No, we don't, with all due respect...we want them coming into Thanksgiving with 1 loss...we beat them and they are most likely no longer in the SEC Championship game...I think we have a very real chance at beating them at Kyle...but don't want to have to play them again the following week for the championship...would much rather match up against Uga, Bama, whoever at that point...but I guess that is just me...but I bet a number of others would agree...

Stock Markets

26,676,406 Views |

237940 Replies |

Last: 8 hrs ago by Golf1

gougler08 said:AgShaun00 said:

no outrage at the number of people who think the sips will win is the top choice on the survey. disappointing

It's painful, but we want Texas to win on Saturday

I keep it simple

Never root for major recruiting rivals to win. Thats tu, OU and LSU

EnronAg said:

No, we don't, with all due respect...we want them coming into Thanksgiving with 1 loss...we beat them and they are most likely no longer in the SEC Championship game...I think we have a very real chance at beating them at Kyle...but don't want to have to play them again the following week for the championship...would much rather match up against Uga, Bama, whoever at that point...but I guess that is just me...but I bet a number of others would agree...

I mean it makes sense, but we need Georgia to get a 2nd loss somewhere unless you think we're running the table (which I find doubtful)

NOPE!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!gougler08 said:AgShaun00 said:

no outrage at the number of people who think the sips will win is the top choice on the survey. disappointing

It's painful, but we want Texas to win on Saturday

NVDA with 98,500 volume today on the 12/20 180c

Uga still plays ole miss and Tenn. sips play no one until us. Give me Uga all day!

gougler08 said:AgShaun00 said:

no outrage at the number of people who think the sips will win is the top choice on the survey. disappointing

It's painful, but we want Texas to win on Saturday

Dafuq we do. Want them to lose every damn time.

Talon2DSO said:gougler08 said:AgShaun00 said:

no outrage at the number of people who think the sips will win is the top choice on the survey. disappointing

It's painful, but we want Texas to win on Saturday

Dafuq we do. Want them to lose every damn time.

This. Our SoS will get us in on our own merit.

Tuck Fexas!!

An Aggie does not lie, cheat, steal, root for the sips or tolerate those who do. Dems da rules.

gougler08 said:AgShaun00 said:

no outrage at the number of people who think the sips will win is the top choice on the survey. disappointing

It's painful, but we want Texas to win on Saturday

gougler08 said:EnronAg said:

No, we don't, with all due respect...we want them coming into Thanksgiving with 1 loss...we beat them and they are most likely no longer in the SEC Championship game...I think we have a very real chance at beating them at Kyle...but don't want to have to play them again the following week for the championship...would much rather match up against Uga, Bama, whoever at that point...but I guess that is just me...but I bet a number of others would agree...

I mean it makes sense, but we need Georgia to get a 2nd loss somewhere unless you think we're running the table (which I find doubtful)

uGA plays Ole Miss and Tennesee back to back weeks. I'm rooting for UGA although a texas win doesn't end up being terrible for us.

I always root for what's best for us over what's worse for them.

We've overtaken Texas. But what gets me is that more people think someone outside of the current top 20 is going to win the title. Sure, many are probably just picking their own team.. but who outside of the top 20 could get through a 3-4 game gauntlet against mostly top 10 teams? I just don't see a Syracuse, Michigan, SMU, Illinois, Arizona State, Nebraska type team being able to do it.

gougler08 said:AgShaun00 said:

no outrage at the number of people who think the sips will win is the top choice on the survey. disappointing

It's painful, but we want Texas to win on Saturday

Guys, yall can buy FUBO right now with a stop at $1.35. Not saying it's going to work out, but the risk of stop is <30 cents and the target is $3.00 - $4.75 or 2-3x gain. 6.5x R/R on minimum target and 14x R/R on max.

Brian Earl Spilner said:gougler08 said:AgShaun00 said:

no outrage at the number of people who think the sips will win is the top choice on the survey. disappointing

It's painful, but we want Texas to win on Saturday

No, we don't

TAMU ‘98 Ole Miss ‘21

Anyone still have a position in HUMA? FDA compliance doc from May was posted yesterday afternoon for some fairly minor non-compliance items and the stock fell 16%.

I am considering loading up on more considering the FDA has to be nearing a decision on the AETV. Thoughts?

I am considering loading up on more considering the FDA has to be nearing a decision on the AETV. Thoughts?

Maximus Johnson said:

Anyone still have a position in HUMA? FDA compliance doc from May was posted yesterday afternoon for some fairly minor non-compliance items and the stock fell 16%.

I am considering loading up on more considering the FDA has to be nearing a decision on the AETV. Thoughts?

I got stopped out yesterday about 5 minutes after I considered raising my stop to 6. Seriously, 5 minutes after I looked and considered it the FDA dropped that and then poof.

Maximus Johnson said:

Anyone still have a position in HUMA? FDA compliance doc from May was posted yesterday afternoon for some fairly minor non-compliance items and the stock fell 16%.

I am considering loading up on more considering the FDA has to be nearing a decision on the AETV. Thoughts?

Im in with shares and dec calls. No stop for me. I'm playing this one ride or die.

The timing of that document release is strange to say the least.Cru said:Maximus Johnson said:

Anyone still have a position in HUMA? FDA compliance doc from May was posted yesterday afternoon for some fairly minor non-compliance items and the stock fell 16%.

I am considering loading up on more considering the FDA has to be nearing a decision on the AETV. Thoughts?

I got stopped out yesterday about 5 minutes after I considered raising my stop to 6. Seriously, 5 minutes after I looked and considered it the FDA dropped that and then poof.

I read into it fairly thoroughly and one of the non-compliance items was that one person was not up to date on a single training. All of the other non-compliance issues align with that level of minor infraction.

I don't understand who or why this document was released but something smells fishy.

Maximus Johnson said:The timing of that document release is strange to say the least.Cru said:Maximus Johnson said:

Anyone still have a position in HUMA? FDA compliance doc from May was posted yesterday afternoon for some fairly minor non-compliance items and the stock fell 16%.

I am considering loading up on more considering the FDA has to be nearing a decision on the AETV. Thoughts?

I got stopped out yesterday about 5 minutes after I considered raising my stop to 6. Seriously, 5 minutes after I looked and considered it the FDA dropped that and then poof.

I read into it fairly thoroughly and one of the non-compliance items was that one person was not up to date on a single training. All of the other non-compliance issues align with that level of minor infraction.

I don't understand who or why this document was released but something smells fishy.

I believe large short positions were taken prior to release. Fishy indeed

ZIM has some legs this morning. I need my other shipping company, SBLK, to get with the program.

AGI with a nice move also.

AGI with a nice move also.

Looks like it completed the Model T.Heineken-Ashi said:WestTexasAg said:

Whoever brought UUUU to the board - thanks! Wonder how much room it has to run?

Unfortunately, it's not the cleanest pattern off the low. $5 range is still the stop you don't want it falling under. Consider taking some risk off if you can't stomach a sizeable drop after this run. That said, I'd prefer it hold $6 range and move into the target box so we can go net free up there.

The red retracement fibs you are seeing are measuring from the top all the way back in 2021, not the September 2023 top you see on the chart. The bearish case is that, yes, it completed an upward retracement and will move back down. But that would be a 3+ year moves down and just a two month move back up. Not proportional at all. Hence why my primary is expecting this to hold lower highs and continue up.

Do you expect the time frame on these moves to track the timeline on your chart? So 2Q 2025 maybe?Heineken-Ashi said:

Guys, yall can buy FUBO right now with a stop at $1.35. Not saying it's going to work out, but the risk of stop is <30 cents and the target is $3.00 - $4.75 or 2-3x gain. 6.5x R/R on minimum target and 14x R/R on max.

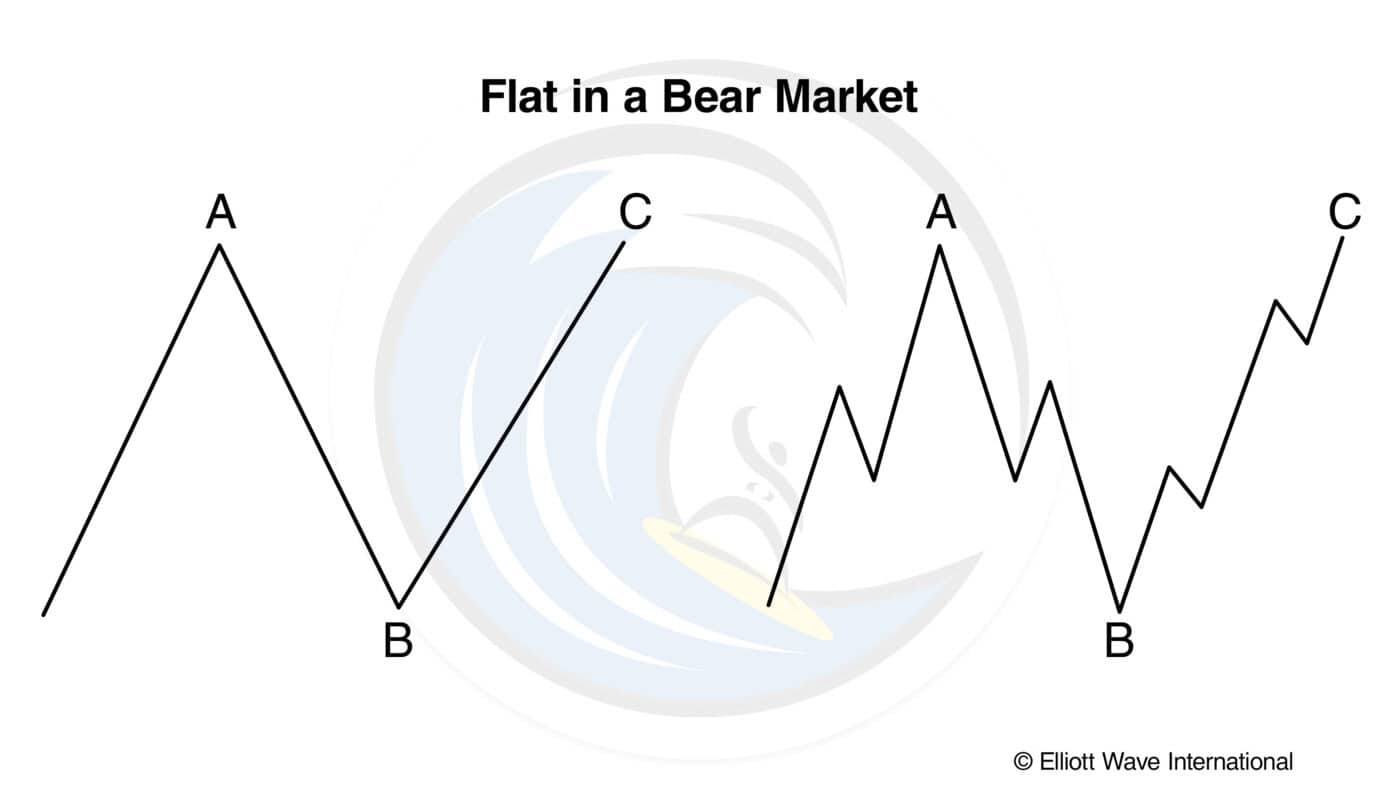

So when you see an A-B-C like shown on the chart, that's a corrective move. Meaning it's going counter-trend. Those can happen in multiple ways, but the most standard is what's called a zigzag and you see them on all timeframes extremely frequently. The most common is where the first move, the "A" will look like a 5-wave impulse. But it then retraces between 38.2% and 61.8% on the next move, the "B". So you would expect a finishing 5-wave move after completion of the B, moving in the same direction and roughly the same trajectory as A, targeting 100% the length of A from the bottom of B. Follow? If not, see below.AgEng06 said:Do you expect the time frame on these moves to track the timeline on your chart? So 2Q 2025 maybe?Heineken-Ashi said:

Guys, yall can buy FUBO right now with a stop at $1.35. Not saying it's going to work out, but the risk of stop is <30 cents and the target is $3.00 - $4.75 or 2-3x gain. 6.5x R/R on minimum target and 14x R/R on max.

The next most common is what's called a flat. In that scenario, the A is usually 3-waves (which I have shown here), with the B retracing almost the entire move. You then expect the C to finish where the A finished in roughly the same trajectory.

Timing is ALWAYS a guess. Never make trades based on timing of my chart. While I do my best to project a timing component of what seems reasonable, more often than not, I am more trying to show the entire move on the screen while displaying the price expectations. If you plan to take a trade with a timing component, like an option, I would ALWAYS give yourself extra time that what seems like the reasonable move. In this case, the reward is 2-3x on your money with the risk about 15-20% of your money. What's the point in playing an option when you can achieve option-like results without having to worry about timing? This is a share position 10 times out of 10. Within the move, if I see a breakout setup with defined risk and outsized reward more conducive to options, I'll post it.

Got it. Thank you for the explanation.

And I definitely don't do options enough to make my own determinations on timing, so I won't be doing it here either.

And I definitely don't do options enough to make my own determinations on timing, so I won't be doing it here either.

SLV making a push

Buying FSM Nov $5.5 calls with this potential breakout in silver.

Contract price = $0.20

Delta = $0.35

That means a $1 move in the stock raises the contract to $0.55 or more than 2x what you paid.

Gamma = $0.46

That means the next $1 move in the stock raises the contract to $1.56 or 7x what you paid.

And none of that takes into account an increase in volatility which will juice it further.

While there's no guarantee the stock moves to $6 or higher, let's say you buy 5 contracts. You spend $100. The reward is $100-$600 profit on $100 risk. And again, if silver finally truly breaks out, stocks like this will explode. It's high risk high reward. But these are the types of Greek setups you want to see. You want low IV (currently 56% where as high IV will be over 100%), delta that indicates an outsized move, amd gamma that explodes the delta.

I'm in for 20. All or nothing.

Contract price = $0.20

Delta = $0.35

That means a $1 move in the stock raises the contract to $0.55 or more than 2x what you paid.

Gamma = $0.46

That means the next $1 move in the stock raises the contract to $1.56 or 7x what you paid.

And none of that takes into account an increase in volatility which will juice it further.

While there's no guarantee the stock moves to $6 or higher, let's say you buy 5 contracts. You spend $100. The reward is $100-$600 profit on $100 risk. And again, if silver finally truly breaks out, stocks like this will explode. It's high risk high reward. But these are the types of Greek setups you want to see. You want low IV (currently 56% where as high IV will be over 100%), delta that indicates an outsized move, amd gamma that explodes the delta.

I'm in for 20. All or nothing.

Happygilmore20 said:

SLV making a push

I just jumped in $28p expiring next Friday as a hedge. Only .05

I'm in with you

The SLV 11/15 $30's are about to be in the money with a month left!

Edit: they ARE in the money!

Edit: they ARE in the money!

We're just barely poking through the pivot area in silver. If it can get through and close above it, we could be sitting on an absolute launchpad. Go look at 2010 and 2020 for what can happen on a breakout in silver.

Featured Stories

See All