Windy City Ag said:Quote:

Before you can say well these people should pay more taxes or they won the parental lottery you need to first establish

a) how that is bad for society if it even is

And

b) how the proposed change is better

Well, I think we know:

a) We have a massive and growing deficit and national debt

b) We have two political parties totally unwilling to reign in spending.

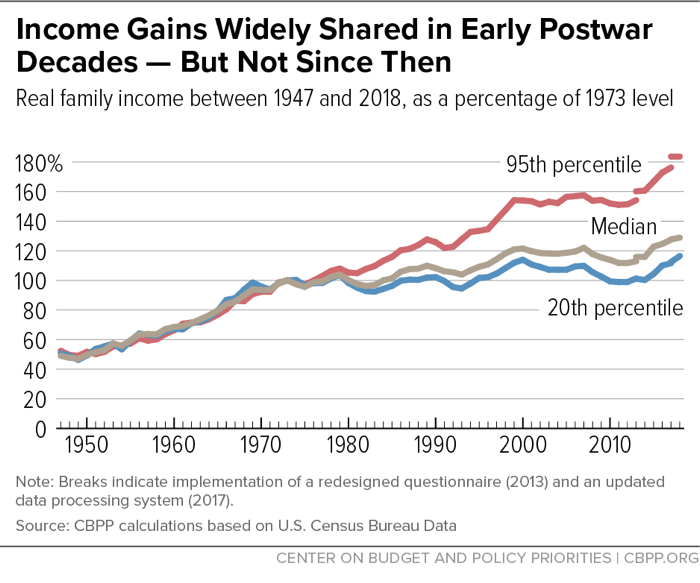

c) We know that wealth is more concentrated in fewer hands today versus most of the latter half of the 20th Century by mostly every measure.

d) We have steadily diminished both income and capital gains tax rates over the last 50 years. Long Term Cap Gains was 35% in the late 1970s and 20% today. The top brackets for individual income taxes were slashed consistently to the current levels that started in the 1980s.

So this is the reality of things . . . . .if we are serious about fiscal prudence and reigning in debt, we have to tax something and the ultra-rich have it better right now than they ever had both in terms of net worth and a friendly tax code so they are the obvious targets.

The problem is the conclusion "therefore we need to tax the rich more" does not follow from a-d. The bold part of your statement is just wrong because ineffective.

If we took ALL the wealth from ALL US billionaires it would be $5.7 trillion. Our deficit is $1.8 trillion. So that gets you through three years without further deficit. And that ignores the very real problem of capital flight a wealth tax would cause - likely resulting in LESS revenues, not, not more - much less the economic impact. It's not like that money is liquid cash!!

There is not enough wealth to confiscate to cover what we're doing. The problem is a spending problem, not a revenue problem. This is like being overweight - you can't outrun your diet, and you can't out-tax your spending.

I am not even sure how c and d are related to a and b.