My gosh, CWH. Every time I pick a runner I feel like I have to sell. Rarely let it ride.

Stock Markets

26,792,430 Views |

238457 Replies |

Last: 1 hr ago by bmoochie

Conversely, reports of slow or no travel is worse.cryption said:

I'm not sure travel is an indication of a strong economy - since people are funding a lot of it using credit cards these days. CC debt is at an all-time high. To me that doesn't scream healthy economy. Layer in people living off a CC just to afford increases in prices. Yes people are spending - but they're spending money they don't have and won't be able to pay back.

Travel is a sign of an affluent population.

People will always spend money they don't have.

Love ripping people off at the close

You don’t trade for money, you trade for freedom.

You're probably right, being bearish hasn't worked out for me so far this year. Someday the debts will have to get paid - but I suppose today isn't that day. I just can't wrap my mind around the economy being healthy with so many individual indicators screaming to me things are bad and we're just waiting for the bottom to fall out.Farmer @ Johnsongrass, TX said:Conversely, reports of slow or no travel is worse.cryption said:

I'm not sure travel is an indication of a strong economy - since people are funding a lot of it using credit cards these days. CC debt is at an all-time high. To me that doesn't scream healthy economy. Layer in people living off a CC just to afford increases in prices. Yes people are spending - but they're spending money they don't have and won't be able to pay back.

Travel is a sign of an affluent population.

People will always spend money they don't have.

Are we?

You don’t trade for money, you trade for freedom.

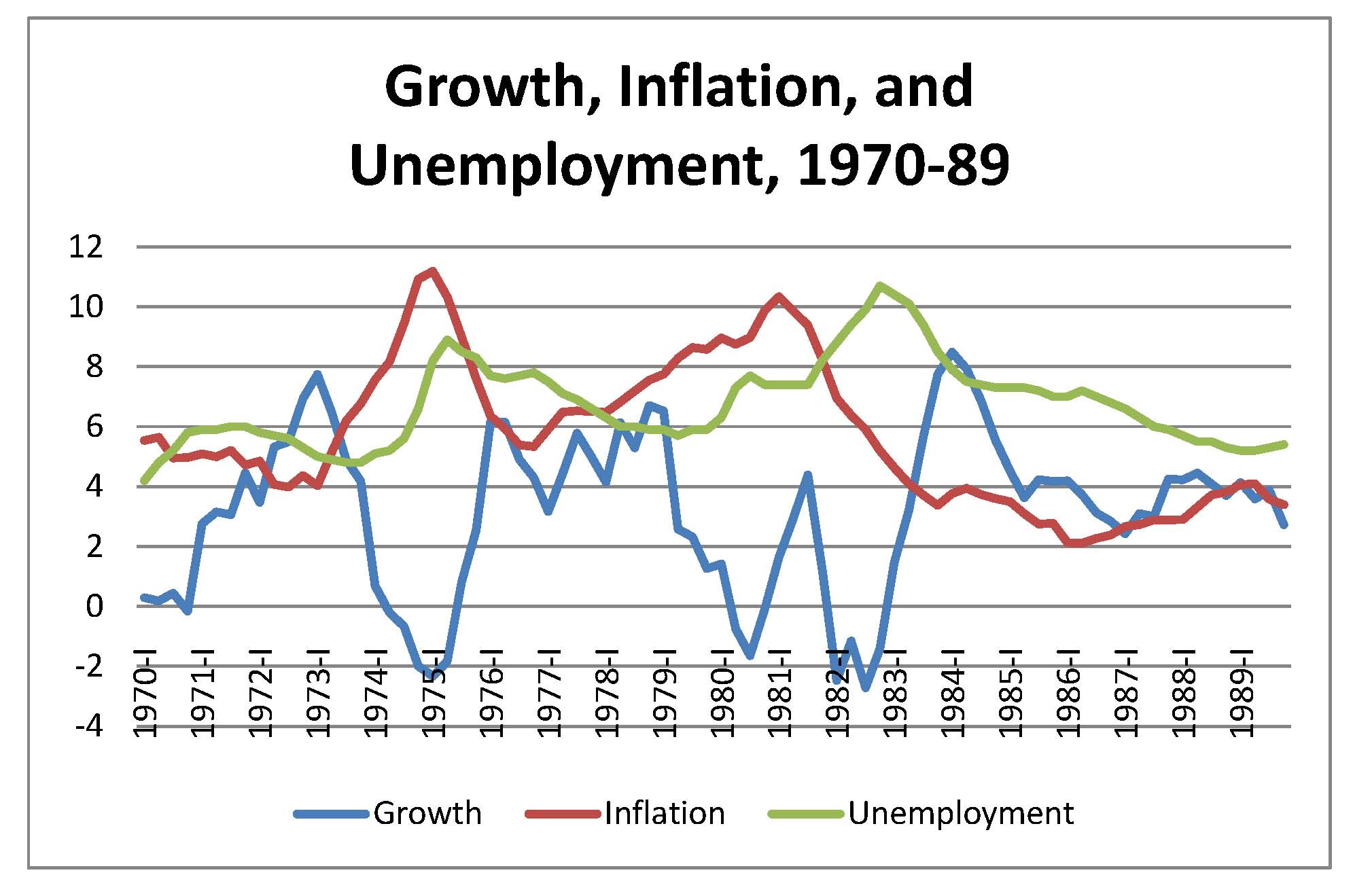

I agree with you, How does this end well?? but we have to keep in mind history sometimes repeats and inflation can take years to realize.cryption said:You're probably right, being bearish hasn't worked out for me so far this year. Someday the debts will have to get paid - but I suppose today isn't that day. I just can't wrap my mind around the economy being healthy with so many individual indicators screaming to me things are bad and we're just waiting for the bottom to fall out.Farmer @ Johnsongrass, TX said:Conversely, reports of slow or no travel is worse.cryption said:

I'm not sure travel is an indication of a strong economy - since people are funding a lot of it using credit cards these days. CC debt is at an all-time high. To me that doesn't scream healthy economy. Layer in people living off a CC just to afford increases in prices. Yes people are spending - but they're spending money they don't have and won't be able to pay back.

Travel is a sign of an affluent population.

People will always spend money they don't have.

Here's an interesting graph I found... unemployment seems to lag inflation by roughly 1 year.

Not my work below, but I know the guy that put this together. It's solid work.

My estimates have US production dropping below 12.2M bpd by July 20th.

My estimates have US production dropping below 12.2M bpd by July 20th.

Quote:

The June Short Term Energy Outlook(STEO) now "projects" US oil production will average 12.61M bpd for all of 2023 (up from 12.53M bpd in May STEO). So far in 2023 there have been 11 weekly reports at 12.2M bpd and 10 weekly reports at 12.3M bpd for an average of 12.25M bpd over the 21 week period.

To meet EIAs new "projection" of 12.61M bpd, US production would have to magically jump by 655,000 bpd to 12.86M bpd and stay at that level for the remaining 31 weeks of 2023.

Not possible...... not even close EIA. IMO, US production will tick down below 12.2M bpd in the coming weeks. EIA continues to have a clear agenda..... to purposely "overestimate" US oil production..... in order to influence oil markets and drive oil prices

While I agree with you longer term, watch this video it will open your eyes a bit. Dry, so I speed up the playback, but just objective look at data.cryption said:You're probably right, being bearish hasn't worked out for me so far this year. Someday the debts will have to get paid - but I suppose today isn't that day. I just can't wrap my mind around the economy being healthy with so many individual indicators screaming to me things are bad and we're just waiting for the bottom to fall out.Farmer @ Johnsongrass, TX said:Conversely, reports of slow or no travel is worse.cryption said:

I'm not sure travel is an indication of a strong economy - since people are funding a lot of it using credit cards these days. CC debt is at an all-time high. To me that doesn't scream healthy economy. Layer in people living off a CC just to afford increases in prices. Yes people are spending - but they're spending money they don't have and won't be able to pay back.

Travel is a sign of an affluent population.

People will always spend money they don't have.

China's exports plunge by 7.5% in May, far more than expected

https://www.cnbc.com/2023/06/07/chinas-exports-plunge-by-7point5percent-in-may-far-more-than-expected.html

https://www.cnbc.com/2023/06/07/chinas-exports-plunge-by-7point5percent-in-may-far-more-than-expected.html

Wow interesting video thanks for sharing. I'm starting to rethink my oppressive bearishness for at least the short term

There is a gap from Friday June 2 on $SPX in the 4230's. How should I be assessing that for trading this week, if at all?

Carioca Corredor said:

There is a gap from Friday June 2 on $SPX in the 4230's. How should I be assessing that for trading this week, if at all?

If 4275 fails on e-mini, I would target that gap filling. I wouldn't bother thinking about it until that condition is true.

You don’t trade for money, you trade for freedom.

Did OA delete his twitter

No. In fact, he's never been more active

Weird. I can't find him when I search, but he's on my feed

Well, OECD says, What recession?

OECD raised their global growth forecast to +2.7% for 2023

https://www.oecd.org/economic-outlook/june-2023/

OECD raised their global growth forecast to +2.7% for 2023

https://www.oecd.org/economic-outlook/june-2023/

Someone got blocked...

Boom! Top ticked it.

You don’t trade for money, you trade for freedom.

Out for 13% gain!bmoochie said:bmoochie said:

Looking at MARA and its in a little Darvish box since Mid April. Buying around $9 and then selling or doing CCs around $10 could be an easy 10-12% increase. I have $8.61 area as support so lose that I think is when I would cut. Seems to be bouncing between the 50 and 200 EMAs in this box as well.

Filled some shares this morning at $8.95. Going to give this a try but with the Coinbase and crypto stuff could cause this to fail. We will see!

Fear and Greed Index - Investor Sentiment | CNN

FWIW, we just crossed into 'extreme greed' territory.

FWIW, we just crossed into 'extreme greed' territory.

ProgN said:

Fear and Greed Index - Investor Sentiment | CNN

FWIW, we just crossed into 'extreme greed' territory.

Wonder if we get sell now. We need it

You don’t trade for money, you trade for freedom.

Draw the Fib on SPY from high (479.98 on 1/5/22) to low (348.11 on 10/12/22). The .618 retracement is 429.61.

Monday's high? 429.62

Today's high? 429.62

Monday's high? 429.62

Today's high? 429.62

What's wrong with GOOG?

We're just crossing the Rubicon now..$30,000 Millionaire said:

Wonder if we get sell now. We need it

Don't bring me down ~ ELO

Boy Named Sue said:

What's wrong with GOOG?

Look as nasdaq big boy

You don’t trade for money, you trade for freedom.

I'm not following.

Nasdaq is down today. Google will follow.

Broader market is down today, so is GOOGBoy Named Sue said:

I'm not following.

GOOG all the way back to Monday prices.

They were up to 75 on the daily RSI as well, due for a cool off.

They were up to 75 on the daily RSI as well, due for a cool off.

PLTR with a blow off the top move this morn?

NQ needed this reset. I got my bag earlier, so just watching.

You don’t trade for money, you trade for freedom.

We are at neckline of recent double top here.

pretty ticked at myself for paper handing CAT.

I had bought some 230C at $2.50 and sold at $2.85

I had bought some 230C at $2.50 and sold at $2.85

You don’t trade for money, you trade for freedom.

Featured Stories

See All

52:09

10h ago

2.5k

CJ Wilcher's 'assassin' status may be required to end A&M's SEC skid

by Olin Buchanan

9:40

45m ago

644

44:19

10h ago

2.2k

FINAL from Daikin Park: Arizona 3, No. 1 Texas A&M 2

by Richard Zane

Old Buffalo

Texas A&M Athletics to ink massive media rights deal with Playfly Sports

in Billy Liucci's TexAgs Premium

175

Tex100

Texas A&M Athletics to ink massive media rights deal with Playfly Sports

in Billy Liucci's TexAgs Premium

81

Legal Custodian

Texas A&M Athletics to ink massive media rights deal with Playfly Sports

in Billy Liucci's TexAgs Premium

73

Keller6Ag91

Texas A&M Athletics to ink massive media rights deal with Playfly Sports

in Billy Liucci's TexAgs Premium

64

Braxton.Sherrill

Texas A&M Athletics to ink massive media rights deal with Playfly Sports

in Billy Liucci's TexAgs Premium

60

Hungry

Texas A&M Athletics to ink massive media rights deal with Playfly Sports

in Billy Liucci's TexAgs Premium

57