I can't recall, but wasn't there some limited access if you participated in the seminars last year? I need to start focusing again on my portfolio, but I'd rather start at the beginning on trading.

Stock Markets

26,652,981 Views |

237921 Replies |

Last: 1 hr ago by Mas89

He'll do two weeks free from Texags in general.

To the other poster, just web search OA1 trading

To the other poster, just web search OA1 trading

Well ****, SMCI is being added to the SPX next Friday.

Thats great!! Bought more after hours at $913. Next thing is a stock split at some point!?! Let's ride

https://www.cnbc.com/2024/03/01/the-us-national-debt-is-rising-by-1-trillion-about-every-100-days.html

Quote:

The debt load of the U.S. is growing at a quicker clip in recent months, increasing about $1 trillion nearly every 100 days.

The nation's debt permanently crossed over to $34 trillion on Jan. 4, after briefly crossing the mark on Dec. 29, according to data from the U.S. Department of the Treasury. It reached $33 trillion on Sept. 15, 2023, and $32 trillion on June 15, 2023, hitting this accelerated pace. Before that, the $1 trillion move higher from $31 trillion took about eight months.

U.S. debt, which is the amount of money the federal government borrows to cover operating expenses, now stands at nearly $34.4 billion, as of Wednesday. Bank of America investment strategist Michael Hartnett believes the 100-day pattern will remain intact with the move from $34 trillion to $35 trillion.

ProgN said:

https://www.cnbc.com/2024/03/01/the-us-national-debt-is-rising-by-1-trillion-about-every-100-days.htmlQuote:

The debt load of the U.S. is growing at a quicker clip in recent months, increasing about $1 trillion nearly every 100 days.

The nation's debt permanently crossed over to $34 trillion on Jan. 4, after briefly crossing the mark on Dec. 29, according to data from the U.S. Department of the Treasury. It reached $33 trillion on Sept. 15, 2023, and $32 trillion on June 15, 2023, hitting this accelerated pace. Before that, the $1 trillion move higher from $31 trillion took about eight months.

U.S. debt, which is the amount of money the federal government borrows to cover operating expenses, now stands at nearly $34.4 billion, as of Wednesday. Bank of America investment strategist Michael Hartnett believes the 100-day pattern will remain intact with the move from $34 trillion to $35 trillion.

It simply amazes me the number of people who don't believe a day of reckoning is coming, of which this is only one piece

Lol at SMCI shorts, need to cover in after hours! Y'all in trooooouble teehee

https://www.cnbc.com/2024/03/01/super-micro-joining-sp-500-after-20-fold-jump-in-stock-in-two-years.html

Now we know why SMCI had such a meteoric rise in 30 trading days on no news. Somebody always knows.

Quote:

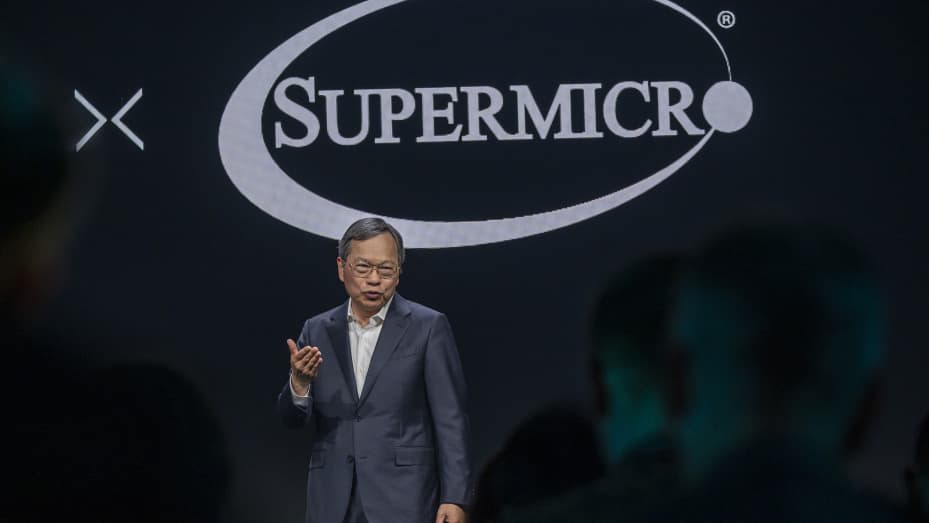

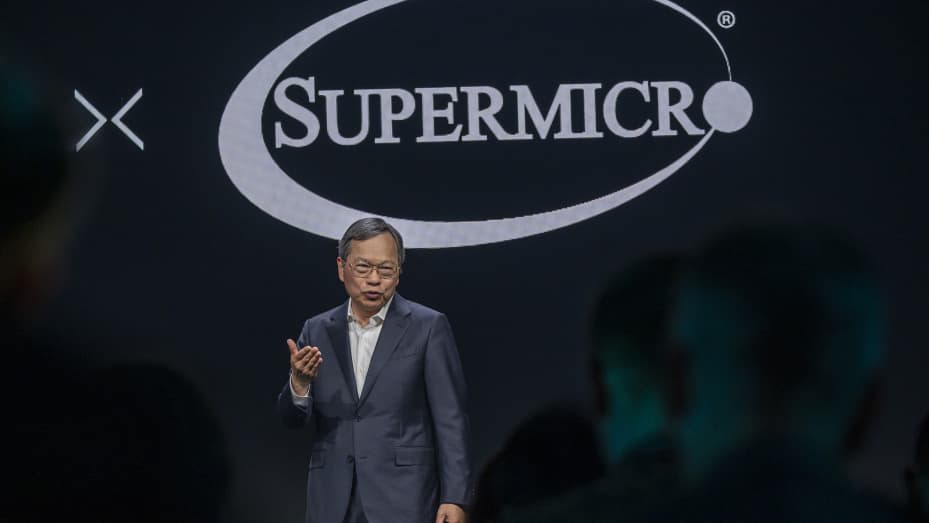

Super Micro Computer

is joining the S&P 500 following a historic rally in the stock that has pushed the company's market cap past $50 billion.

The shares, up more than 20-fold in the past two years and over 200% just since the start of 2024, climbed another 8% in extended trading on Friday.

Super Micro is replacing Whirlpool

, according to a press release. Deckers Outdoor

is also joining the S&P 500, replacing Zions Bancorporation

.

Stocks added to the benchmark index often rise in value because funds that track the S&P 500 will add it to their portfolios. The median market cap for companies in the S&P 500 is $33.7 billion.

Super Micro has been one of the main beneficiaries of the artificial intelligence boom sweeping the technology industry. The company makes servers and other computer infrastructure, and it's one of the primary vendors for building out Nvidia

-based "clusters" of servers for training and deploying AI models

Now we know why SMCI had such a meteoric rise in 30 trading days on no news. Somebody always knows.

ProgN said:

https://www.cnbc.com/2024/03/01/super-micro-joining-sp-500-after-20-fold-jump-in-stock-in-two-years.htmlQuote:

Super Micro Computer

is joining the S&P 500 following a historic rally in the stock that has pushed the company's market cap past $50 billion.

The shares, up more than 20-fold in the past two years and over 200% just since the start of 2024, climbed another 8% in extended trading on Friday.

Super Micro is replacing Whirlpool

, according to a press release. Deckers Outdoor

is also joining the S&P 500, replacing Zions Bancorporation

.

Stocks added to the benchmark index often rise in value because funds that track the S&P 500 will add it to their portfolios. The median market cap for companies in the S&P 500 is $33.7 billion.

Super Micro has been one of the main beneficiaries of the artificial intelligence boom sweeping the technology industry. The company makes servers and other computer infrastructure, and it's one of the primary vendors for building out Nvidia

-based "clusters" of servers for training and deploying AI models

Now we know why SMCI had such a meteoric rise in 30 trading days on no news. Somebody always knows.

$TSM is a cheaper way to be exposed to that sector

TAMU ‘98 Ole Miss ‘21

And now PLTR won't be in and the stock dropped AH on the news SMCI joined

Think PODD is on its way back to $200?

Heineken-Ashi said:RightWingConspirator said:

Hope it didn't come across as judgement. We all make our own decisions, but I let myself get influenced by perhaps folks that have a differing philosophy. Nothing wrong with differing motivations, but one must stay true to their own philosophy.

Try beer candles when a stock is on the run. It's the best trend indicator there is. Might help you identify when to sell, when to add protection, and when to let it ride.

The hardest thing in stocks is picking winners. The second hardest thing is knowing when to take profit. This is the kind of thing OA and 30k are experts on, and even they don't catch all of every move. If you don't have a profit point, you will never catch a top without being lucky.

Edit to add: I did not take you as judgemental. Not at all. I took you as someone looking up at what got away not appreciating the bounty you had achieved. It's easy to do. We will find more. I can promise you that.

On that note, I think I teased the board weeks back on a write up on how to profit from downside setups. I'll see if I can get to it this weekend. Because I think where the group on here takes the next step is when we stop always looking up for success. It should come in all scenarios.

I would greatly appreciate this if you have time

M4 Benelli said:M4 Benelli said:M4 Benelli said:

Everyone keep an eye on AEHR. 52 wk low, circling the drain. This thing rockets off good news, with a high over 50. Can easily see it hit the median in short order off decent news. Everything is frothy, so it would be a set and forget, toe in the water entry. With that being said they offer a unique business that has been expanding. Fwiw

Big day on no news, grab your rocket packs.

Heini mind doing your thing with this ticker?

Looks like AEHR shipped to Intel who makes photonic wafers (lasers on silicon).

The fact its not a new customer makes this relatively insignificant, but its a good reminder that AEHR and wafer level burn in isn't just for SiC or GaN. As photonics get more use globally (going to be a big thing in AI data centers in the future) more burning in going to happen. This bodes well for AEHR and their niche business model.

Up 10 percent on the day. If history repeats itself this one can easily take us to Valhalla.

I'm no Heineken, if Heineken is Heineken, I'm keystone light... but here's my 2 cents, and some levels. I added AEHR to my watch list too. If it can stair step from here, it has real room to run (and gaps to fill back up).

17.23 is the 50% retrace of this recent move up out of that box (below). If it sells off back to there, we watch closely what it does there. We also want it to stay above that box it just shot out of.

there are some juicy targets though: 21, 24/25 (gap), 30, 44 (gap)

Good charting.

Hourly action is another classic example like what I gave on SNOW a couple pages back.

We have an initial move up off a significant low. Measure from that bottom to the top of the move up. $14.54 - $19.19, a $4.65 move. It then came back down to $15.81. So we want AT LEAST 100% of that $4.65 from $15.81, so $20.46 range but hoping it extends higher and gap fills or more. Wherever that move tops, we don't want to see it drop below that $20.46 or else the setup becomes unreliable for higher. If it can hold that level, we're looking for the stair step up with higher highs and higher lows.

Hourly action is another classic example like what I gave on SNOW a couple pages back.

We have an initial move up off a significant low. Measure from that bottom to the top of the move up. $14.54 - $19.19, a $4.65 move. It then came back down to $15.81. So we want AT LEAST 100% of that $4.65 from $15.81, so $20.46 range but hoping it extends higher and gap fills or more. Wherever that move tops, we don't want to see it drop below that $20.46 or else the setup becomes unreliable for higher. If it can hold that level, we're looking for the stair step up with higher highs and higher lows.

Heineken-Ashi said:

Good charting.

Hourly action is another classic example like what I gave on SNOW a couple pages back.

We have an initial move up off a significant low. Measure from that bottom to the top of the move up. $14.54 - $19.19, a $4.65 move. It then came back down to $15.81. So we want AT LEAST 100% of that $4.65 from $15.81, so $20.46 range but hoping it extends higher and gap fills or more. Wherever that move tops, we don't want to see it drop below that $20.46 or else the setup becomes unreliable for higher. If it can hold that level, we're looking for the stair step up with higher highs and higher lows.

Do you have a suggested entry point to look for on Monday?

If I were taking entry, a limit of $17.25 with a stop of $16.28. It opened at $16.28 Wednesday and Thursday, and then Fridays low was just above that at $16.29. So with Brew and HA's fib extension targets, a 3:1 reward to risk ratio. I'm still new and learning, but that's my $.02.

So on these retracement/bounce plays, the best entry is when a support holds after the initial bounce. For this, it would have been after the double tap second yellow circle. As you can see, it's already gotten more than halfway to target. So while you could enter now with a stop at $17.40 below Fridays low, the actual stop for the play would be that double tap zone. That means that while you can have a very low risk with stop at $17.40, the reward at this point is less than $3. In other words, too much of the potential reward has already happened. It's now intraday overbought so you might be in a chop zone. The biggest push off support was missed. We didn't catch it in time. But if you want to still go for it you can. Just know, there's a better chance of getting stopped out with the higher stop whereas people that got in with the push off the low have a much lower stop.sosolik said:Heineken-Ashi said:

Good charting.

Hourly action is another classic example like what I gave on SNOW a couple pages back.

We have an initial move up off a significant low. Measure from that bottom to the top of the move up. $14.54 - $19.19, a $4.65 move. It then came back down to $15.81. So we want AT LEAST 100% of that $4.65 from $15.81, so $20.46 range but hoping it extends higher and gap fills or more. Wherever that move tops, we don't want to see it drop below that $20.46 or else the setup becomes unreliable for higher. If it can hold that level, we're looking for the stair step up with higher highs and higher lows.

Do you have a suggested entry point to look for on Monday?

As hot as the markets were Friday, a pullback on Monday at some point is likely if the markets race up first, maybe buy a naked $15 put 3/15 put.

UNFI earnings PM on Wednesday. Been in a downtrend since 2/12, but still within the upward channel since the October earnings sell off. RSI pushing down close to oversold going into this weeks earnings.

SMCI only has 55M shares outstanding hence the big drive up in price for inclusion in the S&P500. Would this also be a catalyst (along with high share price) for a stock split soon? 4:1 maybe?

Can't force everyone onto the digital dollar with full control by the administrative state if you don't burn down the paper dollar first.ProgN said:

https://www.cnbc.com/2024/03/01/the-us-national-debt-is-rising-by-1-trillion-about-every-100-days.htmlQuote:

The debt load of the U.S. is growing at a quicker clip in recent months, increasing about $1 trillion nearly every 100 days.

The nation's debt permanently crossed over to $34 trillion on Jan. 4, after briefly crossing the mark on Dec. 29, according to data from the U.S. Department of the Treasury. It reached $33 trillion on Sept. 15, 2023, and $32 trillion on June 15, 2023, hitting this accelerated pace. Before that, the $1 trillion move higher from $31 trillion took about eight months.

U.S. debt, which is the amount of money the federal government borrows to cover operating expenses, now stands at nearly $34.4 billion, as of Wednesday. Bank of America investment strategist Michael Hartnett believes the 100-day pattern will remain intact with the move from $34 trillion to $35 trillion.

GOOG is looking real bad at the moment. TSLA has a rough opening too.

AAPL looks like it could lose support.

But rest of the market looks okay.

AAPL looks like it could lose support.

But rest of the market looks okay.

I'm torn on how this all plays out. Obviously, the old, fiat system is in dire straits. Are the monetary masters going to convert the stock market, derivatives market, commodities market to some form of block-chain digital currency? Sounds like a colossal undertaking. If government is involved, I see nothing but failure written all over it.FTAG 2000 said:Can't force everyone onto the digital dollar with full control by the administrative state if you don't burn down the paper dollar first.ProgN said:

https://www.cnbc.com/2024/03/01/the-us-national-debt-is-rising-by-1-trillion-about-every-100-days.htmlQuote:

The debt load of the U.S. is growing at a quicker clip in recent months, increasing about $1 trillion nearly every 100 days.

The nation's debt permanently crossed over to $34 trillion on Jan. 4, after briefly crossing the mark on Dec. 29, according to data from the U.S. Department of the Treasury. It reached $33 trillion on Sept. 15, 2023, and $32 trillion on June 15, 2023, hitting this accelerated pace. Before that, the $1 trillion move higher from $31 trillion took about eight months.

U.S. debt, which is the amount of money the federal government borrows to cover operating expenses, now stands at nearly $34.4 billion, as of Wednesday. Bank of America investment strategist Michael Hartnett believes the 100-day pattern will remain intact with the move from $34 trillion to $35 trillion.

But, but...NVDA!!...amiright?texagbeliever said:

GOOG is looking real bad at the moment. TSLA has a rough opening too.

AAPL looks like it could lose support.

But rest of the market looks okay.

fightintxag13 said:

I'm keeping an eye on KR. It's approaching $50 and it has gotten rejected in that area 6 times, including one failed breakout, going back to August 2022. I will likely by medium-term puts if it gets above $50 and is rejected again.

Edit: It also got rejected there in Jan 2022. It's clearly a very strong resistance level.

KR hit above 50. I entered the 3/22 $49 puts. I was a little delayed to get to it after the alert went off so I got them at $1.00.

Edit to add: I'm on mobile so I can't look at the chart as east today, but I know at least 2 of those previous rejections were on earnings. They have earnings this Thursday before the market.

Which is awesome...because what are my 3 largest individual positions?texagbeliever said:

GOOG is looking real bad at the moment. TSLA has a rough opening too.

AAPL looks like it could lose support.

But rest of the market looks okay.

BIG could have one more push into the $6's, but it could also be done. If you got in under $4.00, I'd take some profits.

El_duderino said:

UNFI earnings PM on Wednesday. Been in a downtrend since 2/12, but still within the upward channel since the October earnings sell off. RSI pushing down close to oversold going into this weeks earnings.

Great analysis. Someone was buying a bunch pre market, saw the price jump to 16.70's.

SMCI - sitting at the 100% extension of the move up off the 2/20 low from last week's low. I've talked about this move recently. If it buts it's head there, could be a high and a reversal. If it moves over, you don't want to see it go below that for a truly bullish play.

You can sell the Mar 15 puts for $1 right now...pocket a good premium for a 2 week tie-up of capital or entry at $14, I'm going to look to enter hereBrewmaster said:El_duderino said:

UNFI earnings PM on Wednesday. Been in a downtrend since 2/12, but still within the upward channel since the October earnings sell off. RSI pushing down close to oversold going into this weeks earnings.

Great analysis. Someone was buying a bunch pre market, saw the price jump to 16.70's.

Sitting here waiting for the market to sell off……..

$save Anyone buying at these prices? Jetblue and spirit call off merger deal.

UNFI wants to pop soon so bad, but I can't pound the table on it. It's just such an ugly move up off a major low. When bullishness struggles this much to take hold, you have to consider that it might not actually be bullish. There's no options activity today, but that could change tomorrow.

The daily MACD still looks like a buildup though I'd like to see it turn up today or tomorrow, and if this general area can hold as a low, something good can happen here. It can hold a lower trendline into the high $14's.

All I'm saying is, don't risk more than you can handle on this one. It could dissapoint just as easily as it could amaze. And it's in a sector of stocks that have been a mixed bag this earnings season.

The daily MACD still looks like a buildup though I'd like to see it turn up today or tomorrow, and if this general area can hold as a low, something good can happen here. It can hold a lower trendline into the high $14's.

All I'm saying is, don't risk more than you can handle on this one. It could dissapoint just as easily as it could amaze. And it's in a sector of stocks that have been a mixed bag this earnings season.

aggies4life said:

$save Anyone buying at these prices? Jetblue and spirit call off merger deal.

Of course i had 3/1 6 puts

Featured Stories

See All

LIVE from Reed Arena: No. 7 Texas A&M vs. No. 6 Tennessee

by Luke Evangelist

No. 7 A&M seeks to respond vs. No. 6 Tennessee on Saturday morning

by Olin Buchanan

13:35

13h ago

3.9k

10:35

17h ago

1.3k

Keys to the Game: No. 7 Texas A&M vs. No. 6 Tennessee

by Luke Evangelist

LukeEvangelist

LIVE from Reed Arena: No. 7 Texas A&M vs No. 6 Tennessee

in Billy Liucci's TexAgs Premium

12