I mean, the pull back from oct '18 to dec '18 was pretty significant.

Stock Markets

26,064,495 Views |

235536 Replies |

Last: 3 hrs ago by zgolfz85

Futures up 14 after Mnuchin says trade deal is 90% done. Come on MU, run today

Markets needed this kind of news.gougler08 said:

Futures up 14 after Mnuchin says trade deal is 90% done. Come on MU, run today

sorry, wrong thread

Giddy up!

Prognightmare said:Markets needed this kind of news.gougler08 said:

Futures up 14 after Mnuchin says trade deal is 90% done. Come on MU, run today

Was thinking tomorrow is the prime day to grab SPY 296-297 for 7/5

This is assuming a deal is made of the weekend but fully announce Tuesday-ish.

That's a 3% move from $289 which is the lowest I see us possibly going before the weekend.

As long as Trump stays off of Twitter until the weekend, I'll be happy.

Quote:

Needham upgrades Micron (NASDAQ:MU) from Hold to Buy with a $50 PT, a 53% upside.

After yesterday's earnings report, the firm thinks Micron's EPS is bottoming and the book value is stabilizing, creating a an attractive risk/reward balance.

More action: Piper Jaffray lowers its Micron target from $40 to $36, believing that the recovery will take several more quarters. The firm stays on the sidelines with a Neutral rating.

Micron shares are up 9% pre-market to $35.63.

Seems like the analysts are going to lean both ways.

Analysts are just a modern day Nostradamus. Throw enough **** against the wall and eventually something will stick

The sad part is that they sway the stock price so muchIrishTxAggie said:

Analysts are just a modern day Nostradamus. Throw enough **** against the wall and eventually something will stick

Yeah, that's the only reason I bring it up.

Fingers crossed that INTC breaks resistance for a run with MU

Today feels like a day we are tricked into thinking it'll be a green day, but then it goes red.

rgag12 said:

Today feels like a day we are tricked into thinking it'll be a green day, but then it goes red.

Don't you bring those bad vibes in herergag12 said:

Today feels like a day we are tricked into thinking it'll be a green day, but then it goes red.

MU got up to $37 right after the open

SoupNazi2001 said:Bonfire1996 said:

Turns out Powell doesn't like being called a dumbass and effectively a little beech. So he came out today and ensured that he looked like a dumbass and a little beech.

Someone should ask him what happens to his grandkids if China wins the economic warfare of the 21st century. Are they going to be free or are they going to speak mandarin and use an even more restrictive version of google? The FED should realize that capitalism is an economic theory that the totalitarianists would love to erase from the history books. Instead, we get a bunch of high ego intellectuals who care more about rubbing endows with the swells and would rather crash an economy than realize Donald effing Trump was right all along. Right on rates, right on China, right on Mexico, etc.

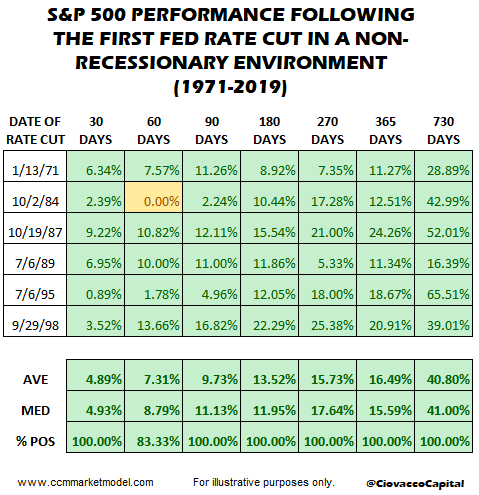

Because Powell won't cut 25 or 50 bps the economy is going to crash? This is hilarious. If the economy is going to crash, it will do it in spite of this because this has been the longest business cycle in history at 10+ years. As it stands a 2.5% Fed Funds rate would by far be the lowest terminal Fed Funds in history at the end of a rate hike cycle. The first Fed Funds cuts are typically a negative for the market. China is not going to budge in my opinion regardless of where rates are and Trump won't budge unless the market tanks again.

Could be that the difference is the first cut in a low inflationary vs first cut.

sold my calls at $2.92, bought a couple weeks back at $1.07.gougler08 said:

MU got up to $37 right after the open

IF any of y'all are interested in rolling the dice on the MU momentum, you might want to take a look at SGH

Out on OSTK at $11.35 from $10.88 yesterday.

If anyone wants a stock that moves back and forth all day, this is it.

If anyone wants a stock that moves back and forth all day, this is it.

If ROKU comes down to $84 I'll be looking at calls on it. Thoughts?

ALGN better bounce from here.

NVDA fighting 160 resistance if it gets through then 162/165/170 are next stopping points

I bought puts but will have a tight stop. H&S shoulder line broke

jumped inEngrAg14 said:

NVDA fighting 160 resistance if it gets through then 162/165/170 are next stopping points

General Mills (GIS) is getting slaughtered on a selloff, but appears to have found some support at 48.60. I went with some 7/19 $50s there.

Yep, projects way lower to that Jan 30th low of 207.

and jumped out on the spike over 161.Ragoo said:jumped inEngrAg14 said:

NVDA fighting 160 resistance if it gets through then 162/165/170 are next stopping points

OSTK back to 10.87

JD having a strong day, going to look towards that ~31 resistance line again soon

Featured Stories

See All

75:17

22h ago

6.9k

No. 11 A&M looks to right the ship on Saturday night vs. LSU at Reed

by Olin Buchanan

11:35

2h ago

1.0k

Aggie ace Ryan Prager feels 'great' as he builds toward Opening Day

by Ryan Brauninger

7:49

1h ago

604

Transfer infielder Wyatt Henseler ready to make his Texas A&M debut

by Ryan Brauninger

Keys to the Game: No. 11 Texas A&M vs. Louisiana State

by Luke Evangelist

Psychag

Aggies offer 2028 WR - Dez Bryant Jr. (Colleyville Heritage HS)

in Billy Liucci's TexAgs Premium

34