Yesterday was a good run and put it on breakout alert. Hit a 52 week high today. Hopefully the volume starts rolling in

Stock Markets

26,428,928 Views |

237081 Replies |

Last: 1 hr ago by Seven Costanza

Anyone know why WWR popped?

Sold 2/21 $1 covered calls on 1/3 of my position at $0.15 a contract. A great chance to lower cost basis.

BucketofBalls99 said:

POWL…….yikes

Up 25+ points from 48 hours ago.

Red Pear Luke (BCS) said:

Anyone know why WWR popped?

Hopefully securing the financing they claimed would be done in January.

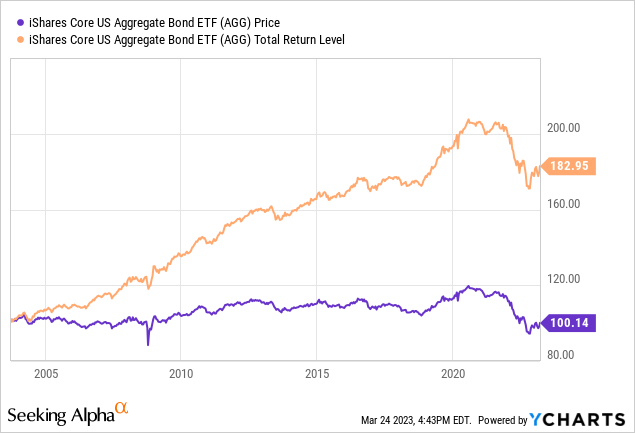

how are the yields "good"jamey said:

You still like the bonds play?

I know you're using TLT but mine is just a broad market fund that tracks the Bloomberg US aggregate bond index, similar to AGG i think

I'm only abiut 16% in bonds. Thinking about taking some profit and moving little more over to bonds. I'm 55 and probably should start moving more that direction anyway long term and the yields are good

every one of my bond funds including TLT and AGG are negative

Red Pear Luke (BCS) said:

Anyone know why WWR popped?

No clue but it's finally green for me.

Hunter_812 said:BucketofBalls99 said:

POWL…….yikes

First time?

Your reply did make me lmao.

MARA back over $20 again. Hopefully it's the little engine that could this time, and gets me to my $24 sell target.

Keeps hitting it's head hard in the 20.70s but with 26% short interest it seems like we are due for a mini squeeze at least.

Keeps hitting it's head hard in the 20.70s but with 26% short interest it seems like we are due for a mini squeeze at least.

LMCane said:how are the yields "good"jamey said:

You still like the bonds play?

I know you're using TLT but mine is just a broad market fund that tracks the Bloomberg US aggregate bond index, similar to AGG i think

I'm only abiut 16% in bonds. Thinking about taking some profit and moving little more over to bonds. I'm 55 and probably should start moving more that direction anyway long term and the yields are good

every one of my bond funds including TLT and AGG are negative

That's the price and yield or just price isn't it, not just the yield.

The yield is around mid 4ish percent depending on the bond. YIeld goes up and price goes down.

If yields drop then price goes up for your bonds and you've already got.the higher yield

Am I right here folks?

Damn I really wish I'd have listened to a buddy and jumped on the CEG train

GEV and VST were huge misses

Chef Elko said:

Sold 2/21 $1 covered calls on 1/3 of my position at $0.15 a contract. A great chance to lower cost basis.

Catching a couple fills on 5/16 $2c for .15

I just bought a bunch of call options to increase my exposure without having to own the stock.Charismatic Megafauna said:Chef Elko said:

Sold 2/21 $1 covered calls on 1/3 of my position at $0.15 a contract. A great chance to lower cost basis.

Catching a couple fills on 5/16 $2c for .15

Probably not a smart move but they are August expiries so bought for time as well.

If the bottom is in on WWR, then it happened with an ED, putting the reversal timeline through the end of 2025. As always, it doesn't have to take the whole time. The logical EW interpretation is that this move will top off soon and then fall back into consolidation between 60 cents and 75 cents. But that needs a huge grain of salt, as this is a penny stock operating on a windfall of good news finally, possibly starting to see the signs of a short squeeze. What we really need is a 10M volume day.

I know you've talked a lot about metals but is there any other area you could park money and get yields during that scenario such as high yield bonds or do you see those being down too?Heineken-Ashi said:

Ya, but what I worry about most is that let's say we hit my target of 5100 in June. So many stocks on sale. We go on buying spree. But that low ends up merely being the first low of a very long bear market. A bear market I feel is inevitable eventually. So all those things you bought on sale, the fake out before they fall again in a couple years to let's say 3500, that would be the devastating one.

I don't worry about a 30% crash like COVID. I worry about a long-term sustained bear market. Think 2022 but lasting 10 years, where every bounce whether months or years never makes a new high and before you can react has wiped out your gains. Literally anyone under 40 that hasn't done deep research and studying of history has never seen any other investing regime other than buy the dip - it always works. Many under 70 have no idea what it's like to for the market to never pay off outside of 1-2 year stretches at a time before dropping again. And nobody alive today has any idea what a depression is like. I pray these things never happen. But frankly, a systematic deleveraging, no matter how painful, is the only hope for the youth in this country to not have financial conditions that screw them from day 1. But in getting there, everyone in the work force would see 401k's, IRA's, house equity, etc wiped out. Nobody can even begin to understand how that might happen, or that it could happen. It's frightening. And there's really no way for the average person to prepare if they aren't committed to seriously reducing risk and going counter-trend to everything that's ever worked That's HARD, and frankly, painful until it eventually pays off.. which might be never.

Haven't charted high yield bonds in a while. Adding to my list for tonight. Will get back soon. Any specific tickers?fourth deck said:I know you've talked a lot about metals but is there any other area you could park money and get yields during that scenario such as high yield bonds or do you see those being down too?Heineken-Ashi said:

Ya, but what I worry about most is that let's say we hit my target of 5100 in June. So many stocks on sale. We go on buying spree. But that low ends up merely being the first low of a very long bear market. A bear market I feel is inevitable eventually. So all those things you bought on sale, the fake out before they fall again in a couple years to let's say 3500, that would be the devastating one.

I don't worry about a 30% crash like COVID. I worry about a long-term sustained bear market. Think 2022 but lasting 10 years, where every bounce whether months or years never makes a new high and before you can react has wiped out your gains. Literally anyone under 40 that hasn't done deep research and studying of history has never seen any other investing regime other than buy the dip - it always works. Many under 70 have no idea what it's like to for the market to never pay off outside of 1-2 year stretches at a time before dropping again. And nobody alive today has any idea what a depression is like. I pray these things never happen. But frankly, a systematic deleveraging, no matter how painful, is the only hope for the youth in this country to not have financial conditions that screw them from day 1. But in getting there, everyone in the work force would see 401k's, IRA's, house equity, etc wiped out. Nobody can even begin to understand how that might happen, or that it could happen. It's frightening. And there's really no way for the average person to prepare if they aren't committed to seriously reducing risk and going counter-trend to everything that's ever worked That's HARD, and frankly, painful until it eventually pays off.. which might be never.

Well that's the nail in the coffin for PLTR

Nothing can stop Palantir, nothing

— Jim Cramer (@jimcramer) January 23, 2025

Red Pear Luke (BCS) said:I just bought a bunch of call options to increase my exposure without having to own the stock.Charismatic Megafauna said:Chef Elko said:

Sold 2/21 $1 covered calls on 1/3 of my position at $0.15 a contract. A great chance to lower cost basis.

Catching a couple fills on 5/16 $2c for .15

Probably not a smart move but they are August expiries so bought for time as well.

Man you gotta get some may ones. That way you can throw your money away again on august ones once the mays expire!

Have been holding and testing out BKHY, SJNK, HYDB, and SCYB.Heineken-Ashi said:Haven't charted high yield bonds in a while. Adding to my list for tonight. Will get back soon. Any specific tickers?fourth deck said:I know you've talked a lot about metals but is there any other area you could park money and get yields during that scenario such as high yield bonds or do you see those being down too?Heineken-Ashi said:

Ya, but what I worry about most is that let's say we hit my target of 5100 in June. So many stocks on sale. We go on buying spree. But that low ends up merely being the first low of a very long bear market. A bear market I feel is inevitable eventually. So all those things you bought on sale, the fake out before they fall again in a couple years to let's say 3500, that would be the devastating one.

I don't worry about a 30% crash like COVID. I worry about a long-term sustained bear market. Think 2022 but lasting 10 years, where every bounce whether months or years never makes a new high and before you can react has wiped out your gains. Literally anyone under 40 that hasn't done deep research and studying of history has never seen any other investing regime other than buy the dip - it always works. Many under 70 have no idea what it's like to for the market to never pay off outside of 1-2 year stretches at a time before dropping again. And nobody alive today has any idea what a depression is like. I pray these things never happen. But frankly, a systematic deleveraging, no matter how painful, is the only hope for the youth in this country to not have financial conditions that screw them from day 1. But in getting there, everyone in the work force would see 401k's, IRA's, house equity, etc wiped out. Nobody can even begin to understand how that might happen, or that it could happen. It's frightening. And there's really no way for the average person to prepare if they aren't committed to seriously reducing risk and going counter-trend to everything that's ever worked That's HARD, and frankly, painful until it eventually pays off.. which might be never.

Watch $SMR after what President Trump just told everyone at Davos.

Synopsis?

Worth getting into now?

Looks like it dropped about 7%?

What a, may I dare say, Charismatic vindication you haveCharismatic Megafauna said:Red Pear Luke (BCS) said:I just bought a bunch of call options to increase my exposure without having to own the stock.Charismatic Megafauna said:Chef Elko said:

Sold 2/21 $1 covered calls on 1/3 of my position at $0.15 a contract. A great chance to lower cost basis.

Catching a couple fills on 5/16 $2c for .15

Probably not a smart move but they are August expiries so bought for time as well.

Man you gotta get some may ones. That way you can throw your money away again on august ones once the mays expire!

Every time I check my account, I'm either red or green today, but by small fractions of a %. Silly day

Red Pear Luke (BCS) said:

Well that's the nail in the coffin for PLTRNothing can stop Palantir, nothing

— Jim Cramer (@jimcramer) January 23, 2025

WHYYYYY?!?!

Trump just told Davos that he's going to require data centers fully power themselves and build essentially their own powerplants on site. In order to facilitate that end, he is going to eliminate all bs red tape to make it happen quickly. Small modular reactors are going to become the focus of these massive data centers. All this very positive for $SMR and likely to bring their products to market much quicker.flashplayer said:

Synopsis?

I think it will breakout and set a new ATH very shortly with the buildup of momentum.TheVarian said:

Worth getting into now?

It was $20/shr 5 days ago. I attribute the drop to profit taking and dumbass shorts, but we'll see.El_duderino said:

Looks like it dropped about 7%?

Ah I didn't know what he said and just saw your explanation.

Also - guess what substance that WWR is working on, is an excellent use in nuclear reactors?ProgN said:Trump just told Davos that he's going to require data centers fully power themselves and build essentially their own powerplants on site. In order to facilitate that end, he is going to eliminate all bs red tape to make it happen quickly. Small modular reactors are going to become the focus of these massive data centers. All this very positive for $SMR and likely to bring their products to market much quicker.flashplayer said:

Synopsis?

https://en.wikipedia.org/wiki/Nuclear_graphite

Red Pear Luke (BCS) said:Also - guess what substance that WWR is working on, is an excellent use in nuclear reactors?ProgN said:Trump just told Davos that he's going to require data centers fully power themselves and build essentially their own powerplants on site. In order to facilitate that end, he is going to eliminate all bs red tape to make it happen quickly. Small modular reactors are going to become the focus of these massive data centers. All this very positive for $SMR and likely to bring their products to market much quicker.flashplayer said:

Synopsis?

https://en.wikipedia.org/wiki/Nuclear_graphite

wish i was strong enough to quit, but picked up some $1C a few weeks ago.

just mistakenly picked the scab and looked back at my 2020-2023 losses on WWR... if this goes to $21 soon i'll break even.

shame.

Featured Stories

See All

LIVE: No. 10 Texas A&M at No. 15 Missouri

by Luke Evangelist

6 Days 'til: Top-ranked Aggies face daunting SEC schedule in 2025

by Ryan Brauninger

Texas A&M honors former head coach Rob Childress' No. 29 jersey

by Richard Zane

15:52

16h ago

5.5k

Davis Drama! No. 7 Ags plate nine unanswered to erase six-run deficit

by Mathias Cubillan

AggieCrew44

Indiana Head Coaching Search (Buzz mentioned as one of top)

in Billy Liucci's TexAgs Premium

102

KillerAg21

Indiana Head Coaching Search (Buzz mentioned as one of top)

in Billy Liucci's TexAgs Premium

35

KillerAg21

Indiana Head Coaching Search (Buzz mentioned as one of top)

in Billy Liucci's TexAgs Premium

31

Capitol Ag

Indiana Head Coaching Search (Buzz mentioned as one of top)

in Billy Liucci's TexAgs Premium

29

aginlakeway

Indiana Head Coaching Search (Buzz mentioned as one of top)

in Billy Liucci's TexAgs Premium

24

HockAg522

7 Days 'til: Takeaways from an entire day spent with Michael Earley

in Billy Liucci's TexAgs Premium

21

CrawfishAg

Davis Drama! No. 7 Ags plate nine unanswered to erase six-run deficit

in Billy Liucci's TexAgs Premium

18

AggieShanks

A&M announces it has installed extended netting at BBP

in Billy Liucci's TexAgs Premium

18