Diggity said:

Sully Dog said:

Absolutely there is a demand side element to this. 12% of US homeowners spent two years not paying their mortgages. Student loans still don't have to be repayed. We handed out billions in "child credits" We lowered interest rates to effectively zero. Where do you think the money went?

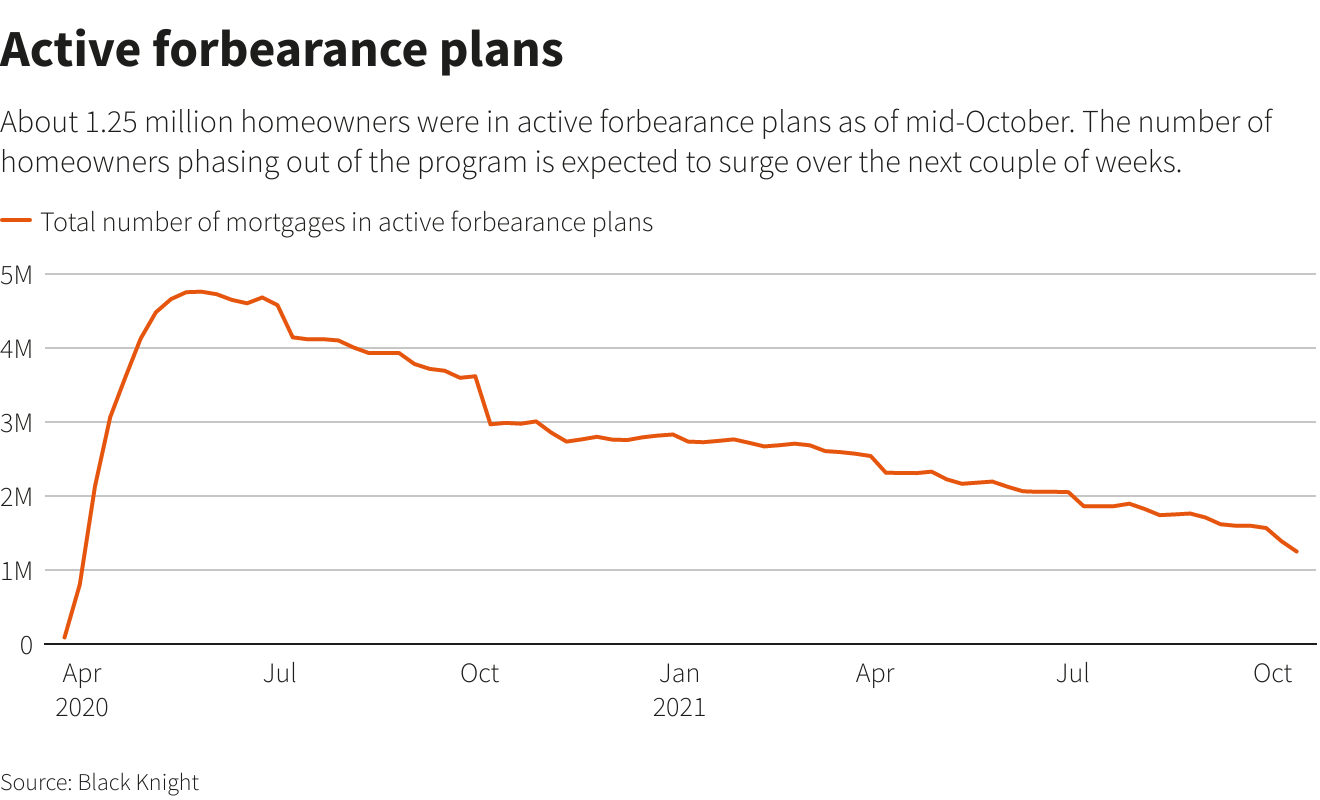

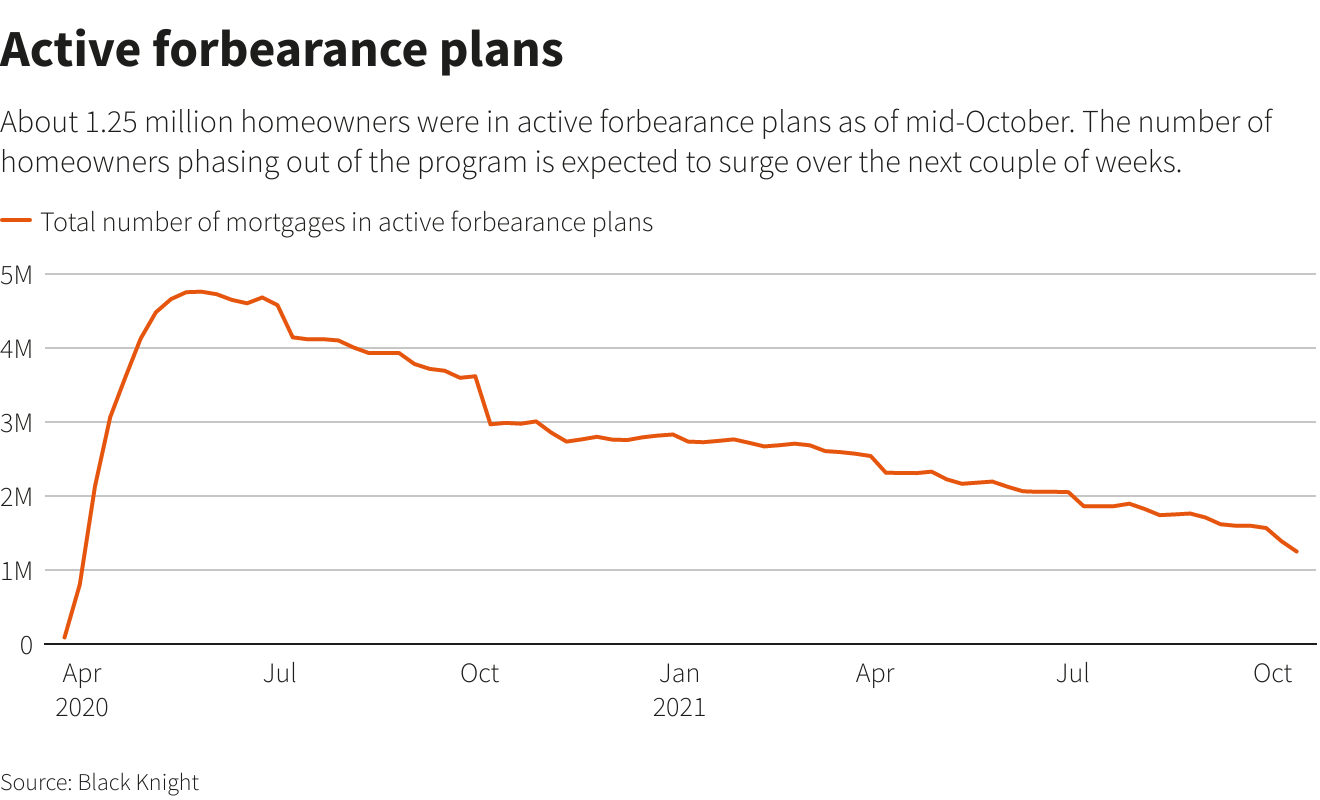

might be just a little bit of hyperbole here.

at it's peak it was close to that % but the numbers dropped pretty quickly.

Currently we're at around 2.5%

12% is the number that came out of the Atlanta Fed. and that was the peak, but the point still stands. That's billions of dollars that was added to the US economy just through that one program. Where do you think the money went? Because I think it went into a variety of investments from stocks to rental homes etc that have been a demand side driver of inflation.

Deplorable Neanderthal Clinger