Stock Markets

26,959,288 Views |

239013 Replies |

Last: 9 min ago by southernskies

Entry PointTubTub said:

Interested to know your price outlook on WEAT, SOYB, and CORN. Still holding or exiting in the next week?

CORN = $29.63

SOYB = $28.66

WEAT = $10.99

Today's Close

CORN = $29.23

SOYB = $28.27

WEAT = $11.90

The only one of these 3 that has a near term chance for a pop is WEAT. WEAT is a fund of Futures traded on the Chicago Exchange (soft wheat). The wheat of concern is hard red winter wheat and that's traded on the Kansas City Exchange. So, we have the right crop picked (wheat) but the wrong type (Soft and not Hard Red). The action will be in the Kansas City pit with some spill over into Chicago. Most folks diving into this stuff don't know this detail and most think "wheat is wheat" and that's fine. I am going to enter a sell order at $12.25. I think it has a good chance to hit that number.

CORN and SOYB, I hate to bail on these, but I just want my money back. I will enter orders at cost. If you plan to hold these, I'd exit before the end of June.

If holding for longer than June, I would pick WEAT as the longer term hold.

Basically, my entry points sucked. It happens.

Snap filed an 8-K that basically said due to challenging macro environment, they aren't going to meet guidance. Brought all of tech way down.

Article from May 18th - Pratt, KS - hard red wheat country.Farmer @ Johnsongrass, TX said:Entry PointTubTub said:

Interested to know your price outlook on WEAT, SOYB, and CORN. Still holding or exiting in the next week?

CORN = $29.63

SOYB = $28.66

WEAT = $10.99

Today's Close

CORN = $29.23

SOYB = $28.27

WEAT = $11.90

The only one of these 3 that has a near term chance for a pop is WEAT. WEAT is a fund of Futures traded on the Chicago Exchange (soft wheat). The wheat of concern is hard red winter wheat and that's traded on the Kansas City Exchange. So, we have the right crop picked (wheat) but the wrong type (Soft and not Hard Red). The action will be in the Kansas City pit with some spill over into Chicago. Most folks diving into this stuff don't know this detail and most think "wheat is wheat" and that's fine. I am going to enter a sell order at $12.25. I think it has a good chance to hit that number.

CORN and SOYB, I hate to bail on these, but I just want my money back. I will enter orders at cost. If you plan to hold these, I'd exit before the end of June.

If holding for longer than June, I would pick WEAT as the longer term hold.

Basically, my entry points sucked. It happens.

https://www.pratttribune.com/2022/05/18/southwest-kansas-wheat-devastated-by-drought/

This is bullish wheat.

Maybe I am setting my sights to low at $12.25..

That should help a reversal (which it isn't technically)lobwedgephil said:

Snap filed an 8-K that basically said due to challenging macro environment, they aren't going to meet guidance. Brought all of tech way down.

These bounces don't change the macro environments.

Trade wisely

Wealth gained hastily will dwindle. but whoever gathers little by little will increase it.

Proverbs 13:11

Proverbs 13:11

lobwedgephil said:

Snap filed an 8-K that basically said due to challenging macro environment, they aren't going to meet guidance. Brought all of tech way down.

What are the rules around filing an 8-K like that?

Believe you have something like 4 days to file once the company is aware of the material change.

Snap may go under. Wow.

You don’t trade for money, you trade for freedom.

I don't how much truth there is to this, but it's not entirely surprising. They don't really do anything…we'll I guess they tried to make some glasses? Lol.

They're a messaging app that caters to kids and young people, the most fickle of all… an app that can be replaced in daily life as soon as young people decide they want to use a different app.

They're a messaging app that caters to kids and young people, the most fickle of all… an app that can be replaced in daily life as soon as young people decide they want to use a different app.

Just drawing pictures.

Hmmmmm......

Wealth gained hastily will dwindle. but whoever gathers little by little will increase it.

Proverbs 13:11

Proverbs 13:11

If we break out above that by the end of the week, we might see volume return after the holiday.

I don't think that if is gonna happen, but it could.

I don't think that if is gonna happen, but it could.

Aren't descending triangles typically continuing patters more than reversal patterns? It is what it is but just considering a hedge

Yes, bearish continuation patterns typically. This isn't a triangle though, nothing to connect the low.

You guys ready to be Dow traders?

I think we are f'ed. Like really f'ed. we gonna bounce, yeah, probably. But don't fool yourselves.

Energy, banks, utilities, consumer staples, hard assets will be the way.

I think we are f'ed. Like really f'ed. we gonna bounce, yeah, probably. But don't fool yourselves.

Energy, banks, utilities, consumer staples, hard assets will be the way.

You don’t trade for money, you trade for freedom.

$30,000 Millionaire said:

Snap may go under. Wow.

But twtr get one snap free, Elon

I have been of this persuasion for a while, but I've yet to see a great place to go long? I think O&G will probably continue to do well for a time, but recessions tend to cause everything to go down: bolds, equities, commodities, metals, etc.

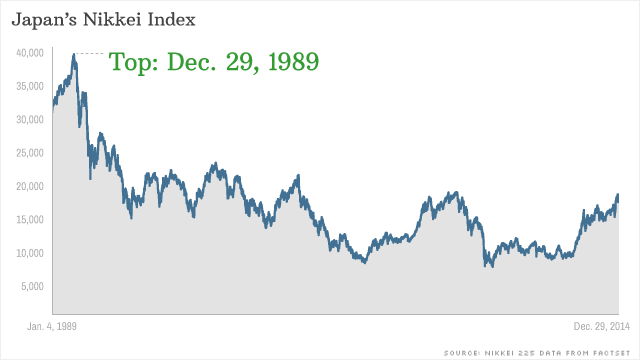

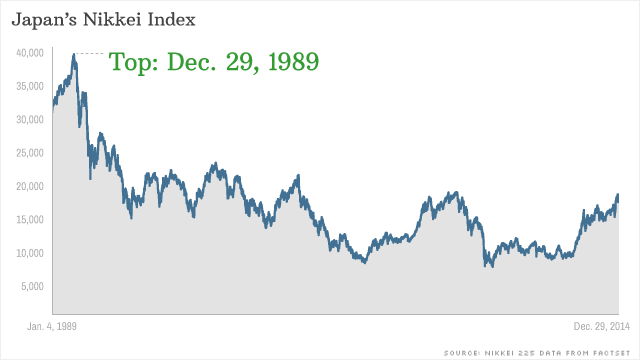

I'm not feeling super confident about pretty much anything st this point. Some trustworthy people whispering utterances about 5-10 yrs of pain. Karsan says he thinks 4818 SPX will stand as the ATH for any foreseeable futures.

That is SOBERING!

I'm not feeling super confident about pretty much anything st this point. Some trustworthy people whispering utterances about 5-10 yrs of pain. Karsan says he thinks 4818 SPX will stand as the ATH for any foreseeable futures.

That is SOBERING!

$30,000 Millionaire said:

You guys ready to be Dow traders?

I think we are f'ed. Like really f'ed. we gonna bounce, yeah, probably. But don't fool yourselves.

Energy, banks, utilities, consumer staples, hard assets will be the way.

Yes! So much yes!

Or longer

Yeah, the first book I read in technical analysis commented about people who bought in the DJIA in 1955 found it to have same price in 1975.

That's a pretty painful "buy and hold/never sell" strategy.

That's a pretty painful "buy and hold/never sell" strategy.

$30,000 Millionaire said:

You guys ready to be Dow traders?

I think we are f'ed. Like really f'ed. we gonna bounce, yeah, probably. But don't fool yourselves.

Energy, banks, utilities, consumer staples, hard assets will be the way.

Tell us more. Are you rethinking the long term s&p index strategy?

Philip J Fry said:$30,000 Millionaire said:

You guys ready to be Dow traders?

I think we are f'ed. Like really f'ed. we gonna bounce, yeah, probably. But don't fool yourselves.

Energy, banks, utilities, consumer staples, hard assets will be the way.

Tell us more. Are you rethinking the long term s&p index strategy?

No, the S&P rebalances itself and ten years from today we will be trading 6,000. 2022 may be another story. The 2000s may be in the cards this year.

You don’t trade for money, you trade for freedom.

And I thought seeing 11K in the NQ was pessimistic for this board...but once I saw it in the charts, I couldn't unsee it. So far it's held though.

I assume you think we are about to go through more than a recession? Wouldn't this put us in full blown depression mode?

I assume you think we are about to go through more than a recession? Wouldn't this put us in full blown depression mode?

Thanks for the good stuff.

What do you think of ag service companies such as Nutrien (NTR)? Looks like we already missed the train but with potential stagflation looming I rather be in this than tech.

What do you think of ag service companies such as Nutrien (NTR)? Looks like we already missed the train but with potential stagflation looming I rather be in this than tech.

Philip J Fry said:

And I thought seeing 11K in the NQ was pessimistic for this board...but once I saw it in the charts, I couldn't unsee it. So far it's held though.

I assume you think we are about to go through more than a recession? Wouldn't this put us in full blown depression mode?

No, the fed will step in. 1975 - 1985

You don’t trade for money, you trade for freedom.

That's much better.

Mornun!

Just a quick check in early premarket. Little gap down into SPY 391.50. Pattern continues.

Heading into Holiday weekend so I'd expect volume to dry up as the week comes to a close.

Trade wisely!

Just a quick check in early premarket. Little gap down into SPY 391.50. Pattern continues.

Heading into Holiday weekend so I'd expect volume to dry up as the week comes to a close.

Trade wisely!

Wealth gained hastily will dwindle. but whoever gathers little by little will increase it.

Proverbs 13:11

Proverbs 13:11

Powell speaks today around noon. I think the market is just waiting to hear what he has to say.

FJ43 said:

. Heading into Holiday weekend so I'd expect volume to dry up as the week comes to a close.

For me this means if I continue scalping, I switch from buying puts/calls to buying/shorting shares. Otherwise I'll get chewed up with low volume chop. Probably Wed is when I'll switch. Also means I should be more selective with setups.

TESLA SHARES DOWN 2.7% AT $656.87 PREMARKET; DAIWA CAPITAL MARKETS CUTS PT TO $800, LOWERS ITS 2022 DELIVERIES ESTIMATE$TSLA

— *Walter Bloomberg (@DeItaone) May 24, 2022

Wealth gained hastily will dwindle. but whoever gathers little by little will increase it.

Proverbs 13:11

Proverbs 13:11

Best Buy (BBY) beat on revenue with a slight miss on earnings 1.57 v 1.59. Following the retailer trend.

It is up 5% pre market. Which implies the hit it took on 5/18 likely due to Target's miss might have priced in lower guidance for bal-year.

And it gave it all up.

It is up 5% pre market. Which implies the hit it took on 5/18 likely due to Target's miss might have priced in lower guidance for bal-year.

And it gave it all up.

I bought FB at 180.3

You don’t trade for money, you trade for freedom.

What I thought would happen then is happening now. Food and energy shortages. Out of control inflation, supply chain disruption, war. Let's see but we are going lower

You don’t trade for money, you trade for freedom.

Do you think we get summer rally some are predicting?

SNAP has traded below $5 before -- in 2018. I think that's probably where it is heading again

Crazy round trip....even the COVID low in SNAP was a touch below $8, then a 10X all the way to $80+, then to fall back down probably into single digits again

Crazy round trip....even the COVID low in SNAP was a touch below $8, then a 10X all the way to $80+, then to fall back down probably into single digits again

Featured Stories

See All

15:03

2h ago

1.8k

Michael Earley recaps A&M's final non-conference series vs. NMSU

by Ryan Brauninger

8:10

18h ago

3.7k

No. 14 Texas A&M drops series finale to New Mexico State, 4-1

by Richard Zane

11:59

1h ago

482

aggietony2010

Outscored 27-5 and their official account posts this.

in Texas A&M Baseball & Softball

46