facts that are not up for negotiation nor are they optional.

Regardless of whether you are building a dog house or a sky scrapper, the basic fundamentals of foundational strength and structural integrity will always hold true and the absence of them will always result in failure. It's not negotiable.

While no one can predict exactly when and how the failures resulting from bad economic policy will happen, it is inevitable that they will happen.

In a truly free, un-manipulated market, you have normal ups and downs, normal booms and busts. But the market always corrects. Because human nature is self-preserving and when human capital is optimized, it finds the path of least resistance and highest fortune. When governments and monetary activists meddle in markets thinking they can sustain unending moderate prosperity, that's when you get the depressions that wipe out everything in their path.

Read your history.

By the same token, you absolutely DO NOT hoard cash if you expect runaway inflation.

You absolutely do if your profits rely on yields in fixed income instruments which would rise considerably in an inflationary environment. If you're tied up in low yield instruments you'd have to sell them at depressed values to purchase longer yield instruments.

I mean.. do you even read up on the anecdotes you try to throw at me?

Jamie Dimon: JPMorgan is hoarding cash because 'very good chance' inflation here to stay (cnbc.com)

Jamie Dimon: JPMorgan is hoarding cash because 'very good chance' inflation here to stay (cnbc.com)

Quote:

- JPMorgan Chase has been "effectively stockpiling" cash rather than using it to buy Treasuries or other investments because of the possibility higher inflation will force the Federal Reserve to boost interest rates, Dimon said Monday during a conference.

- "We have a lot of cash and capability and we're going to be very patient, because I think you have a very good chance inflation will be more than transitory," said Dimon, longtime JPMorgan CEO.

- The bank now expects $52.5 billion in net interest income in 2021, down from the $55 billion it disclosed in February, as the firm stockpiled cash and on lower credit card balances.

Featured Stories

See All

14:22

5h ago

1.6k

A&M's season ends with microcosmic second-half collapse in Las Vegas

by Olin Buchanan

Learned, Loved, Loathed: USC 35, Texas A&M 31 (2024 Las Vegas Bowl)

by Olin Buchanan