HOUSTON

From HAR:

THE FACTS

[img] [/img]

[/img]

https://www.har.com/content/department/newsroom?pid=2017

MY TAKE

From HAR:

Quote:

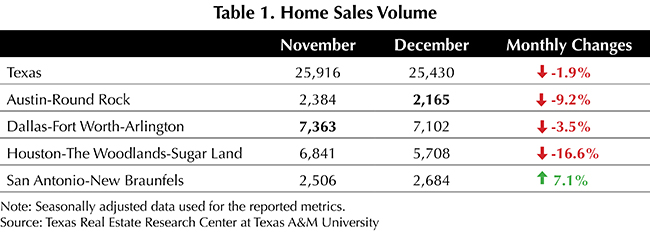

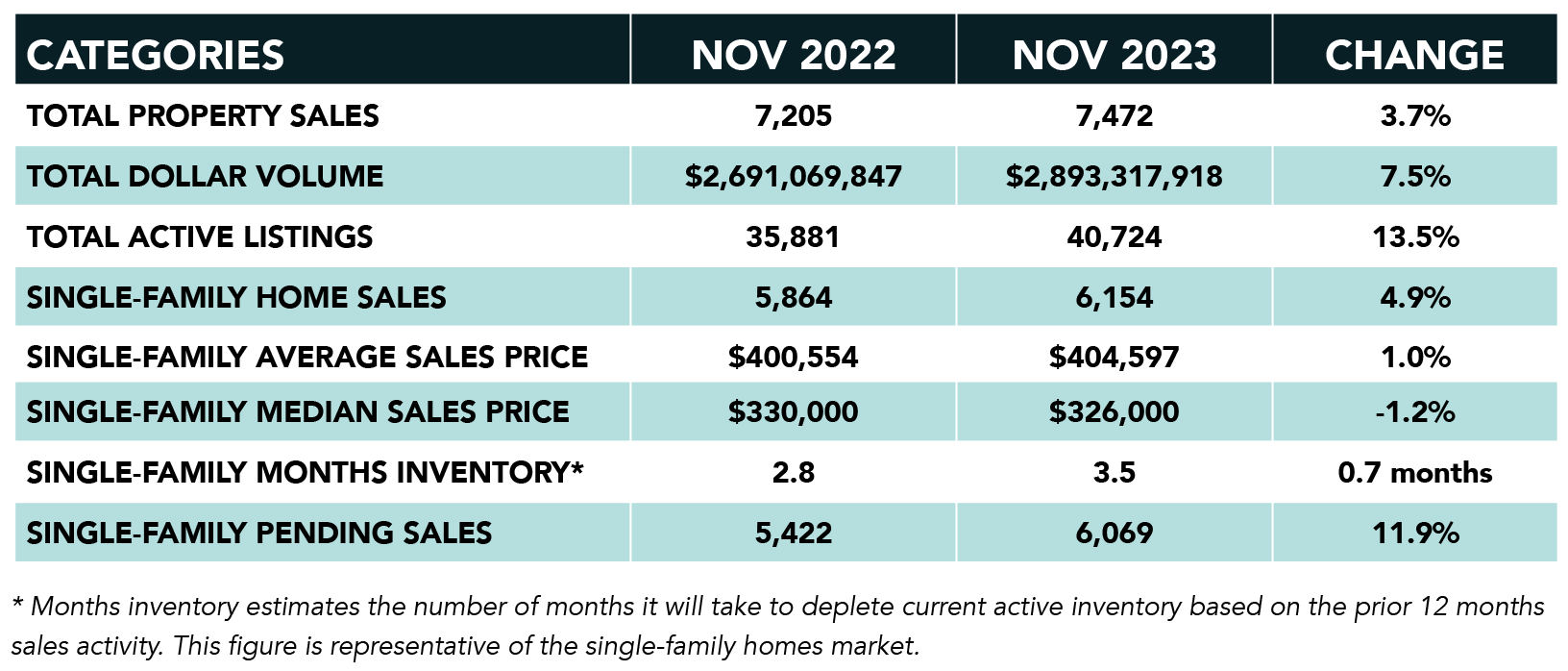

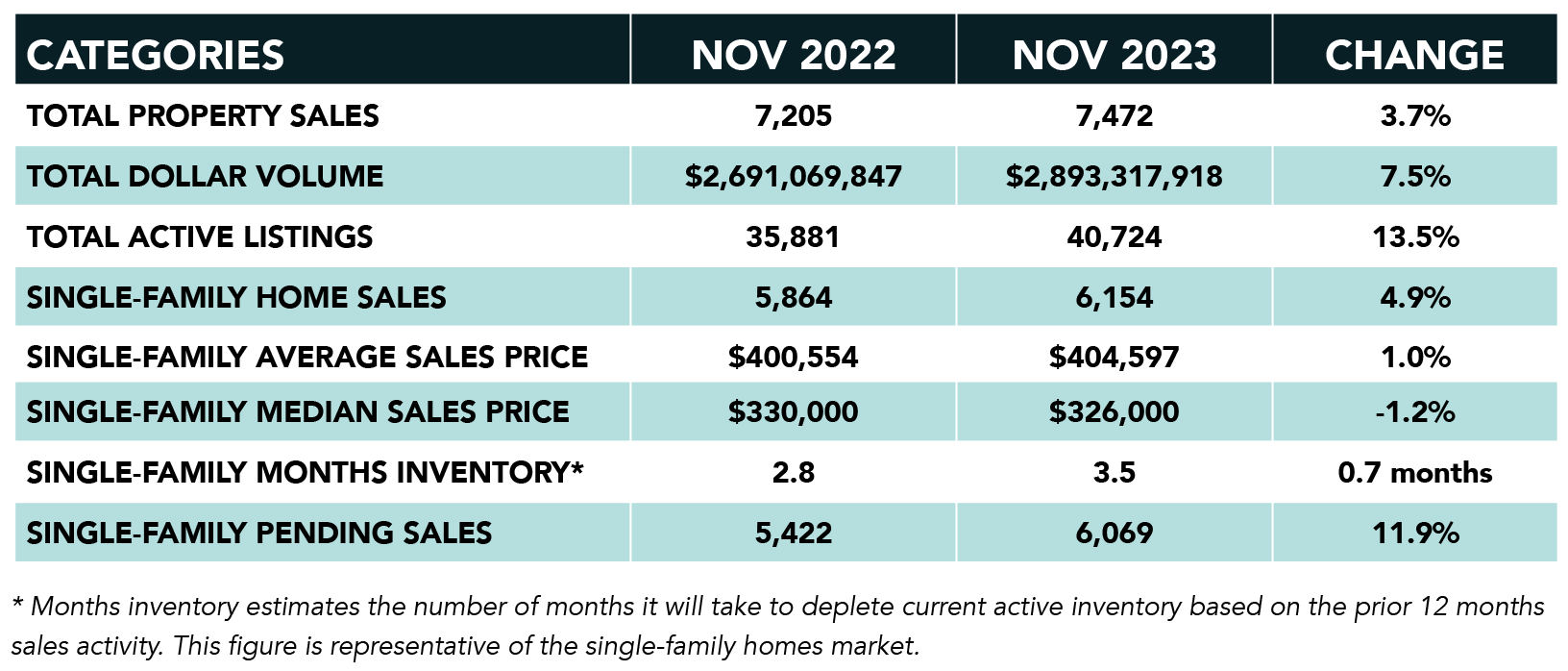

November marked the first time in 19 months that single-family homes sales were in positive territory with sales rising 4.9 percent year-over-year. When compared to pre-pandemic November 2019, sales were down 3.2 percent and when stacked up against the sales volume in November 2018, five years ago, sales were statistically flat.

In addition to the increase in single-family sales volume, total property sales rose 3.7 percent and total dollar volume climbed 7.5 percent from $2.7 billion to $2.9 billion. Single-family pending sales rose 11.9 percent. Active listings, or the total number of available properties, were 13.5 percent ahead of the 2022 level.

Months of inventory expanded from a 2.8-months supply last November to 3.5 months, matching its October 2023 level. It is the greatest supply of homes since November 2019. Housing inventory nationally is at a 3.6-months supply, according to the latest report from the National Association of Realtors (NAR). A 4.0- to 6.0-month supply is generally considered a "balanced market" in which neither buyer nor seller has an advantage.

THE FACTS

- Months inventory fell month over month from 3.6 months to 3.5 months.

- As mentioned above, total sales increased for the first time in 19 months.

- Average pricing is up 1.0% YOY and median pricing is down 1.2% YOY.

- The 10 year US treasury continued its 2 month decline to about 4.166% today.

- CPI numbers released yesterday came in at: 3.1% YOY and basically flat (up 0.1%) from October.

[img]

[/img]

[/img]https://www.har.com/content/department/newsroom?pid=2017

MY TAKE

- Months inventory fell month over month from 3.6 months to 3.5 months. This is not a good sign for buyers, or the health of the market, in my opinion. November normally sees increasing inventory leading into December, not the other way around.

- Falling inventory, coupled with falling inflation (fueled by lower gas prices) and falling interest rates could make for a hot spring and summer 2024. "Here we go again" is the short version of my take today.

- The last two weeks or so have been busy for me, with a new listing under contract, signing a few leases, and several new listings. I've also had several future buyers reach out in the last two weeks, which I haven't had in a while.

- All in all, it feels like the market feels like we may have hit "bottom". If that's right, buckle up.

Sponsor Message: We Split Commissions. Full Service Agents in Austin, Bryan-College Station, Dallas-Fort Worth, Houston and San Antonio. Red Pear Realty