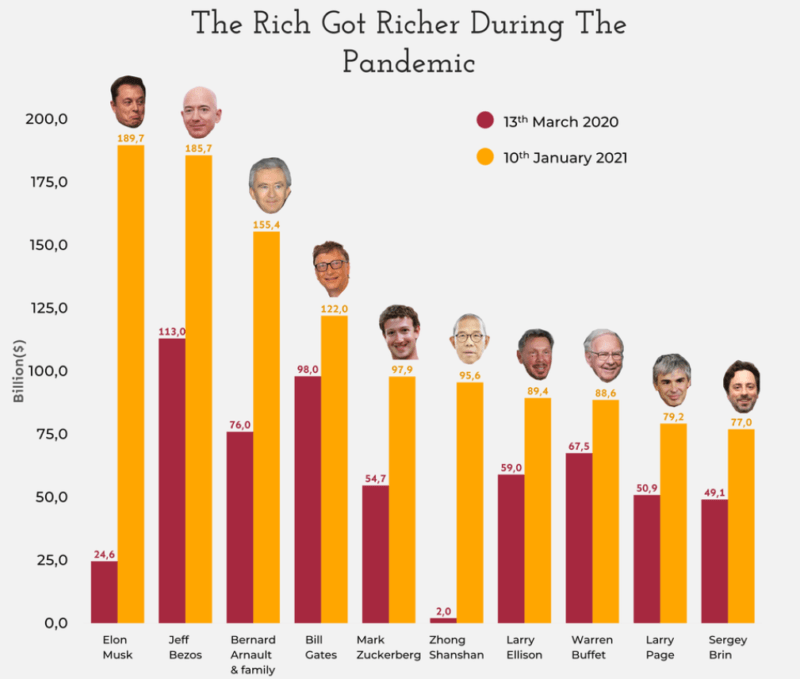

Man that's a weird cherry-picked start date more than halfway down the Covid market nose-dive. I'd love to see YOY figures.ClutchCityAg said:

But even with the start date, I'm not sure what this really shows. Considering SPY has gone up 42% since March 13 (and QQQ has gone up 70%), you could argue that half these guys just basically market-performed; some even underperformed significantly (Gates, Buffett).

Adam and OA's levels have been pure gold by the way.

Adam and OA's levels have been pure gold by the way.